Are you looking to transfer property ownership but unsure where to start? Navigating the ins and outs of property transfers can feel overwhelming, but it doesn't have to be. This article will guide you through a simple letter template that ensures all necessary components for the transfer are included. So, if you're ready to simplify the process and protect your interests, keep reading!

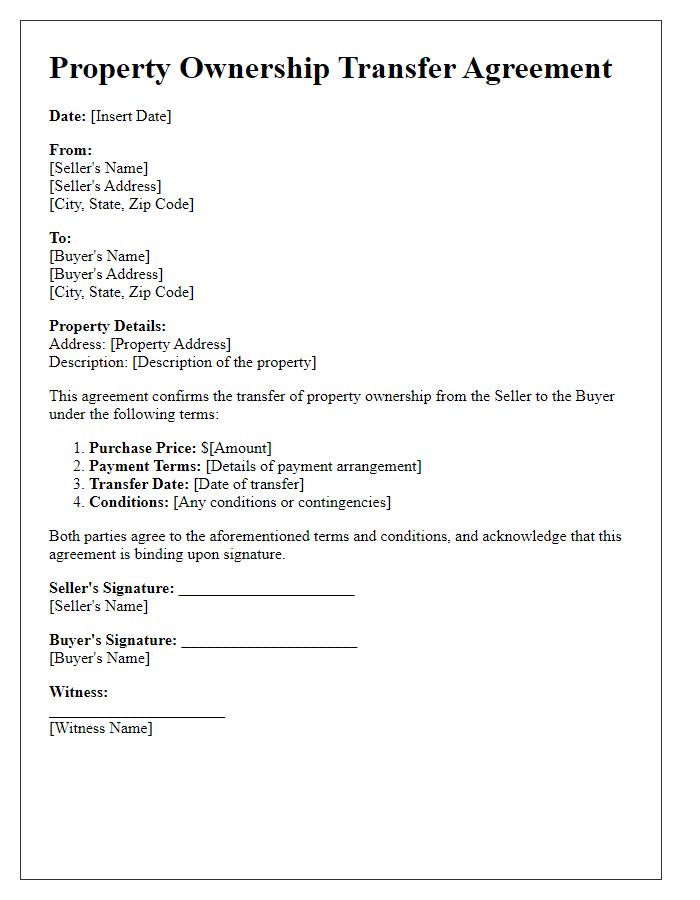

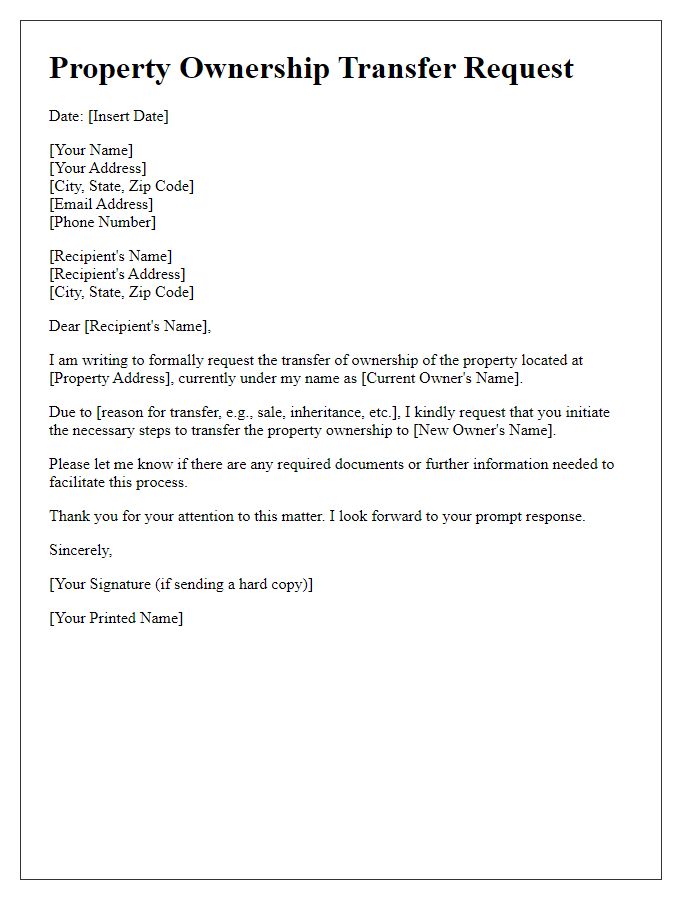

Transferor and transferee details.

