Are you considering adopting electronic payment systems for your business but unsure where to start? This innovative approach can streamline your financial transactions and enhance customer satisfaction. With the rise of digital wallets and contactless payments, embracing these technologies is becoming increasingly vital. Join us as we delve into the benefits, implementation strategies, and best practices for electronic payment systemsâlet's explore this exciting landscape together!

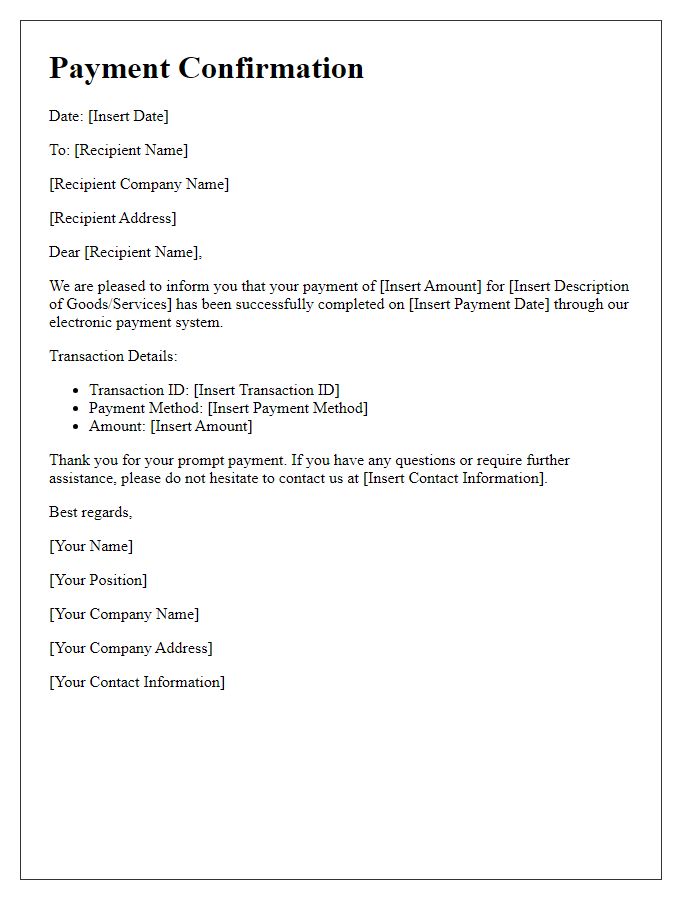

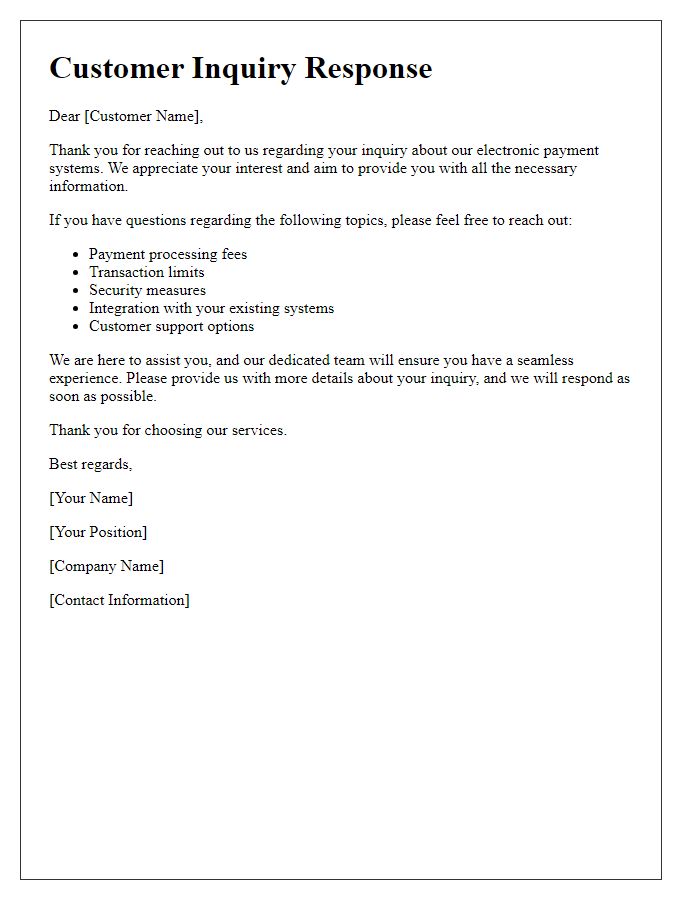

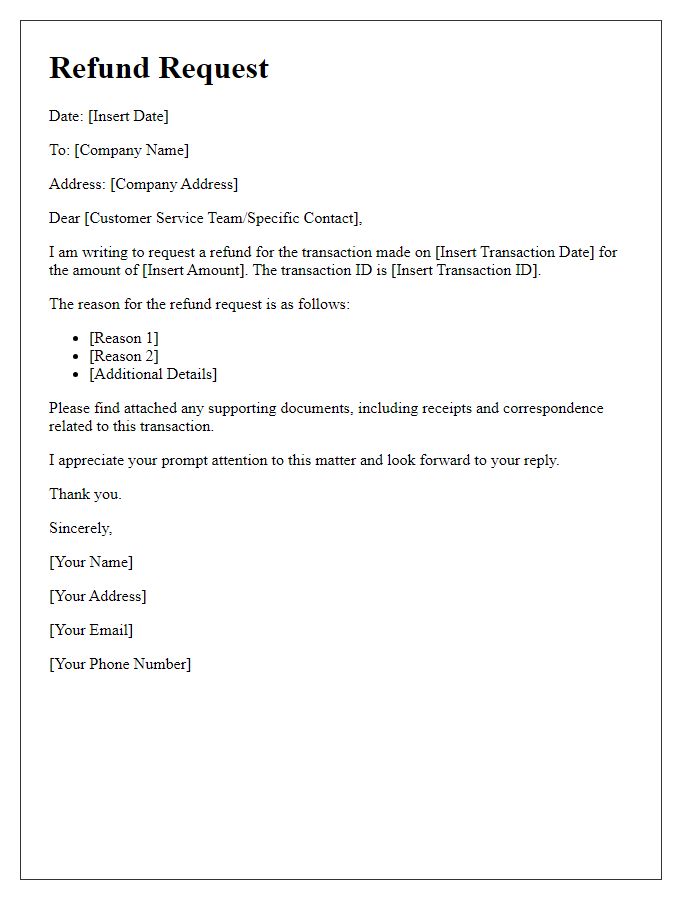

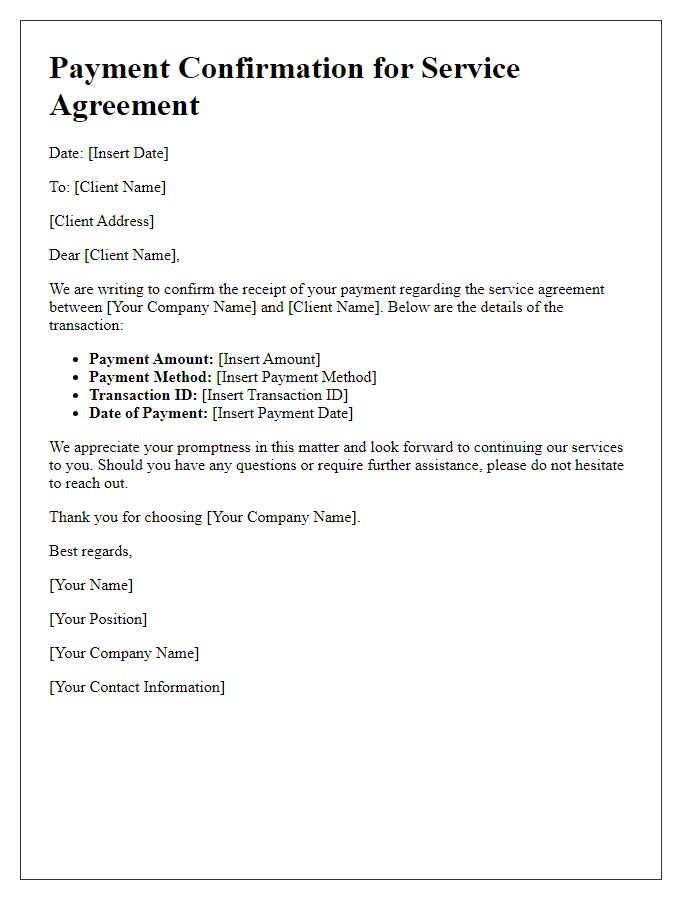

Purpose of the letter

The increasing adoption of electronic payment systems, such as digital wallets and mobile payment applications, has transformed financial transactions across various sectors. These systems streamline the payment process, enabling consumers to conduct transactions quickly and securely using their smartphones or other electronic devices. Notable platforms like PayPal, Venmo, and Apple Pay have revolutionized the way businesses and individuals exchange value, allowing for instantaneous funds transfer without the need for physical cash or traditional banking. Additionally, the integration of advanced encryption technologies ensures user data protection, enhancing consumer confidence in online transactions. The widespread acceptance of contactless payments, especially during events such as global pandemics, has also accelerated the shift towards cashless societies, influencing consumer behavior and business operations.

