Are you feeling overwhelmed by the process of selling an inherited property? You're not aloneâmany find the legalities and emotional aspects challenging to navigate. From understanding the property's value to dealing with potential heirs, it can quickly become a complex journey. Let's explore some helpful tips and resources to guide you through this processâkeep reading!

Beneficiary Details

Inherited properties often require careful management to ensure a smooth transition for beneficiaries. The beneficiary details, including names, contact information, and relationships to the deceased owner, must be clearly outlined. For example, if the inherited property is located in San Francisco (noted for its booming real estate market), property tax implications and local regulations should be addressed during the sale process. Additionally, if multiple beneficiaries exist, determining individual shares and responsibilities is crucial to avoid disputes. Estate planning documents such as wills or trusts should be reviewed to clarify the intended distribution, and any outstanding debts tied to the property, such as mortgages or liens, should be resolved prior to sale to ensure a clear title.

Property Description

The inherited property located at 123 Maple Street, Springfield, is a charming two-story, 2,500 square foot home built in 1990. This residence features four spacious bedrooms and three bathrooms, ideal for families and accommodating guests. The property includes a well-maintained landscaped yard measuring 0.25 acres, complete with mature trees and vibrant flower beds, creating a serene outdoor environment. A two-car garage complements the home, providing ample parking and storage space. The interior boasts high ceilings and an open-concept floor plan, allowing natural light to flow throughout the living spaces. Recent updates include a new roof installed in 2022 and upgraded kitchen appliances. Located in a desirable neighborhood known for its excellent schools and proximity to local parks, this property presents an ideal investment opportunity for potential buyers looking for a family home or rental property.

Legal Documentation

Inherited property sales often require comprehensive legal documentation to ensure a smooth transaction. Essential documents include the property deed, which provides evidence of ownership, and a death certificate of the deceased owner to validate inheritance rights. A probate court order may also be necessary to confirm the legitimacy of the estate distribution. In addition, tax documents, including property tax statements or assessments, help ascertain outstanding liabilities on the inherited property located in the specific jurisdiction. Finally, an estate inventory list detailing assets, including the property's value and condition, can assist in establishing fair market value for sale purposes. Each document plays a critical role in maintaining legal integrity throughout the sale process.

Selling Intentions

Inherited property often carries emotional weight alongside financial implications. Navigating the sale of such assets, especially in populous regions like California, involves understanding market dynamics and potential gains. Estate taxes can significantly impact proceeds, with federal exemptions set at $12.92 million for individuals in 2023. Local market comparisons, such as areas in Los Angeles or San Francisco, can provide insights into pricing strategies. Engaging a real estate agent knowledgeable about market trends increases the likelihood of a successful transaction, while also ensuring compliance with legal obligations concerning inherited properties. Timely communication with beneficiaries and advisors is crucial for a smooth sale process.

Contact Information

Inherited properties can present unique challenges during the sale process, especially when dealing with legal matters and emotional ties. Executors or heirs often find themselves navigating complex estate laws, which vary by state. For instance, probate may be required in locations like California, extending the timeline of the sale to several months. Valuable assets, such as homes in high-demand areas like New York City or San Francisco, may attract competitive offers, yet fair market valuations are crucial. Therefore, collaborating with real estate professionals experienced in inherited property transactions can help maximize the sale price while ensuring compliance with legal requirements. Additionally, understanding tax implications, such as potential capital gains taxes, can significantly impact the financial outcome of the sale.

