Are you considering stepping into the world of homeownership but feeling a bit overwhelmed by the mortgage process? It's completely normal to have questions, and that's where a mortgage advisor can play a crucial role in guiding you. With their expertise, they can help you navigate through various options, ensuring that you find the right mortgage solution tailored to your needs. Ready to take the first step toward your dream home? Let's dive deeper into what a mortgage advisor can do for you!

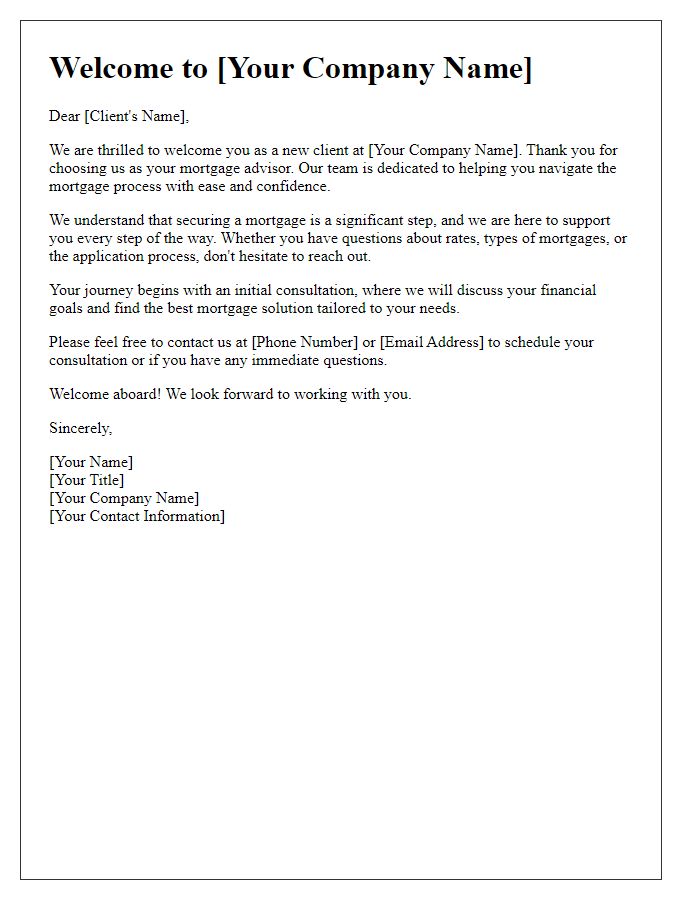

Personalization and Client's Information

A mortgage advisor introduction should include personalized details for optimal engagement and understanding of the client's unique financial situation. Start by incorporating the client's name, for example, "Dear [Client's Name]." Next, highlight the importance of the mortgage process tailored to the client's circumstances, such as first-time homebuyers or refinancing existing loans. Mention key details like income range, credit score expectations, and desired mortgage amount to establish context. Include specifics about the local real estate market, referencing average home prices in [Location Name] or recent mortgage trends in the area, ensuring the client feels informed about their options. Finally, express your readiness to guide them throughout this crucial financial journey, ending with an invitation for further discussion.

