When it comes to the world of finance, transparency is key, and a well-crafted financial disclosure statement can make all the difference. Whether you're an individual or a business, sharing your financial information clearly and effectively builds trust with your stakeholders. This letter template is designed to help you navigate that process seamlessly, ensuring you cover all necessary details while maintaining a conversational tone. So, grab your pen, and let's dive in â you won't want to miss what comes next!

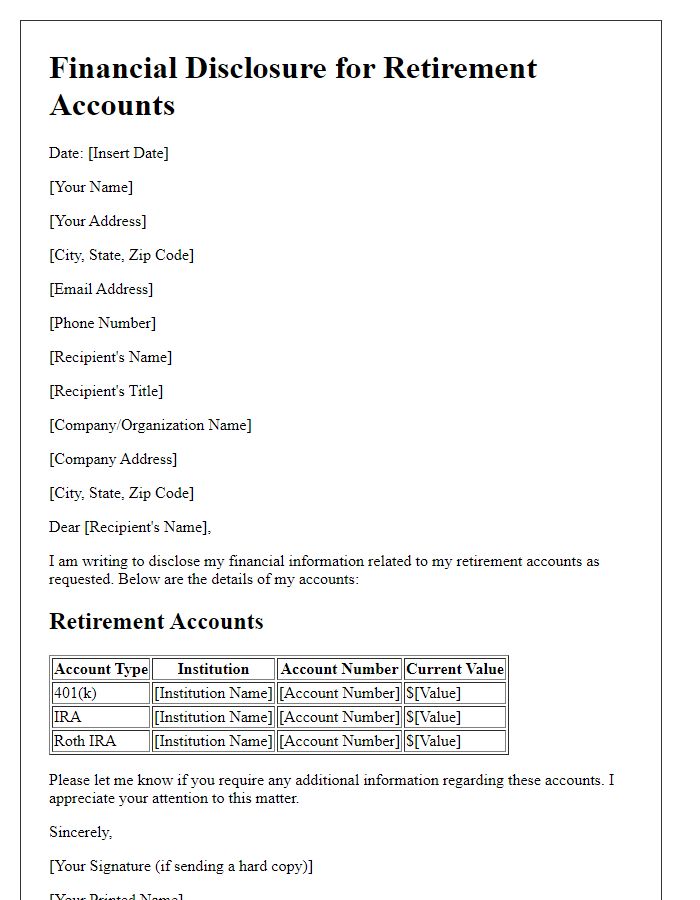

Complete financial overview

A comprehensive financial disclosure statement provides an in-depth analysis of an individual or organization's financial status. This statement typically includes key components such as assets (real estate, stocks, bonds, and cash holdings), liabilities (mortgages, loans, credit card debt, and outstanding bills), and net worth (the difference between total assets and total liabilities). Detailed income sources should be listed, indicating figures from salaries, investments, and other revenue streams. Additionally, expenditures should be meticulously categorized, ranging from essential living expenses to discretionary spending. Financial obligations, such as dividend payments or recurring donations, should also be presented clearly. This complete financial overview is crucial for transparency, compliance with regulations, and informed decision-making for stakeholders and potential investors.