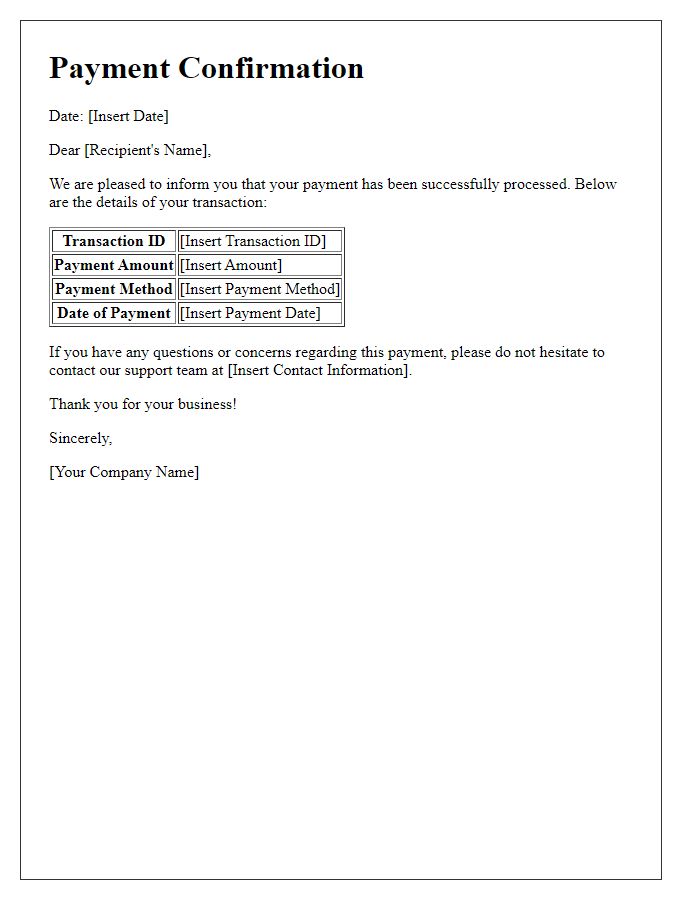

Customer account details

Customer account details in electronic payment systems often require secure information management. Key identifiers such as account numbers (usually 16 to 19 digits long) and routing numbers play a significant role in transactions. Platforms like PayPal and Stripe facilitate seamless online payments by providing a user-friendly interface enabling customers to link their bank accounts or credit cards (Visa, Mastercard). Security measures include encryption protocols like SSL (Secure Socket Layer) and tokenization, which transform sensitive data into non-sensitive equivalents during the transaction process. Additionally, email addresses associated with accounts often serve as unique identifiers for transaction confirmations and account notifications, ensuring easy communication and security alerts for users.

