Hey there! Have you ever lost track of your credit card payment due dates and faced those pesky late fees? It can happen to the best of us, but staying organized is key to keeping your finances in check. In this article, we'll explore some effective strategies for creating a personalized credit card bill payment alert system that works for you. So, let's dive in and discover how to simplify your payment process!

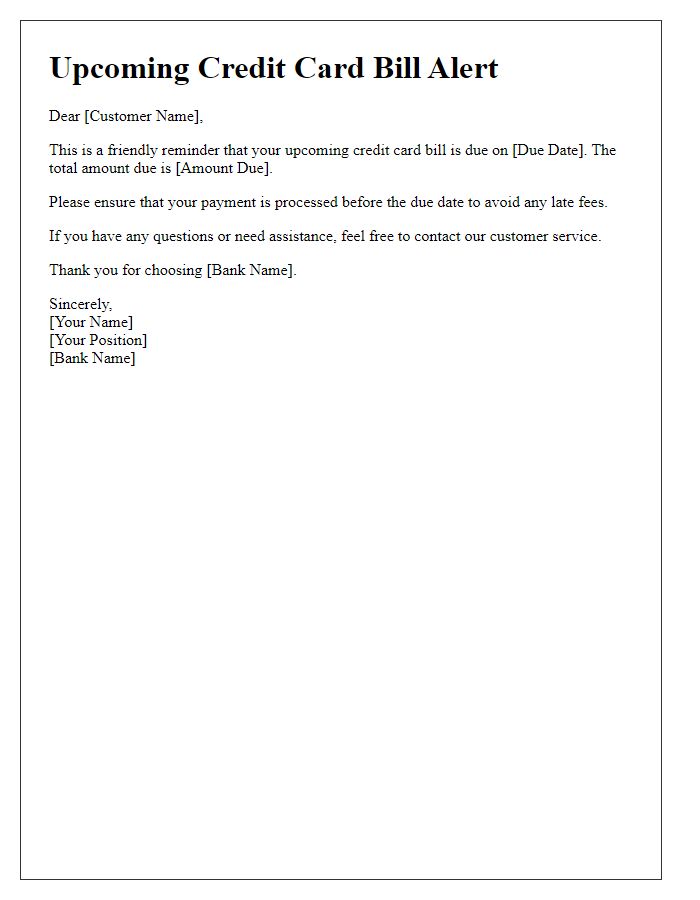

Clear and Concise Subject Line

Credit card bill payment alerts serve as essential notifications for account holders. Timely reminders ensure that payments reach credit card companies, such as Visa or Mastercard, on or before due dates, preventing late fees averaging $30. Alerts typically highlight the total amount due, payment deadline, and available credit, helping individuals maintain financial health. Missing a payment can impact credit scores, which often range from 300 to 850, significantly affecting borrowing capabilities and interest rates on loans. In busy urban centers like New York City or Los Angeles, where high living costs prevail, staying informed about these payments can foster better financial decision-making and budget management.

