Are you considering a bank loan but not sure how to ask for it? Writing a loan request letter doesn't have to be daunting; it's simply your opportunity to present your financial needs clearly and professionally. In this article, we'll break down the key components of an effective loan request letter, ensuring that you make a strong case for your borrowing needs. Keep reading to discover helpful tips and a template that can guide you through the process!

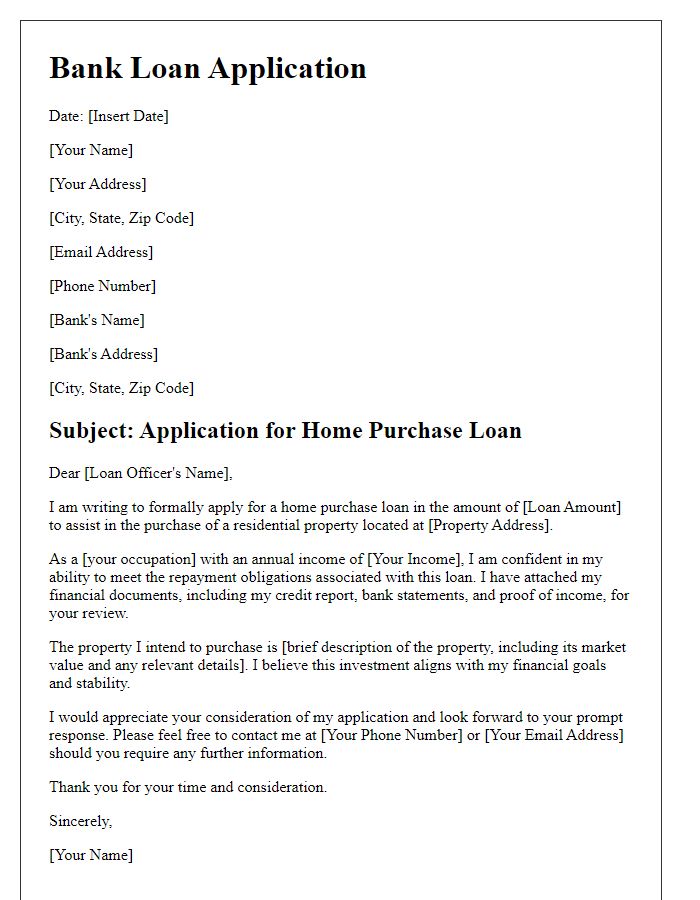

Personal Information

Personal information, including name, address, date of birth, and social security number, is crucial for processing a bank loan application. Financial institutions, such as JPMorgan Chase or Bank of America, require accurate personal identification to assess creditworthiness. Employment details, including job title, employer name, and duration of employment, provide insight into income stability. Additionally, personal income figures, which often range from $30,000 to $100,000 annually for average applicants, are essential for evaluating repayment capacity. Contact information, such as phone number and email address, facilitates communication throughout the loan process, ensuring a smooth application experience.

