Are you feeling overwhelmed by debt and unsure how to navigate the repayment process? Writing a debt repayment agreement can be a helpful step towards regaining control of your financial situation. This letter serves as a formal yet friendly way to outline the terms of your repayment plan, ensuring that both parties are clear on expectations and timelines. Ready to take the first step toward financial freedom? Read on to discover how to create an effective debt repayment agreement!

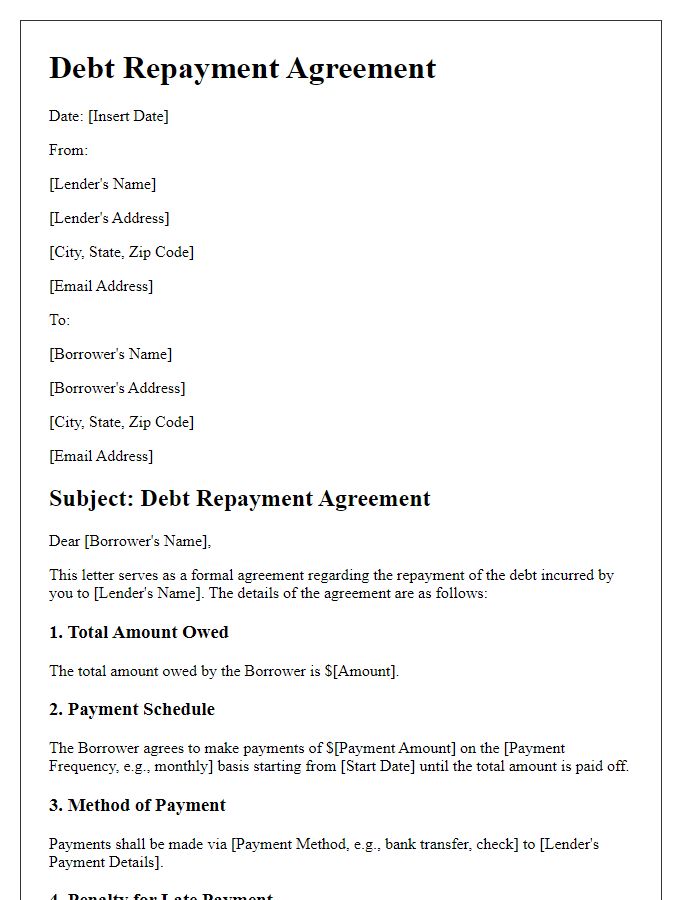

Identification of Parties

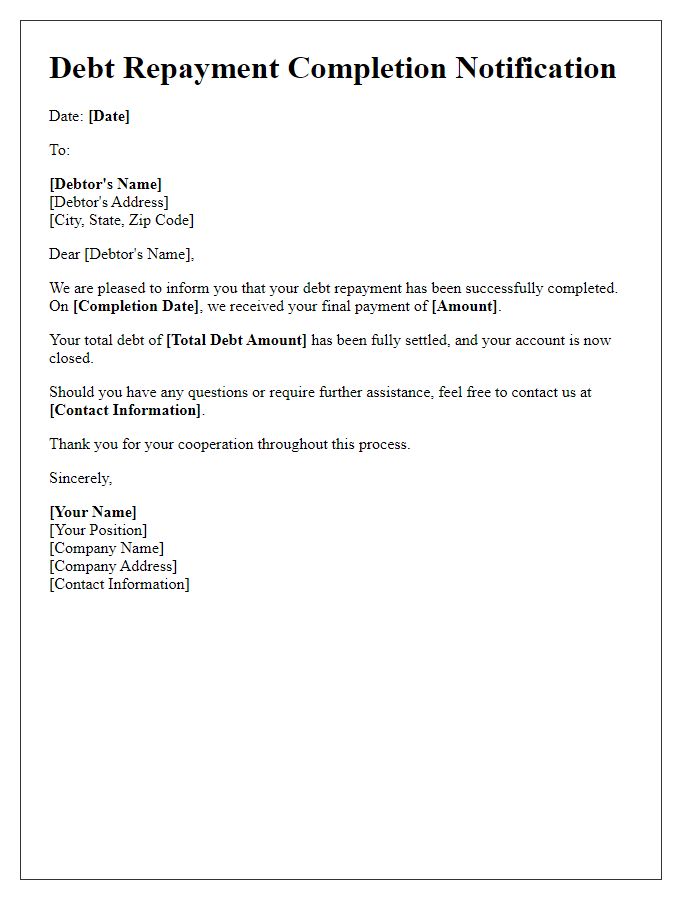

This Debt Repayment Agreement identifies the parties involved in the financial obligation. The Debtor, [Full Name of Debtor], residing at [Debtor's Full Address], acknowledges the debt owed to the Creditor, [Full Name of Creditor], located at [Creditor's Full Address]. The agreement outlines the terms for repayment of the total amount of [Total Debt Amount] incurred on [Date of Debt Incurred]. Both parties consent to the conditions set forth in this document, which includes the repayment schedule, interest (if any), and consequences of default. This identification of parties forms the foundation for the obligations and commitments outlined in the subsequent sections of the agreement.