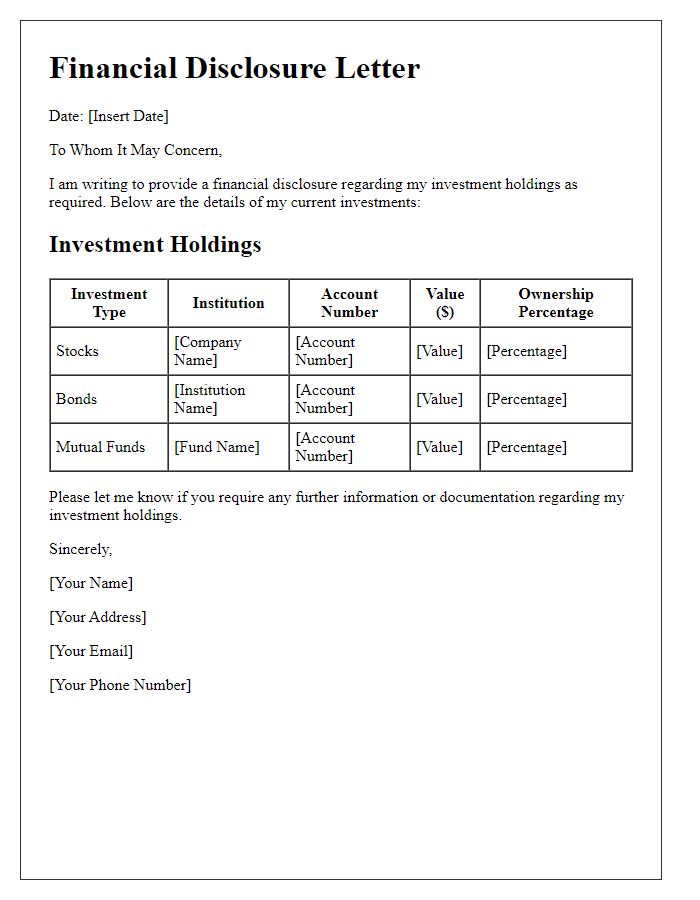

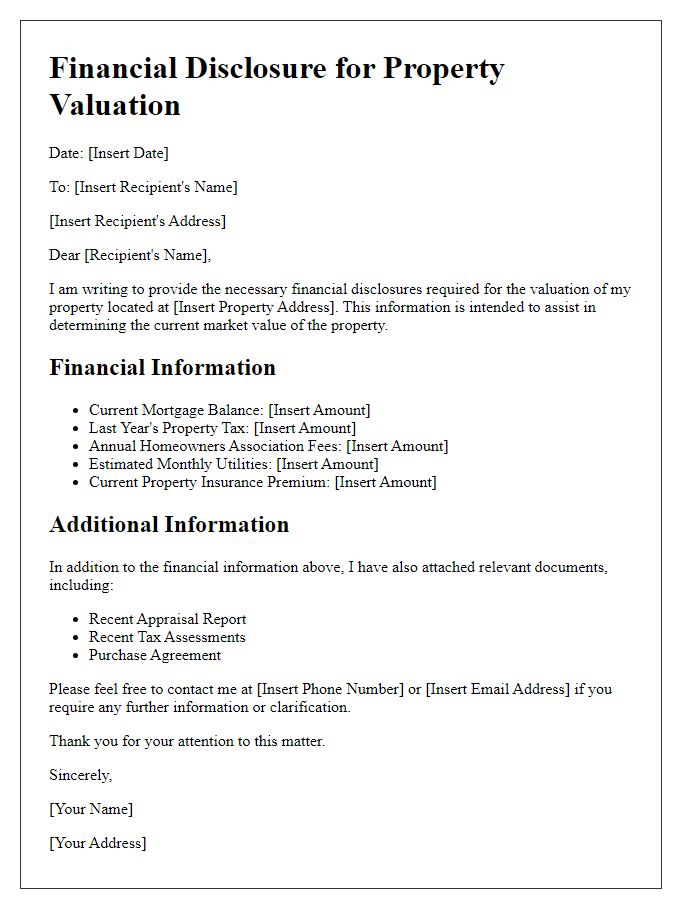

Asset and liability details

A financial disclosure statement outlines essential information regarding assets (valuable resources owned) and liabilities (financial obligations owed). Assets may include real estate properties, such as a home in Los Angeles valued at $850,000, vehicles like a 2019 Tesla Model 3 worth approximately $40,000, and investments, including stocks worth $15,000 in notable companies like Apple and Google. Liabilities encompass mortgages, for instance, a $500,000 mortgage on the home, car loans totaling $25,000 for the Tesla, and credit card debts accumulating to $7,500. This comprehensive overview helps in assessing an individual's financial health and obligations as of October 2023.