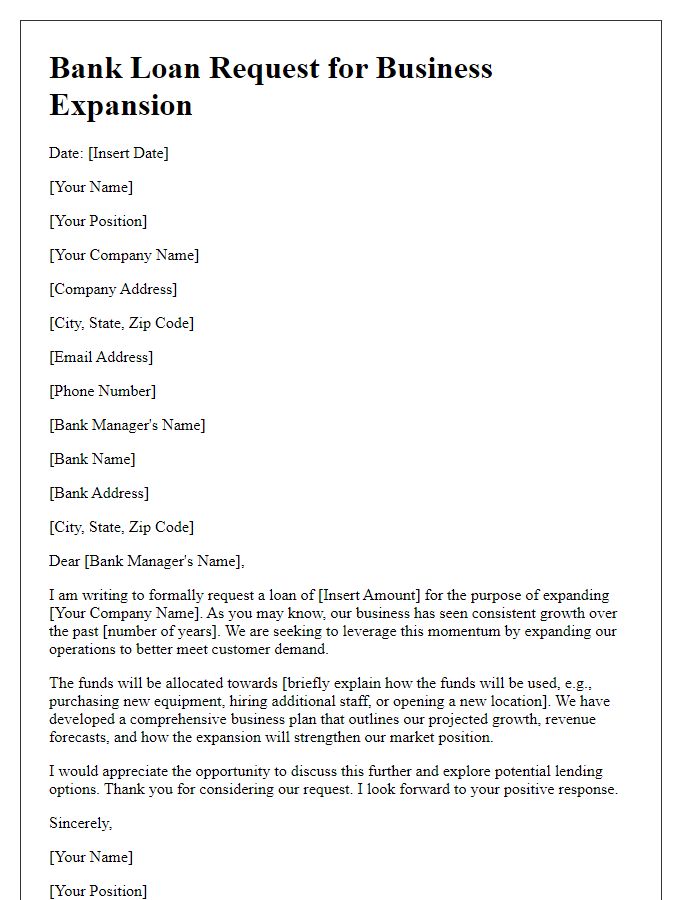

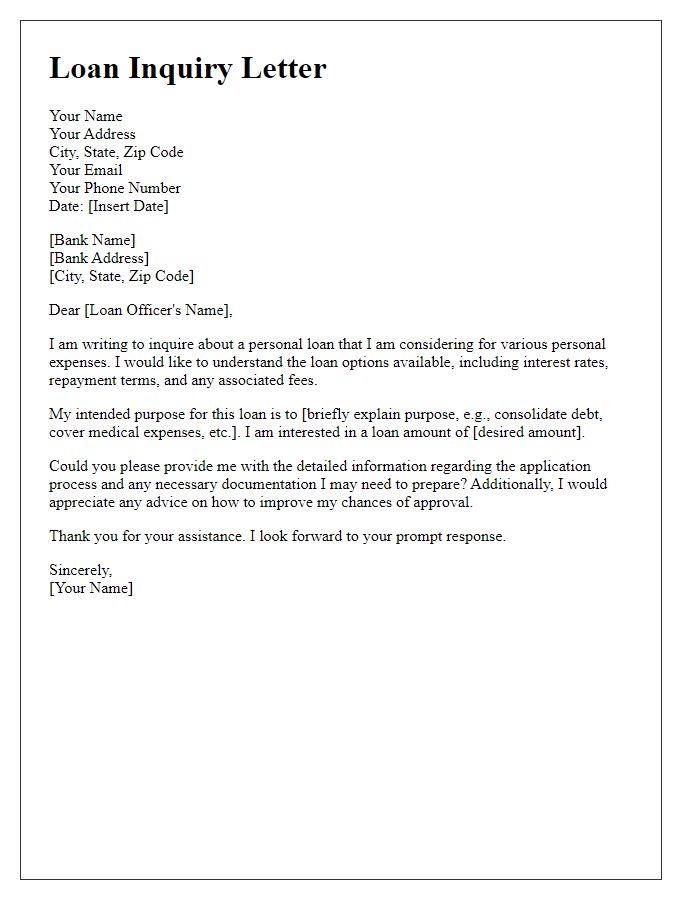

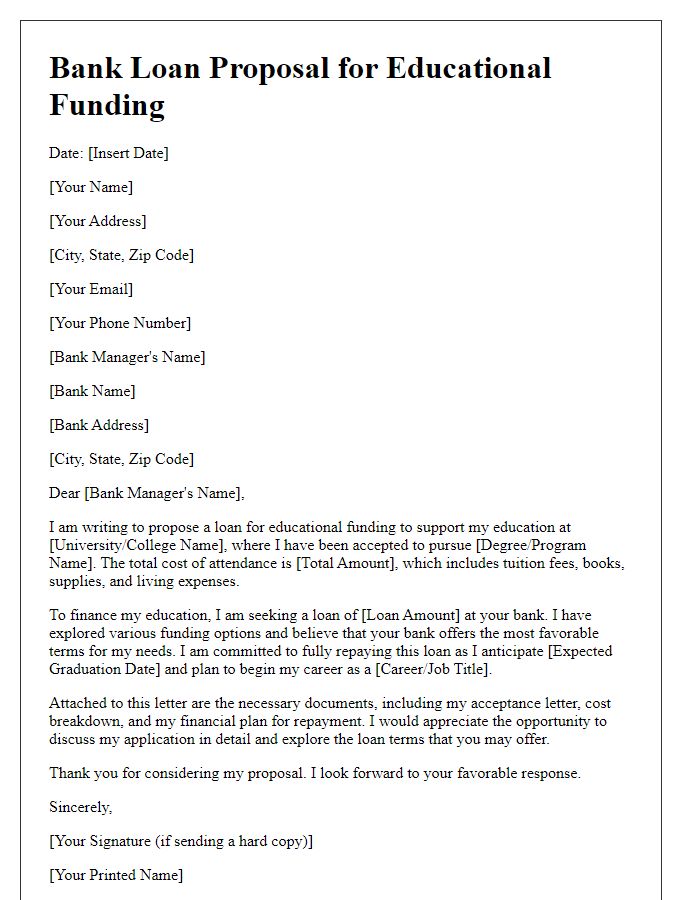

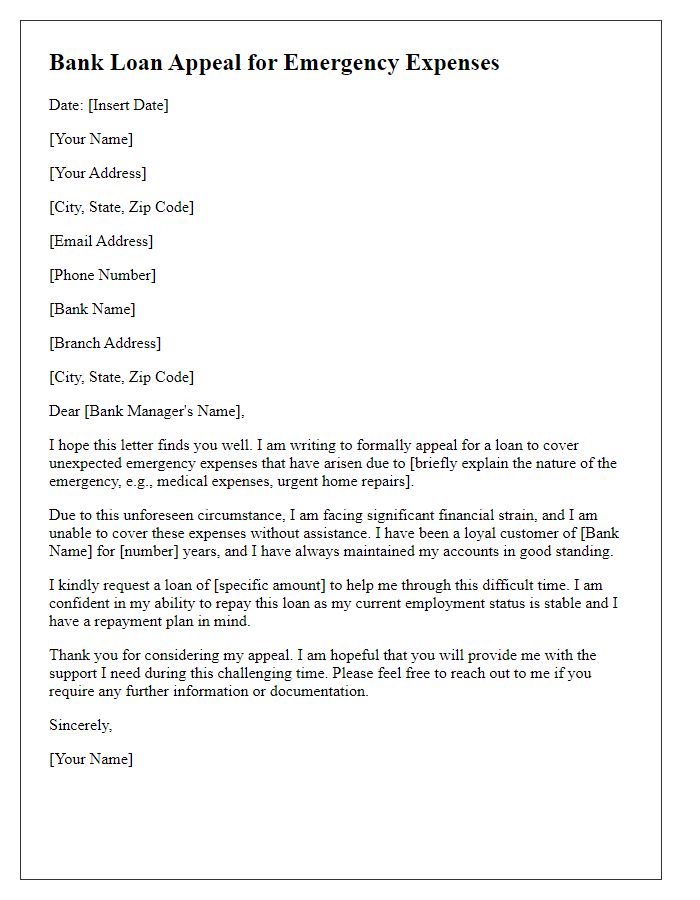

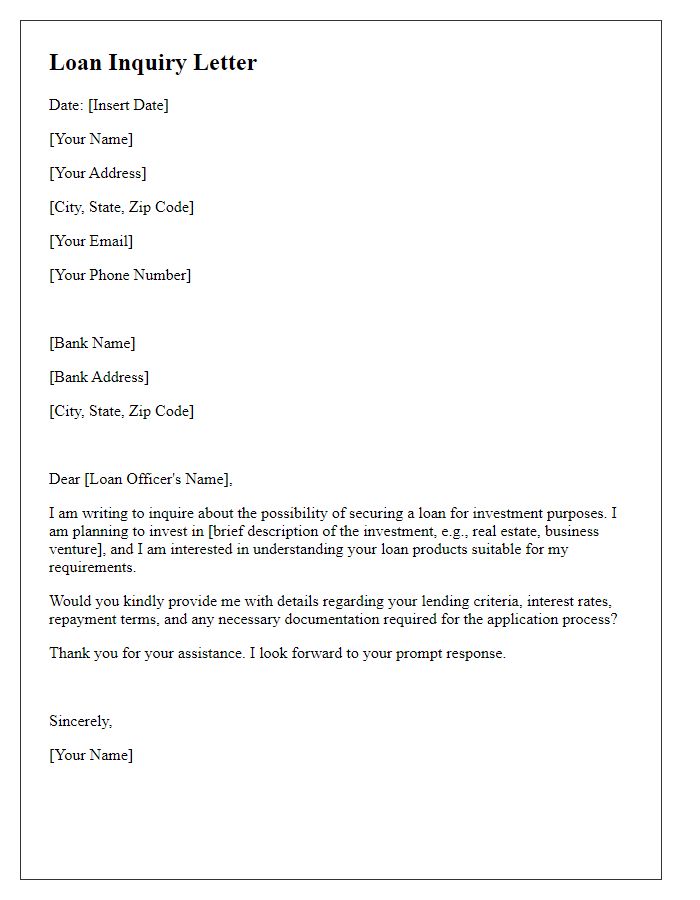

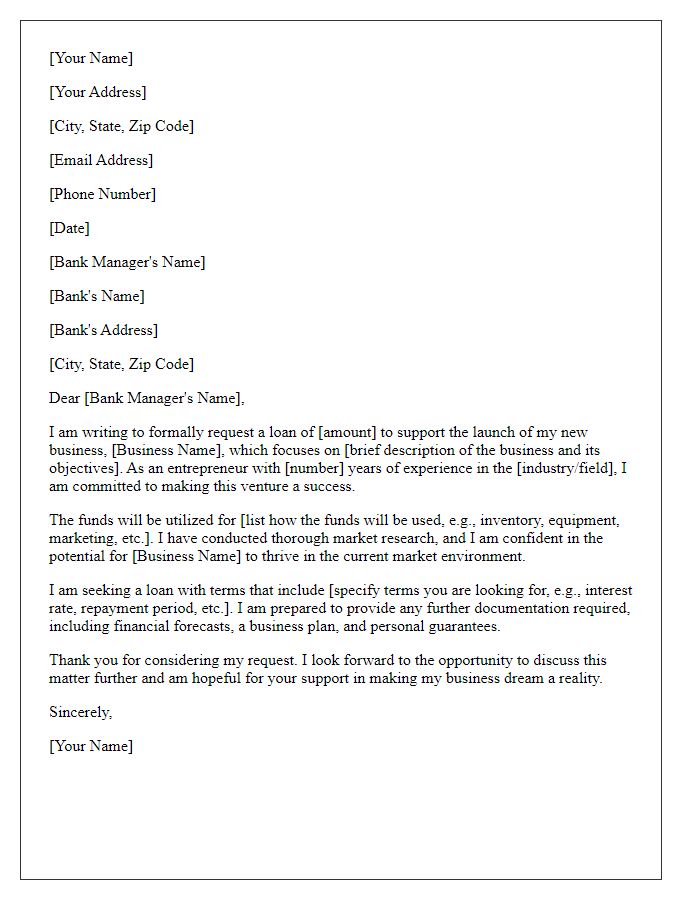

Loan Purpose

A bank loan for educational purposes can significantly alleviate financial burdens for students pursuing higher education at institutions such as Harvard University or Stanford University. Many students seek funding between $5,000 to $50,000 to cover tuition fees, textbooks, and living expenses associated with attending these esteemed universities. Federal loans, private student loans, and scholarships are common options, providing flexibility in repayment terms, often spanning 10 to 30 years, depending on the lender. Additionally, interest rates for student loans can range from 3% to 12%, impacting the total cost of borrowing. Proper documentation, including proof of enrollment and income statements, is essential to secure favorable loan conditions and support responsible financial planning.

