Are you feeling overwhelmed by your legal financial obligations? You're not alone; many individuals find themselves navigating the complexities of financial responsibilities under the law. Understanding these obligations is crucial for managing your finances effectively and ensuring compliance. If you want to learn more about handling legal financial matters, keep reading!

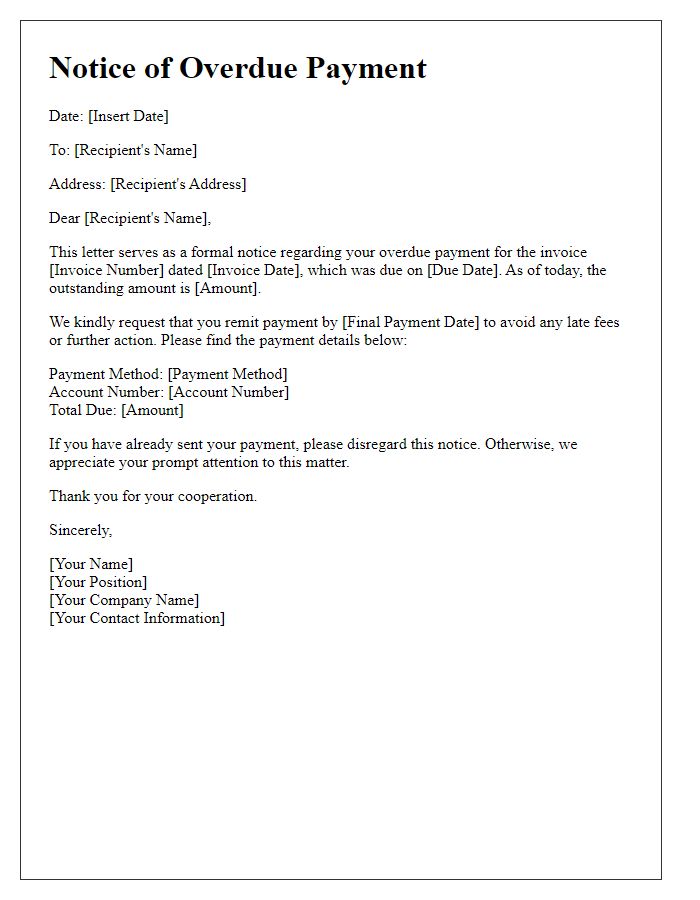

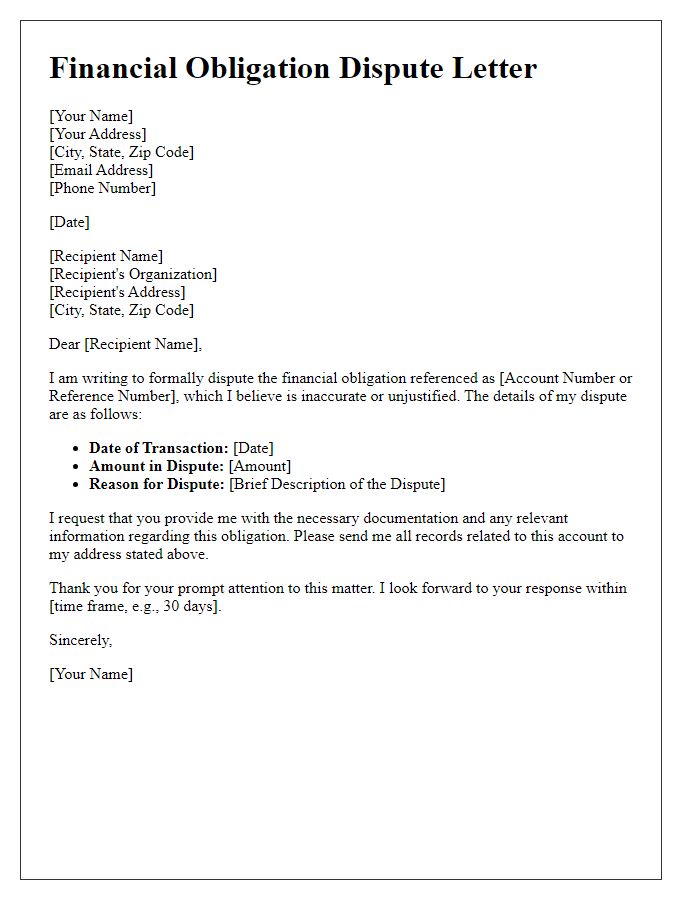

Clarity and Precision

Legal financial obligations often require clarity and precision to ensure mutual understanding between parties. For instance, a loan agreement (a formal document outlining terms of the loan, repayment schedule, and interest rates) specifies the lender's (the individual or institution providing the loan, such as a bank or credit union) and borrower's responsibilities (the party receiving the loan). Clear articulation of payment dates (specific days when payments are due each month) and amounts (the total sum to be paid) is crucial, often detailed in numerical figures, such as 12 monthly installments of $500. Additionally, potential penalties (charges incurred for late payments) for non-compliance must be outlined, including specific percentages or dollar amounts. Effective communication ensures both parties have a mutual understanding of expectations and consequences.