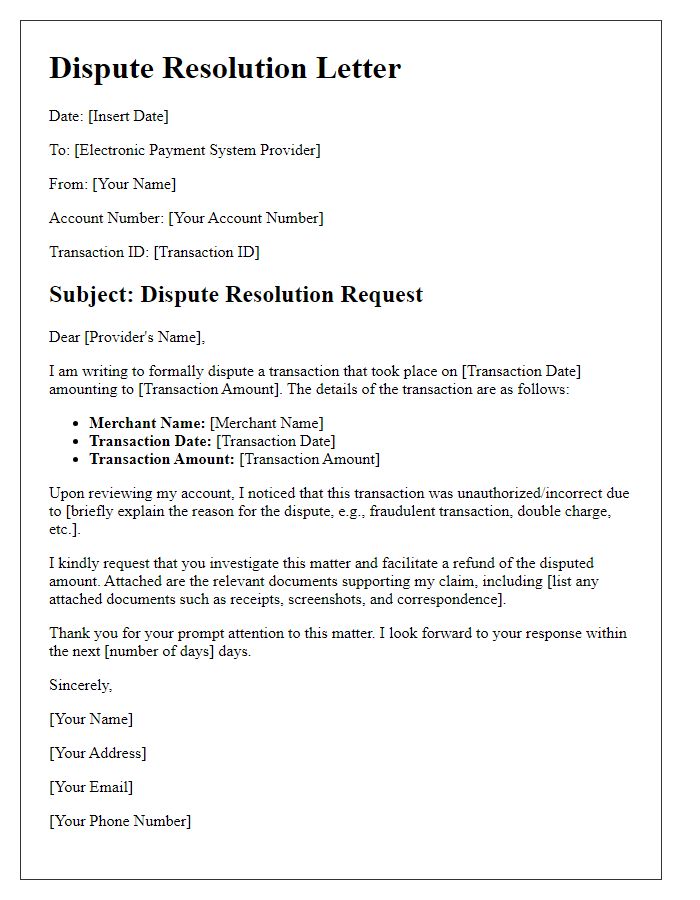

Transaction security information

Transaction security measures are vital for electronic payment systems, including digital wallets and online banking platforms. Robust encryption protocols, such as AES (Advanced Encryption Standard) with 256-bit keys, protect sensitive data during transmission. Multi-factor authentication (MFA) enhances security by requiring additional verification steps, reducing the risk of unauthorized access. Compliance with industry standards, such as PCI-DSS (Payment Card Industry Data Security Standard), ensures merchants adhere to strict security guidelines. Regular vulnerability assessments and penetration testing monitor system integrity and identify potential weaknesses. Consumer education on recognizing phishing schemes and secure browsing practices further fortifies transaction safety, fostering trust in electronic payment solutions.

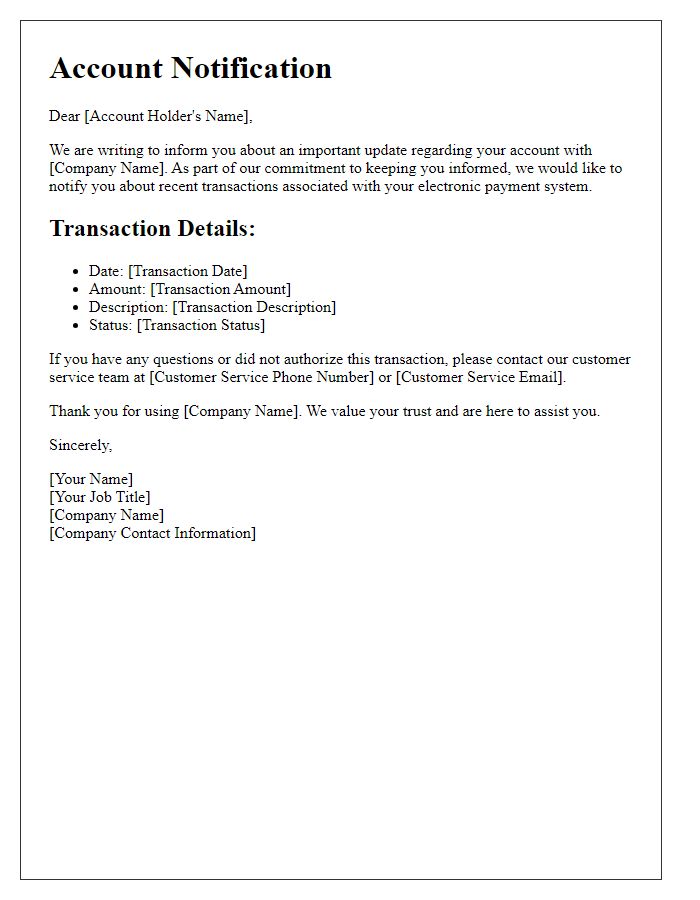

Contact support information

Electronic payment systems, like PayPal or Square, provide users with various support options. For immediate assistance, users can typically reach customer support via dedicated helplines, often available 24/7, with wait times averaging under five minutes. Email support is another channel, allowing users to send inquiries and receive responses usually within 24 hours. Live chat options often exist on the company's website, facilitating real-time assistance with transaction issues or account management. Additionally, many electronic payment platforms have extensive help centers, complete with FAQs and troubleshooting guides that address common concerns, security features, and transaction limits. For urgent issues, social media platforms like Twitter also serve as a rapid communication method, as companies often monitor these channels closely for customer service inquiries.

Terms and conditions summary

Electronic payment systems such as PayPal or Stripe require users to understand their terms and conditions to ensure secure transactions. Users must acknowledge the necessity for data protection measures, in compliance with the General Data Protection Regulation (GDPR), which mandates the safeguarding of personal information across the European Union. Fees associated with transactions, typically ranging from 1.9% to 3.5%, can vary based on payment volume and type of transaction. Furthermore, users should be aware of potential chargeback policies, which allow customers to dispute transactions within 60 days, impacting both the merchant's revenue and reputation. Also, the processing timeframe for transactions, usually 1 to 3 business days, can influence cash flow, particularly for small businesses. Awareness of these conditions is critical for users engaging in electronic commerce across platforms.

Comments