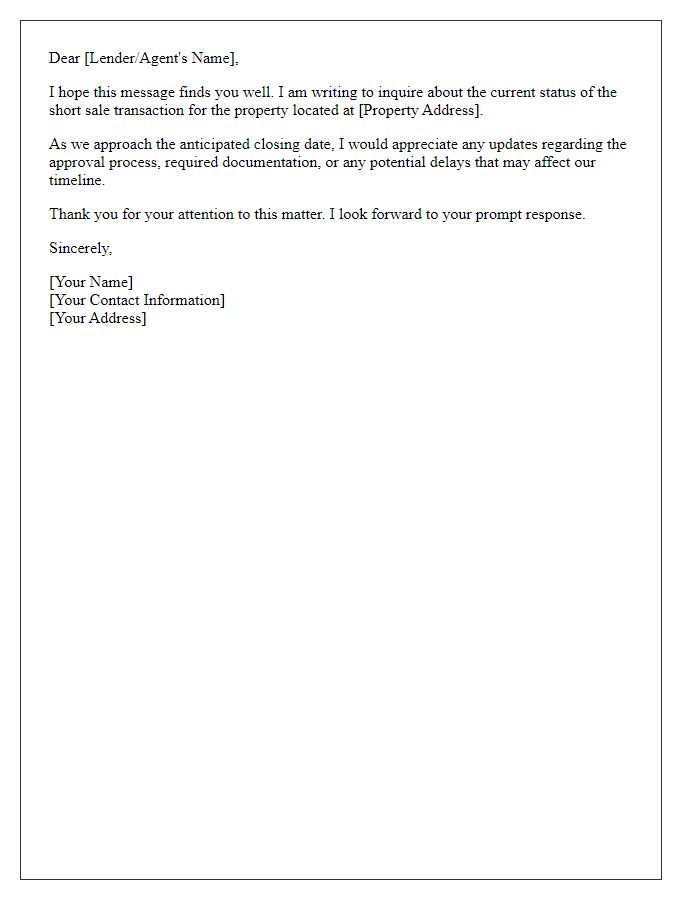

Hey there! If you're navigating the complexities of a short sale, you know how crucial it is to stay updated. In this article, we'll break down the essential steps and provide valuable tips to simplify your transaction process. Whether you're an eager seller or a curious buyer, we've got insights just for youâso stick around to learn more!

Borrower Information

The short sale transaction update reflects critical borrower information essential for the process. The borrower, identified by their name, [insert borrower name], has a loan number, [insert loan number], associated with their property located at [insert property address]. Current financial hardships, such as job loss or medical expenses, have prompted the need for a short sale. Communication has been established with the lender, [insert lender name], who has been provided with necessary documents, including a hardship letter and financial statements. The valuation of the property currently stands at [insert property value, e.g., $250,000], significantly lower than the outstanding mortgage balance of [insert mortgage balance, e.g., $300,000]. A listing agreement with [insert real estate agent's name or agency] has been executed to expedite the sale process. Time frame for completion remains uncertain, contingent on lender's response to offers received and necessary approvals from all parties involved.

Property Details

In a short sale transaction, property details play a crucial role in determining the outcome and timeline. The property located at 123 Maple Street, Springfield, has unique features including three bedrooms, two bathrooms, and a finished basement which adds approximately 600 square feet to the 1,800 square foot total living area. Recent property assessments, such as the 2023 appraisal report, indicate a market value of $250,000, although the seller faces a mortgage of $300,000, leading to a short sale situation. Additionally, the property is situated in a desirable neighborhood known for its proximity to Springfield High School and local parks, which can positively influence buyer interest. Current status updates should highlight lender communications, listing updates, and any potential offers received, emphasizing the urgency of the transaction given the property's financial circumstances.