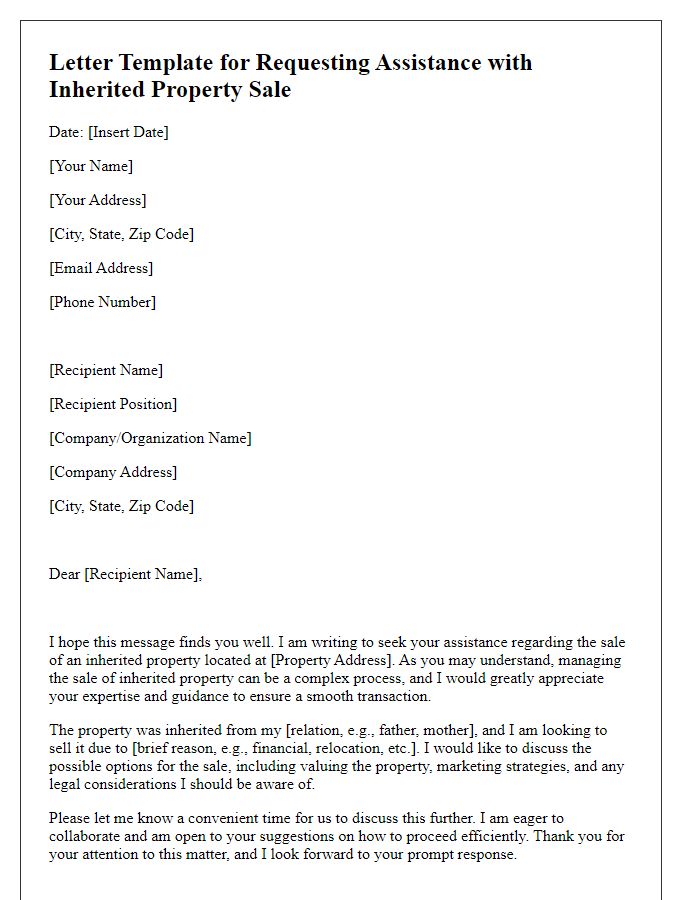

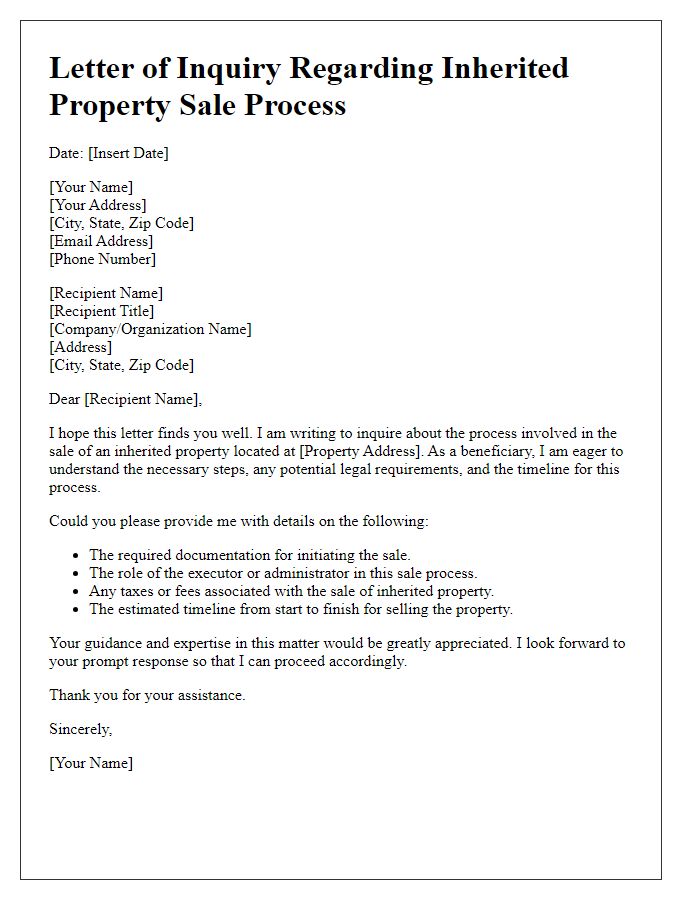

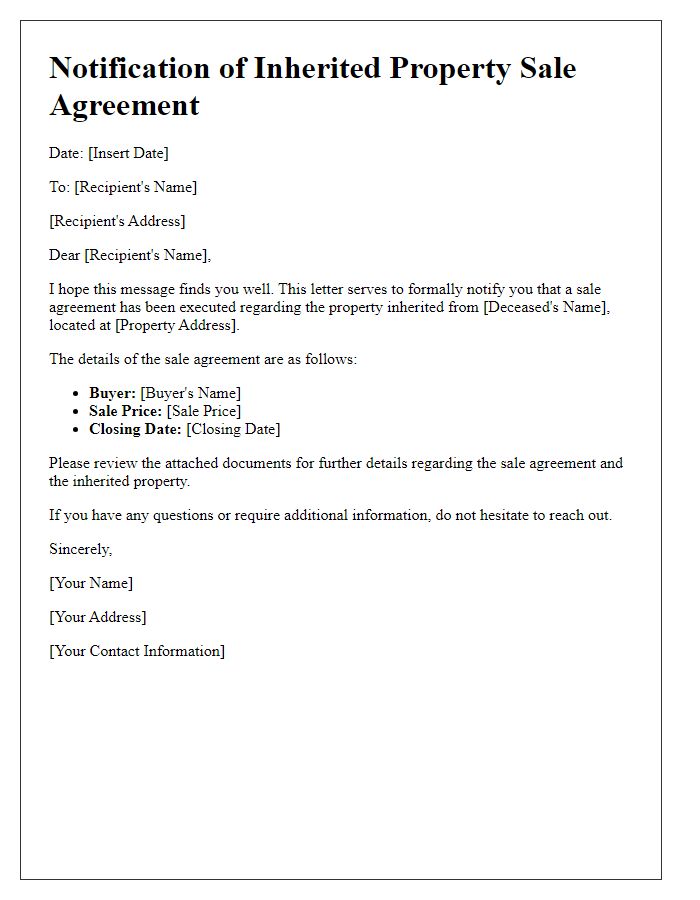