The property ownership transfer process involves detailed documentation outlining the exchange between transferor and transferee. The Transferor, typically identified by full legal name, address, and tax identification number, is the individual or entity relinquishing ownership. The Transferee, also listed with full legal name, address, and tax identification number, is the individual or entity acquiring ownership. Important property details must be included, such as the property address, legal description (including lot number, block number, and parcel identification), and existing liens or encumbrances affecting the property. The transfer document should also reference the applicable laws governing real estate transactions in the jurisdiction, ensuring compliance with local property transfer regulations. Consideration, which refers to the purchase price or value exchanged, must also be clearly stated.

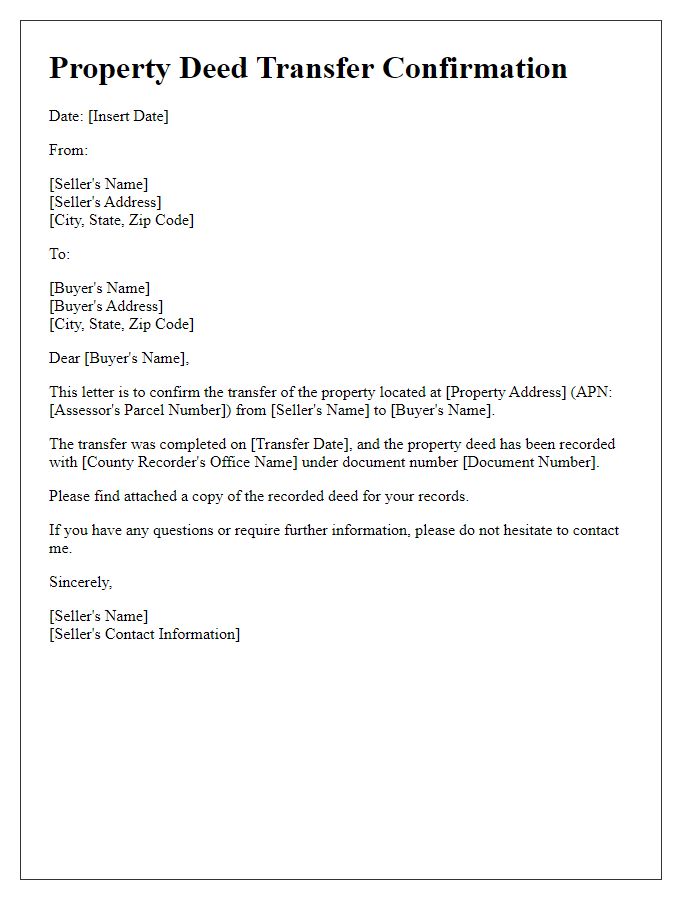

