Are you considering becoming a reseller and need help understanding the credit score evaluation process? Navigating the world of reseller credit can feel overwhelming, but it's essential for securing advantageous partnerships and unlocking funding opportunities. This guide will simplify the evaluation process and equip you with the knowledge to improve your credit standing. So, let's dive in and explore how to enhance your reselling businessâstick around for more insights!

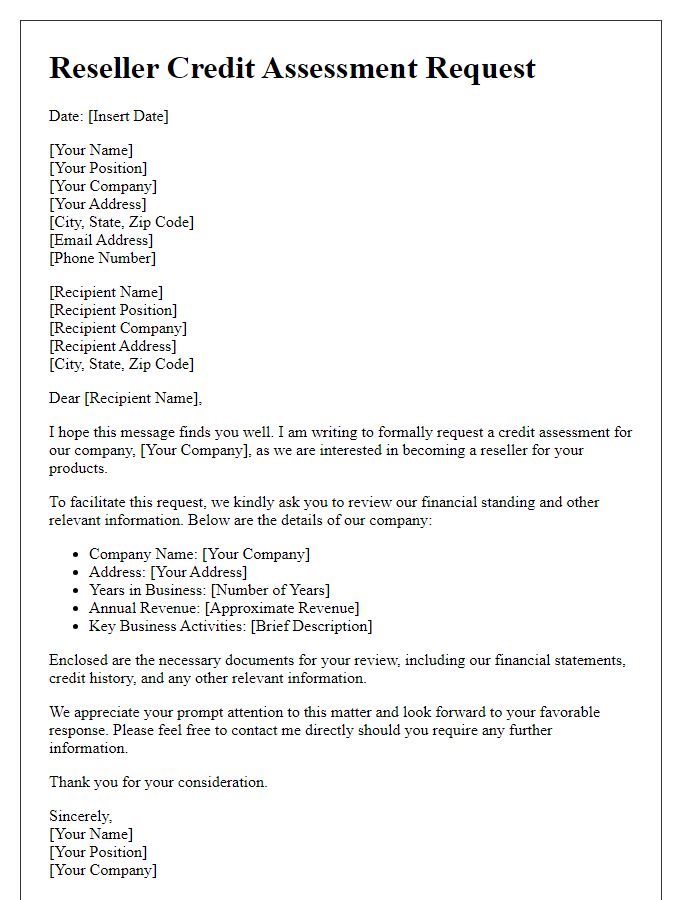

Clear business identification

Reseller credit score evaluation requires clear business identification for accurate assessment. This includes critical data such as the business's legal name, registered address, tax identification number, and contact information. Key documentation, such as state registration certificates and business licenses, also enhances credibility. Understanding industry classification codes (NAICS) helps in contextualizing financial standing and payment behaviors. Additionally, past credit history, including accounts payable age and purchase volumes, contributes vital insights into the business's reliability and risk profile. Overall, comprehensive identification details facilitate precise evaluation of the reseller's creditworthiness.

Comprehensive credit history

A comprehensive credit history analysis is crucial for evaluating reseller capability, particularly for businesses in competitive markets such as retail and e-commerce. This analysis typically includes an examination of payment patterns, credit utilization ratios, and delinquencies over the previous three to five years. For instance, companies with a minimum of three trade lines reported to major credit bureaus, like Dun & Bradstreet, Equifax, or Experian, present a stronger profile. Furthermore, a consistent payment record, preferably above 90% on-time payments, positively influences creditworthiness. Highlighting any bankruptcy filings or significant tax liens within the last seven years is essential, as these factors can severely impact credit scores and reliability. Additionally, understanding the overall financial health of the reseller, indicated by metrics such as debt-to-income ratio and current financial obligations, provides insight into their capacity to fulfill further credit agreements.

