Are you nearing retirement and feeling overwhelmed by the thought of managing your retirement fund? You're not alone; many people face the challenge of ensuring their savings will last through their golden years. With the right guidance and strategies, you can confidently take control of your financial future. Join us as we explore effective retirement fund management techniques that will help you make informed decisions for a secure and fulfilling retirement!

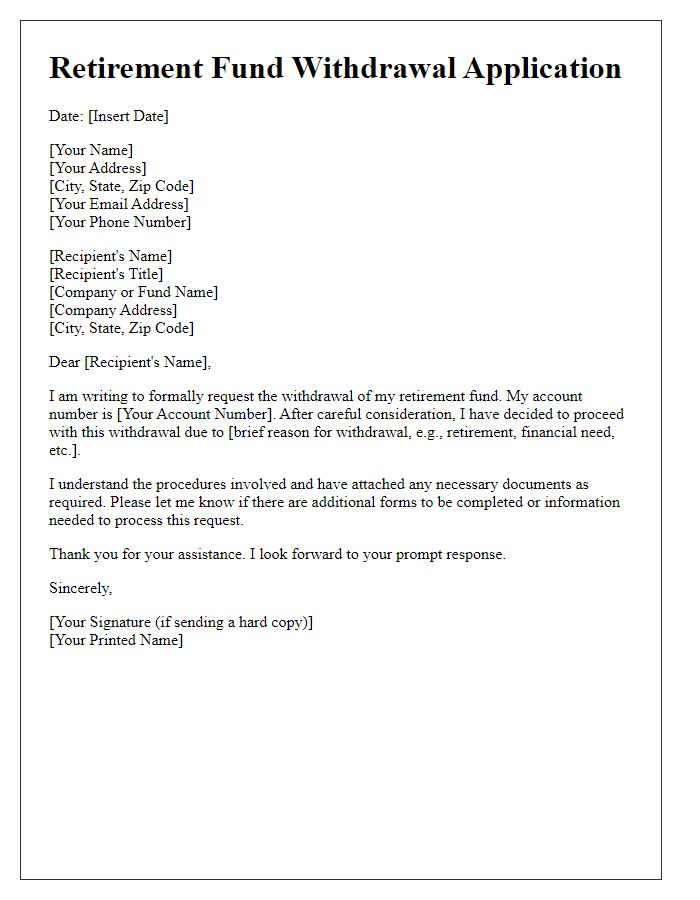

Personal Identification

Personal identification is crucial for retirement fund management processes. Successful verification often requires details such as Social Security Number (SSN) for accurate identification. Retirement accounts, like 401(k) or IRA, may necessitate additional information, including date of birth to verify eligibility and account ownership. Address confirmation ensures correspondence reaches the account holder, while government-issued identification (e.g., passport or driver's license) validates identity and prevents fraud. Updating personal information regularly is essential to maintaining seamless access to retirement benefits, particularly during significant life changes such as relocation or marital status updates.

Retirement Goals

Individuals planning for retirement often set specific goals related to financial security, lifestyle choices, and health care. Retirement age varies, but many aim for 65 years, aligning with Social Security benefits eligibility in the United States. Financial experts recommend having 10-12 times one's final salary saved in retirement accounts, such as 401(k) plans and IRAs, to maintain a comfortable standard of living. Monthly expenses during retirement, including healthcare costs, can average $3,000 to $4,000, highlighting the importance of comprehensive financial planning. Additional considerations may involve estate planning and long-term care insurance, ensuring peace of mind and support for loved ones.

