Are you thinking about applying for a personal loan but unsure where to start? Crafting a well-structured letter can make all the difference in your application process. In this article, we'll guide you through the essential components of a personal loan application letter, ensuring you present your case effectively and professionally. So, grab a cup of coffee and let's dive into the details of how to enhance your chances of approval!

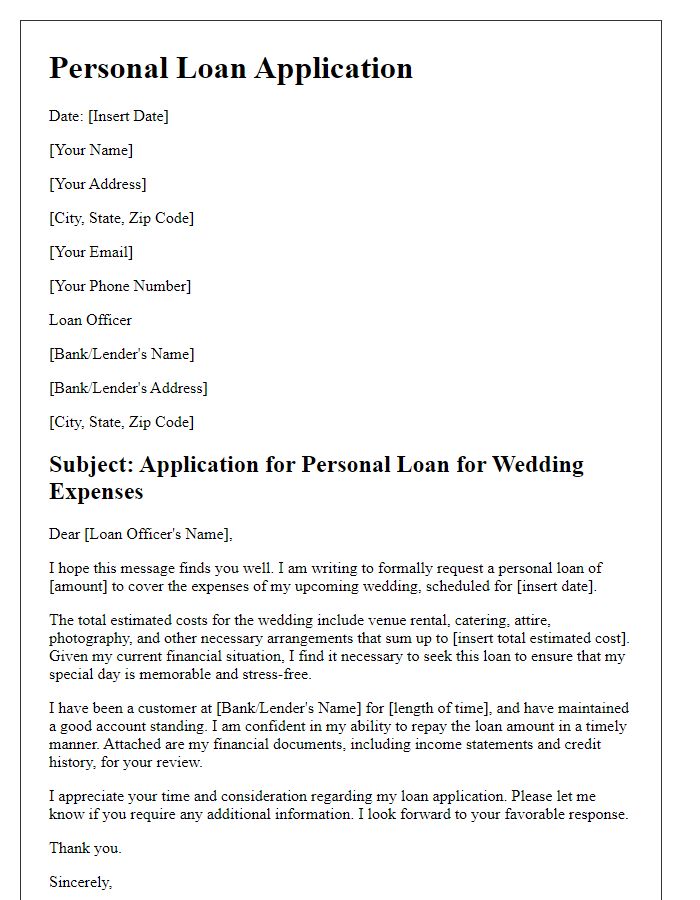

Borrower's personal information

The borrower's personal information section provides essential data for financial institutions analyzing loan applications. This segment typically includes the full name of the applicant, typically structured as first, middle, and last names. Date of birth is crucial for assessing age eligibility, ensuring the borrower meets the minimum requirement (usually 18 years). The Social Security Number (SSN) serves as a unique identifier, allowing the lender to perform a background check. Current residential address includes street name, house or apartment number, city, state, and ZIP code for verification purposes. Contact information, such as a daytime telephone number and email address, facilitates communication regarding the loan status. Employment details may encompass the name of the employer, job title, and length of employment to establish income stability. Annual income is vital for underwriting decisions, often expressed in dollars to ascertain repayment capability.