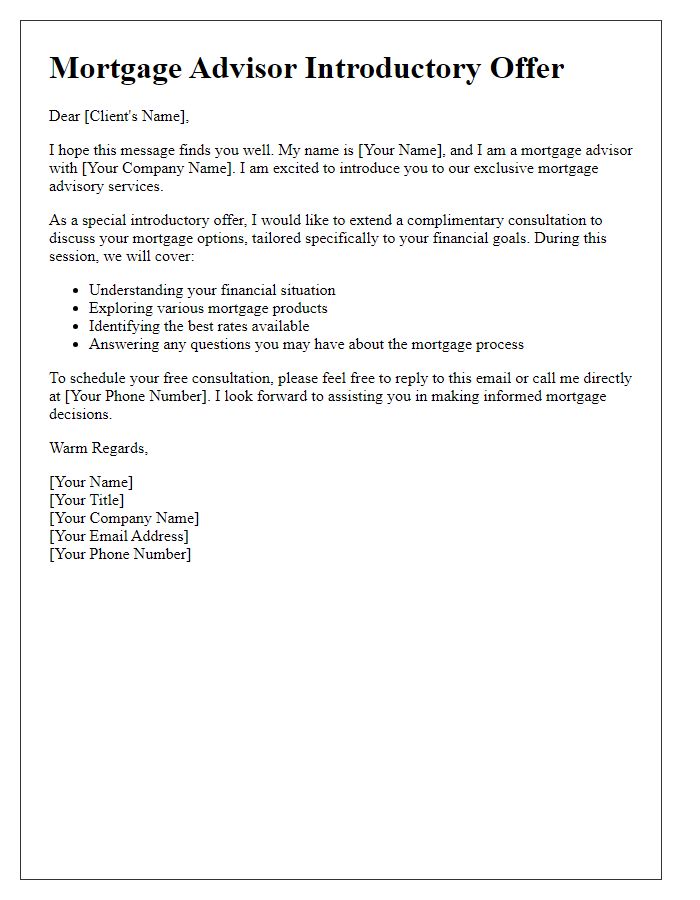

Clear Introduction of the Advisor

A mortgage advisor specializes in guiding individuals through the home financing process, helping them secure loans for properties (residential, commercial, etc.). With expertise in various mortgage products such as fixed-rate (i.e., standard loans with consistent payments), adjustable-rate (loans whose interest rates fluctuate), and government-backed options (like FHA, VA, USDA loans), the advisor assesses financial situations, analyzes credit scores, and identifies suitable lending institutions. An advisor also stays informed on market trends (like interest rate fluctuations) and regulatory changes, enabling clients to make informed decisions. Through personalized consultations, the advisor builds trust, ensuring that each client's unique needs and long-term financial goals are met effectively.

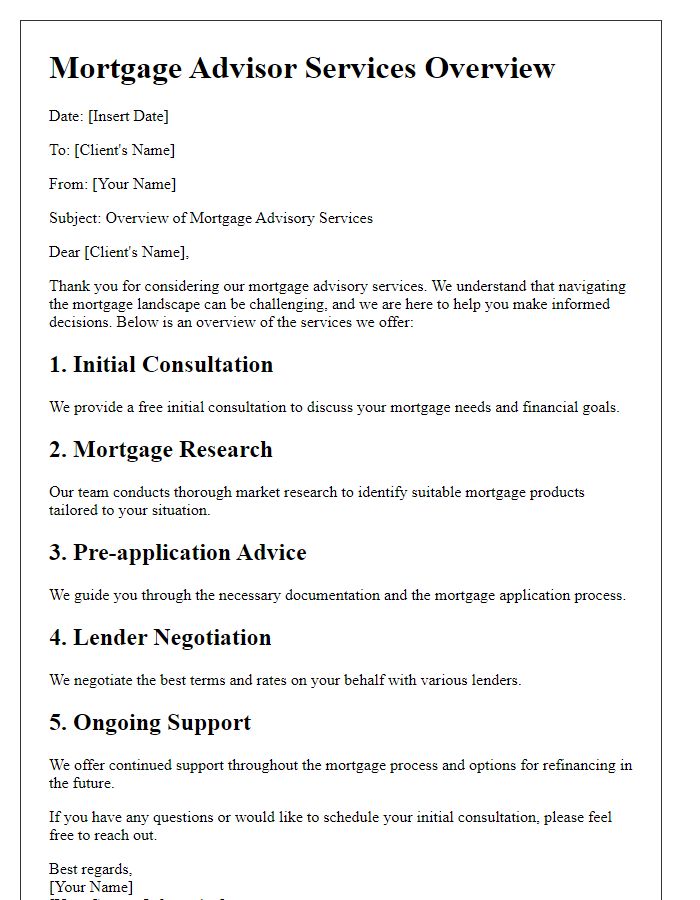

Explanation of Services Offered

A mortgage advisor provides essential guidance throughout the home financing process, assisting clients in securing loans tailored to their financial situations. Key services include mortgage pre-approval, which involves evaluating financial health and credit scores (typically ranging from 300 to 850). Advisors also conduct market research to identify suitable lenders, assessing interest rates (usually between 2% to 5% depending on economic conditions) and terms based on client needs. They prepare and submit mortgage applications, ensuring all documentation, such as tax returns and employment verification, is in place. Post-approval, advisors offer ongoing support, helping clients understand closing costs, which can be approximately 2% to 5% of the loan amount, and facilitating a seamless transition into homeownership. Their expertise helps clients navigate complex financial decisions, ultimately enhancing the likelihood of successful loan approval.

Contact Information and Call to Action

A mortgage advisor provides essential guidance for individuals seeking financial assistance in acquiring properties, covering aspects such as interest rates, loan types, and credit qualifications. The advisor often operates in a specific region, such as metropolitan areas like New York or Los Angeles, where housing markets thrive. Additionally, advisors utilize key financial metrics like loan-to-value ratios (LTV) and debt-to-income ratios (DTI) to assess a client's eligibility. Effective communication channels include phone consultations and email correspondence, ensuring clients receive timely advice. Encouraging potential clients to schedule personalized consultations empowers them to navigate the complexities of mortgage applications confidently.

Professional Tone and Formal Language

The role of a mortgage advisor is crucial in navigating the complex landscape of home financing. Expert guidance from mortgage advisors, such as licensed professionals with certifications from organizations like the National Association of Mortgage Brokers, enables clients to understand mortgage options, interest rates, and repayment plans. Advisors often analyze financial profiles, including credit scores (which can range from 300 to 850), debt-to-income ratios, and employment history to recommend suitable mortgage products. They also assist in the paperwork and communication with banks or credit unions, ensuring a smoother process for clients aiming for home ownership in competitive markets such as the Greater Toronto Area or San Francisco. Furthermore, keeping abreast of market trends and regulations enhances their ability to provide clients with up-to-date advice tailored to individual needs and financial situations.

Comments