Life can sometimes throw us curveballs, and we all know that unexpected circumstances can lead to financial hiccups. If you find yourself in a situation where a late payment is unavoidable, crafting a thoughtful letter to your creditor can help maintain your relationship and open the door for understanding. In this article, we'll guide you through the essential elements of a late payment explanation letter, ensuring you convey sincerity and responsibility. Ready to learn how to communicate effectively with your creditor? Let's dive in!

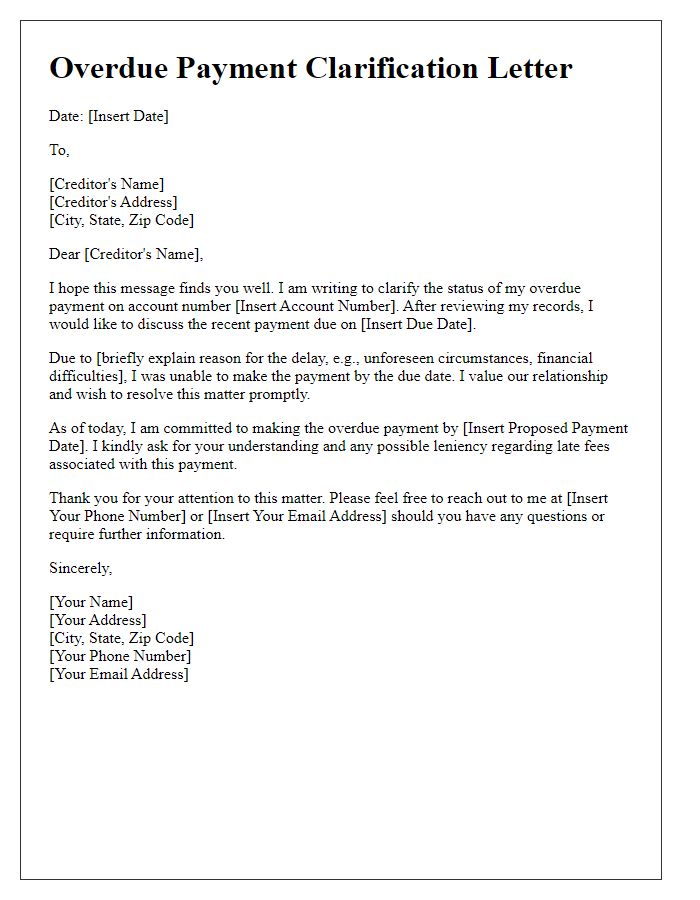

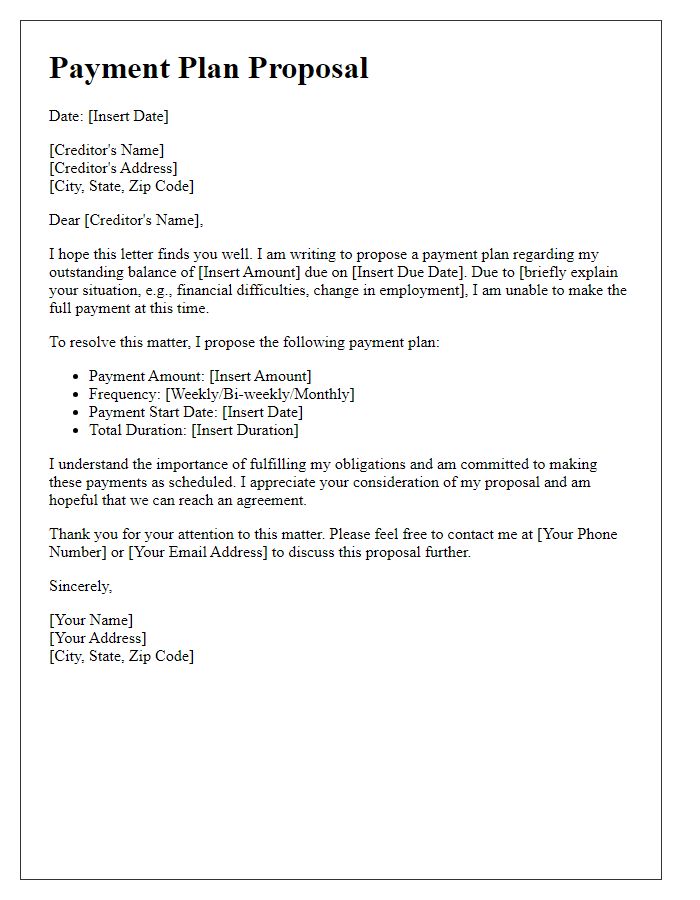

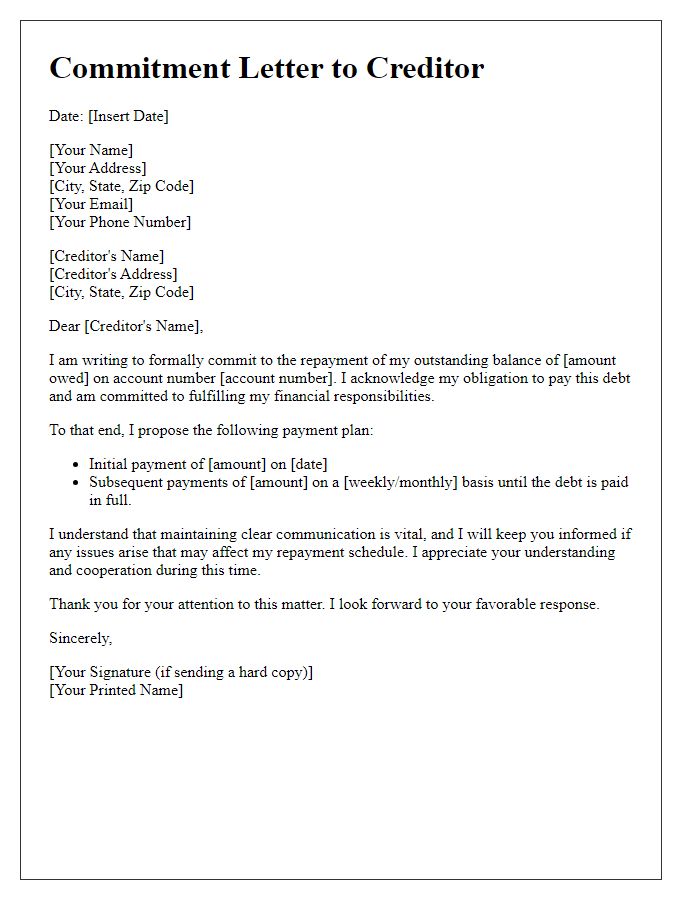

Clear Acknowledgment of Delay

Late payments can create significant challenges for both creditors and debtors. Acknowledgment of the delay demonstrates responsibility and can help maintain a positive relationship. Timely communication is crucial, especially when late payments occur in high-stakes financial environments, such as mortgages or credit cards. The creditor, often a financial institution or service provider, may impose late fees, adjust interest rates, or alter credit scores due to missed payments. Clear documentation, including dates and amounts due, provides a transparent overview of the situation. This proactive approach can lead to more favorable terms or leniency from the creditor, thus preserving the debtor's financial standing.