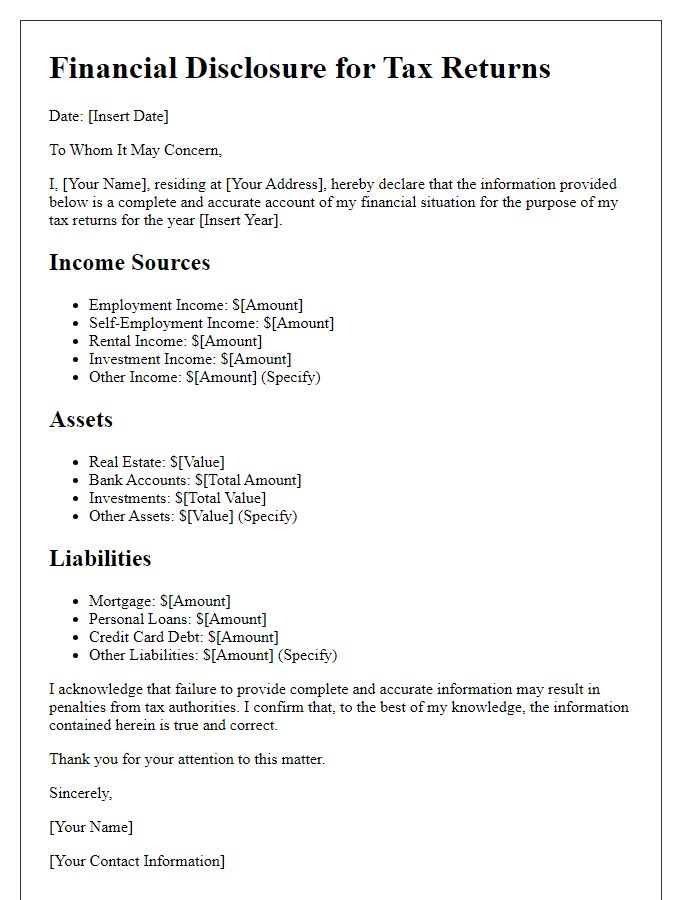

Income sources and amounts

Financial disclosure statements detail income sources and their respective amounts, essential for transparency and accountability. Common income sources include salaries from employment (e.g., annual income of $75,000), rental income from properties (e.g., $1,200 monthly from a condominium in downtown Chicago), investment income from stocks and bonds (e.g., dividends amounting to $5,000 annually), and business profits from entrepreneurial ventures (e.g., $50,000 over the fiscal year). Accurate reporting of all income streams is critical to provide a financial overview necessary for various assessments, including credit evaluations and compliance with regulatory requirements. Each source's documentation, such as pay stubs or tax returns, supports the stated amounts, ensuring credibility in the financial disclosure process.

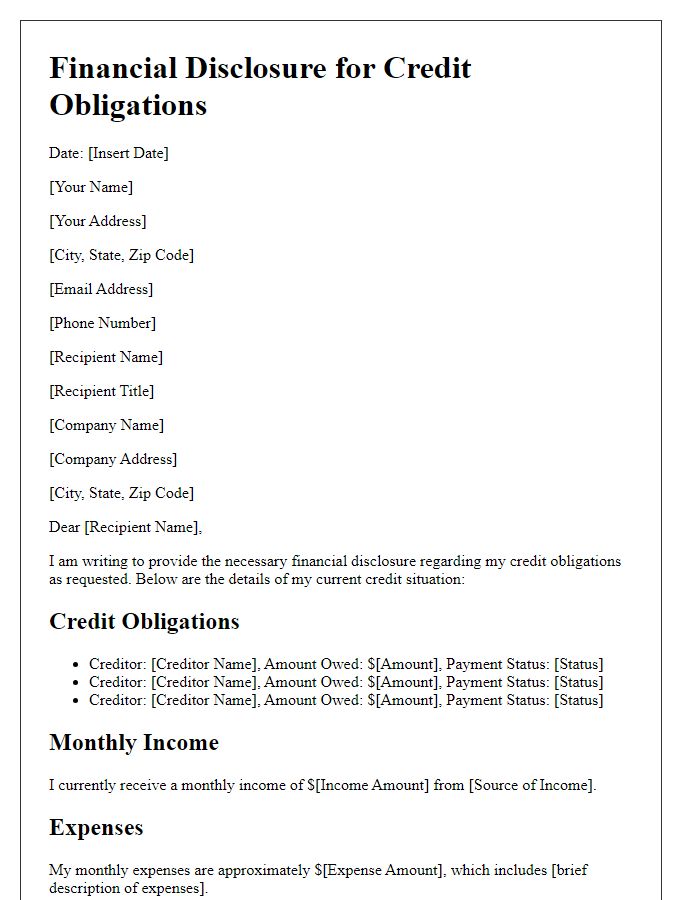

Expenses and financial obligations

A financial disclosure statement detailing expenses and financial obligations requires careful documentation. Monthly expenses, such as rent or mortgage payments averaging $1,500 per month, utility costs nearing $300, and grocery bills approximately $400, must be outlined clearly. Additionally, recurring obligations like student loan payments totaling $200 per month and credit card debt repayments averaging $150 monthly should be included. Other financial responsibilities, such as medical expenses and insurance premiums, can also play a significant role in an individual's financial landscape. Documenting these figures accurately provides a comprehensive view of one's financial commitments.

Legal compliance and acknowledgments

A financial disclosure statement ensures legal compliance by providing transparent information regarding assets, liabilities, income, and expenditures to regulatory bodies like the Securities and Exchange Commission (SEC) or the Internal Revenue Service (IRS). This documentation, typically required for public companies and certain professional entities, aids in preventing financial misconduct and fosters trust among stakeholders, including investors and clients. Acknowledgments within this statement often include a declaration of accuracy signed by the disclosing party, affirming the truthfulness of the provided financial data, with potential penalties for false disclosures under regulations like the Sarbanes-Oxley Act. Legal compliance ensures adherence to financial reporting standards, such as Generally Accepted Accounting Principles (GAAP), promoting ethical financial practices and protecting the integrity of the financial system.

Comments