Financial Overview

A comprehensive financial overview is essential when requesting a bank loan, as it provides key insights into an individual's or business's financial health. This overview should include a detailed breakdown of income, including salaries, rental income, and investment returns, totaling monthly earnings that inform loan repayment capabilities. An overview of expenses is equally crucial, highlighting monthly obligations such as mortgage payments, utility bills, and operational costs, which can sum up to significant amounts depending on lifestyle or business operations. Additionally, assets, such as real estate valued at specific market prices and savings accounts with clear balance figures, should be clearly detailed, along with liabilities like credit card debts or existing loans that provide a net worth perspective. Including recent bank statements and tax returns can further substantiate the financial position and lend credibility to the loan request.

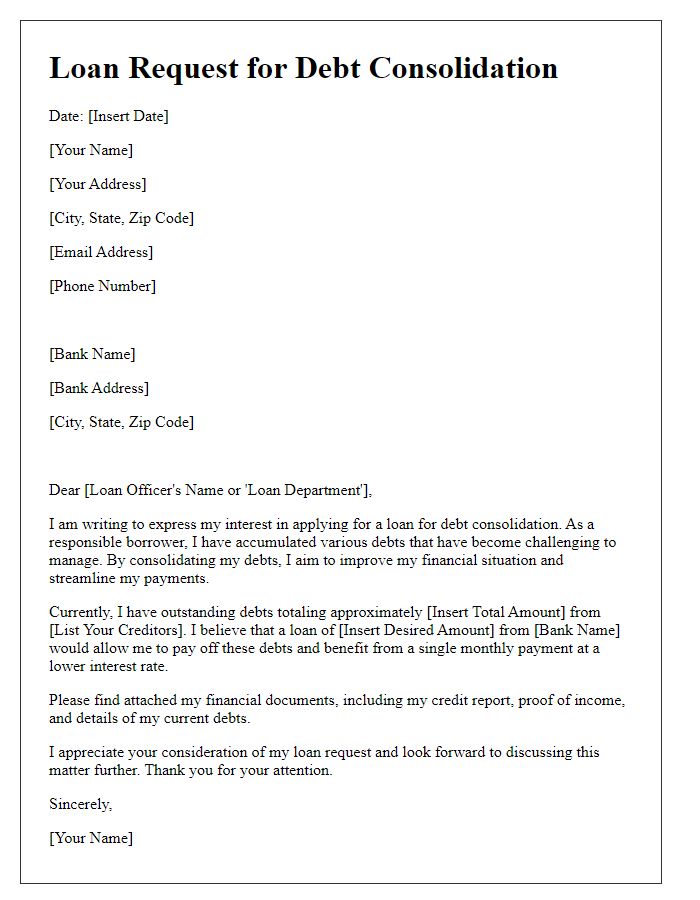

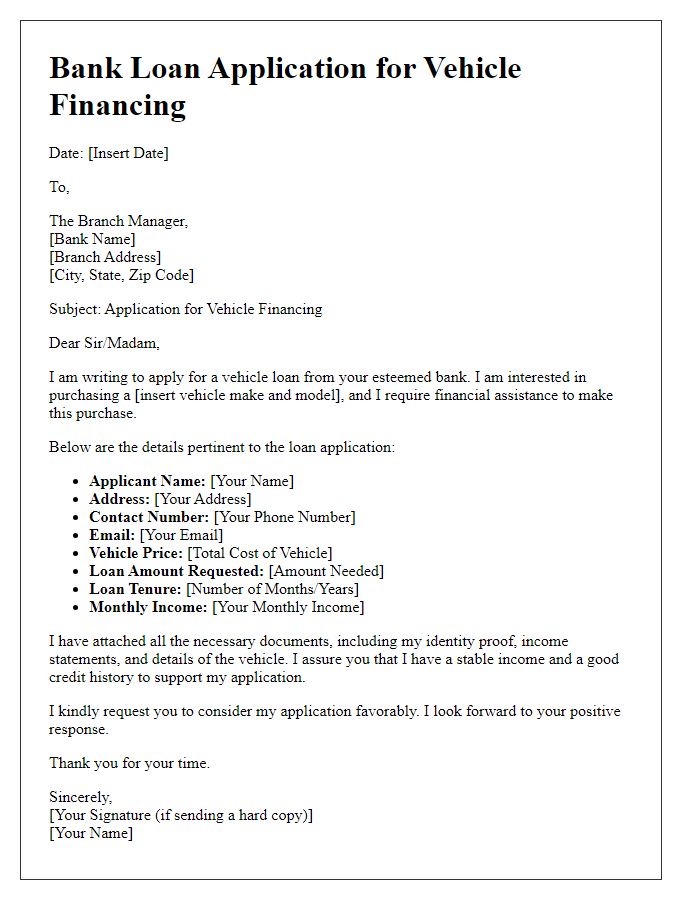

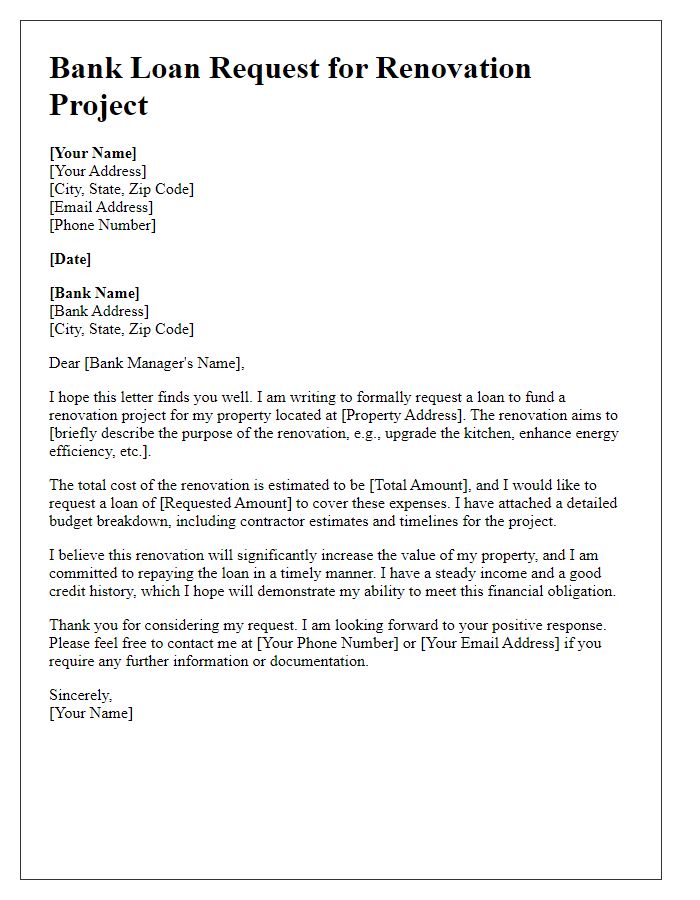

Loan Amount and Terms

Individuals seeking a personal loan from a financial institution often specify details such as loan amount and terms. A requested loan amount, for instance, could range from $5,000 to $50,000, depending on personal financial needs. Loan terms commonly span from one to five years, impacting monthly repayment amounts. Interest rates may vary dramatically, averaging between 5% to 20%, influenced by market conditions and individual credit scores. Additionally, borrowers usually provide details on intended use for the funds, such as home renovations, education expenses, or debt consolidation, ensuring alignment with the bank's lending policies and requirements.

Supporting Documentation

Requesting a bank loan requires a clear presentation of supporting documentation to ensure a smooth application process. Essential documents include a completed application form, which provides personal and financial details. Financial statements such as bank statements (typically the last three to six months) showcase your financial activity. Your credit report, often accessed from agencies like Equifax or Experian, indicates your creditworthiness. Additionally, proof of income, like pay stubs (usually from the last two months) or tax returns (for the last two years), establishes your ability to repay the loan. Business plans accompanied by projections, if applying for a business loan, can lend credibility to your request. Property appraisals might be needed for secured loans, confirming the value of collateral. Lastly, identification documents, like a government-issued ID or Social Security number, are required for identity verification.

Comments