Are you scratching your head over the complexities of tax policies? You're not alone! Navigating tax regulations can feel overwhelming, but understanding them is crucial for making informed decisions. Join us as we unravel the intricacies of tax policy clarification and equip yourself with the knowledge needed for effective financial planningâread on to learn more!

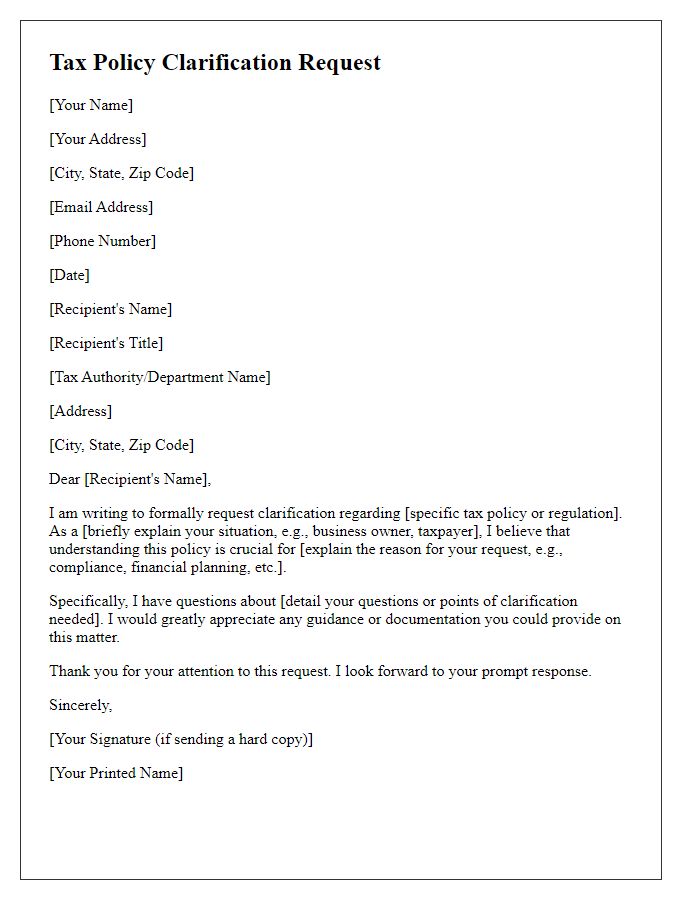

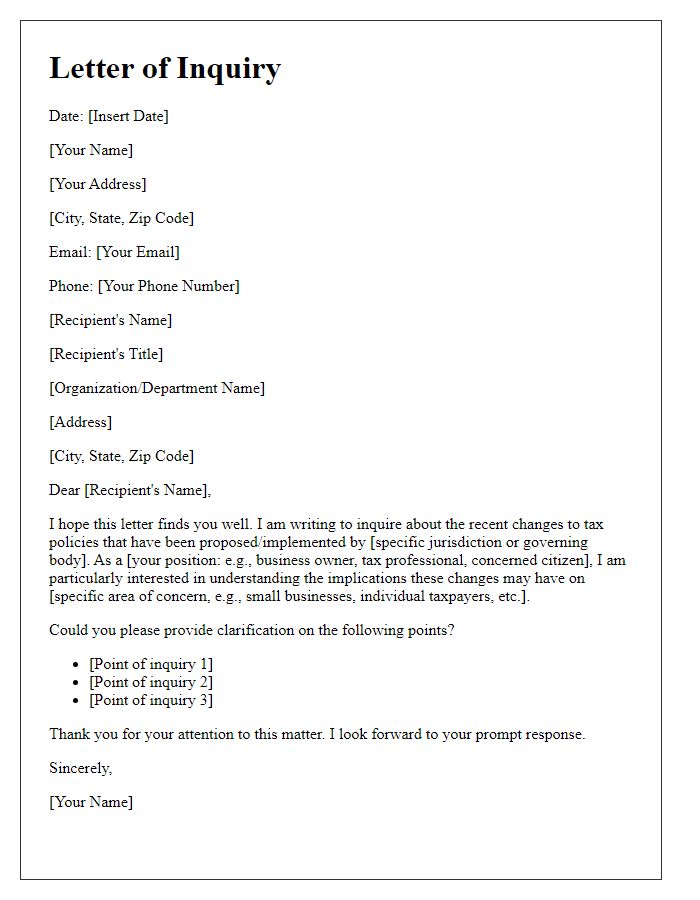

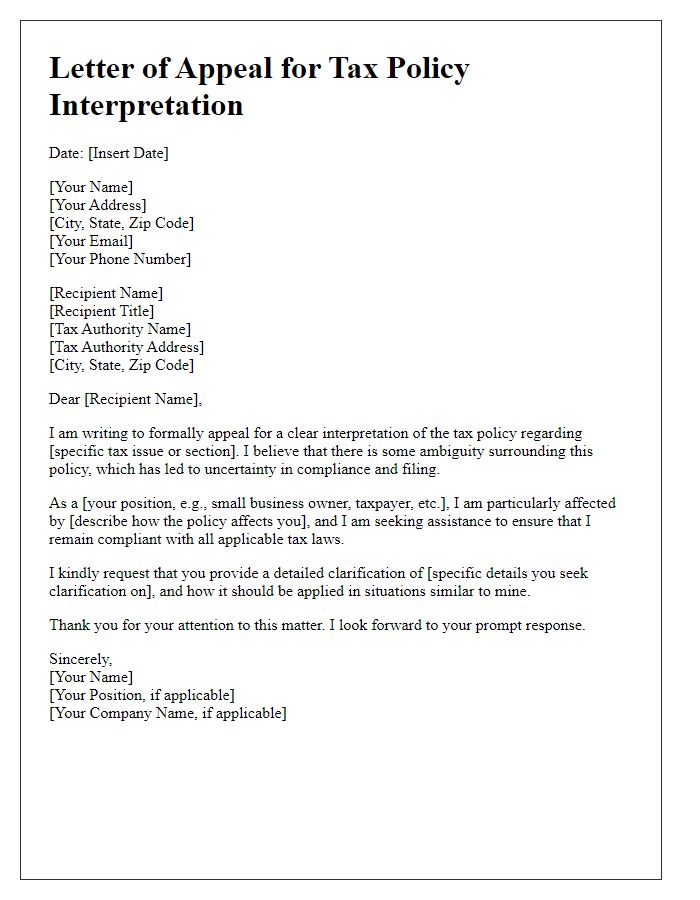

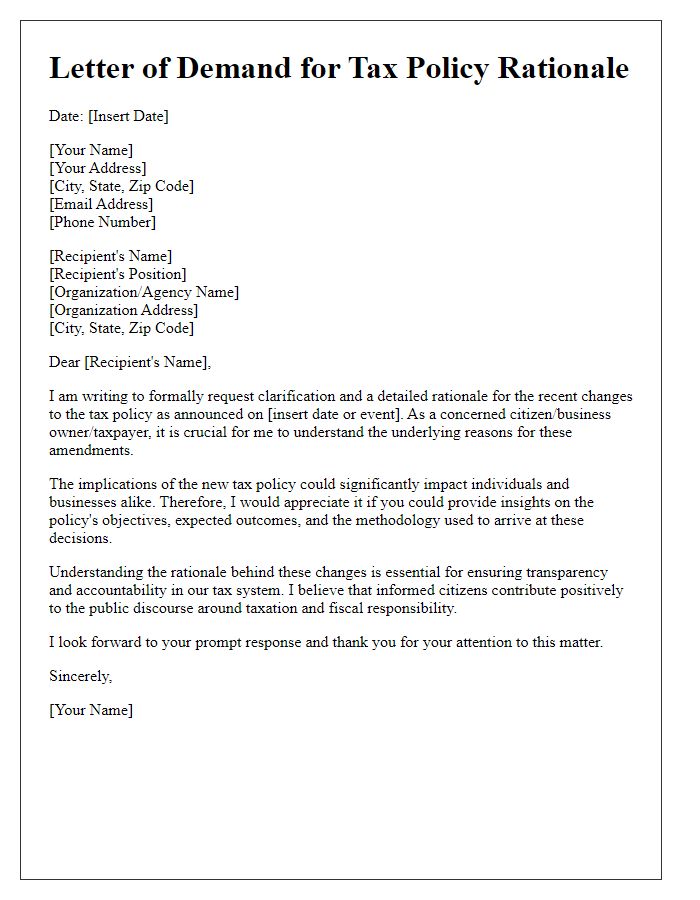

Clear Subject Line

The implementation of new tax policies often leads to various interpretations and uncertainties among taxpayers, businesses, and financial institutions seeking clarity on their obligations. In recent discussions, several stakeholders have identified specific aspects of the tax code, particularly those relating to capital gains tax, corporate tax rates, and tax credits for renewable energy investments. These components play a critical role in financial planning and resource allocation for entities across various sectors. The need for explicit guidelines and clarifications from the Treasury Department regarding changes in tax rates and eligibility criteria for deductions has become increasingly urgent to ensure compliance and financial stability. Furthermore, regular updates and transparent communication could significantly minimize confusion and enhance fiscal responsibility.

