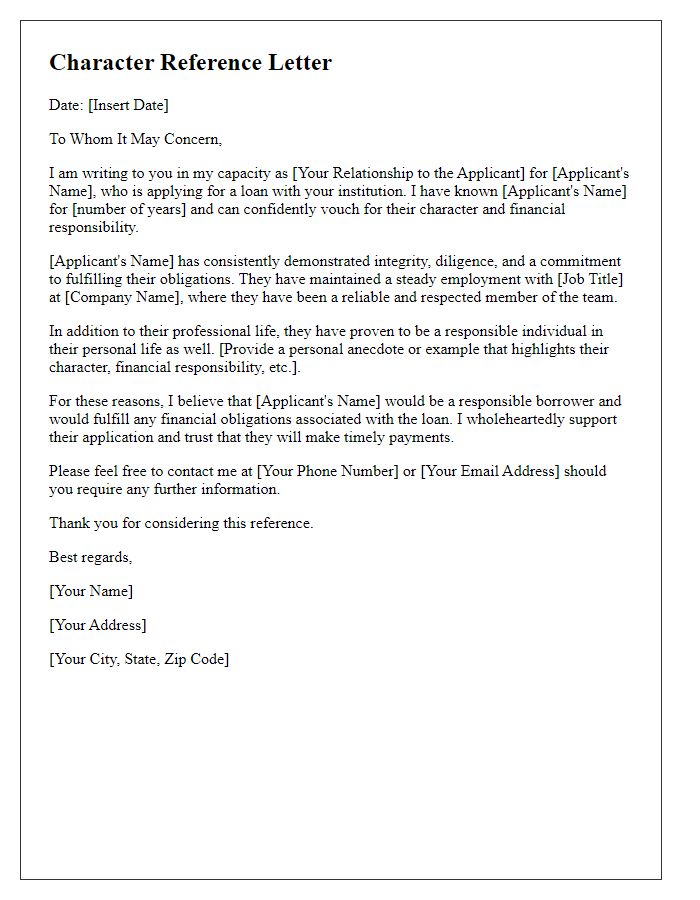

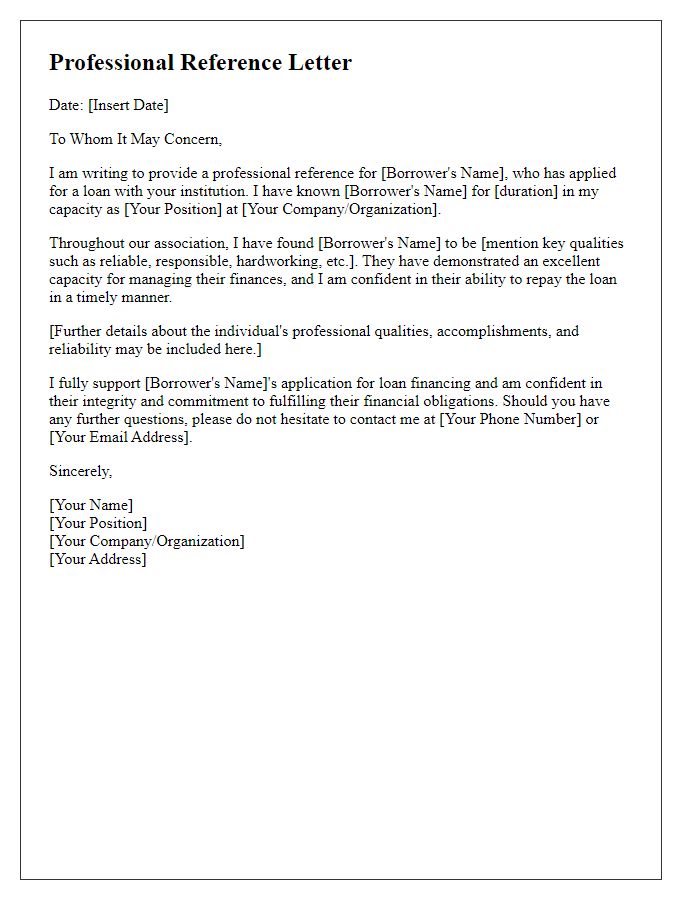

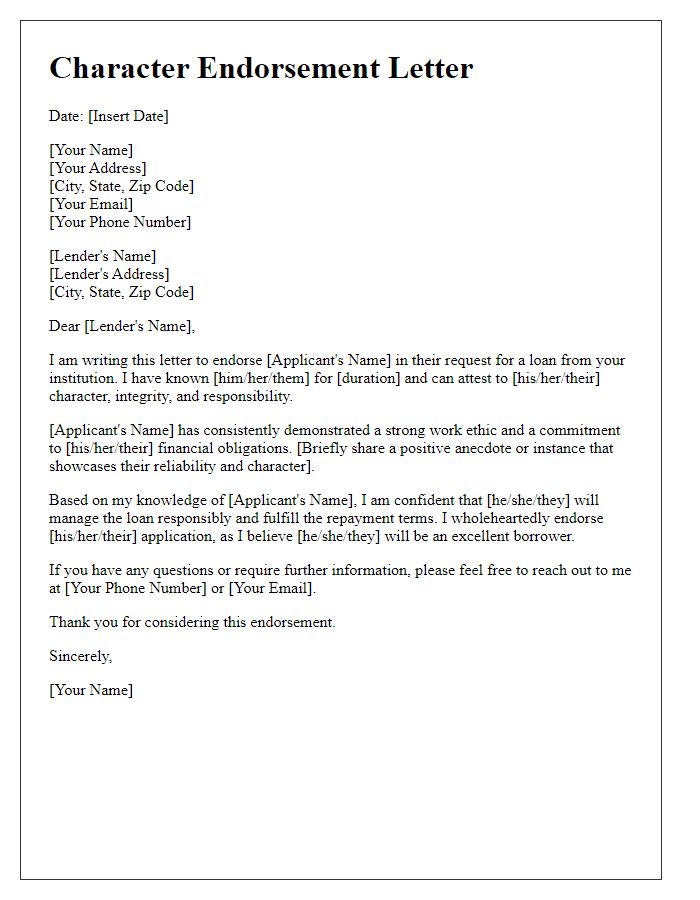

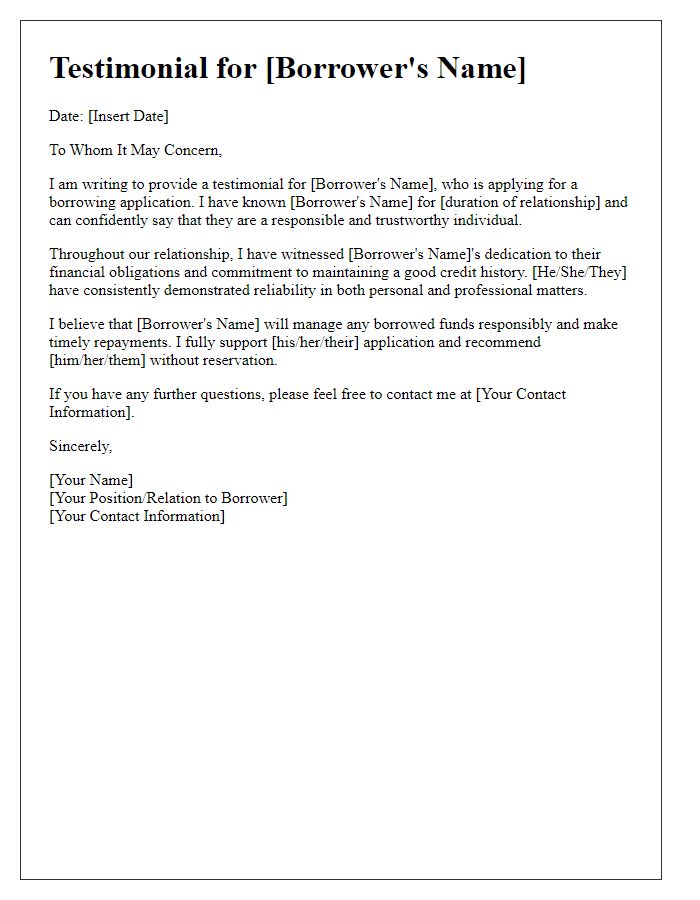

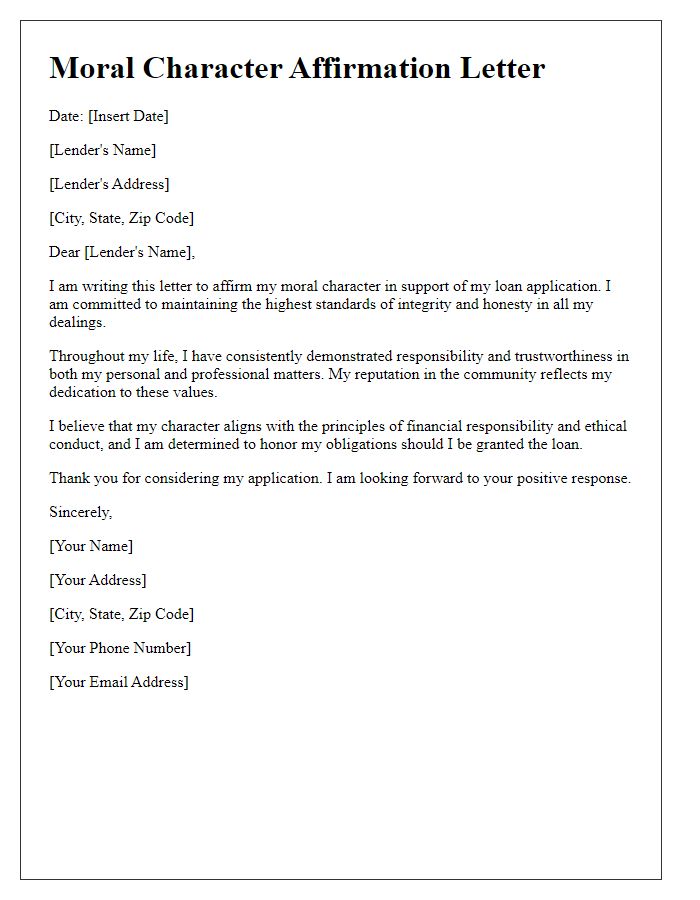

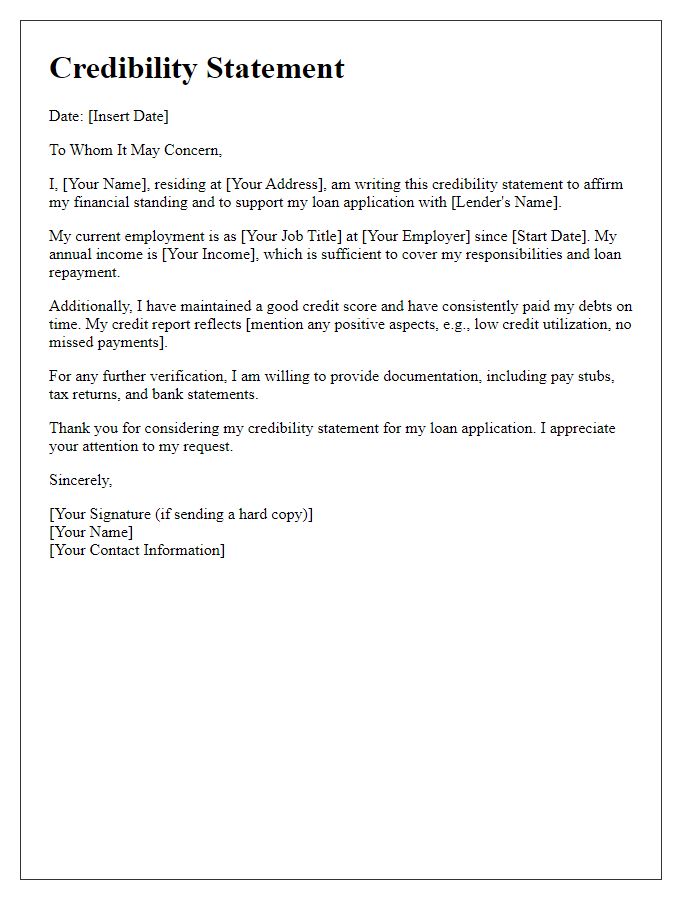

When seeking a loan, having a character recommendation can make all the difference. It provides lenders with assurance of your reliability and