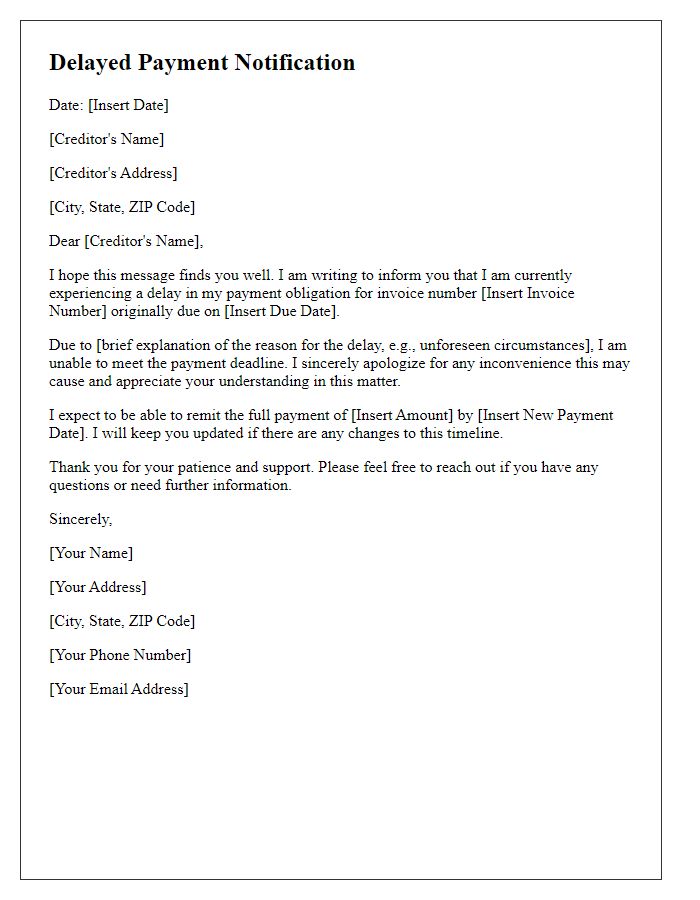

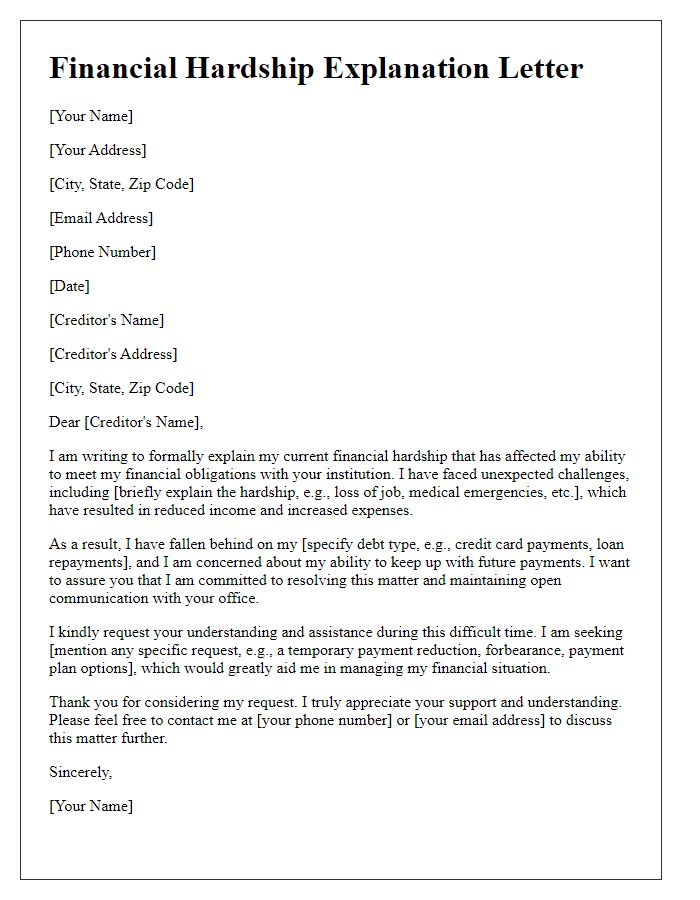

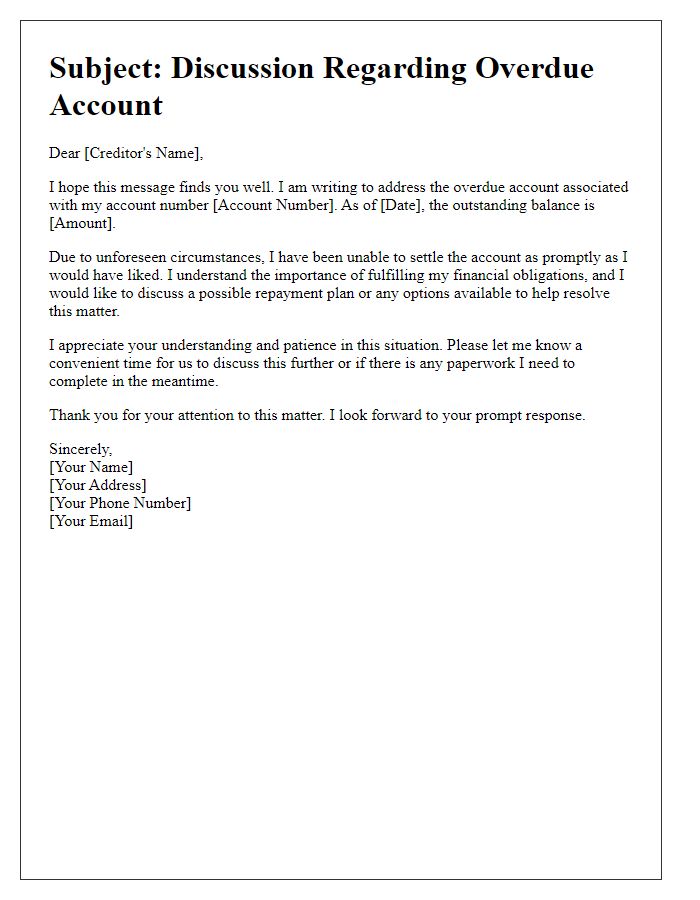

Explanation of Circumstances

Financial difficulties can arise from unexpected events, impacting timely payments to creditors. For example, medical emergencies (such as hospital stays costing thousands of dollars) can deplete savings and disrupt budget plans. Job loss or reduced working hours, which may occur during economic downturns or company layoffs, can further exacerbate cash flow issues. Additionally, unforeseen expenses, such as major car repairs (averaging around $500) or home maintenance, can divert funds originally allocated for bills. Communicating openly with creditors about these challenges often proves essential for negotiating new payment terms or grace periods, fostering a cooperative approach to managing financial obligations.