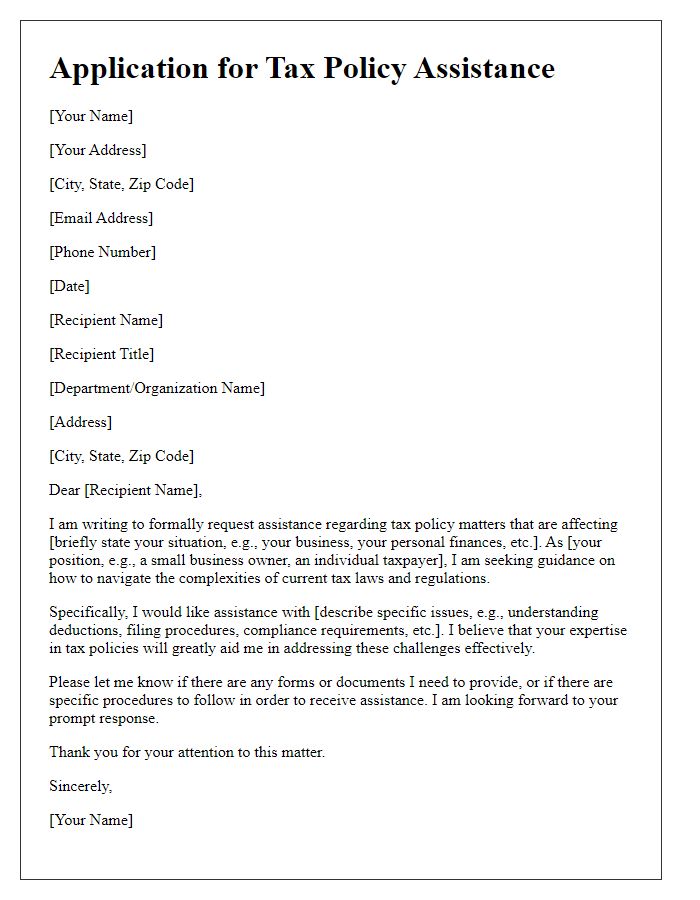

Formal Salutation

Tax policy regulations in the United States, especially the Internal Revenue Code, can often be intricate and challenging to interpret. Specific provisions, such as Section 401(k) plans, offer tax-deferred retirement savings options for American workers, allowing contributions up to $20,500 in 2022 for individuals under 50. These policies influence both individual financial planning and broader economic implications, impacting savings rates and retirement readiness among citizens. Accurate clarification of these policies is essential for compliance and to maximize available benefits while minimizing liabilities.

Brief Introduction

Tax policy clarifications play a critical role in maintaining compliance and understanding for both individuals and businesses. With frequent updates to legislation and changes in regulations, stakeholders often require guidance on specific tax codes, deductions, and obligations. For instance, the recent Tax Cuts and Jobs Act (TCJA) has brought significant alterations to the tax landscape, impacting deductions for mortgage interest and state tax credits. Furthermore, knowledge about IRS regulations, such as the filing requirements and deadlines for different tax brackets, can greatly influence financial decisions. Ensuring clarity in these areas is essential for effective financial planning and legal adherence.

Specific Questions/Concerns

Tax policy clarification often involves complex regulations, such as the Internal Revenue Code in the United States, which contains numerous provisions affecting individuals and businesses. Specific questions may arise regarding deductions, credits, or compliance timelines. Understanding how tax brackets, like the progressive system that ranges from 10% to 37%, impact net income is essential for accurate financial planning. Concerns may surround the recent changes in the tax law enacted during the 2021 American Rescue Plan, which introduced temporary measures affecting child tax credits and stimulus payments. Clarity on these intricate elements is crucial for effective tax strategy development and compliance with federal and state authorities.

Contact Information for Follow-up

Understanding tax policy clarification requires accurate contact information for efficient follow-up. Tax professionals often need direct contact details, including telephone numbers (preferably mobile for quicker response), email addresses (to maintain written communication), and physical addresses (for official correspondence). Providing a dedicated contact person within organizations can streamline inquiries, ensuring questions regarding tax codes, deadlines, exemptions, and compliance processes are promptly addressed. Establishing clear lines of communication aids in navigating complex tax regulations like the Internal Revenue Code (IRC) and enhances collaboration between taxpayers and tax authorities.

Comments