Are you ready to secure your peace of mind for another year? Renewing your insurance policy is a vital step in safeguarding your assets and ensuring your loved ones are protected. In this article, we'll guide you through the essential components of a renewal letter, so you can confidently communicate your intentions to your insurance provider. Keep reading to discover expert tips and a handy template for your next renewal!

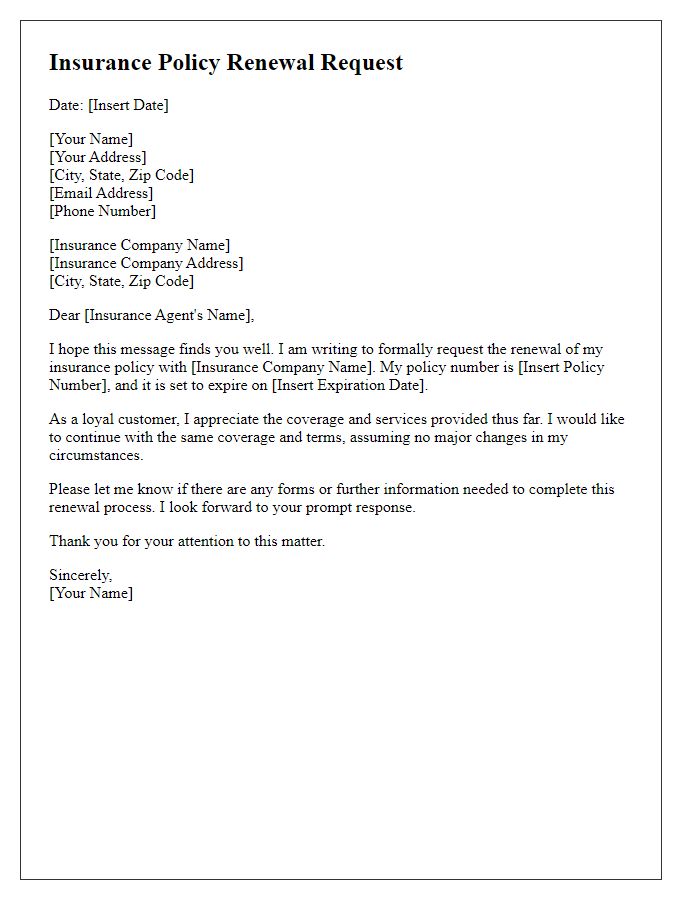

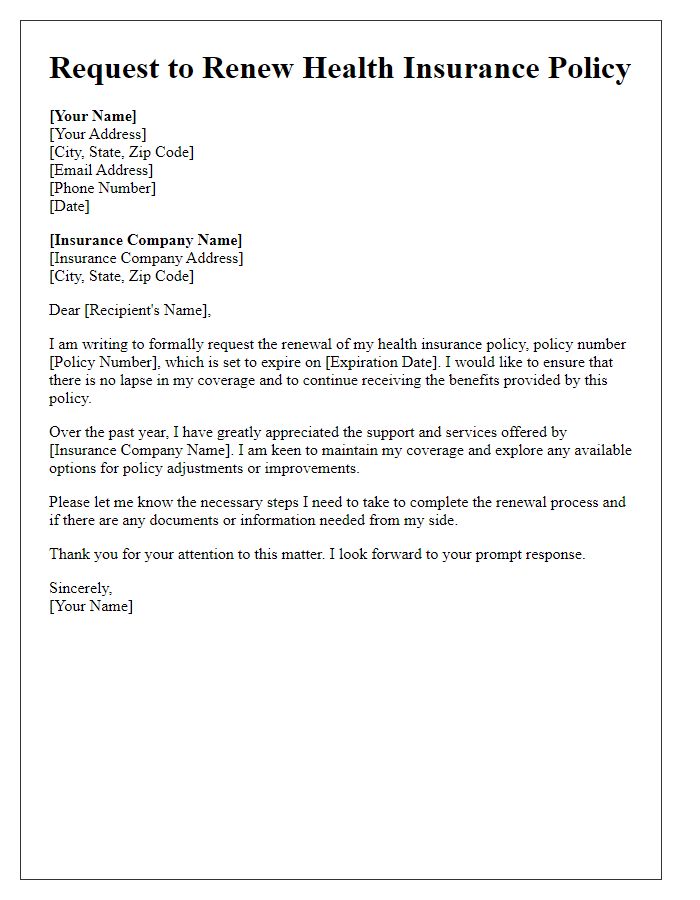

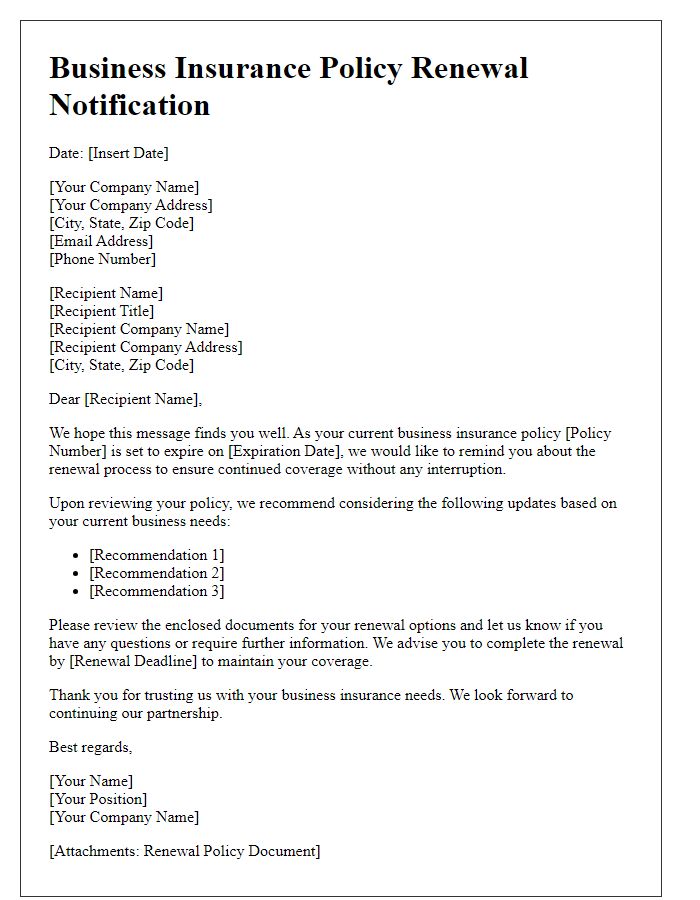

Policyholder Information

Policyholder information consists of essential details that ensure effective communication with the insurance provider. Key elements include the policyholder's full name, such as John Smith, mailing address (e.g., 123 Elm Street, Springfield, IL), phone number (like (555) 123-4567), and email address (for instance, john.smith@email.com). Additionally, the insurance policy number, such as ABC123456, plays a critical role in identifying the specific insurance coverage. The effective date of the current policy, for example, January 1, 2023, along with the renewal due date (like December 31, 2023), are vital for managing policy renewals. Finally, any changes in the policyholder's circumstances, such as marital status, income level, or changes in property value, can impact the renewal process and premium adjustments.