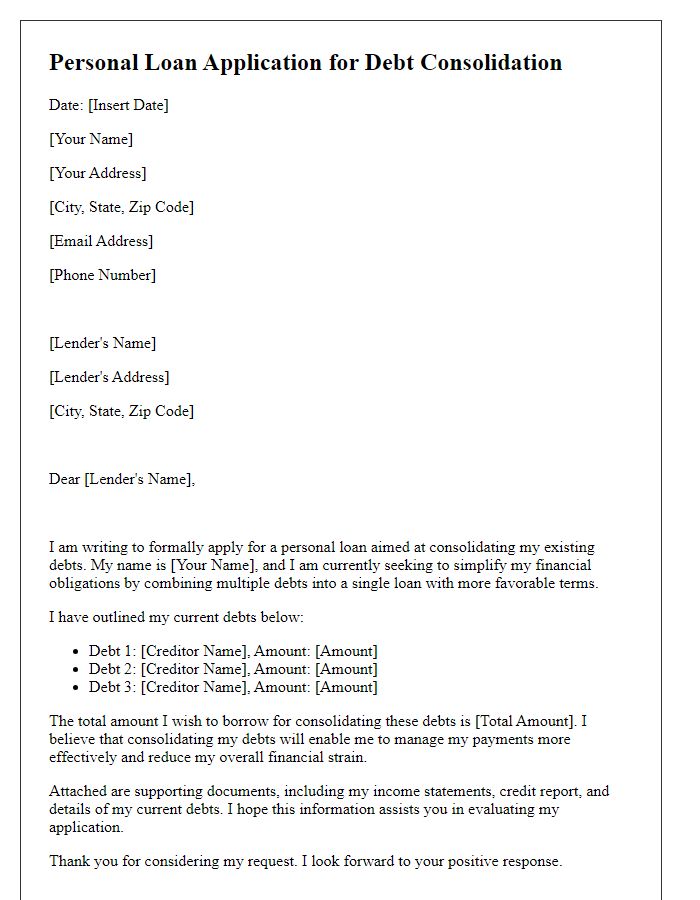

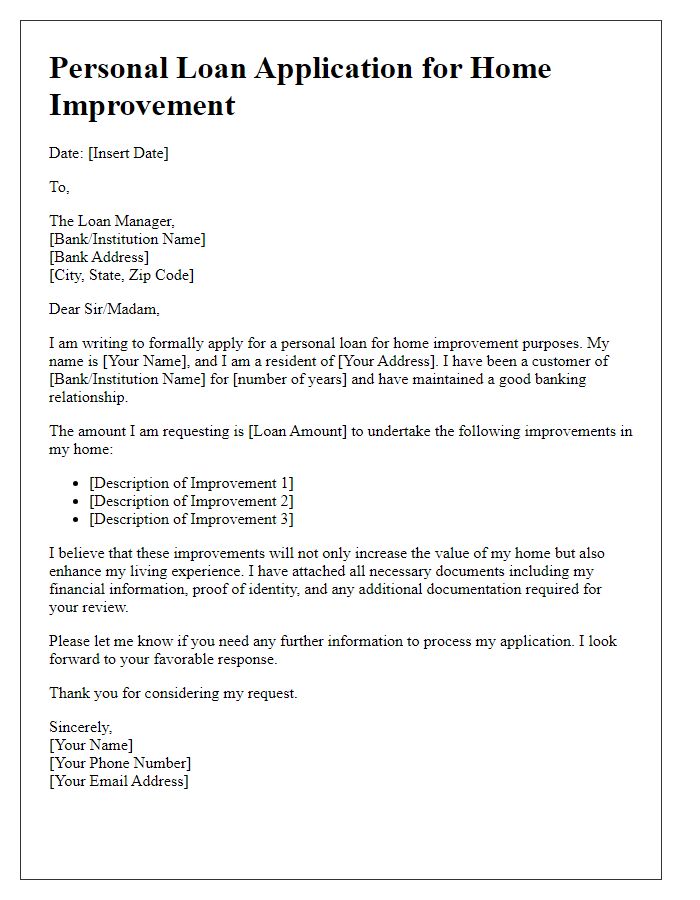

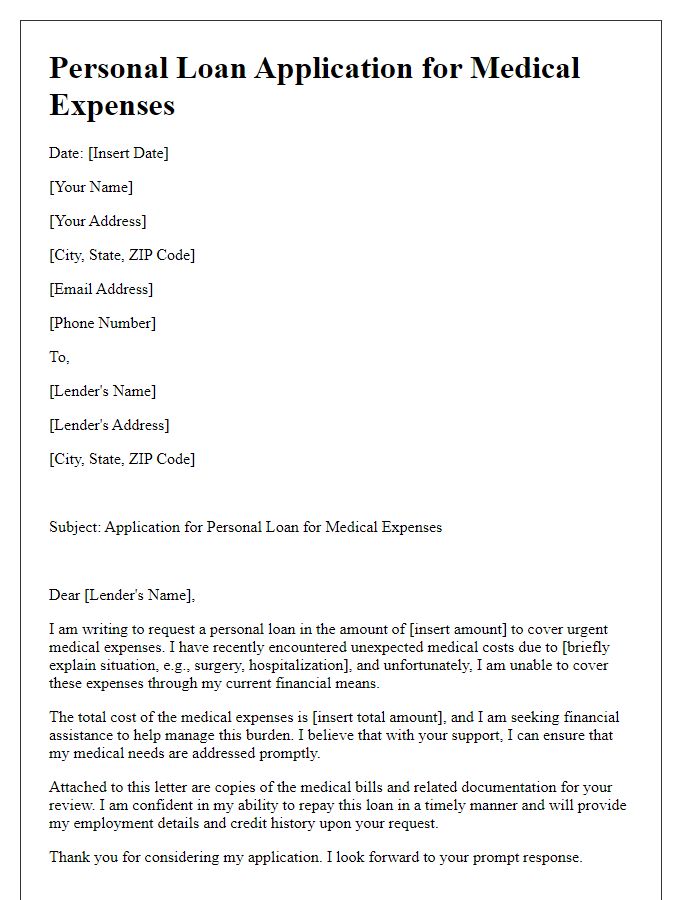

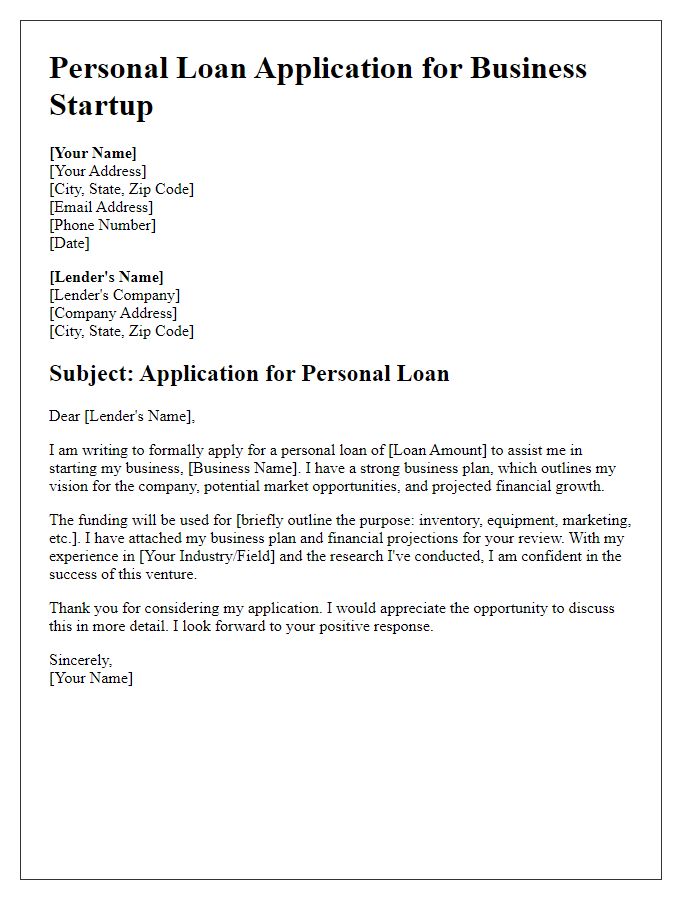

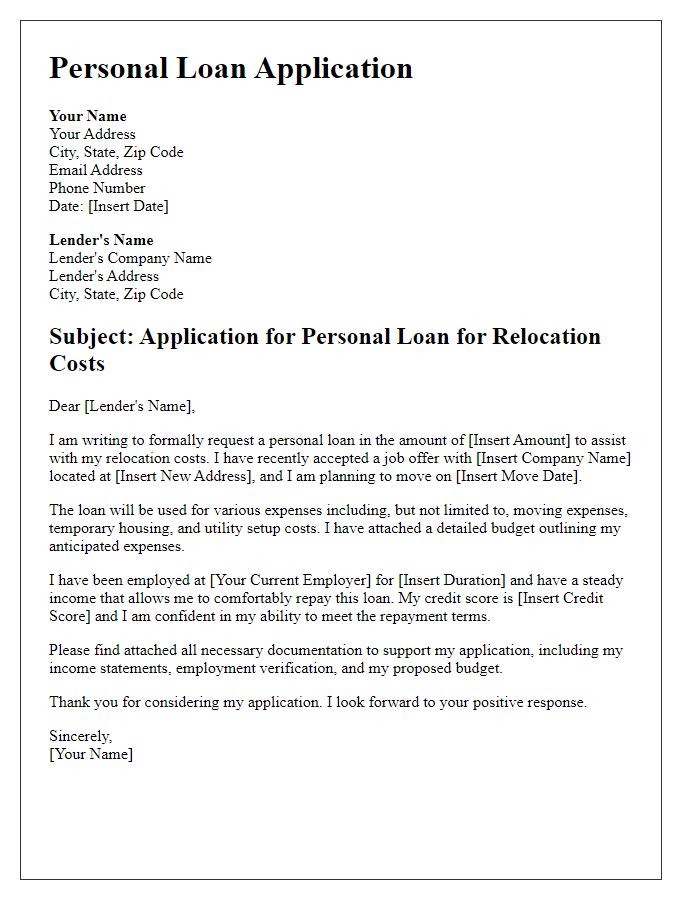

Loan purpose and amount requested

A personal loan application requires clearly stated intentions and financial specifics. A borrower may request an amount, such as $10,000, for reasons such as consolidating high-interest debt from multiple credit cards or financing a necessary home renovation, like a roof replacement averaging $5,000. It's crucial to describe how the loan will improve financial stability or enhance living conditions. Detailed explanations assist lenders in understanding the applicant's motivation and repayment ability, potentially leading to a favorable approval process.

Employment and income details

Employment details, such as position held in a company or organization, significantly influence personal loan applications. For instance, individuals working as financial analysts in major firms like Goldman Sachs often possess higher job stability and income certainty. Income details, including monthly salary or hourly wage, demonstrate the ability