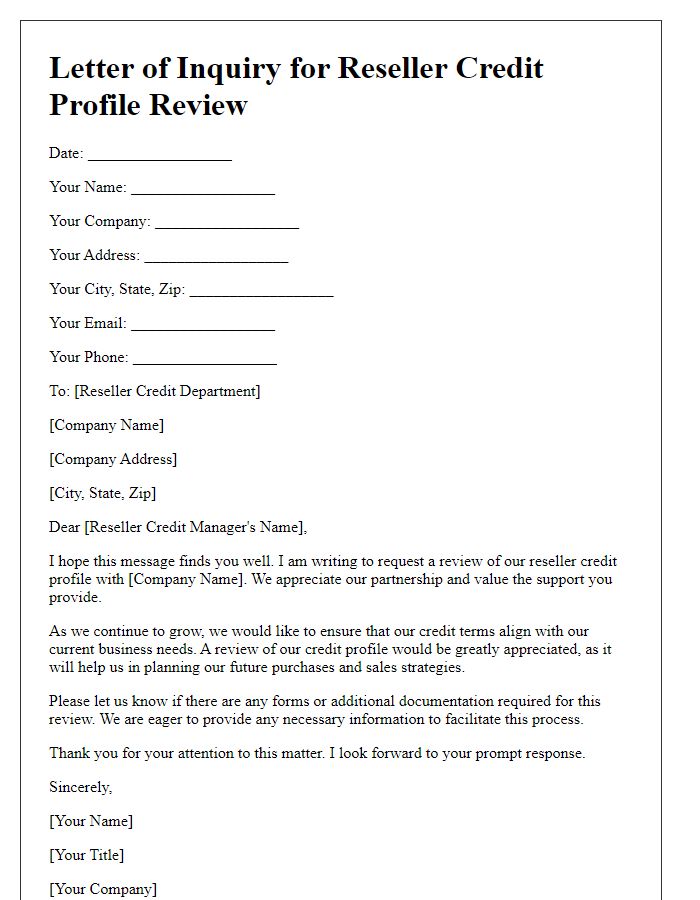

Payment behavior analysis

Effective payment behavior analysis is crucial for assessing the creditworthiness of resellers in various industries. By examining payment histories, frequency of late payments, and adherence to agreed-upon credit terms, businesses can derive valuable insights into a reseller's financial stability. Metrics such as average days to payment, which typically ranges from 30 to 60 days for most sectors, play a pivotal role in this evaluation. Additionally, credit reporting agencies, such as Experian or Dun & Bradstreet, provide comprehensive reports that include payment patterns and outstanding debts. Evaluating these factors can inform decisions regarding credit limits and terms to minimize financial risk, ensuring that partnerships remain mutually beneficial.

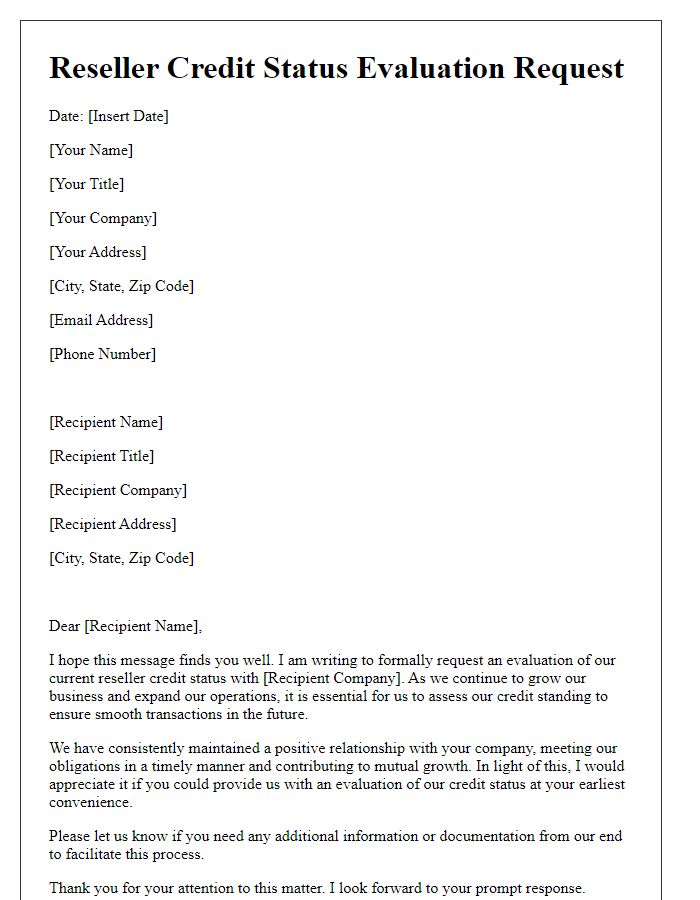

Credit limit recommendations

Reseller credit score evaluations play a crucial role in determining credit limit recommendations, influencing both financial security and business growth opportunities. Detailed assessments involve analyzing a reseller's payment history, outstanding debt levels, and overall creditworthiness based on factors such as FICO scores, which range from 300 to 850, providing insights into reliability. A solid credit profile often correlates with higher recommended limits, while red flags like late payments or excessive credit utilization can lead to conservative limits. In addition, industry benchmarks provide context, with averages varying by sector, such as retail or technology, influencing credit decisions. Careful evaluation ensures that credit limits align with the reseller's capabilities and market conditions, fostering sustainable partnerships.

Evaluation of financial statements

Reseller credit score evaluation requires in-depth analysis of financial statements including balance sheets, income statements, and cash flow statements. A balance sheet provides insight into an entity's assets, liabilities, and equity at a specific point, essential for assessing financial health. The income statement reveals revenue streams (sales figures, cost of goods sold) and profit margins, indicating operational efficiency. Cash flow statements highlight liquidity (cash inflows, outflows) over a period, critical for understanding the ability to meet short-term obligations. Evaluators consider ratios such as current ratio (current assets divided by current liabilities) and debt-to-equity ratio (total liabilities divided by shareholders' equity) to gauge risk levels associated with extending credit. Proper evaluation aids in establishing reliable credit terms suitable for the reseller's financial stability.

Comments