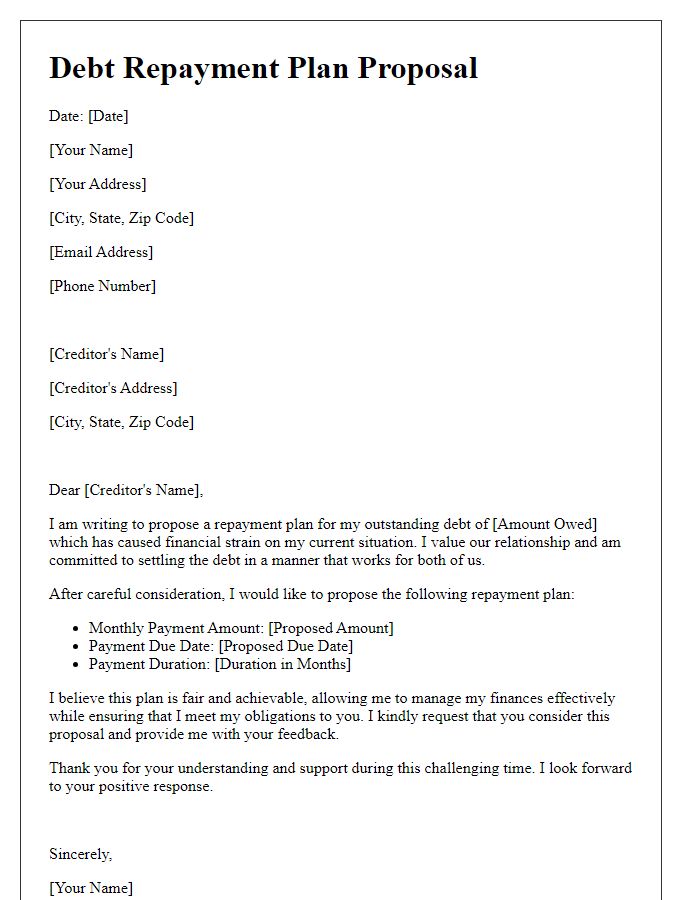

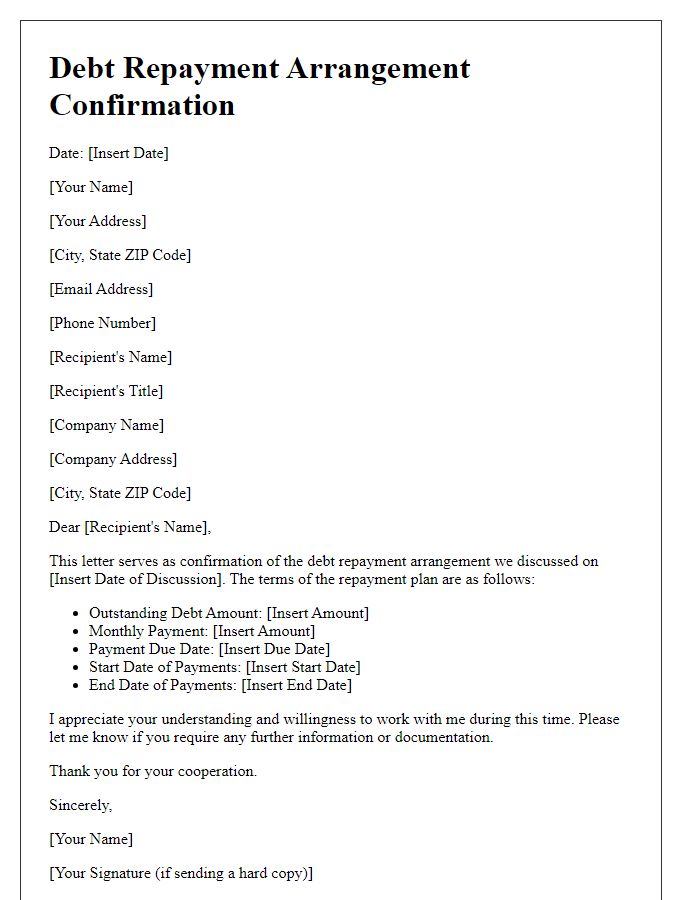

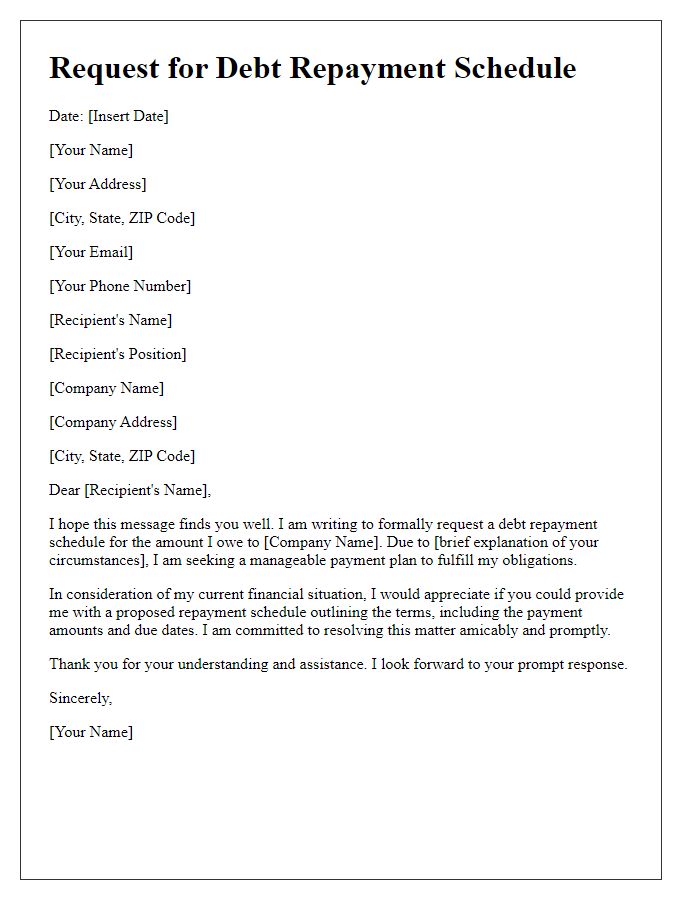

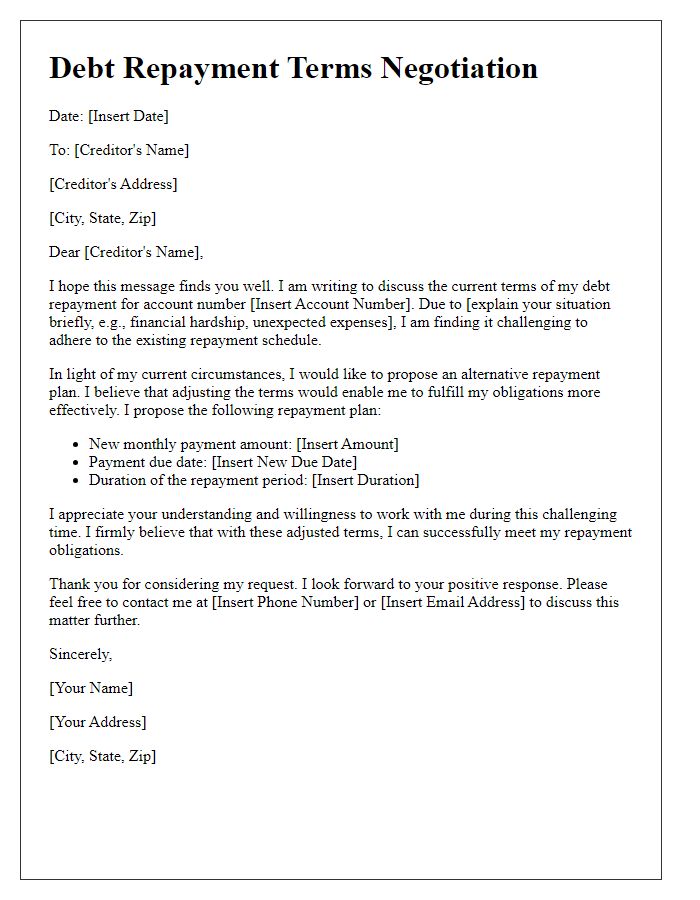

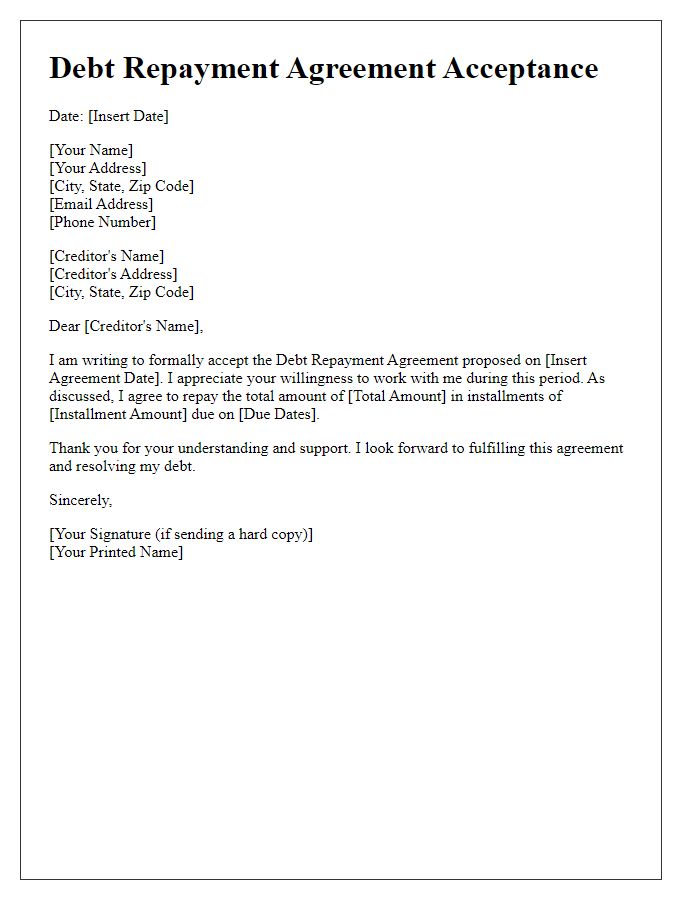

Detailed Repayment Terms

A debt repayment agreement outlines the specific terms for settling a financial obligation, typically between a creditor and a debtor. The agreement specifies the total amount owed (such as $5,000 for a personal loan), repayment schedule (like monthly installments of $500), and the duration of the repayment period (over a ten-month duration). It may include interest rates (e.g., an annual percentage rate of 6%) and any applicable fees for late payments, which can be specified (commonly $50 after a grace period). Additionally, details regarding missed payments (such as the consequence of moving the account to collections) should be explicitly stated. The signatory parties (the debtor and creditor) must provide signatures for legal validation, which may also necessitate witnessing by a third party to ensure compliance and accountability.