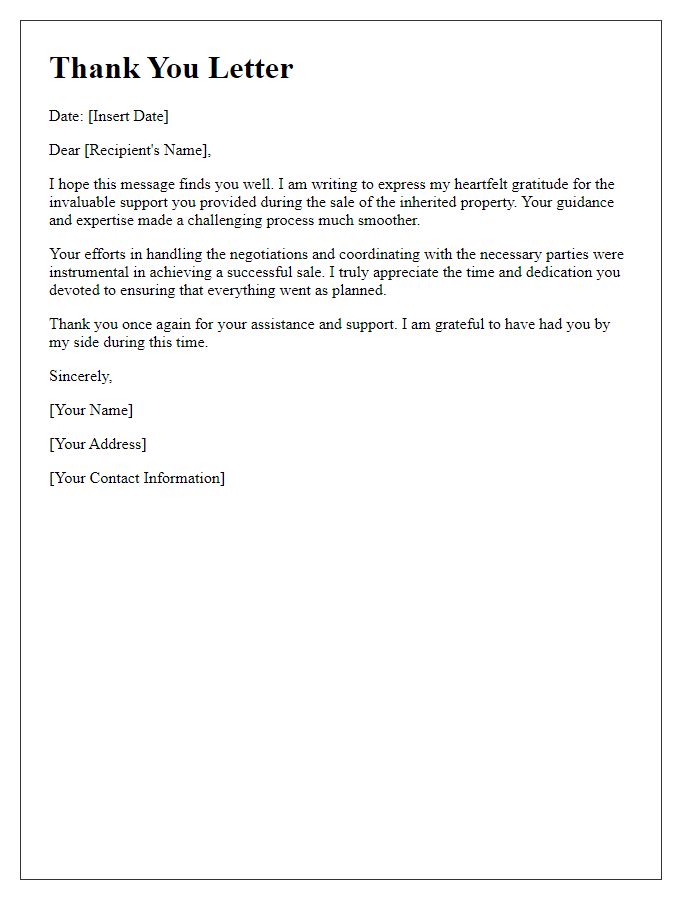

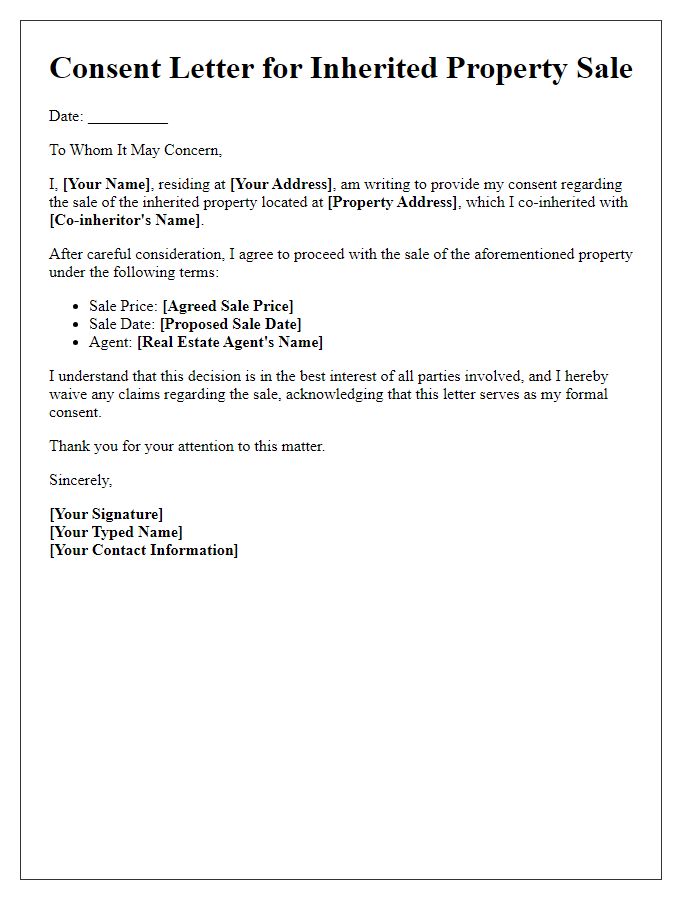

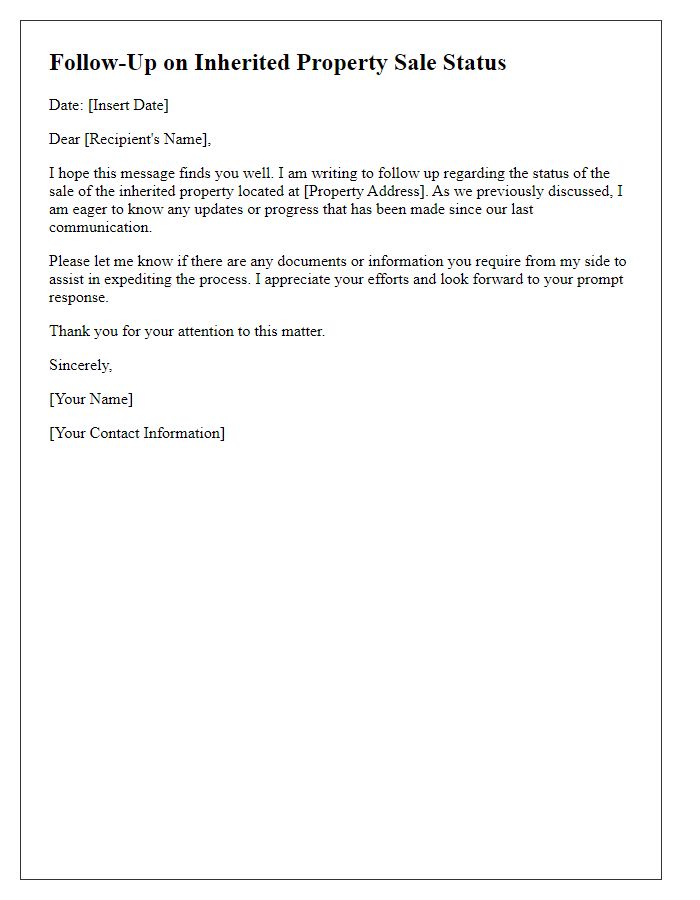

Letter Template For Inherited