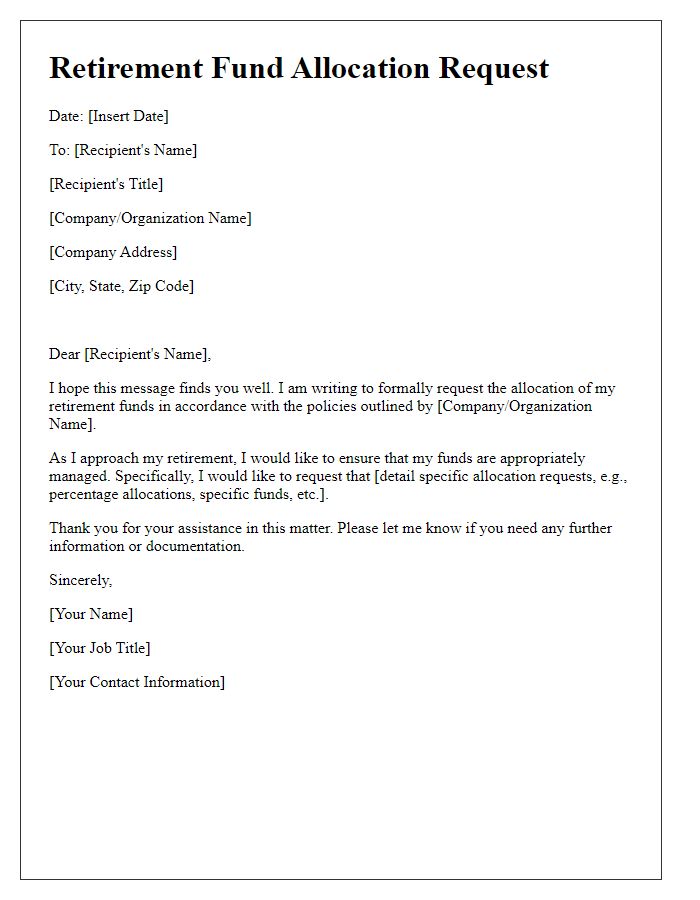

Investment Strategy

An effective investment strategy for retirement fund management involves diversifying assets across various classes such as equities (stocks), fixed income (bonds), and real estate (REITs). Allocating approximately 60% to equities can harness growth potential, particularly in emerging markets and technology sectors, while 30% in fixed income can provide stability through government bonds and corporate bonds during market volatility. The remaining 10% allocated to real estate investment trusts (REITs) can offer income through dividends and potential appreciation. Regular rebalancing (adjusting the proportions of different assets) every 12 months ensures alignment with risk tolerance and market conditions, while incorporating sustainable investment options can appeal to socially conscious investors. The overall goal remains to achieve capital appreciation and generate sufficient income streams to sustain a comfortable retirement, safeguarding against inflation (the general increase in prices) over time.