to meet repayment obligations. Moreover, additional sources of income, such as bonuses or freelance work, can enhance the financial profile. Employment status--full-time, part-time, or contract--is crucial in assessing loan eligibility. Consistent employment over a period, typically requiring at least six months to a year, can further strengthen the application, indicating reliability and responsibility in financial matters.

Repayment plan and financial stability

When applying for a personal loan, it's crucial to outline a detailed repayment plan and demonstrate financial stability effectively, especially to financial institutions like banks or credit unions. A comprehensive repayment plan typically includes the clear loan amount, such as $10,000, proposed interest rate around 6% annually, and a defined loan term of 3 to 5 years. Highlighting a monthly payment projection, for instance, approximately $200, allows lenders to assess affordability. Financial stability should be substantiated by providing proof of consistent income sources, including salaries, consulting contracts, or other employment earnings totaling $50,000 annually, alongside a solid credit score, ideally above 700. Detailing existing financial obligations showcases responsible management or current debts, like a mortgage or car loan, ensuring that sufficient disposable income remains for loan repayment. Additionally, emphasize savings measures, such as maintaining a savings account with at least $5,000 and an emergency fund, which reinforces the commitment to meet repayment schedules.

Contact information and documentation references

Contact information for a personal loan application typically includes details such as a full name, current residential address (including city, state, and ZIP code), phone number, and email address. Documentation references may encompass essential items such as a government-issued identification (like a passport or driver's license), proof of income (such as recent pay stubs or tax returns), and bank statements (often for the last three months) to demonstrate financial stability. Additional references might include a credit report from agencies like Experian, Equifax, or TransUnion, which provides insights into creditworthiness, along with employment verification information from the applicant's employer to confirm job security.

Comments