Are you looking to seamlessly transfer your digital accounts but unsure of where to start? Navigating the process can feel overwhelming, but it doesn't have to be. With our handy letter template, you'll not only save time but also ensure that your requests are clear and professional. So, why not dive in and discover how easy it can be to make your digital transitions smooth?

Account Holder Information

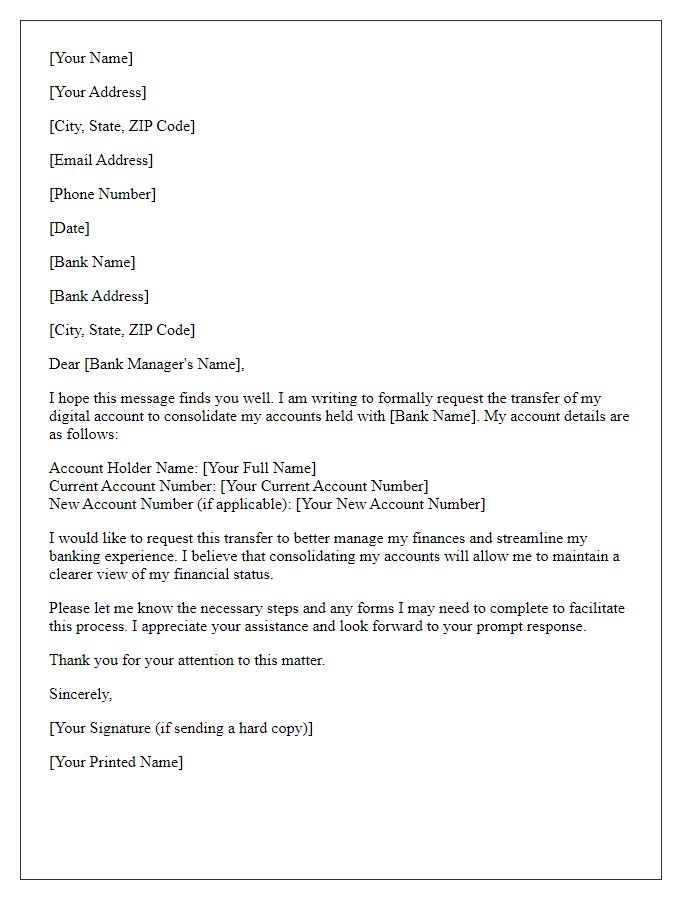

The process of requesting a digital account transfer involves several critical elements that ensure the safe and efficient transfer of financial assets. Key components include the account holder's full name, residential address, and contact information, which must be accurately provided to authenticate the identity of the person making the request. Additionally, details regarding the originating account, such as the account number and financial institution (e.g., Bank of America, Chase), alongside the destination account information, including the new account number and recipient bank name, are crucial. Dates are also important; the requested effective transfer date should fall within standard processing times, typically between three to five business days. Moreover, any specific instructions regarding the transfer method, such as wire transfer or ACH transfer, should be clearly outlined to facilitate the procedure. Finally, including terms and conditions that acknowledge any fees or penalties applicable can ensure that all parties involved are fully aware of potential costs associated with the transfer.

Recipient Bank Details

Initiating a digital account transfer requires specific information to ensure a smooth transaction. The recipient's bank details include the account number, which typically consists of 10 to 12 digits, the bank's name, which could be major institutions like Citibank or Bank of America, and the bank's routing number, usually a 9-digit code in the United States used to identify financial institutions. Additionally, including the recipient's full name as registered with the bank is crucial for verification purposes. It is also advisable to provide the type of account, such as checking or savings, to avoid any confusion during the transfer process. Clear and precise details help facilitate a prompt and accurate digital transaction.

Transfer Request Reason

Requesting a digital account transfer involves crucial details to ensure a smooth process. Individuals need to clearly state the transfer reason, such as relocation, financial restructuring, or a change in service preference. Providing information about the original account, including the account number and service provider name, adds clarity. Additionally, specifying the new account details, like the intended service provider and new account number, is essential for accurate processing. Mentioning any urgency associated with the transfer, including upcoming deadlines or financial commitments, can facilitate timely attention. Thorough documentation, such as identification or proof of address when necessary, strengthens the request and ensures compliance with organizational policies.

Authorization and Consent

Digital account transfers often require explicit authorization and consent from the account holder to ensure that personal and financial information is securely handled. This process typically involves a formal request to the institution managing the account, specifying account details, the reason for the transfer, and the destination of the funds or information. For example, fraud protection measures may necessitate verification of identity through documentation, such as government-issued IDs or utility bills. Furthermore, financial institutions like banks or digital wallets may require a distinct consent form, confirming that the account holder agrees to the terms and conditions associated with the transfer. Clear identification of parties involved (account holder, receiving institution) and adherence to legal regulations protect all entities involved in the transaction.