Interest and Fees

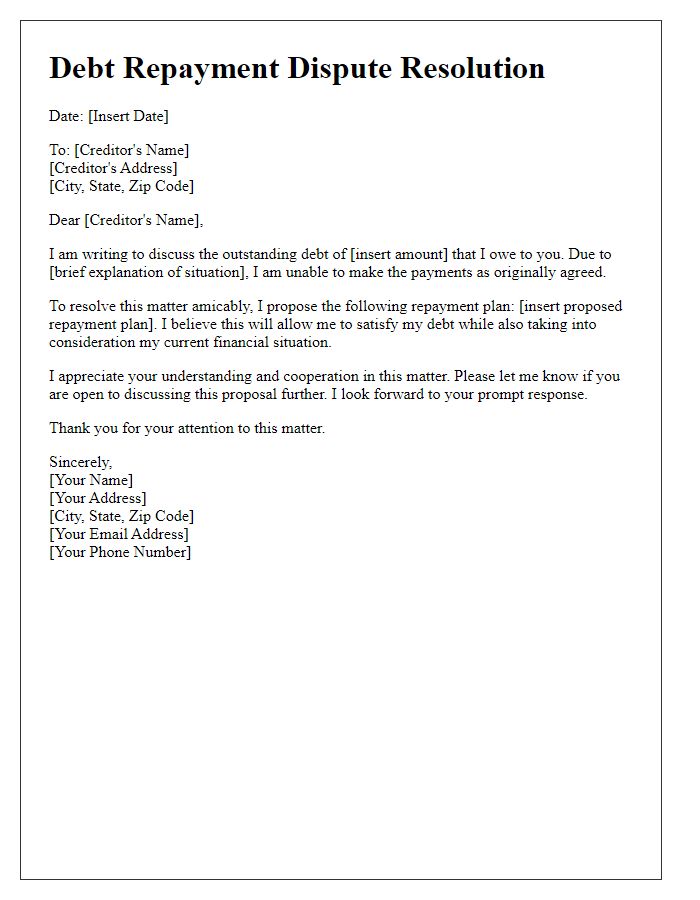

Debt repayment agreements generally outline the terms between a borrower and a lender regarding the repayment of an outstanding loan. Specific details about interest rates, repayment schedules, and any additional fees associated with the debt are crucial. For example, high-interest loans can lead to significant financial burdens if not managed properly, such as payday loans with interest rates exceeding 300% annually. Late fees, commonly around $30 to $50, can apply if payments are not received by the due date. It is essential to maintain clear documentation, typically in written formats, to establish a mutual understanding between both parties to avoid future disputes. Legal jurisdictions and applicable laws also play a vital role in determining enforceability of the agreement, particularly in regions such as New York or California with specific consumer protection regulations.