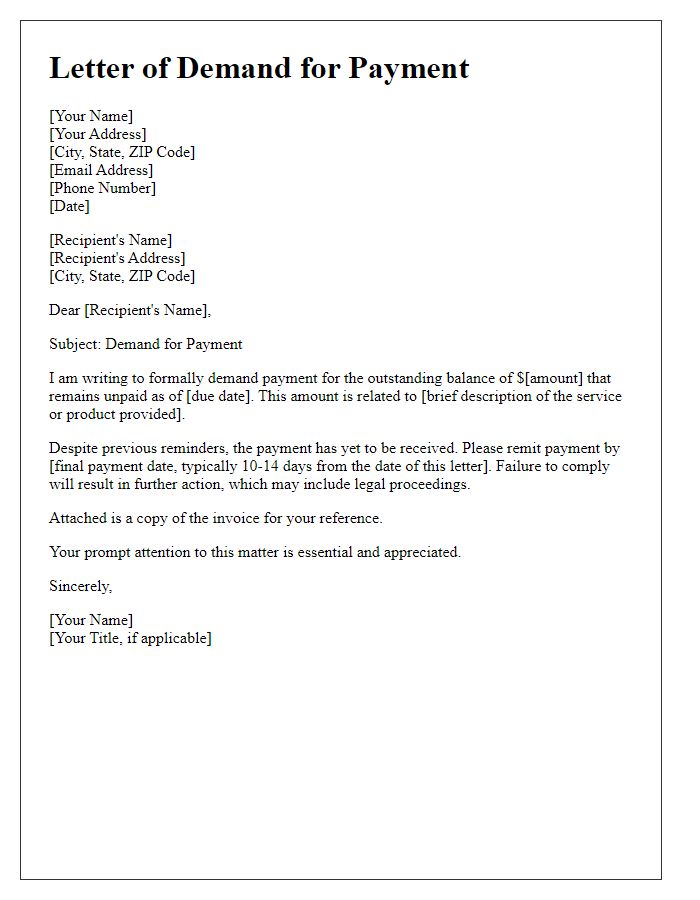

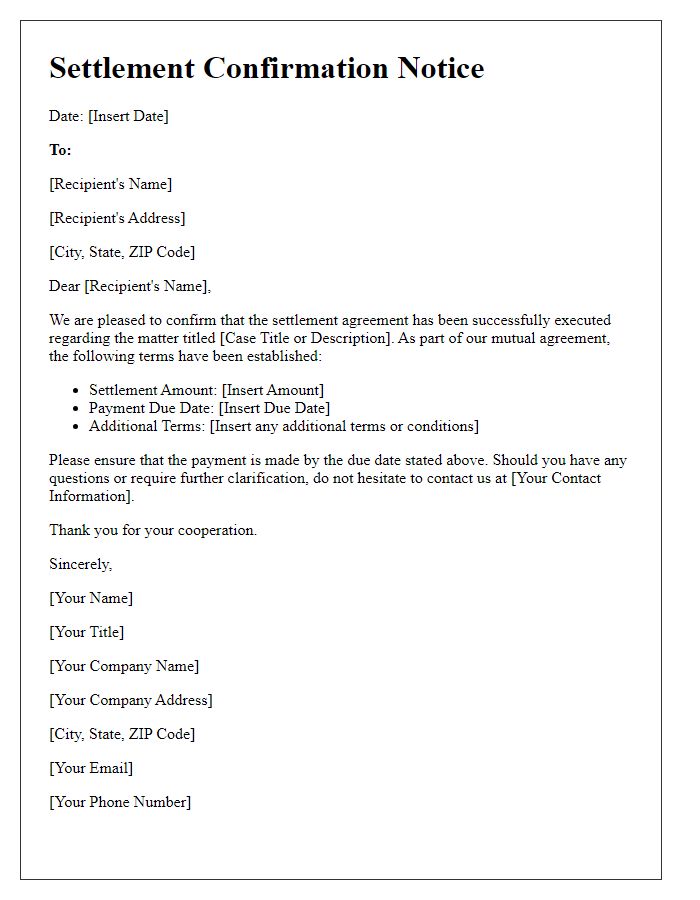

Formal Tone and Language

In instances where individuals or entities face legal financial obligations, it is crucial to establish clarity and transparency regarding the responsibilities involved. Such obligations often arise from contracts, loans, or court judgments, necessitating precise documentation. For example, an individual may owe a specified sum of $10,000 as part of a loan agreement to a financial institution (such as Bank of America), requiring adherence to a repayment schedule of monthly installments over three years. Legal repercussions may ensue if payments are not made on time, potentially leading to complications such as late fees, increased interest rates, or even legal actions including bankruptcy filings. Proper communication regarding these obligations can mitigate misunderstandings and foster a more favorable resolution for all parties involved. Attention to specific details, including due dates and interest calculations, is paramount in ensuring compliance and maintaining financial integrity.