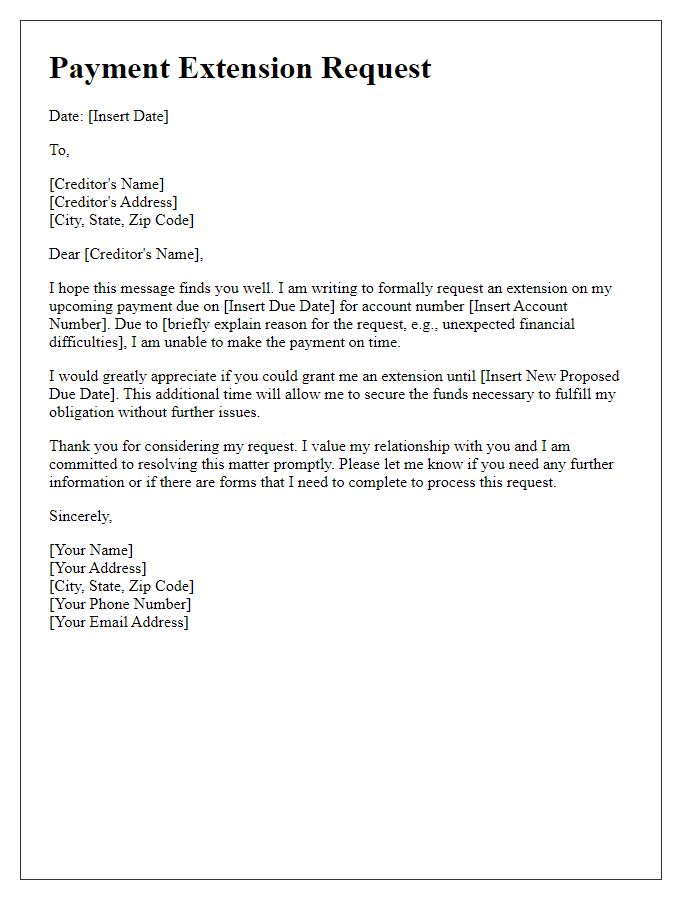

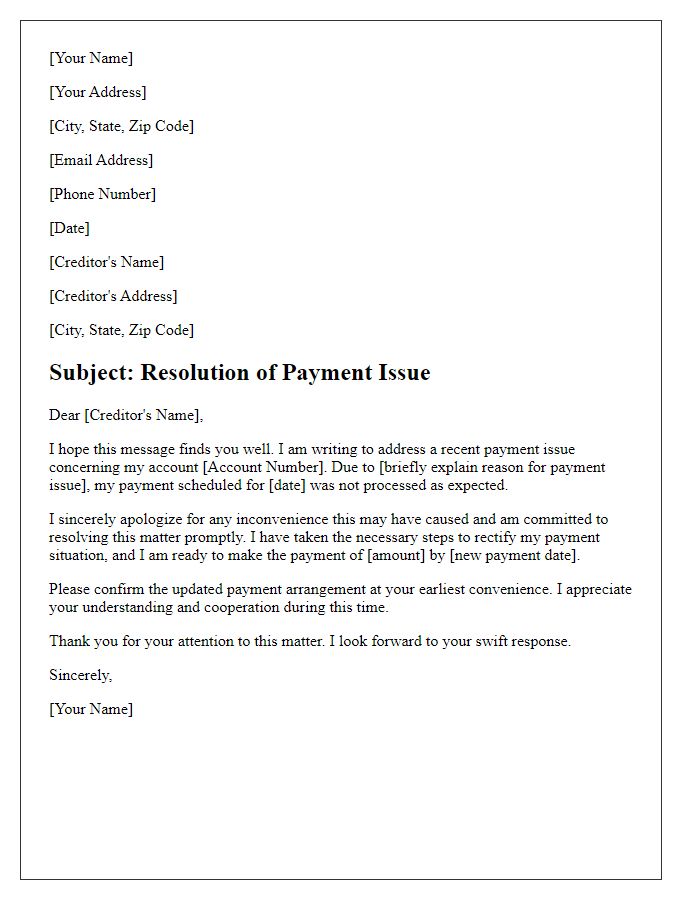

Assurance of Payment

A late payment can cause disruptions in financial agreements, impacting both personal credit scores and the operational capabilities of businesses. The borrower may face late fees, which can range from $25 to $50, depending on the terms specified in the loan or credit agreement. Clear communication with the creditor is essential to maintain a positive relationship and negotiate potential arrangements. Assurance of payment in full, detailing the payment timeline, can mitigate financial penalties and demonstrate responsible borrowing behavior. Establishing a goodwill gesture, such as making a partial payment, may also be beneficial in restoring the creditor's confidence.

