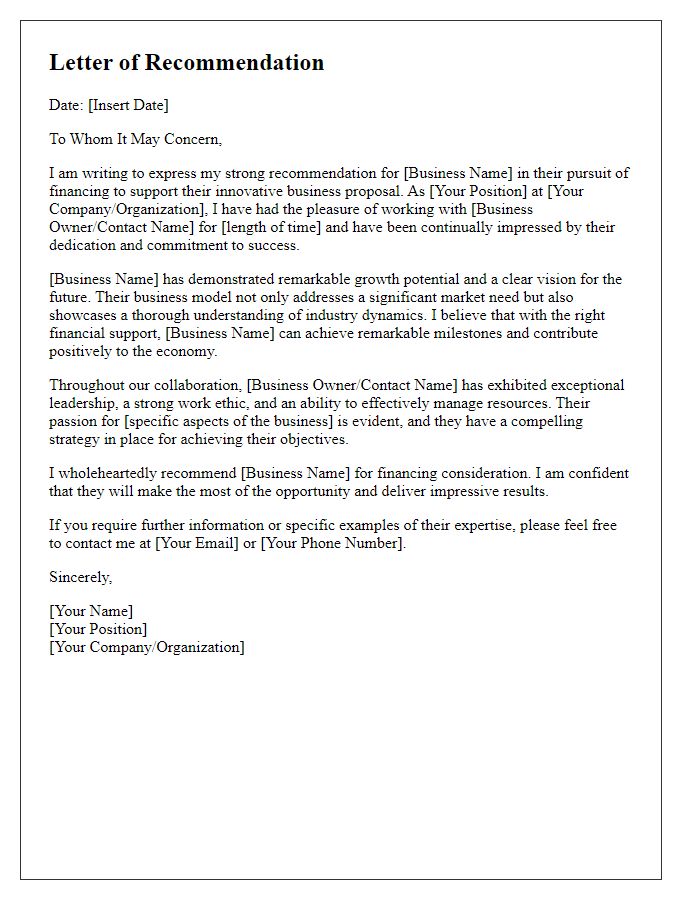

Are you considering applying for a small business loan but unsure how to create a persuasive recommendation letter? Writing a compelling letter is crucial, as it can significantly influence your lender's decision. In this article, we'll explore essential elements and tips for crafting a strong recommendation that showcases your business's credibility and potential. So grab a cup of coffee, and let's dive into the ins and outs of writing an effective letter that opens doors to financing opportunities!

Loan purpose and business goals

A small business loan can significantly enhance operational capabilities, enabling expansion plans for community-centered enterprises like cafes or retail stores. The loan purpose may involve acquiring new equipment such as espresso machines or point-of-sale systems, which can improve service efficiency and customer satisfaction. Additionally, funding can support marketing initiatives aimed at increasing brand awareness, such as social media advertising or local event sponsorships, essential for attracting more customers in competitive markets. Business goals often include increasing revenue by a specific percentage (e.g., 20%) within the next fiscal year, expanding into a second location within two years, or launching a new product line, such as organic food items or handmade crafts. This strategic financial support allows businesses to achieve their objectives and drive growth in their respective local economies.

Borrower's financial stability and creditworthiness

A small business loan recommendation should focus on the borrower's financial stability and creditworthiness. The borrower's financial health reflects their ability to manage debt and repay loans. Key indicators such as a credit score, typically above 700 for favorable terms, and a debt-to-income ratio, ideally below 36%, are essential for assessing creditworthiness. Additionally, consistent revenue growth, with a year-over-year increase of at least 10%, can demonstrate strong operational performance. A solid business plan outlining expected cash flow, including monthly profit and loss statements, enhances credibility. Furthermore, a history of timely payments on previous loans showcases responsibility and reliability in managing financial obligations. Overall, these factors combined provide a strong case for the borrower's eligibility for a small business loan, indicating their potential for successful repayment and long-term sustainability.

Detailed business plan and potential for growth

A detailed business plan outlines the operational strategy, market analysis, and long-term vision of a small business, such as a cafe in downtown Seattle. This plan should include financial projections, such as projected revenues of $150,000 in the first year, and an anticipated growth rate of 15% annually based on market trends. Key aspects of the proposal should highlight the increasing demand for artisanal coffee and local products, as reflected in a 25% rise in local cafe patronage over three years. Setting a competitive edge through unique offerings, like organic pastries and community events, can attract a loyal customer base. Furthermore, clear identification of target demographics and marketing strategies, including social media outreach and partnerships with local suppliers, demonstrate the potential for sustainable growth, positioning the business favorably in front of potential lenders.

Repayment ability and terms

A small business's repayment ability depends on various factors, including cash flow, revenue generation, and existing debt obligations. For instance, if a bakery generates an average monthly revenue of $20,000 and has fixed expenses of $12,000, the available cash flow for loan repayment becomes $8,000 each month. Loan terms play a crucial role in determining the feasibility of repayment; for example, a term length of three years with an interest rate of 6% on a $50,000 loan results in monthly payments of approximately $1,500. These payments must align with the business's financial health to ensure timely repayments without jeopardizing operational stability. A strong repayment plan alongside favorable loan terms enhances the likelihood of a successful borrowing experience, thereby supporting the business's growth and sustainability.