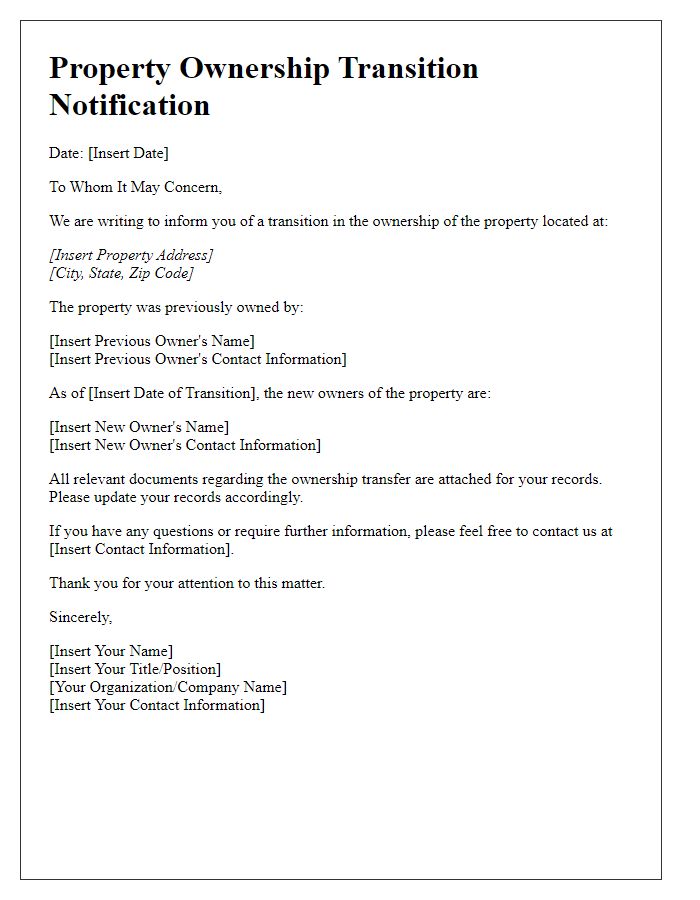

Property description and legal identifiers.

The property ownership transfer procedure involves essential details such as the property description, which includes key characteristics like the address, square footage, and land use type, as well as legal identifiers such as the parcel number and deed reference. Property addresses like 123 Maple Street in Springfield, IL (ZIP code 62701) must be accurately stated. Legal identifiers include unique elements such as the Assessor's Parcel Number (APN), which is crucial for locating property records in local government databases. Additional features may encompass zoning classifications, property taxes, and easement rights that affect the ownership structure. Ensuring these elements are precisely outlined safeguards legal interests and clarifies ownership.

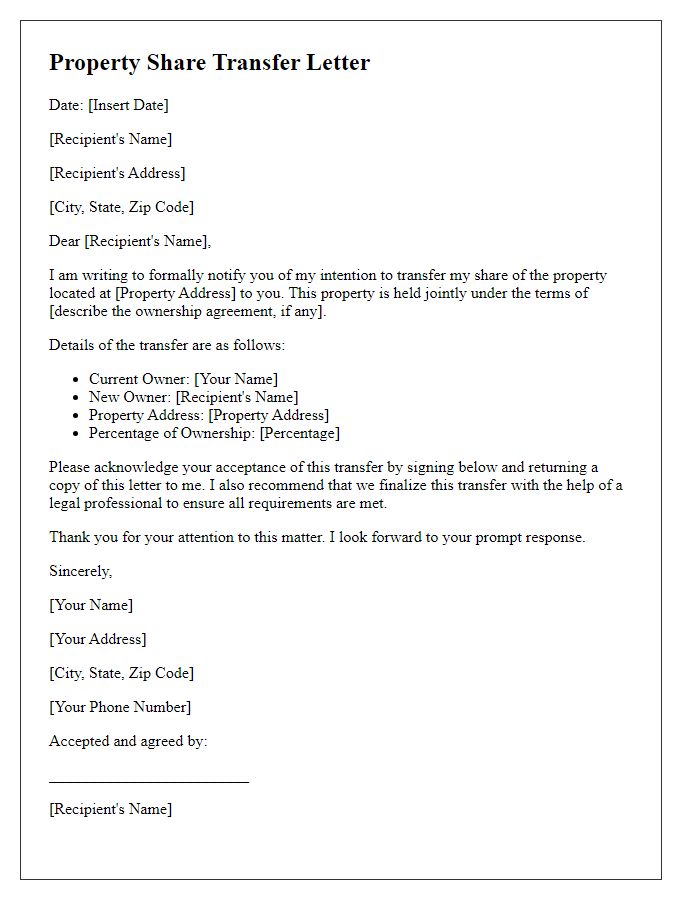

Terms and conditions of transfer.