Contact Information and Signature

A request for a digital account transfer requires precise details and clarity to ensure a smooth process. Each financial institution has specific requirements, often including personal identification, account numbers, and transfer methods. The account holder's full name should be clearly stated, along with the current account number and the desired recipient account details. Including a valid form of identification, such as a government-issued ID, can expedite the transfer. Additionally, the date of the request is essential for record-keeping and to track the transfer's timeline. Finally, a clear signature validates the authenticity of the request, assuring the receiving institution of the requester's intent.

Letter Template For Request Digital Account Transfer Samples

Letter template of request for digital account transfer due to relocation.

Letter template of request for digital account transfer for business purposes.

Letter template of request for digital account transfer for personal reasons.

Letter template of request for digital account transfer to a new provider.

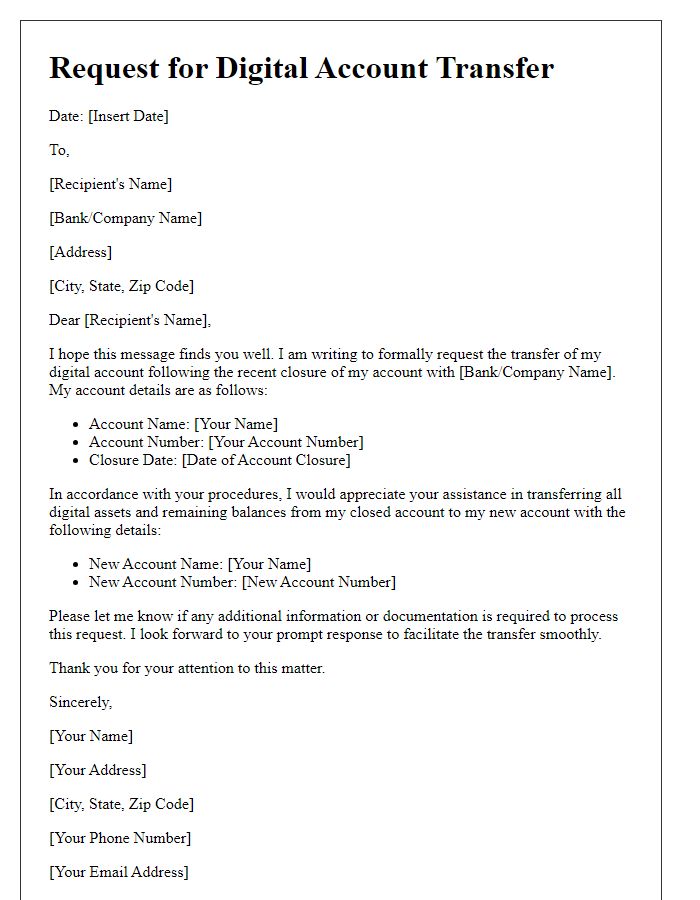

Letter template of request for digital account transfer following account closure.

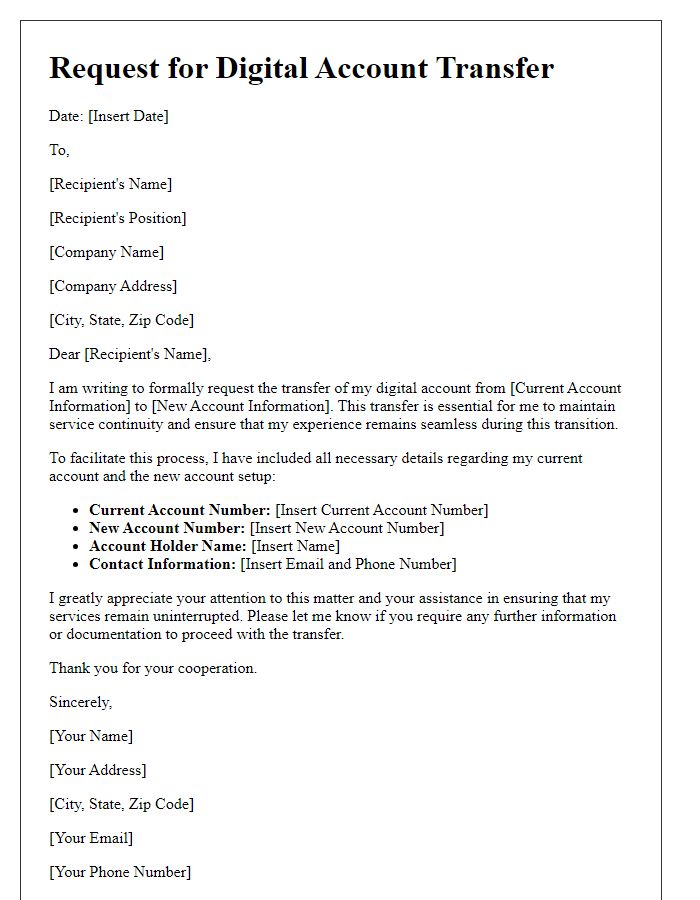

Letter template of request for digital account transfer while maintaining service continuity.