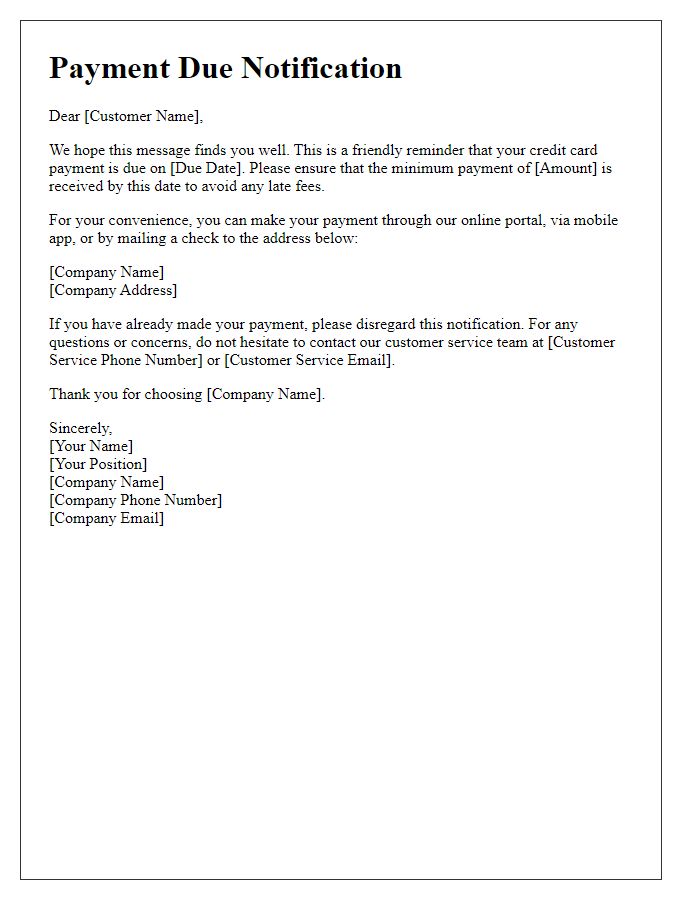

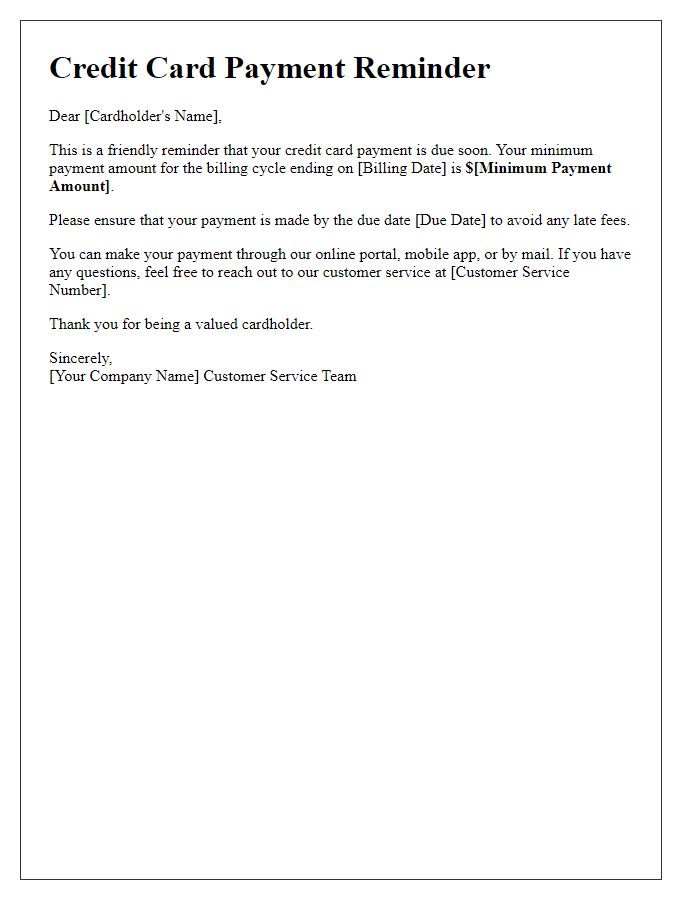

Personalization and Account Details

Consumers often receive credit card bill payment alerts to help manage their financial responsibilities. These notifications typically include personalized elements such as the cardholder's name, the billing cycle due date, and the outstanding balance owed (often in the range of hundreds to thousands of dollars). Additionally, these alerts may specify the minimum payment required, which can be a percentage of the total balance or a fixed amount. The alerts often include account details, such as the last four digits of the credit card number and the payment methods available (like bank transfers or mobile payment apps). It is essential for consumers to stay aware of these details to avoid late fees (sometimes around $35) and potential impacts on their credit scores, ensuring timely payments and financial health.