The transfer of property ownership involves key legal elements and specific terms and conditions that ensure compliance with local laws. The property, located at 123 Oak Street, Springfield, includes a 3-bedroom house and a 0.25-acre lot. The transfer is contingent upon full payment of $250,000, with a deposit of $25,000 due upon signing. The seller, Mr. John Doe, is required to provide a clear title free of encumbrances, ensuring no outstanding liens or disputes exist. Both parties agree to settle any outstanding property taxes up until the date of transfer, scheduled for November 30, 2023. Buyer, Ms. Jane Smith, will receive all property disclosures, including any existing warranty agreements for appliances within the home. A formal closing process will occur at Springfield Title Company, ensuring proper documentation, including the deed of transfer, is filed with the county clerk. Any breaches of these terms may result in legal action or renegotiation of conditions prior to transfer.

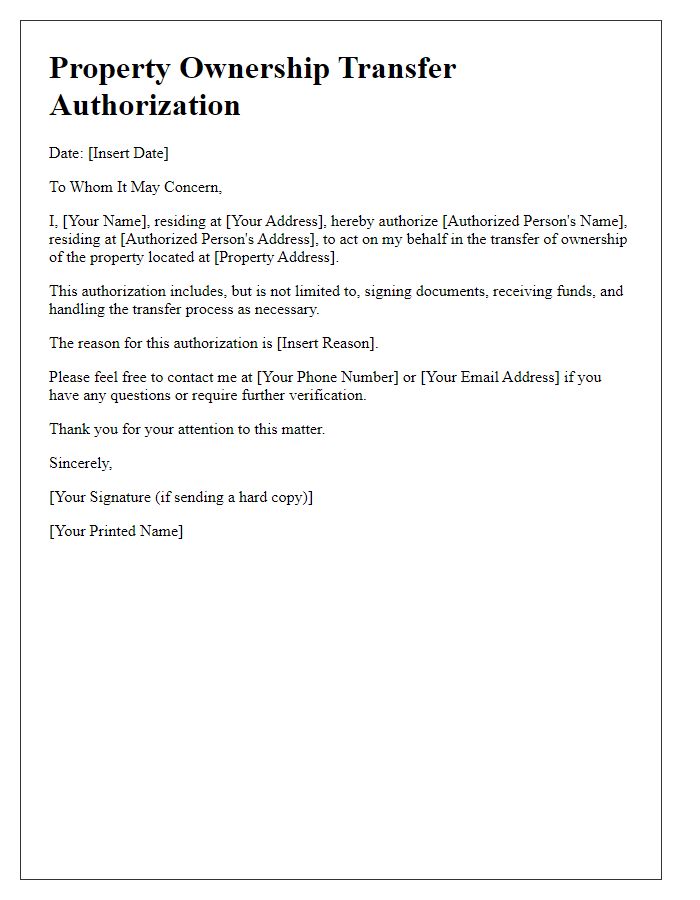

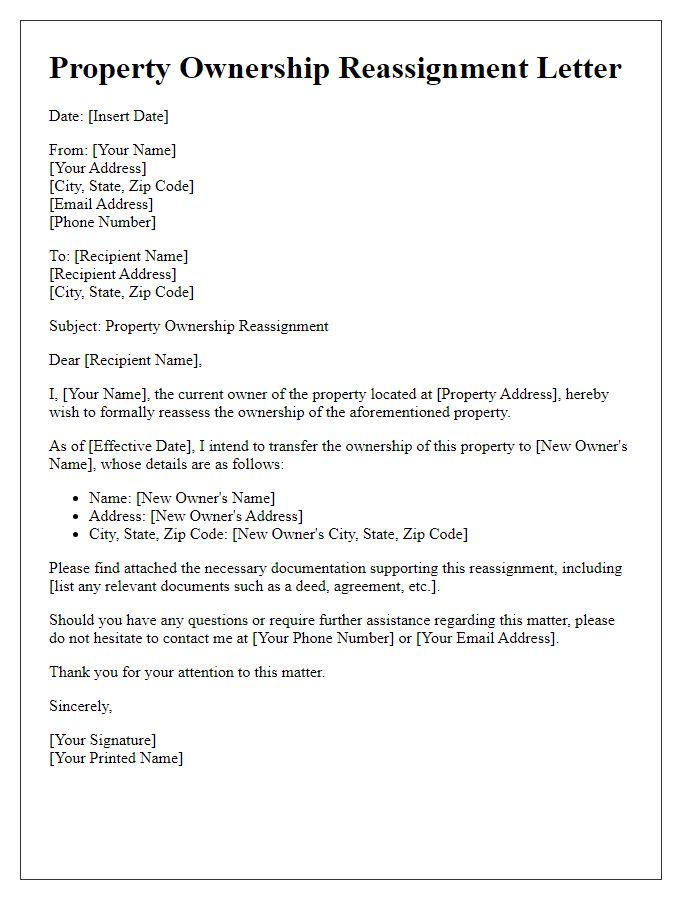

Signatures and notary requirements.

Property ownership transfer documents require specific signatures and notary verification to ensure legal validity. Typically, the property deed must include the signatures of both the current owner (grantor) and the new owner (grantee), usually witnessed by at least one additional individual who can attest to the signing process. Notary public services are integral to authenticate the identities of the signers, confirming they are willingly executing the transfer. Certain jurisdictions mandate that this notarization be completed in person, while others allow for electronic notarization under specific circumstances. Relevant state laws (for example, California's Civil Code Section 1180) dictate the necessary formalities that might include additional documentation, such as a preliminary change of ownership report or proof of identification. Proper adherence to these stipulations safeguards against future disputes regarding property ownership rights.

