Are you feeling frustrated with your health insurance provider? You're not alone; many people face challenges when seeking fair treatment from their insurers. In this article, we'll explore effective strategies for resolving conflicts and ensuring you get the coverage you deserve. So, let's dive in and discover how you can take charge of your health insurance situation!

Personal and Policy Information

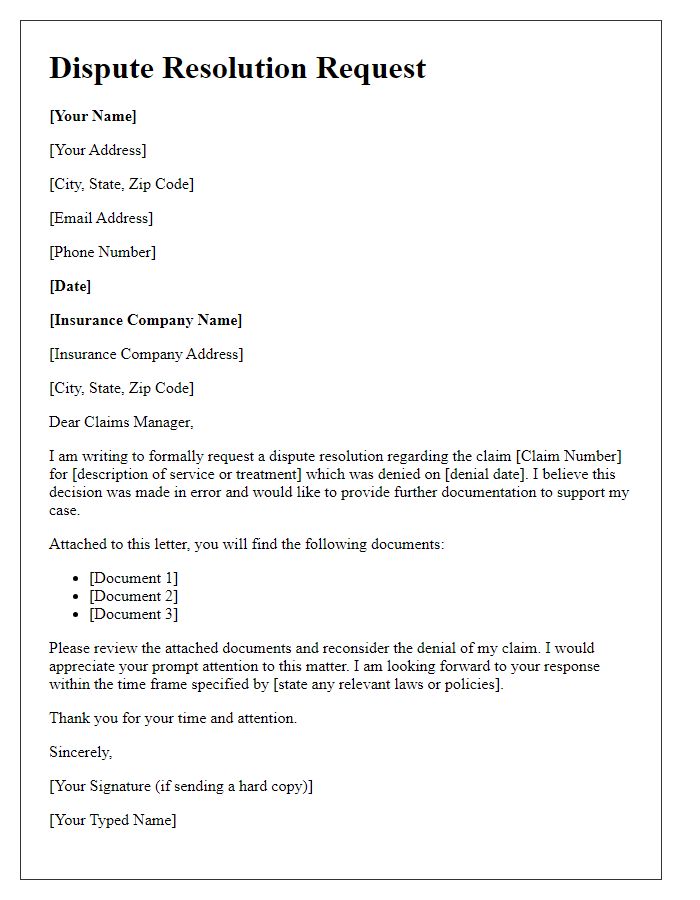

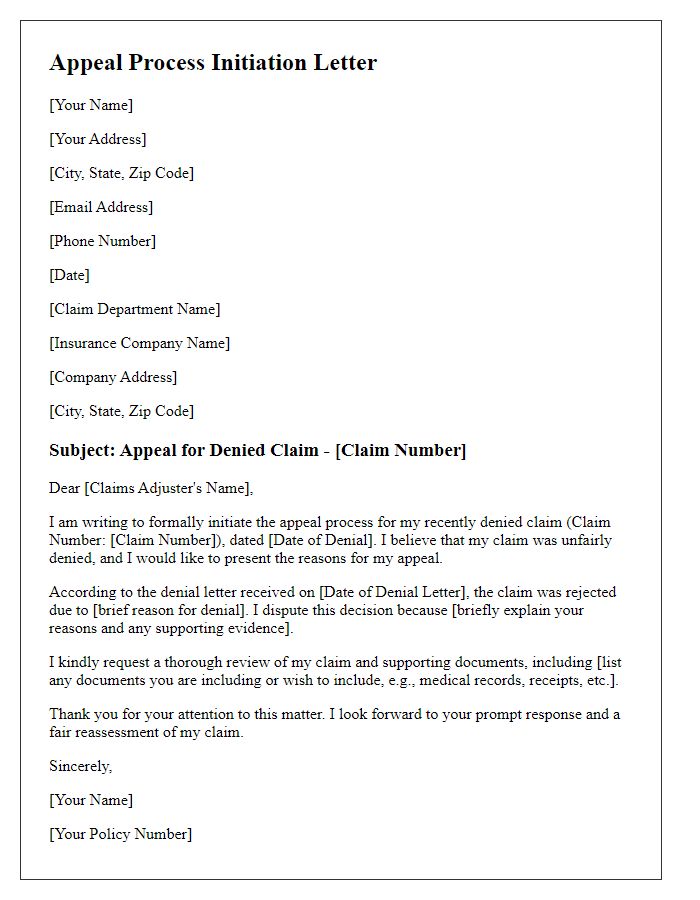

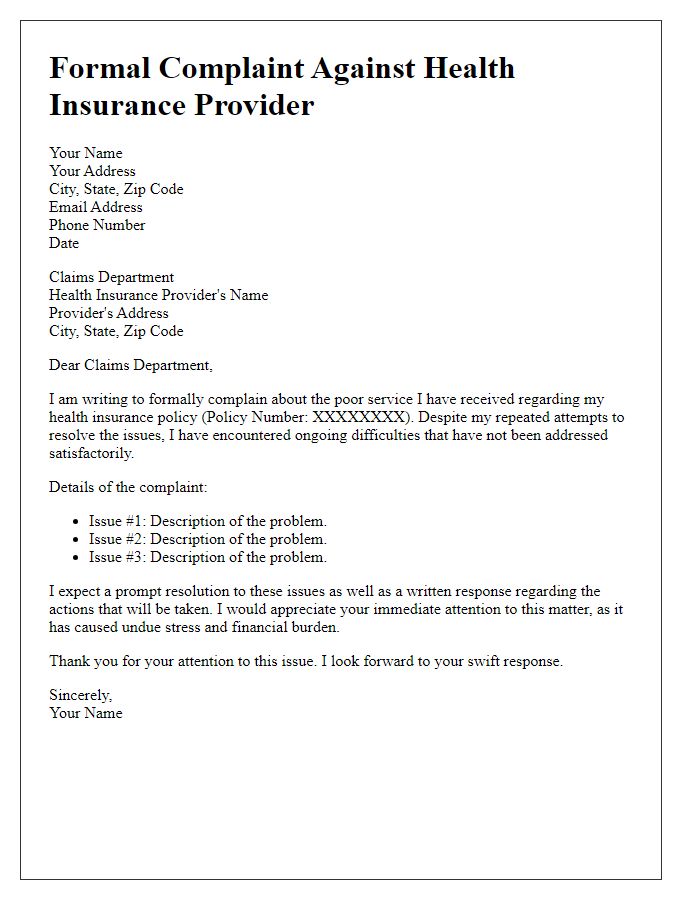

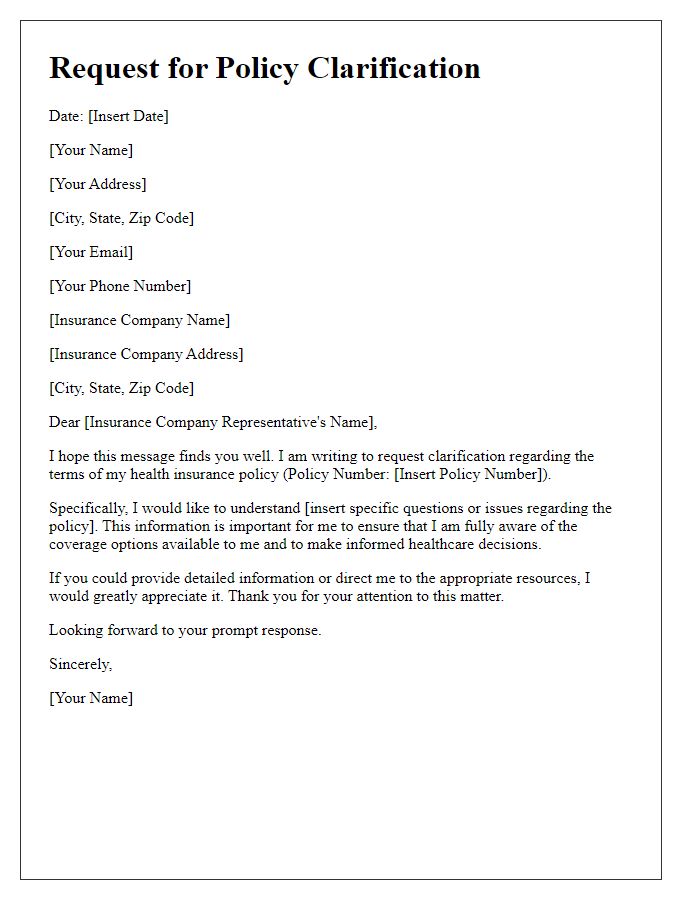

Effective conflict resolution with health insurance providers necessitates clear personal and policy information. Encompass your full name, date