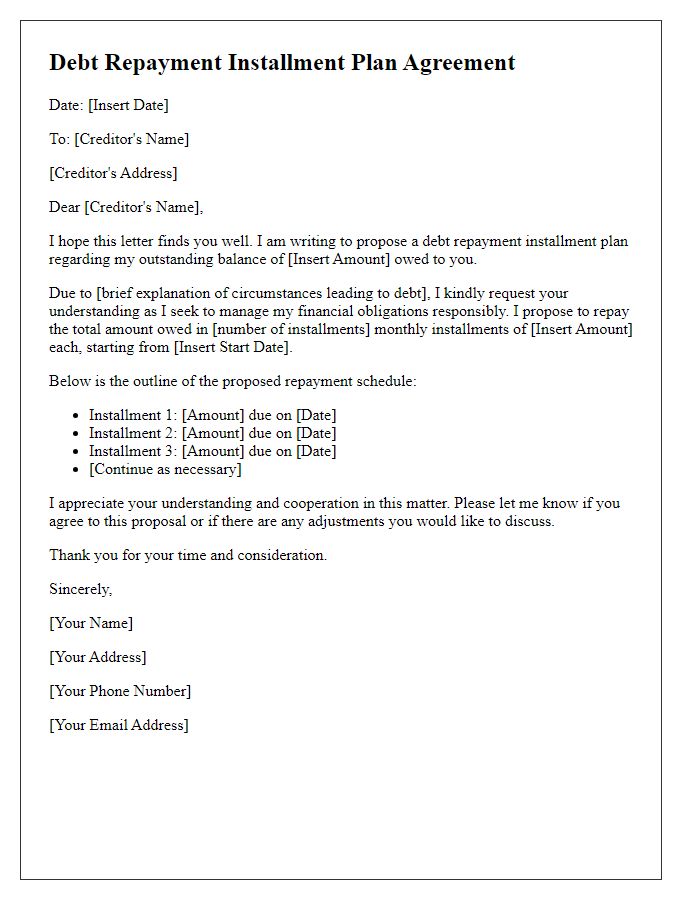

Payment Schedule

A debt repayment agreement outlines a structured payment schedule, detailing the amounts, frequency, and due dates for each payment. For instance, a debtor may agree to pay a total debt of $5,000 in monthly installments of $500 over ten months, beginning on the first of each month. This schedule may also define acceptable payment methods, such as bank transfers or checks. Additional terms could involve late payment penalties, which generally range from $25 to $50 depending on the agreement, and specific consequences for default, including potential legal action. Moreover, both parties' names and contact information, along with a clear identification of the debt being repaid, such as a personal loan from a lender like XYZ Finance, are typically included to ensure clarity and legal standing.

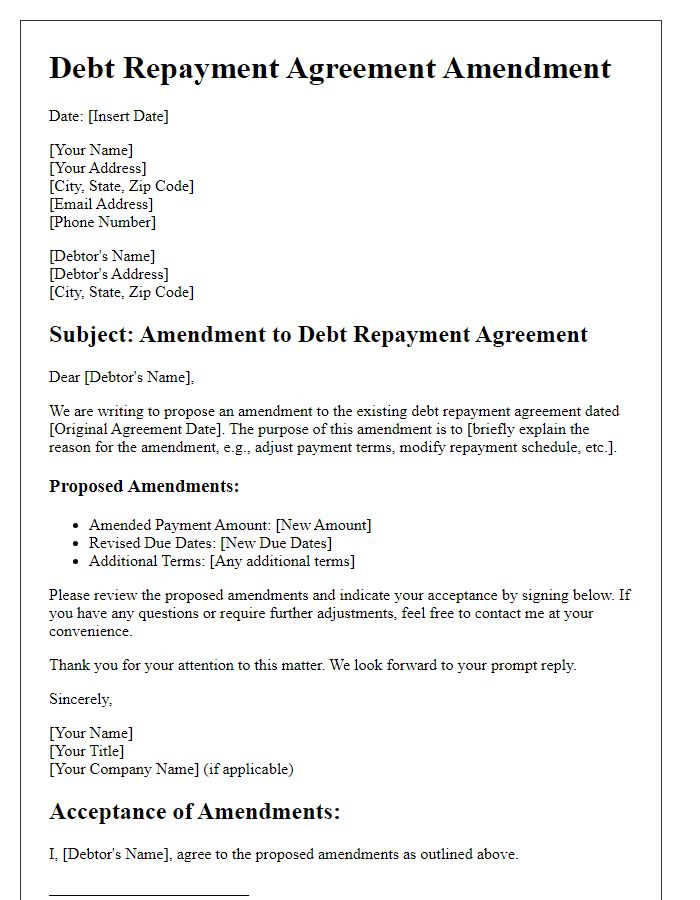

Default and Consequences

A debt repayment agreement outlines the terms and conditions under which a borrower will repay their outstanding debt, typically including specifics about default scenarios and potential consequences. Defaults can occur if payments are missed or not made by the agreed dates, which may lead to late fees, increased interest rates, or legal actions. For instance, a missed payment on a $10,000 loan can result in a 5% penalty fee, escalating the total debt owed. Additionally, consequences may include damage to credit scores, which can drop by 100 points or more, affecting future borrowing opportunities. Legal repercussions might involve collections proceedings initiated by the lender, potentially leading to court costs or wage garnishments. Understanding the implications of default is crucial for maintaining financial health and ensuring timely repayments.

Comments