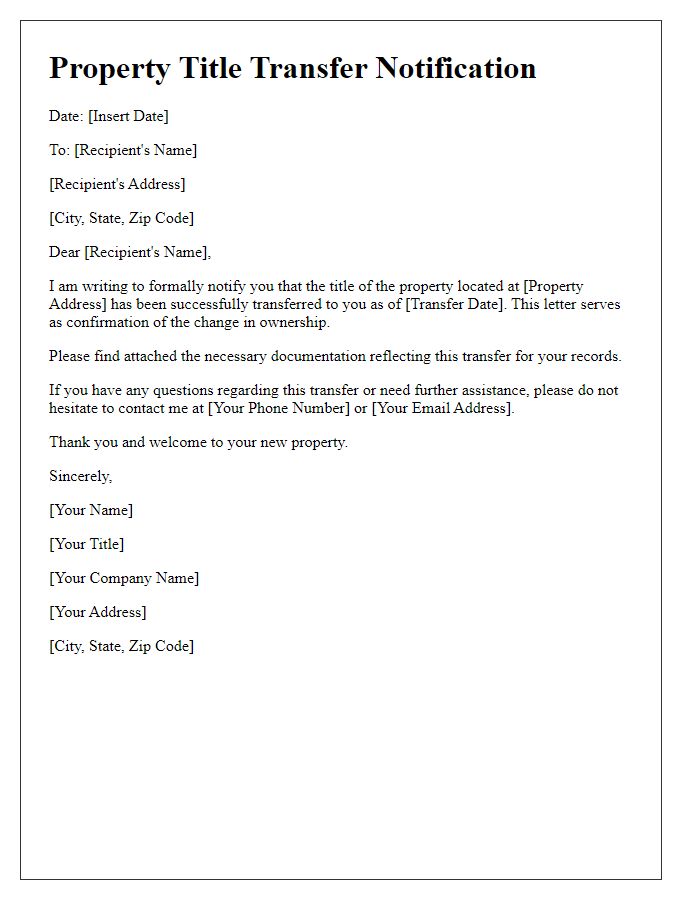

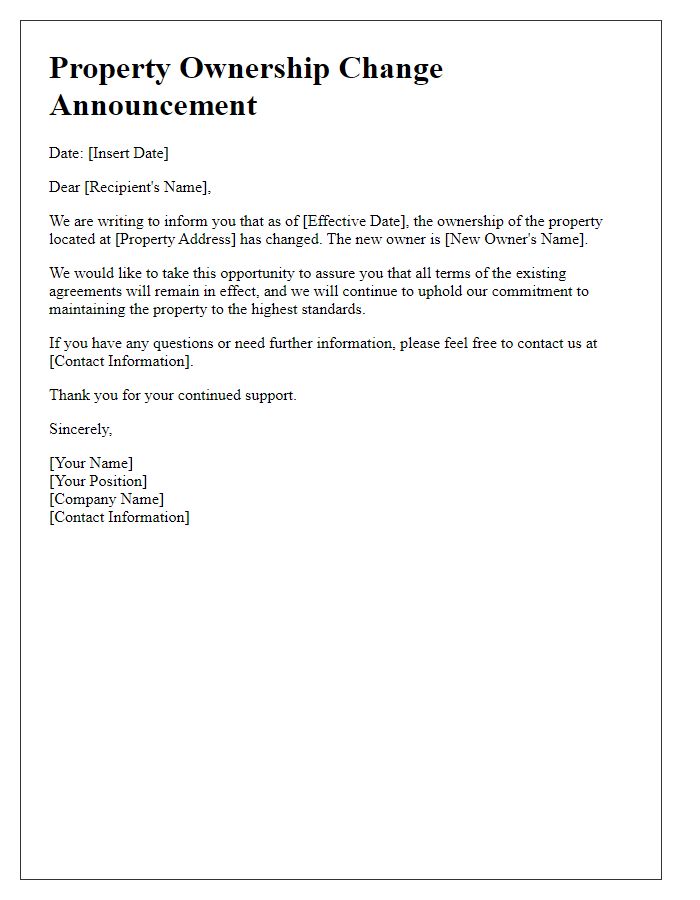

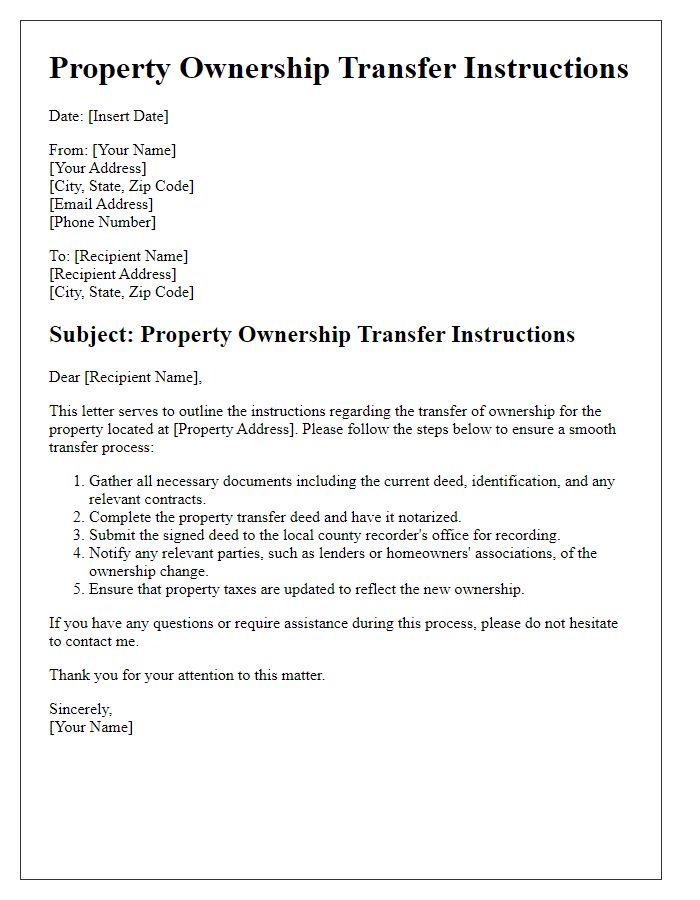

Contact information and date of execution.

In a property ownership transfer, precise details must be documented to ensure a smooth transition. The contact information should include full names, mailing addresses, and phone numbers of both the current owner (also known as the grantor) and the new owner (also known as the grantee). The date of execution signifies when the transfer of ownership occurs, typically marked by the signing of the deed. This date is crucial for legal purposes and may influence tax implications. Accurate recording of these details ensures clear communication between parties and helps prevent future disputes over ownership.

Comments