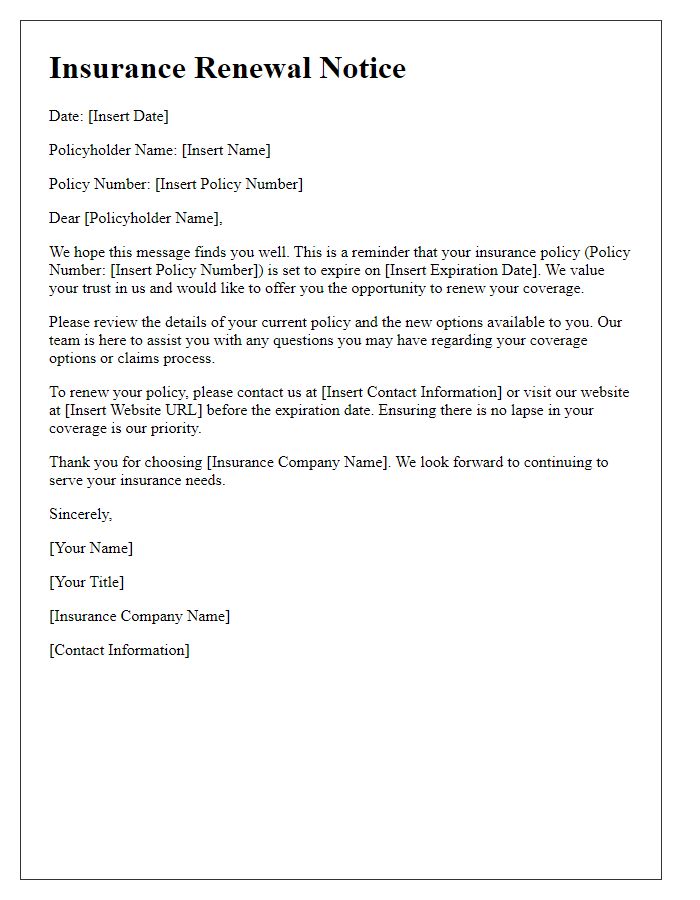

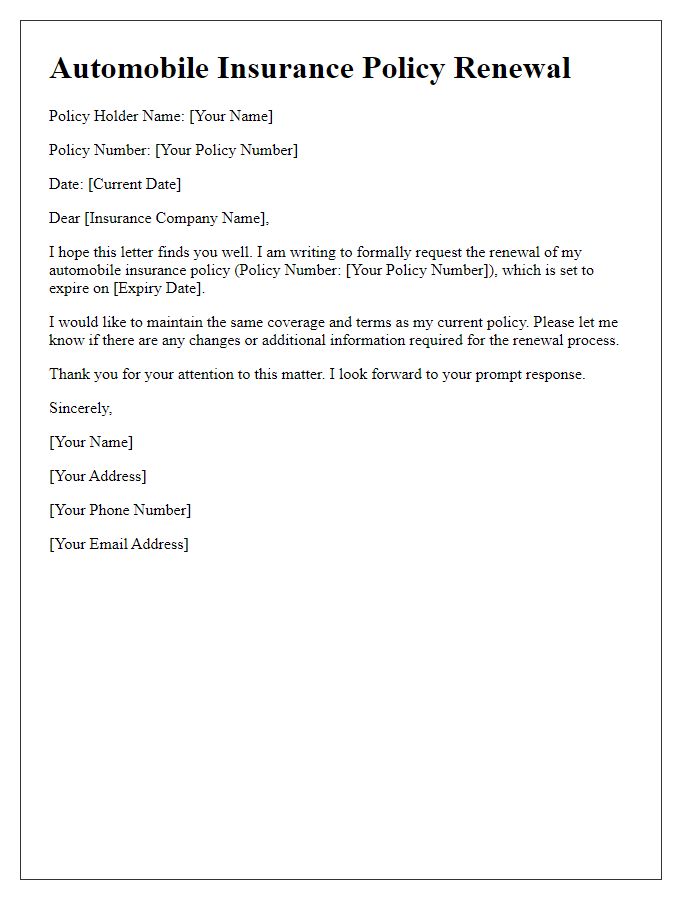

Policy Number and Details

Renewing an insurance policy is a crucial step to maintaining coverage and ensuring financial protection. Policy number XYZ123456 represents auto insurance issued by BrightShield Insurance Agency, effective from January 1, 2022, to December 31, 2022. Policyholder John Doe has consistently made premium payments, totaling $1,200 annually, to secure coverage for his 2020 Honda Accord. A timely renewal before expiration will ensure uninterrupted coverage for liability, collision, and comprehensive protections. Additionally, it's essential to review any changes in premiums or coverage terms for the upcoming year, especially considering adjustments that may arise due to inflation or new regulations.