Property Sale Assistance Samples

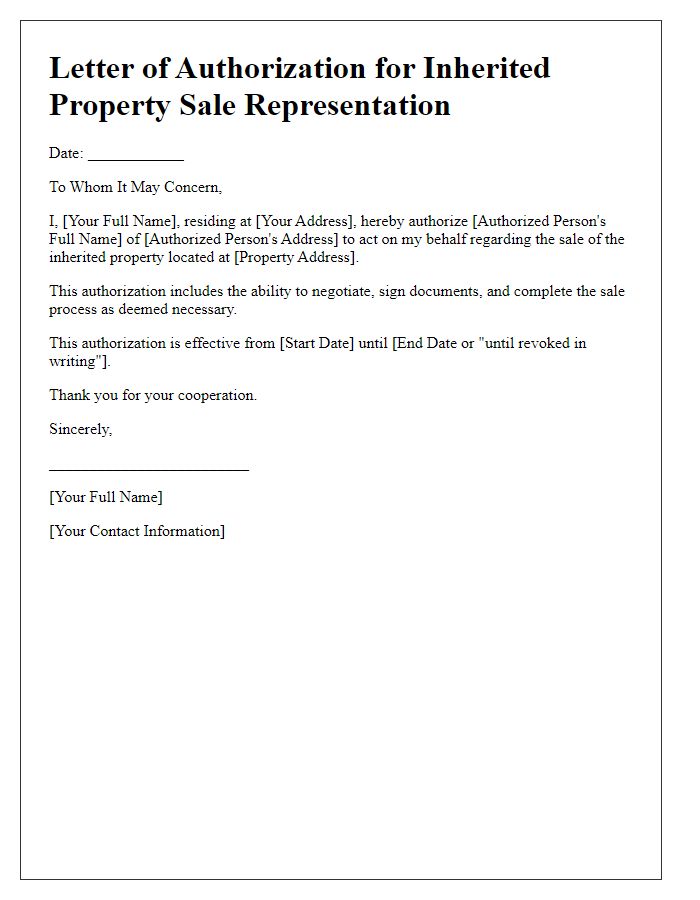

Letter template of authorization for inherited property sale representation