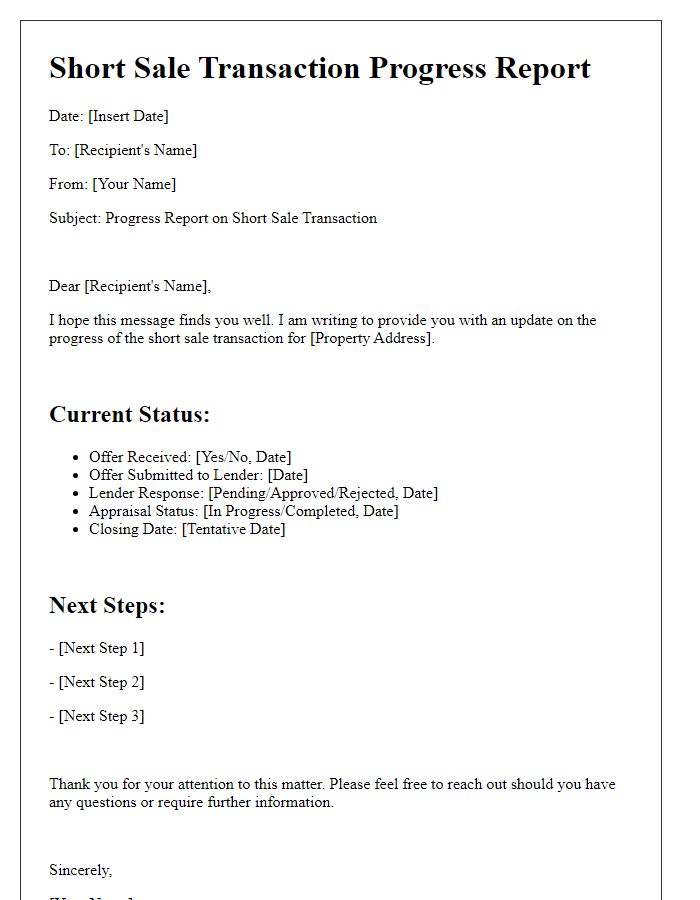

Current Offer Status

In a short sale transaction, the current offer status plays a crucial role in determining the next steps for both buyers and sellers involved. The property, located in Smithville, has received an offer of $250,000, significantly lower than the previous listing price of $300,000. The lender, Bank of America, has acknowledged this offer and initiated its review process, which typically takes 30 to 45 days. Buyers should remain aware that the acceptance of this offer is contingent on the lender's approval, considering the borrower's financial hardship and the property's market conditions. Regular follow-ups with both the real estate agent and the lender ensure all parties stay informed on progress toward a resolution.

Broker Details

In the context of a short sale transaction, the broker's expertise can significantly impact the outcome. A licensed real estate broker, operating in regions such as California, plays a crucial role in negotiating with lenders for short sales, which involve selling a property for less than the outstanding mortgage balance. Effective communication from the broker can enhance the chances of approval, especially in complex cases where multiple liens exist. The broker also assists in preparing necessary documentation, such as the Short Sale Addendum, which outlines terms specific to the transaction, and coordinates closely with all parties involved, including buyers, sellers, and lenders. Their market knowledge, particularly in distressed property values, is invaluable in setting a competitive price that can expedite the sale process. Furthermore, timely updates from the broker on transaction progress are essential for maintaining transparency and ensuring all parties are informed of any changes or requirements needed to complete the short sale successfully.

Next Steps and Timeline

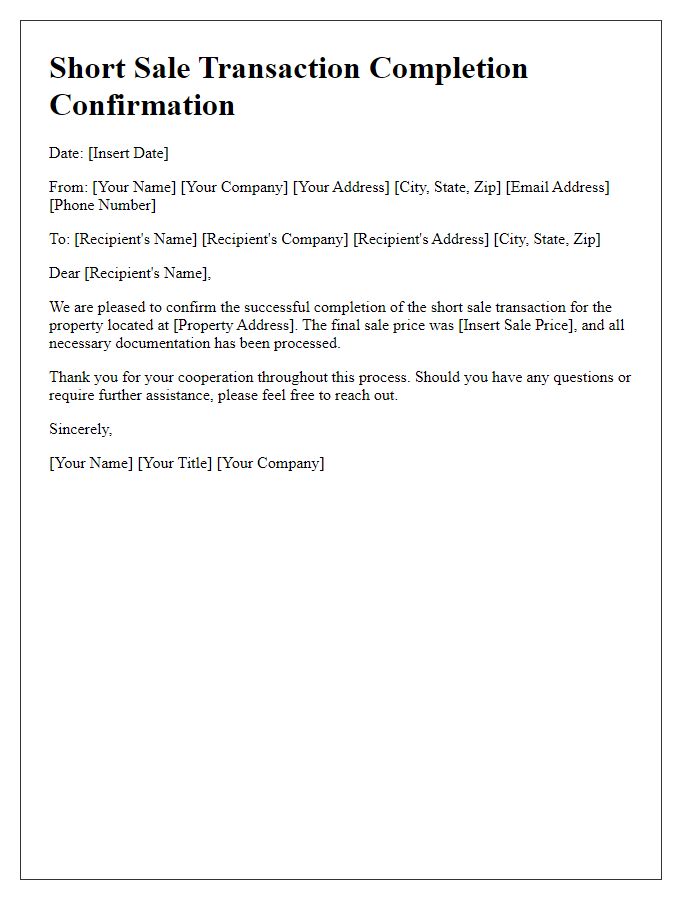

A short sale transaction, particularly for properties under financial distress, often entails several crucial steps and timelines. The current status of the short sale process for Property Address XYZ indicates that the lender, Bank ABC, has received the necessary documentation, including the hardship letter and financial statements, from Seller John Doe. The estimated timeline for evaluating the short sale request is approximately 30 days, given that it is a high-volume period for the lender. Following the evaluation, an approval or denial notification will be sent to Seller Doe, which typically takes 7 to 10 days. If approved, the buyer's agent will receive a short sale approval letter, outlining the terms and conditions, including the agreed selling price of $250,000. It is essential for all parties to remain responsive and ready to meet interim deadlines, including inspections and buyer financing contingencies, to expedite the completion of this transaction successfully.

Comments