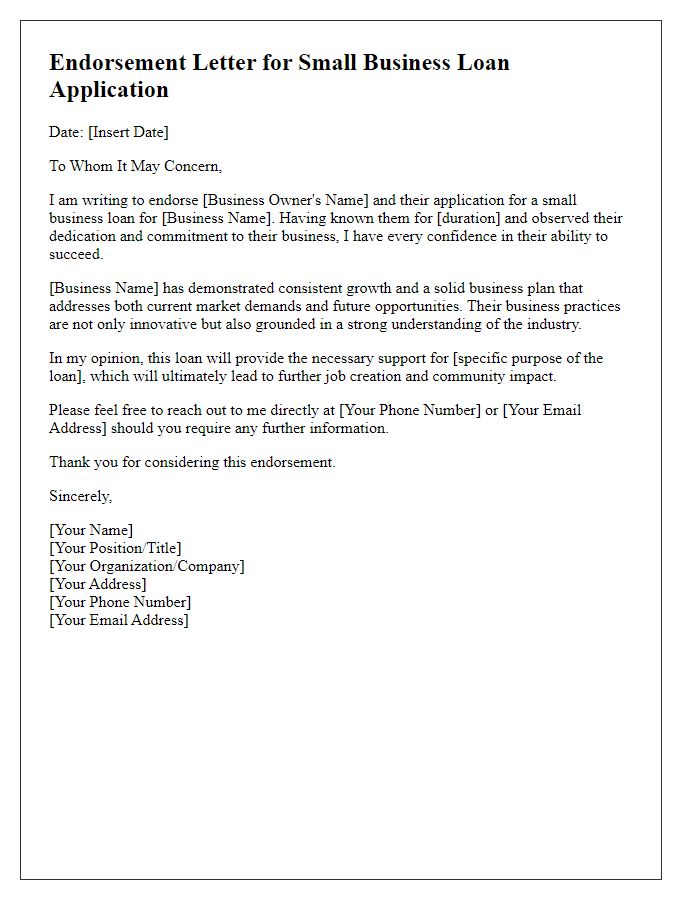

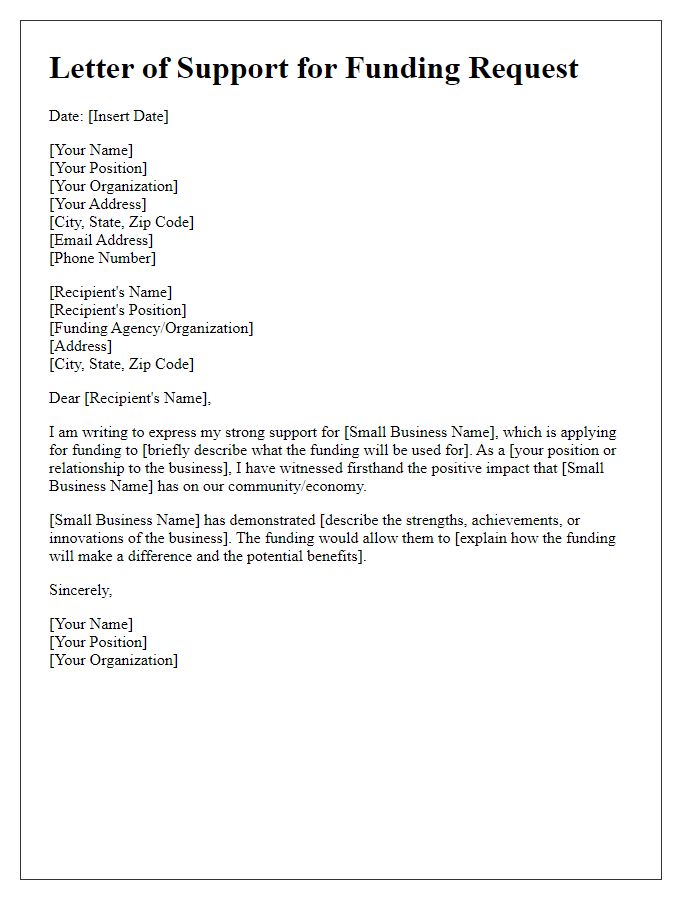

Endorsement and personal assurance

A small business loan endorsement demonstrates trustworthiness and reliability, which are essential for securing financial assistance. The business owner, an entrepreneur who operates in a specific sector, may seek a loan of $50,000 from a financial institution such as a local bank or credit union to expand operations. Personal assurance from a community-based business leader or mentor plays a crucial role, as their endorsement can significantly enhance the applicant's credibility. This can include a detailed account of the applicant's business history, highlighting achievements and contributions to the local economy. A favorable recommendation letter showcases the applicant's financial responsibility and potential for growth, making a compelling case for the loan approval process.

Comments