Are you curious about how recent changes in minimum wage laws might affect you? Understanding these updates can empower you to advocate for your rights and enhance your financial well-being. Whether you are an employee, an employer, or simply interested in labor laws, the implications of these shifts are significant and far-reaching. Let's dive deeper into the details and explore what these changes mean for youâread on to discover more!

Legislative changes

The recent legislative changes regarding minimum wage laws have significant implications for workers across various industries. As of January 1, 2024, the federal minimum wage will increase to $15 per hour, impacting approximately 30 million workers nationwide, particularly those in hospitality and retail sectors. State regulations may vary; for instance, California has adopted a higher minimum wage of $16.50, aiming to address the high cost of living in urban areas like Los Angeles and San Francisco. These adjustments are expected to improve economic stability for low-income earners, facilitate consumer spending, and stimulate job growth, yet they may also pressure small businesses to adapt operational costs amid increased payroll expenses. Stakeholders, including business owners and labor advocates, are closely monitoring these developments to assess their long-term effects on economic productivity and workforce conditions.

Effective date of new wage

The recently passed minimum wage law will take effect on January 1, 2024, increasing the hourly wage to $15 across several states, including California and New York. This adjustment aims to address the rising cost of living, particularly in urban areas where inflation has significantly impacted low-income workers. Employers now have the responsibility to ensure compliance with this new wage standard to provide fair compensation and enhance employee well-being. Organizations must update payroll systems to reflect this change and communicate transparently with their workforce about the implications of the wage increase. Failure to comply could result in legal penalties and decreased employee morale.

Implications for employers and employees

The recent updates to minimum wage laws significantly impact both employers and employees across various industries. In the United States, the federal minimum wage has remained $7.25 per hour since 2009, prompting numerous states and cities to enact higher local rates, such as New York City's $15 per hour minimum wage. These changes reflect a growing movement advocacy aimed at improving the standard of living for low-wage workers. Employers must now navigate the complexities of compliance with potentially varying rates, which can include increased payroll costs and adjustments to budgetary allocations. Employees may experience enhanced purchasing power and improved job satisfaction, yet could also face reduced working hours or increased automation as businesses adapt to higher labor costs. The implications of these laws extend beyond mere financial adjustments, affecting job retention strategies and employer-employee relations in the workplace.