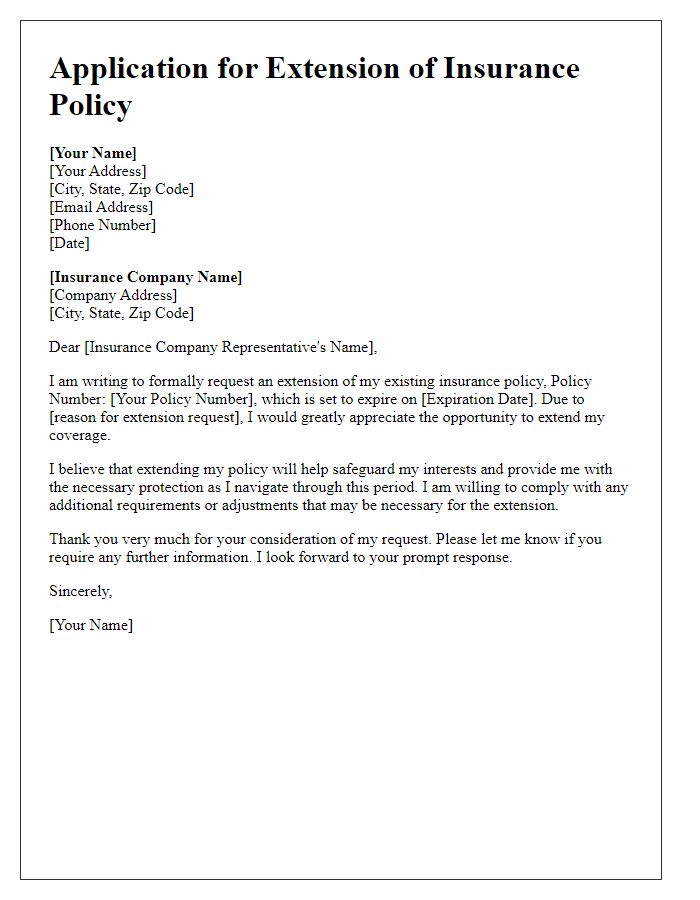

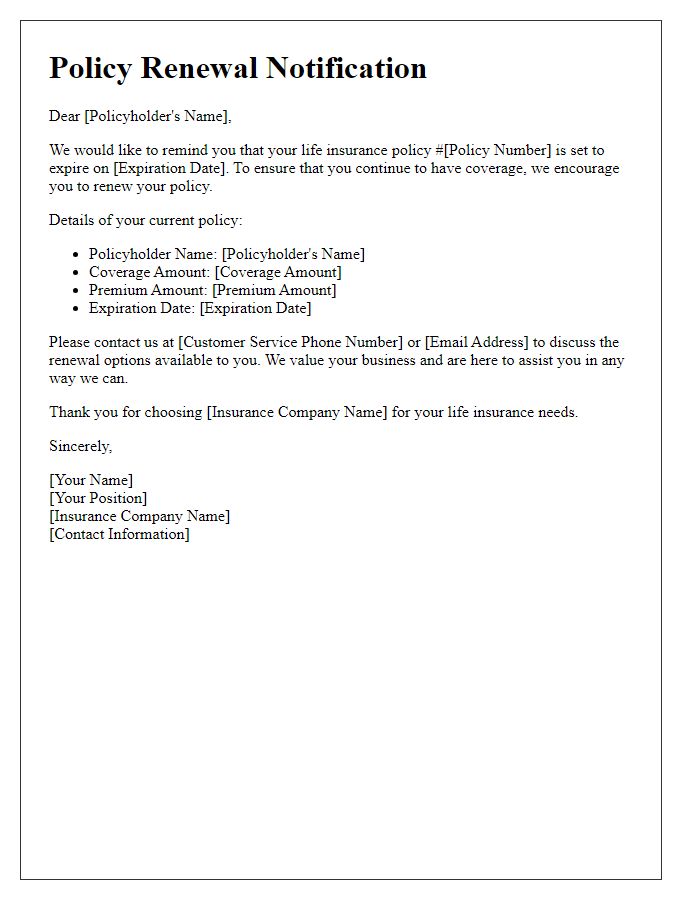

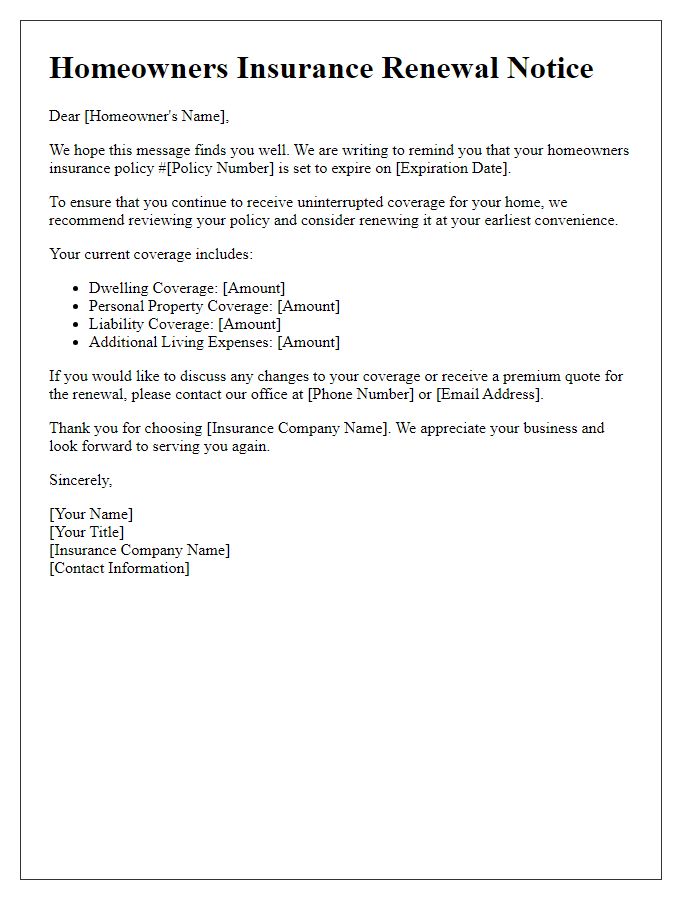

Renewal Terms and Conditions

Renewing an insurance policy involves understanding specific terms and conditions that dictate the coverage, duration, and regulations of the agreement. Typically, policyholders may encounter stipulations regarding premium adjustments based on previous claims (up to a 25% increase in some cases), coverage limits, deductibles, and eligibility for discounts on multi-policy plans. The renewal period often spans a year, requiring timely review (usually 30 days before expiration) to avoid a lapse in coverage. Additionally, policyholders should be aware of any changes in state regulations, which might impact the coverage specifics, such as minimum liability requirements in jurisdictions like California or Texas. Failure to adhere to renewal conditions could lead to cancellation or modified coverage terms.