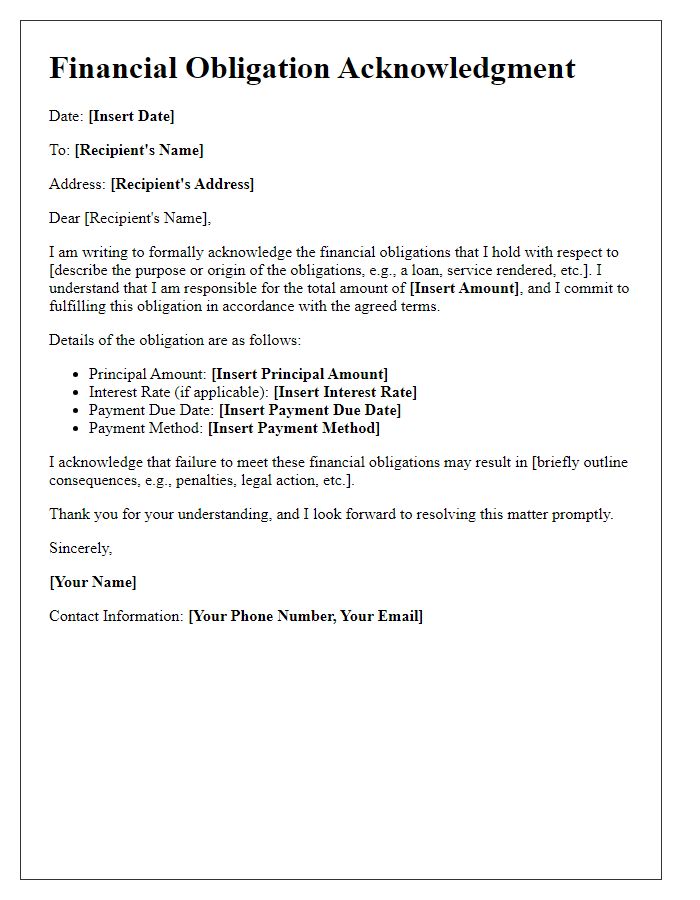

Legal Terminology

Legal financial obligations, such as contractual debts and court-ordered payments, play a crucial role in maintaining financial accountability among parties. Contracts, legally binding agreements between entities, outline the specific terms, including payment schedules and amounts owed, which must be adhered to in accordance with governing laws. Nonpayment of these obligations can lead to legal repercussions, including lawsuits or liens against assets. Jurisdictions, defined areas governed by specific legal systems, may have varying regulations regarding interest rates, penalties, and enforcement measures, which can affect the overall financial obligations of individuals or entities. Accurate documentation, including invoices and receipts, is essential for enforcing these obligations within a legal context and ensuring compliance with local statutes.

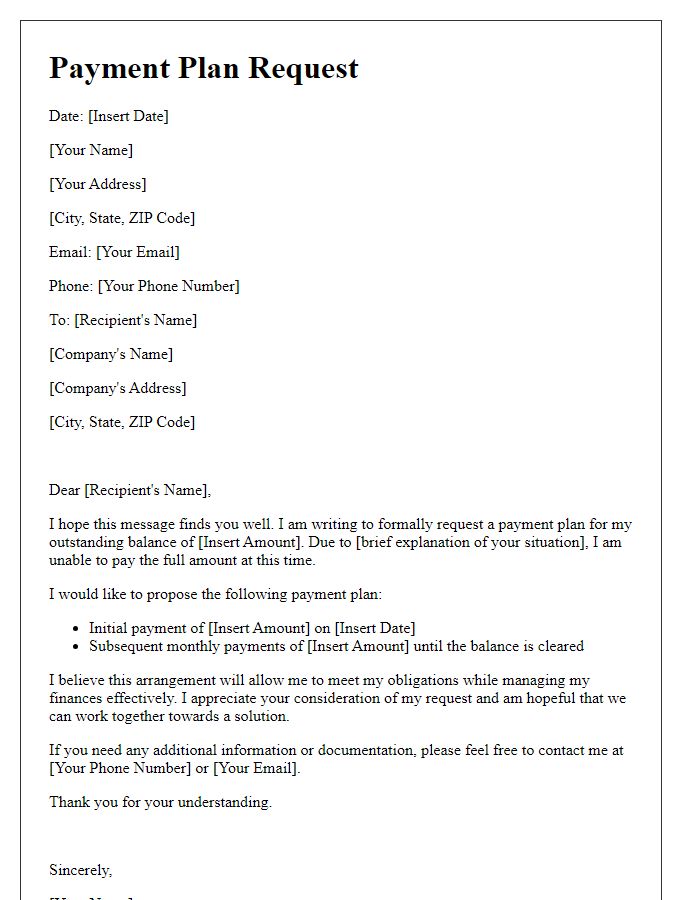

Key Financial Details

Key financial details encompass essential elements such as principal amount (the original sum of money borrowed), interest rates (the percentage charged on the loan or credit), payment schedule (the timetable outlining repayment deadlines), and total repayment amount (the entire sum to be paid, including interest). Loan agreements often specify collateral (assets pledged as security for the loan) and terms of default (conditions under which the borrower fails to meet obligations). Understanding these components is crucial for managing financial responsibilities effectively, particularly in formal agreements involving corporate entities or personal loans. Moreover, penalties for late payments (additional fees for not meeting payment deadlines) can significantly impact overall financial obligations, necessitating diligent monitoring of commitments.

Compliance with Legal Standards

Legal financial obligations encompass a variety of responsibilities that individuals and organizations must adhere to in accordance with jurisdiction-specific laws and regulations. These obligations may involve tax requirements, such as timely filing of income tax returns under the Internal Revenue Code (U.S.) and adherence to local tax laws, which can vary significantly by state or municipality. Contracts and agreements, such as loans or leases, necessitate structured payment schedules and interest rate disclosures, ensuring compliance with the Truth in Lending Act (TILA). Failure to meet these obligations can result in legal consequences, including penalties, interest charges, or potential litigation in civil court, emphasizing the importance of diligent financial management and awareness of relevant legal frameworks.

Comments