Compliance requirements

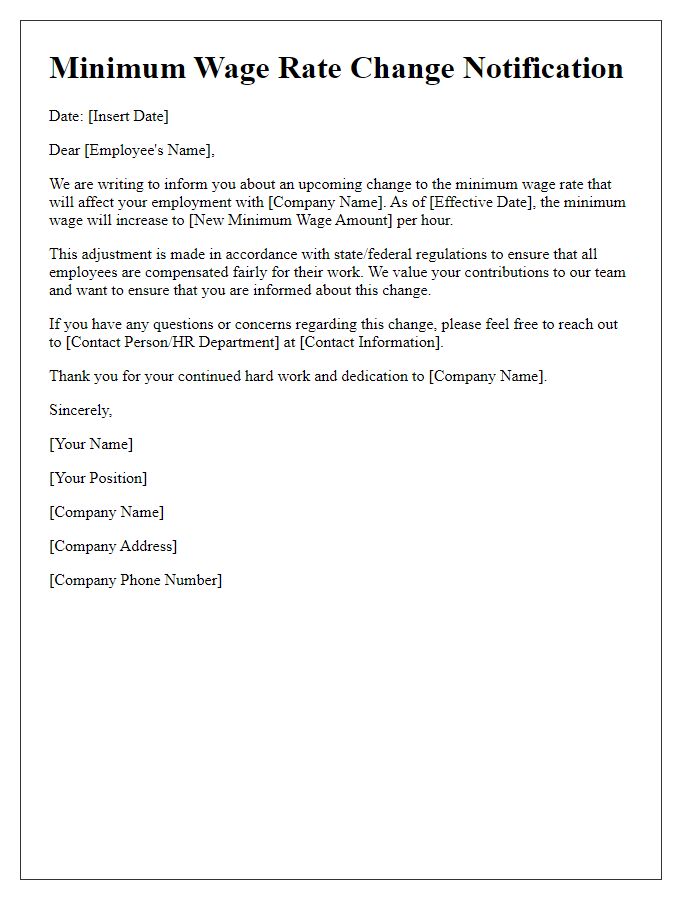

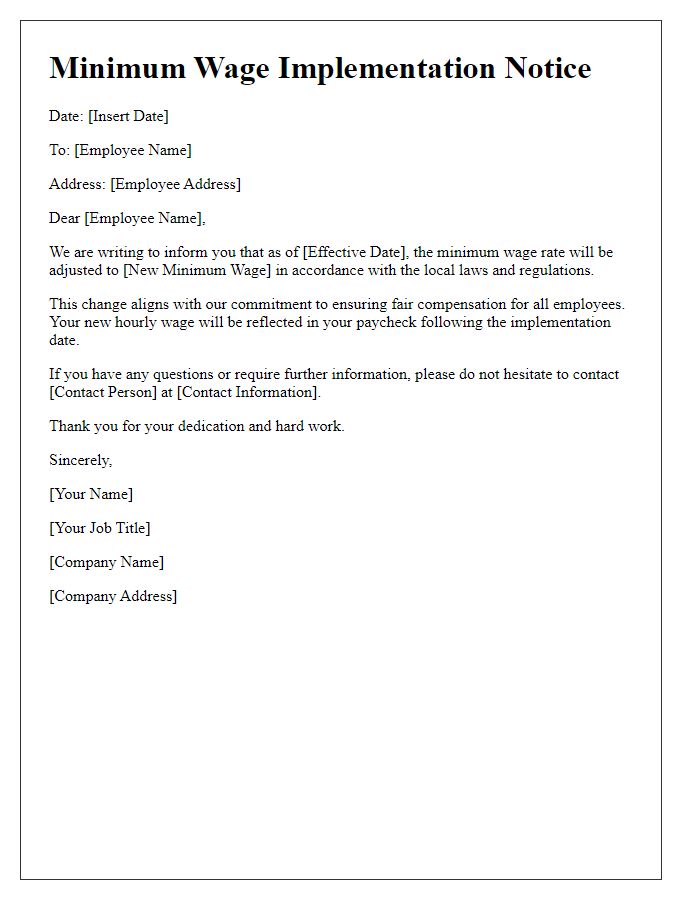

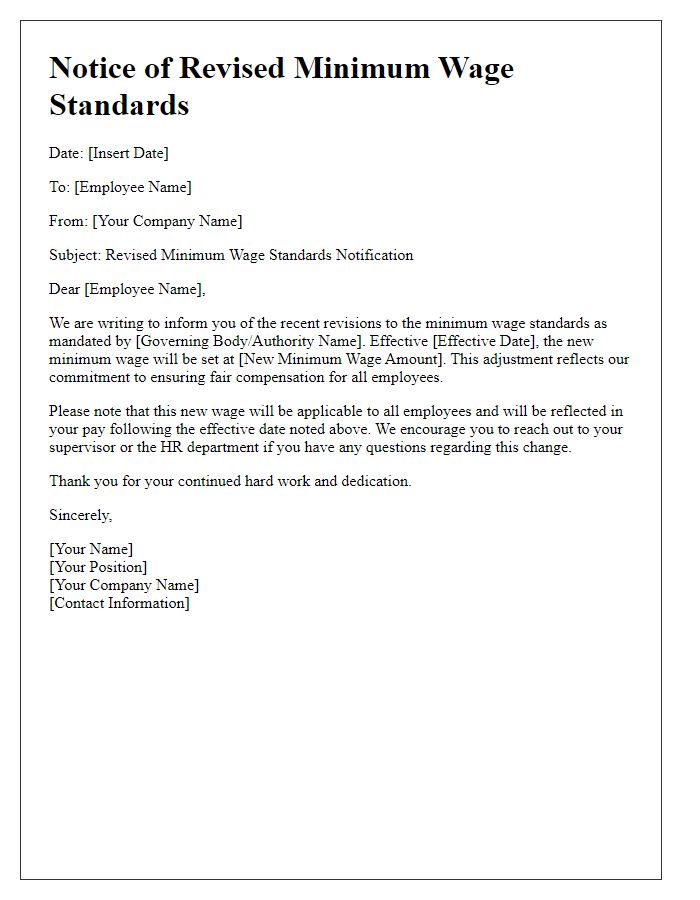

The recent update to the minimum wage law mandates that employers must adjust hourly rates to reflect the new legal benchmark, which is set to $15 per hour in many jurisdictions, effective January 1, 2024. Businesses with over 50 employees need to ensure that payroll systems are updated to comply with this adjustment, as non-compliance may result in penalties ranging from $1,000 to $10,000 per violation, depending on individual circumstances. Additionally, employers must communicate the changes to all employees, ensuring transparency regarding their pay adjustments and any impacts on overtime pay calculations, as the new regulation also includes stipulations for salaried workers. Failure to comply with these updated requirements may lead to increased scrutiny from state labor boards across several states, including California and New York, where enforcement is particularly stringent. Awareness of these changes is crucial not only for legal compliance but also for maintaining employee morale and trust within the workplace.

Contact information for inquiries

The recent update to minimum wage laws in various regions aims to improve the financial stability of workers, particularly in cities like Seattle, Washington, where the rate will increase to $18.00 per hour starting January 2024. This adjustment seeks to address the rising cost of living, with inflation rates projected at 3% annually. For inquiries regarding the specifics of these new regulations, individuals can contact the Department of Labor and Industries through phone number 1-800-123-4567 or visit their office located at 123 Main St, Suite 200, Seattle, WA, during business hours from 8:00 AM to 5:00 PM, Monday through Friday. Moreover, the new regulations include provisions for overtime pay, also increasing to 1.5 times the standard rate, ensuring that employees are fairly compensated for their time.

Comments