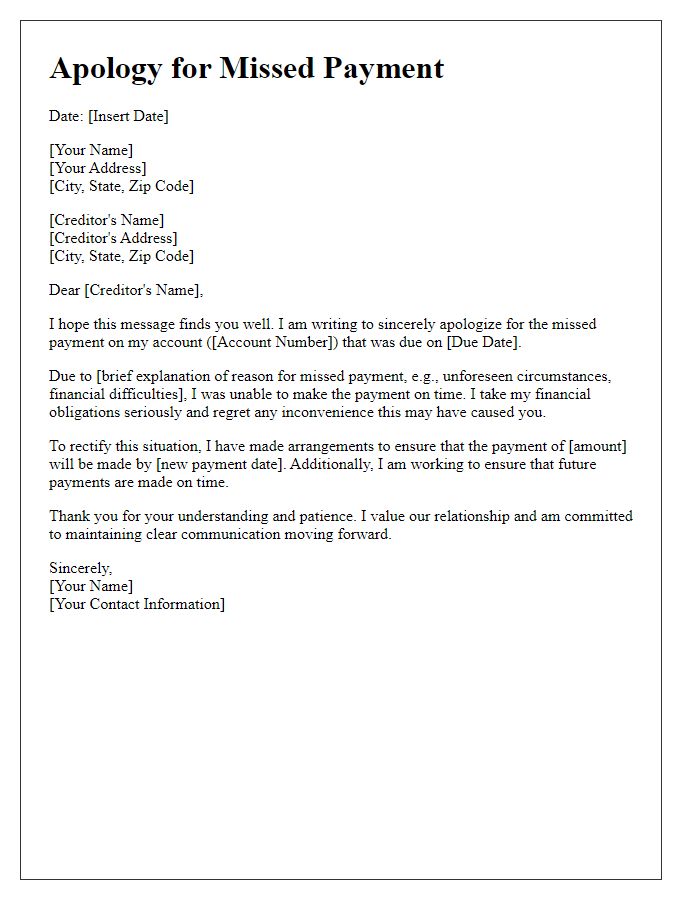

Request for Understanding or Leniency

Apologies for the delay in payment caused by unexpected financial difficulties due to unforeseen circumstances. Recent medical expenses, amounting to over $2,000, have strained my resources. Additionally, my primary source of income has decreased due to a job loss during the recent economic downturn affecting many sectors. I am committed to honoring my debt obligations and sincerely ask for your understanding during this challenging time. My intention is to resume regular payments as soon as possible, possibly by the end of the month. Your consideration in this matter would be greatly appreciated, and I hope to maintain our positive relationship moving forward.

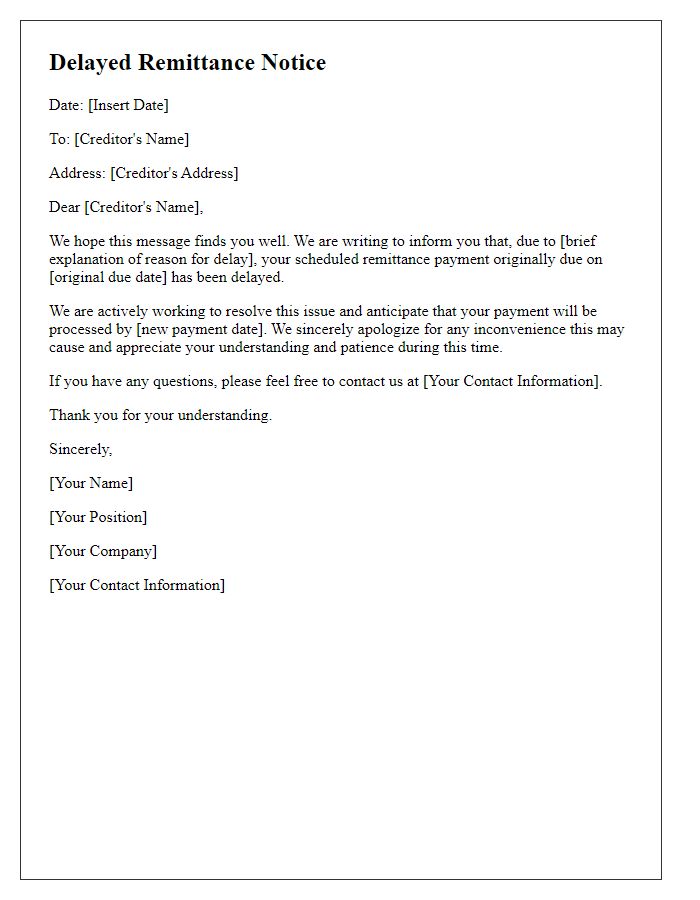

Contact Information for Further Discussion

Contact information is crucial for maintaining clear communication with creditors during late payment situations. Providing a full name, such as John Smith, alongside a professional title, like Account Manager, lends credibility. Including a direct phone number, for instance, (555) 123-4567, allows for immediate discussion. An email address, like john.smith@email.com, serves as an efficient communication tool. A proper mailing address, perhaps 123 Business Lane, Suite 100, City, State, ZIP Code, ensures any formal correspondence reaches its destination. Clarity in communication can enhance relationships and facilitate solutions.

Comments