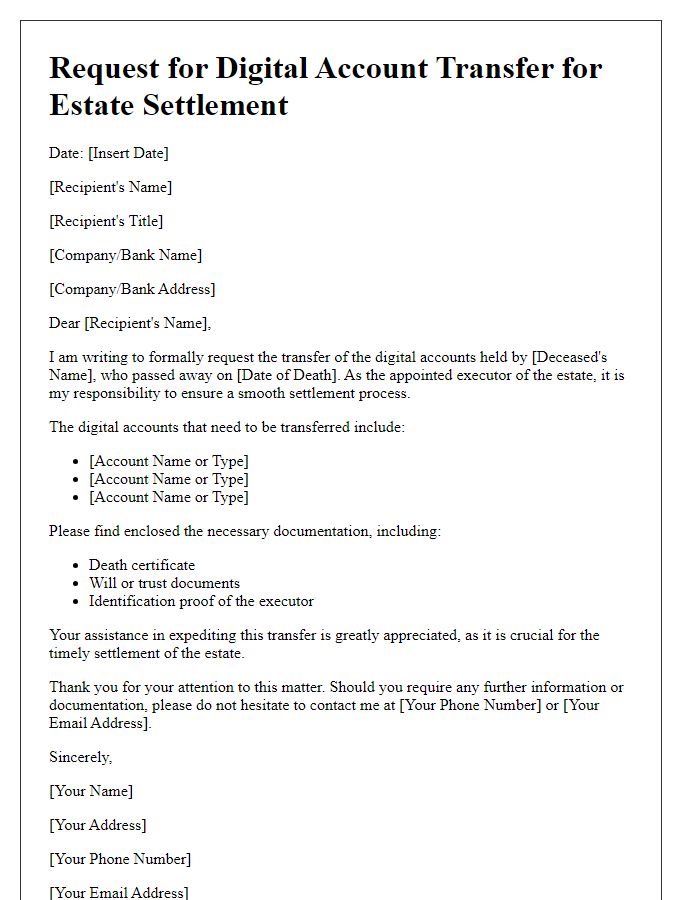

Letter template of request for digital account transfer for estate settlement.

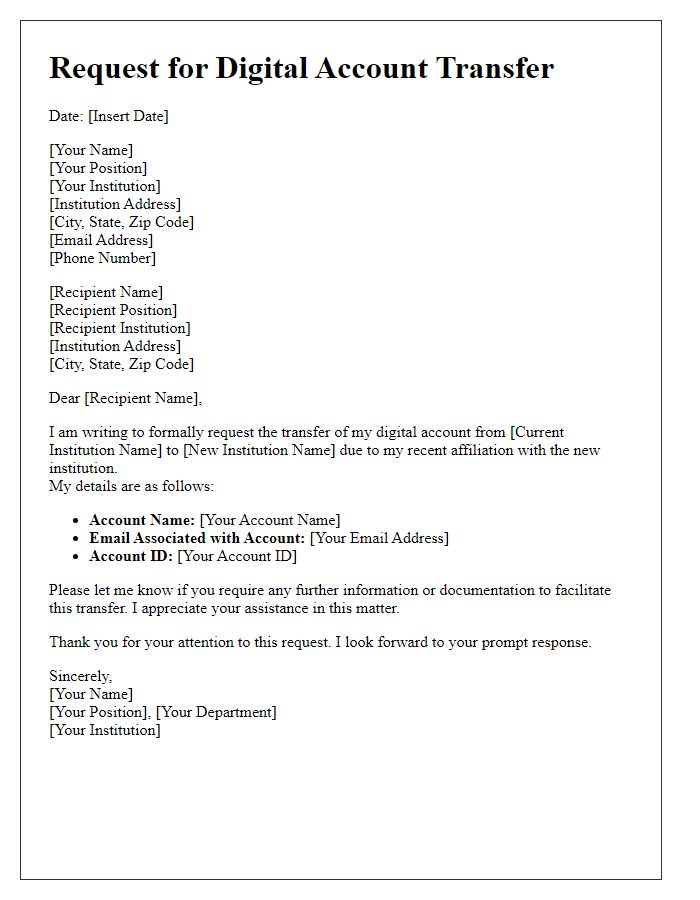

Letter template of request for digital account transfer for institutional affiliation.

Comments