trustworthiness. Whether you're applying for a personal loan or a mortgage, a well-crafted letter showcasing your character can be your key to success. So, if you're curious about how to create an impactful recommendation letter for your loan application, read on for some tips and examples!

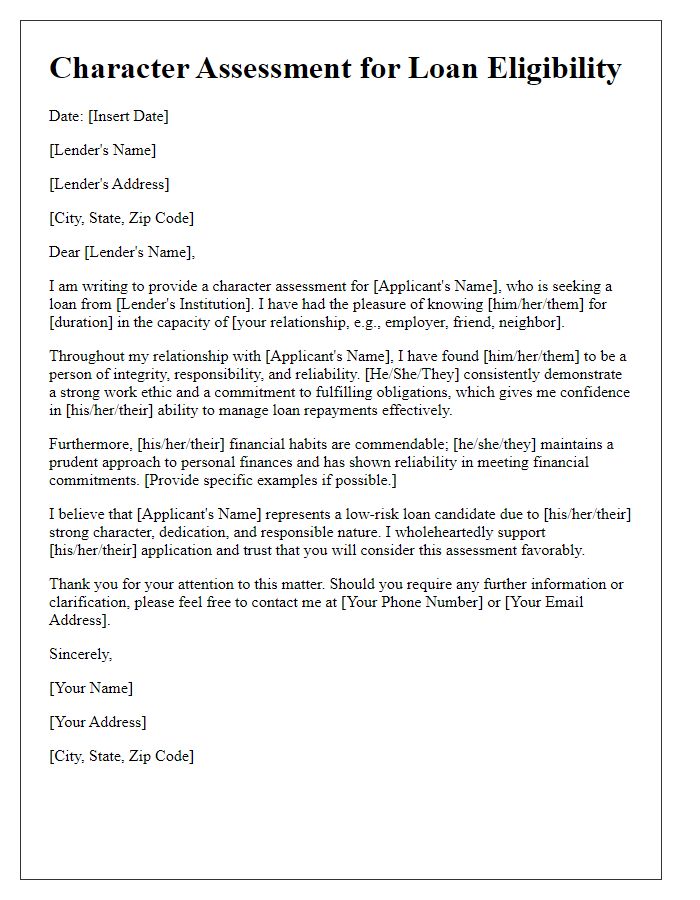

Applicant's personal attributes and character traits

The applicant, John Smith, has consistently demonstrated exceptional personal attributes and character traits that make him an outstanding candidate for a loan. His integrity, highlighted by his impeccable credit history and punctual bill payments, positions him as a reliable borrower. John's strong work ethic, shown through his 10 years of employment at XYZ Corporation, underscores his commitment to financial responsibility. He possesses excellent communication skills and is well-respected within his community, evidenced by his active involvement in local charities since 2015. Furthermore, John's problem-solving capabilities are reflected in his strategic financial planning, allowing him to manage resources efficiently. These traits not only testify to his character but also assure lenders of his ability to honor loan commitments.