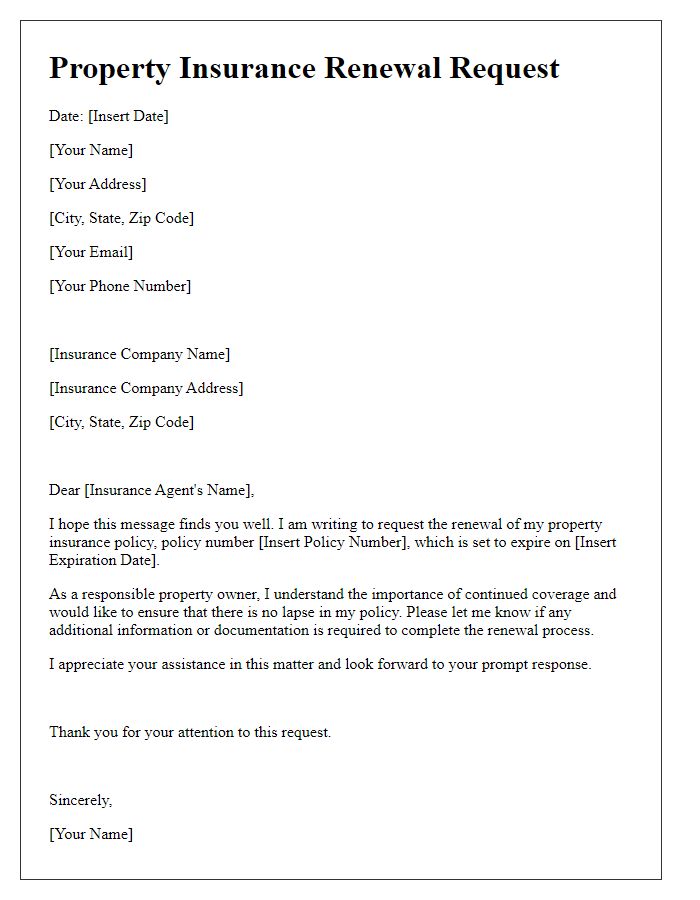

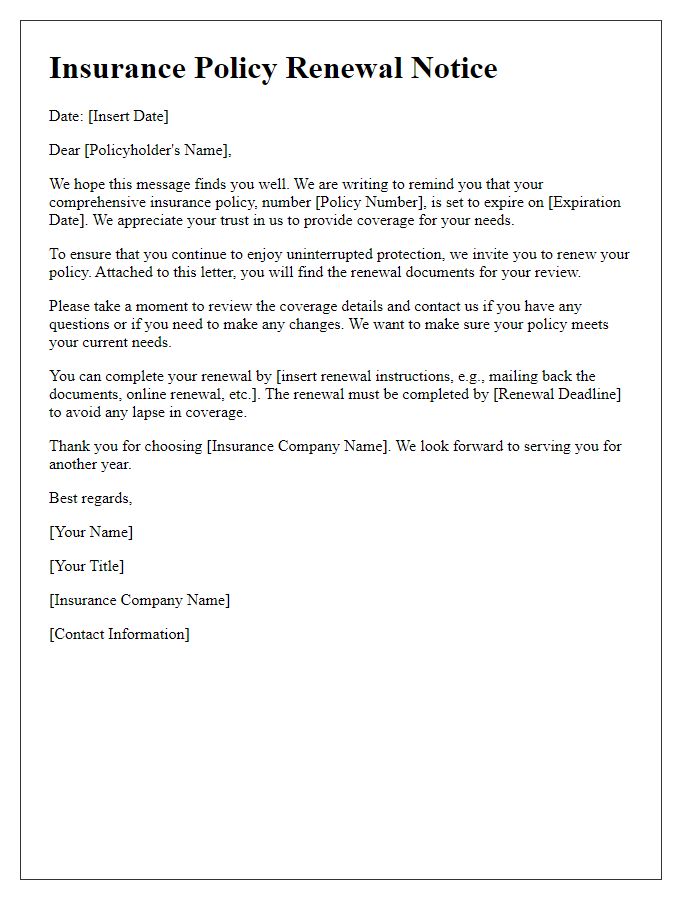

Payment Instructions and Deadlines

Renewal of insurance policies requires careful attention to payment instructions and deadlines to ensure uninterrupted coverage. Insurance policies, such as health or auto insurance, typically have specific renewal dates that may occur annually or semi-annually. Each insurance provider, like Allstate or State Farm, may issue a renewal notice, detailing the amount due, payment methods accepted (credit card, bank transfer, online portal), and the deadline for payment, often 30 days prior to the expiration date. Late payments can result in penalties or lapses in coverage, emphasizing the importance of timely action. Policyholders should also verify that their contact information is up-to-date to receive notifications and should consider utilizing automatic payment options to streamline the renewal process and avoid missing critical deadlines.

Benefits and Coverage Highlights

Renewing an insurance policy is essential for maintaining coverage and financial security. Policyholders benefit from various options, including health, home, and auto insurance, which provide varying degrees of protection. For instance, comprehensive coverage in auto insurance often includes protection against theft, vandalism, and natural disasters, ensuring vehicles remain safe against unforeseen events. Health insurance often covers regular check-ups, hospital stays, and prescription medications, ensuring individuals have access to necessary healthcare services without prohibitive out-of-pocket costs. Home insurance typically protects against property damage from incidents like fires or burglaries, often covering the structure and personal belongings. Each of these policies includes specific coverage limits, deductibles, and premiums, highlighting the importance of understanding the details prior to renewal to ensure adequate protection against risks. Additionally, loyalty benefits or discounts may be available for long-term policyholders, providing added incentives to renew.

Comments