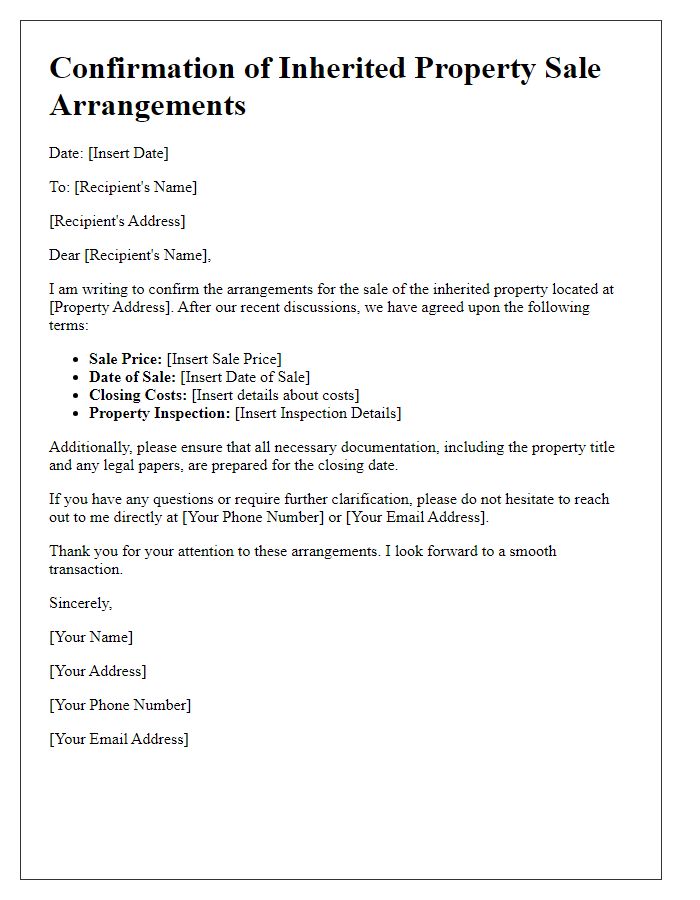

Letter template of confirmation for inherited property sale arrangements

Comments