Relationship with the applicant and duration

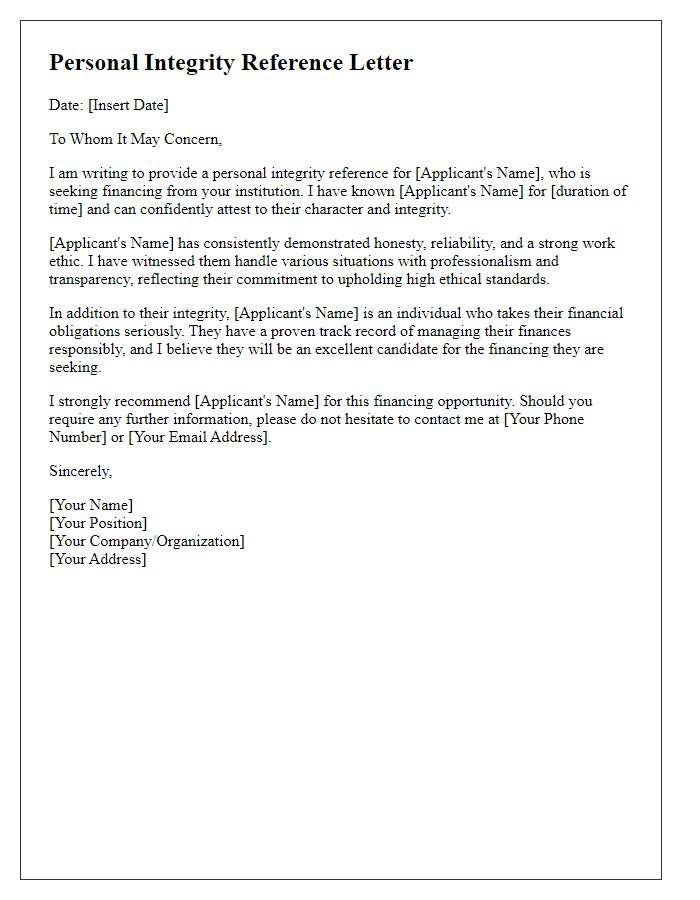

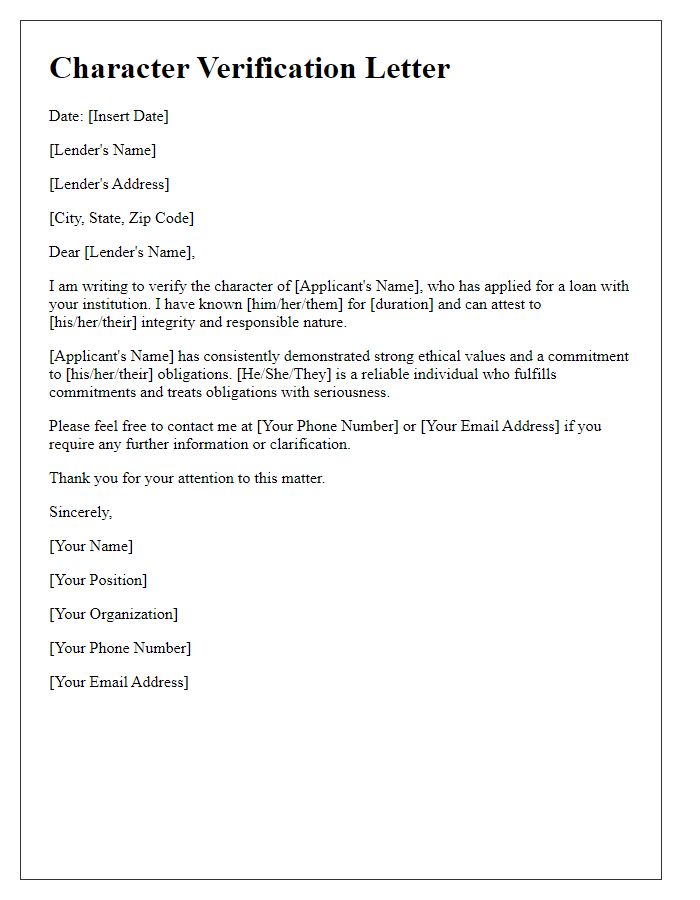

A character recommendation for a loan application can be crucial in establishing the reliability and integrity of the applicant. The relationship with the applicant often underscores the trustworthiness of their character. An individual with a close and personal connection, such as a family member or long-time friend, can provide valuable insights into the applicant's values and behavior. Durations of relationships, such as a friendship spanning over a decade or a familial bond that has lasted a lifetime, strengthen the credibility of the endorsement. In many cases, the recommender can attest to the applicant's financial responsibility, work ethic, and commitment to repaying debts based on firsthand experience, creating a solid foundation for a positive characterization in the loan application process.