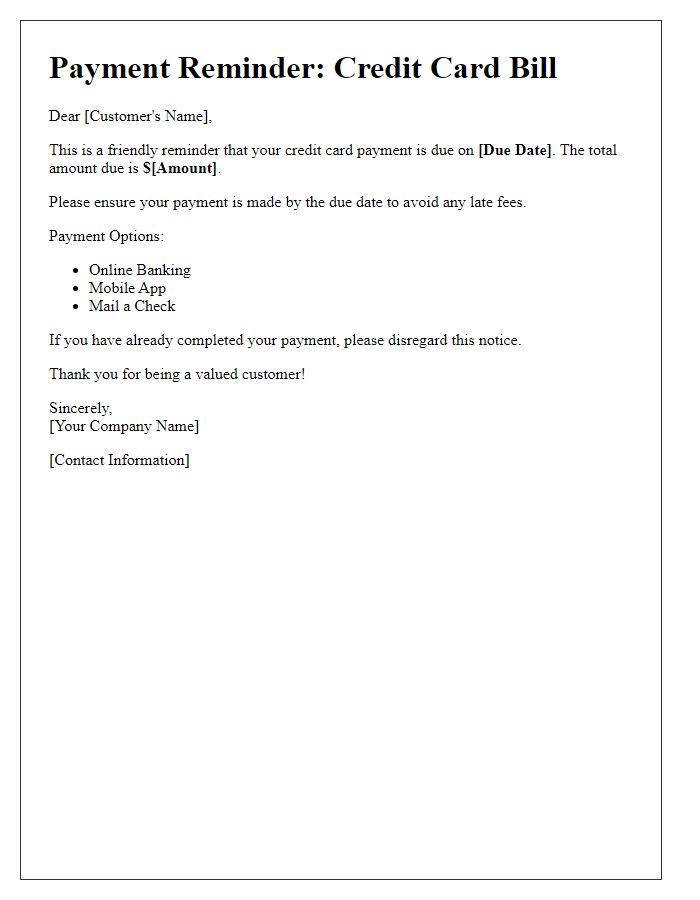

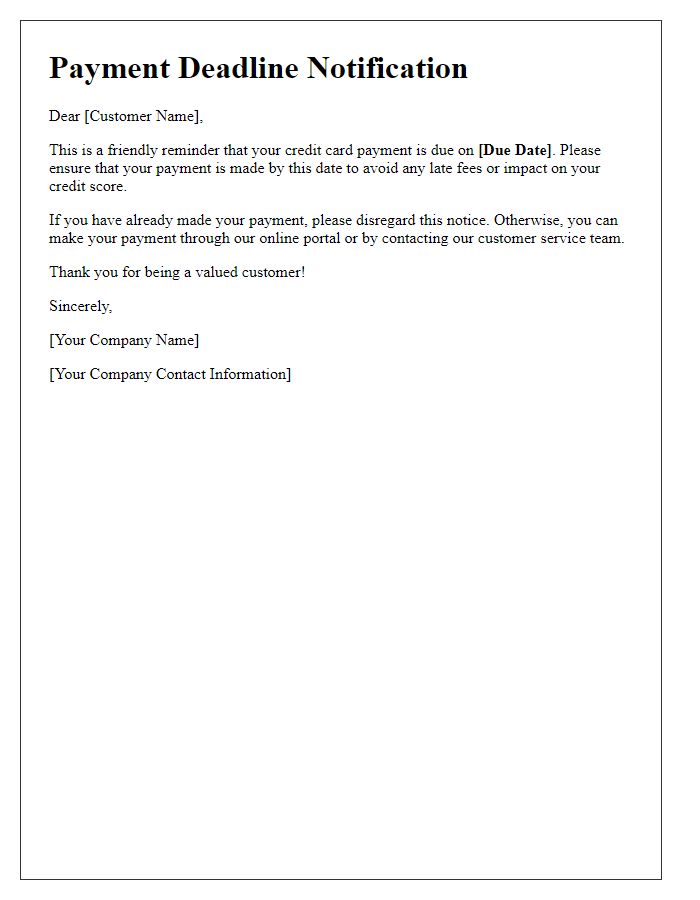

Payment Due Date and Amount

Credit card bill payment alerts serve as essential reminders for cardholders to manage their finances effectively. Each month, cardholders receive notifications indicating the payment due date, typically within the first week of the month, and the minimum payment amount required, which can vary significantly based on the card provider like Visa or MasterCard. Timely payments, often highlighted to be made by specific dates such as the 15th or 30th, help avoid late fees that can range from $25 to $40. Additionally, alerts may emphasize the total outstanding balance, which can affect credit utilization ratios, critical for maintaining good credit scores. Events such as grace periods are also important, as they allow for interest-free payments if settled within the designated timeframe specified in terms and conditions.

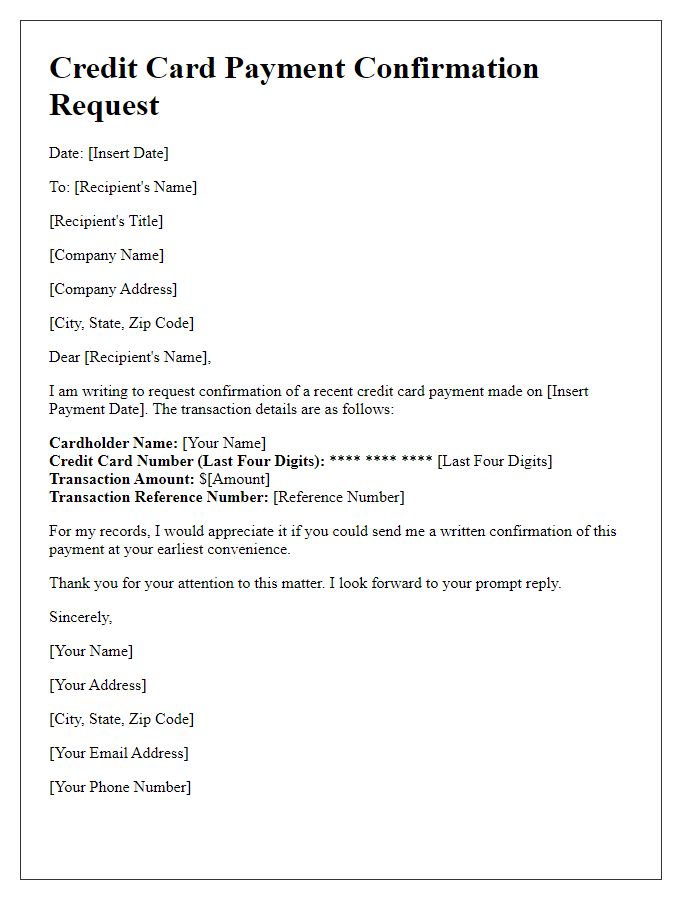

Payment Methods and Instructions

Credit card bill payment alerts provide essential information regarding payment methods and instructions for cardholders. Options include online payments through the card issuer's website or mobile app, phone payments via automated systems, and mailing checks to the billing address listed on the statement. Due dates (typically 25-30 days after the billing cycle ends) must be noted to avoid late fees. Customers may also have the option to set up automatic payments to ensure timely processing. Payment methods vary by issuer (e.g., Visa, MasterCard, American Express) and can also include electronic funds transfer (EFT) directly from linked bank accounts. It's crucial for cardholders to monitor their account balance and ensure sufficient funds before executing transactions, aiming to maintain a good credit score and avoid interest charges.

Contact Information for Assistance

Credit card bill payment alerts are crucial for maintaining financial health. Timely payments prevent late fees and negatively impact credit scores. Many financial institutions, like Chase and Citibank, provide customer service contacts for payment assistance. The standard payment due date each month typically falls on the same day, often the first or the fifteenth, making consistent tracking essential. Contact options include toll-free phone numbers, online chat services, and dedicated email addresses, typically listed on the back of the card or in account statements. Customer service representatives can guide account holders in setting up autopay or reminders to avoid missed payments. Access to these details ensures that account holders can manage their finances effectively and avoid potential penalties.

Comments