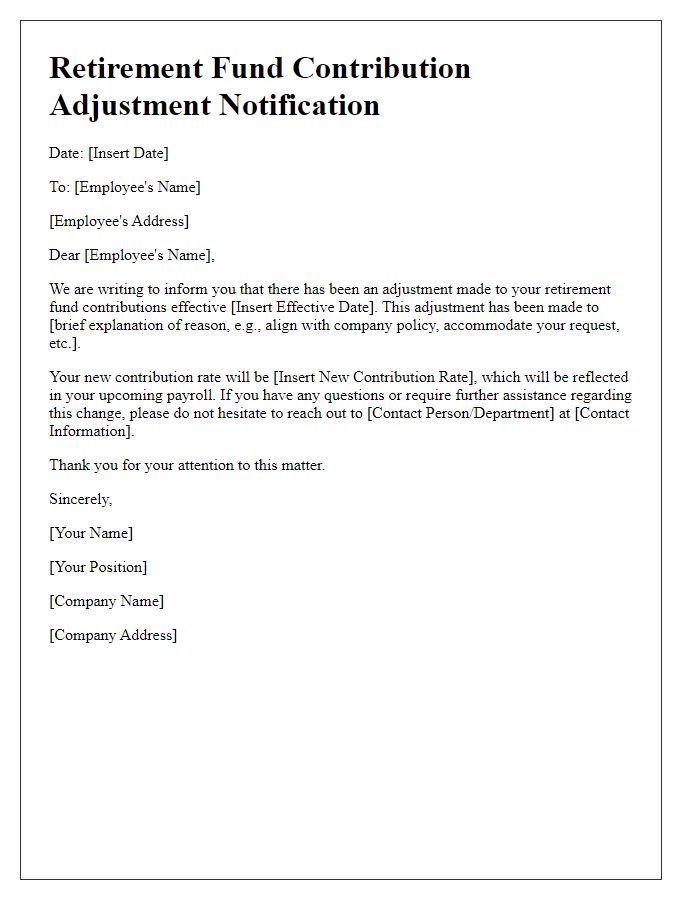

Risk Tolerance

Understanding risk tolerance is crucial for retirement fund management. Investors, such as those planning for retirement, often have varying levels of risk tolerance, influenced by factors such as age, income, investment experience, and financial goals. Higher risk tolerance may allow for more aggressive investment strategies, like equities or real estate, which have potential for significant returns but also increased volatility. Conversely, lower risk tolerance may steer investors toward safer options, such as government bonds or fixed-income securities, generally offering stability but lower returns. Regular assessments of one's risk tolerance, ideally in consultation with a certified financial planner, can help align investment strategies with overall retirement objectives, ensuring a well-balanced portfolio that meets unique needs and timelines.

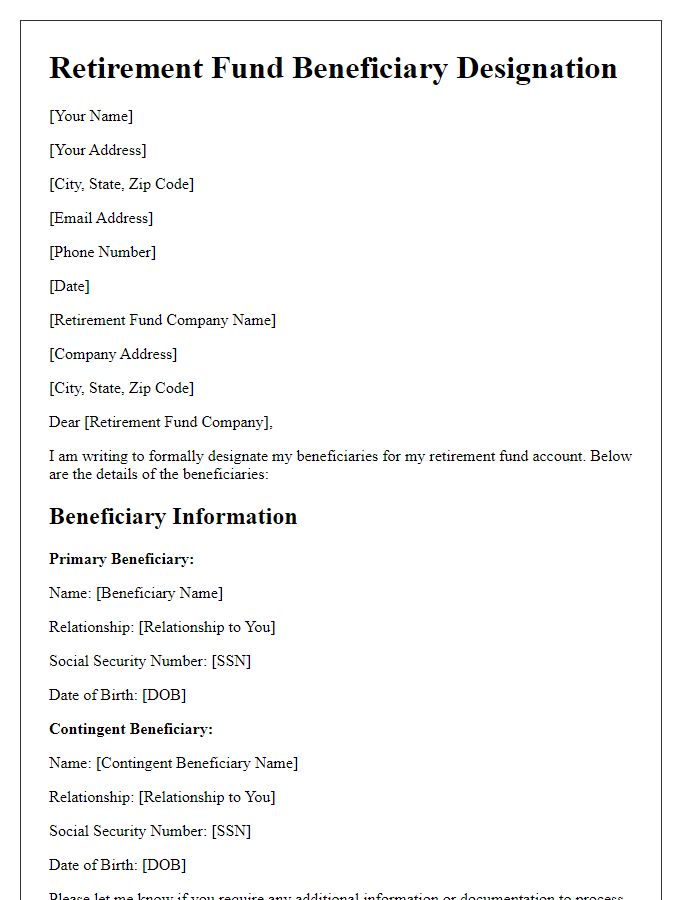

Contact Information

Retirement fund management encompasses strategic planning for individuals' financial assets intended for use during retirement years, typically emphasizing growth and preservation. Effective communication of contact information is crucial in this sector, ensuring clients can reach experienced financial advisors or fund managers for guidance. Relevant details include firm name, such as Vanguard or Fidelity, mailing address, often including city and zip code for precise identification, phone numbers for direct communication, and email addresses facilitating prompt digital correspondence. Additionally, the inclusion of website URLs may offer clients instant access to online resources, investment tools, and educational materials supporting informed decision-making in their retirement planning journey.

Comments