Financial reliability and responsibility

A strong character recommendation for a loan application emphasizes the individual's financial reliability and responsibility. A trustworthy person consistently manages finances, meeting obligations such as bills and loans punctually. For instance, an individual with a credit score above 700 exemplifies financial discipline and creditworthiness. A track record of timely payments over the past five years, combined with a stable income source, illustrates personal responsibility. Additionally, evidence of savings habits, such as maintaining a savings account with a balance of at least three months' worth of living expenses, further underscores their commitment to financial health. This individual likely approaches financial decisions with prudence, ensuring they remain accountable and secure in their financial endeavors.

Specific examples of trustworthy behavior

A character reference for a loan application should highlight specific examples of trustworthy behavior that emphasize the individual's reliability and responsibility. For instance, the applicant could be described as consistently punctual in repayments of a personal loan taken from family members, displaying a commitment to honoring financial obligations. Instances where the individual helped others manage their budgeting, showcasing empathy and understanding of financial principles, could be noted. Furthermore, their active participation in community events--such as volunteering at financial literacy workshops--illustrates a dedication to fostering trust and responsibility within the community. Such behaviors paint a picture of an individual who values integrity and has a history of making sound financial decisions.

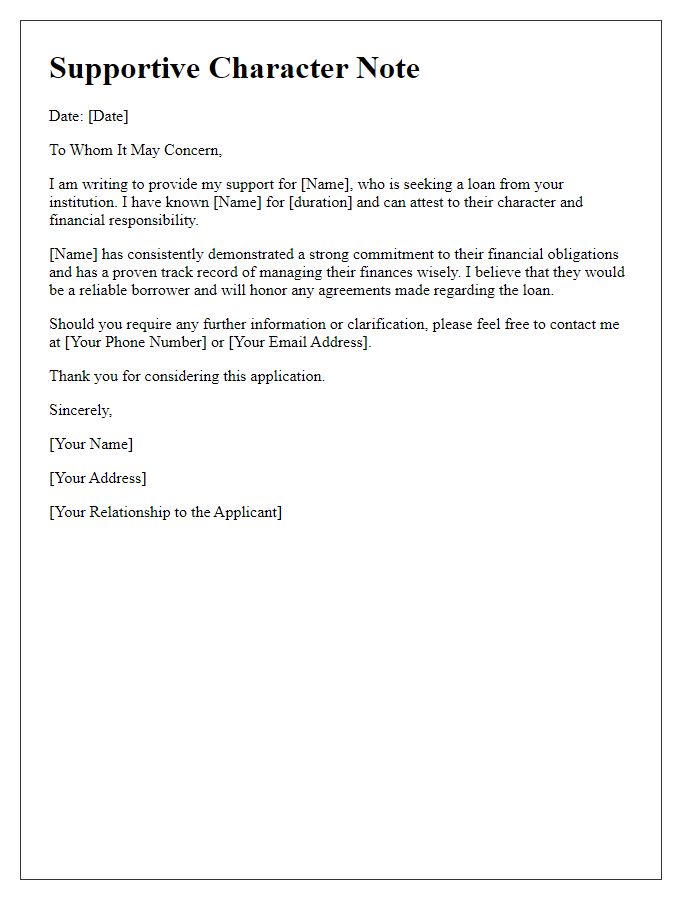

Contact information for follow-up inquiries

A strong character recommendation for a loan application often includes specific details to enhance credibility. Providing a personal touch, such as past interactions or experiences with the applicant, can be beneficial. Trustworthy contacts like family friends, colleagues, or mentors may ensure the recommendation carries weight. Include full names, phone numbers, and emailing addresses for verification. Mention any relevant associations, such as community involvement or professional organizations, which further endorse the applicant's reputation. Keeping the tone professional while highlighting positive traits, such as responsibility, integrity, and financial aptitude, ensures the recommendation serves its purpose effectively.

Comments