of birth, and policy number prominently at the top. Include the name of the insurance provider, along with their customer service contact number, ideally categorized by department, such as claims or member services. Specify your plan type, for instance, HMO (Health Maintenance Organization) or PPO (Preferred Provider Organization), to provide context about your coverage options. Include dates of any relevant medical service received, reference claim numbers, and describe the nature of the dispute succinctly, highlighting any attempts made to resolve the issue. Conclude with a request for a specific resolution, such as re-evaluation of a claim, preferably referencing any supporting documentation, such as medical bills or correspondence.

Clear Description of the Issue

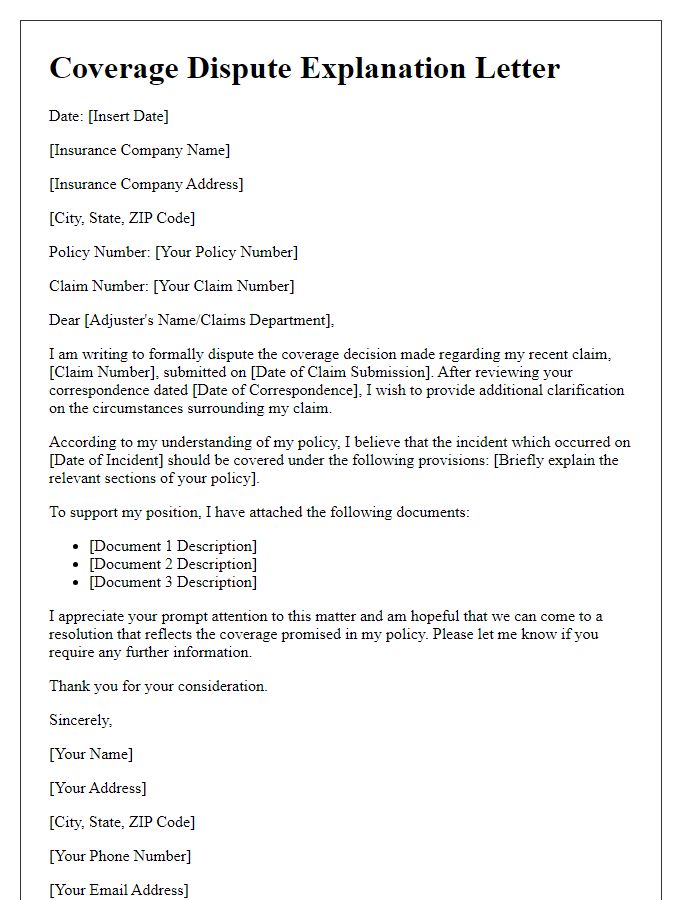

Navigating health insurance disputes can be challenging, particularly when unexpected claims arise. A common issue involves denied claims for necessary medical procedures, such as surgeries or diagnostic tests. For example, a recent claim denial for a critical MRI at St. John's Medical Center highlights discrepancies in coverage specifics versus policy explanations. The Health Insurance Provider's handbook states that prior authorization is required for imaging services, yet the guideline lacked clarity on required procedures or appropriate channels for obtaining such approvals. Additionally, time-sensitive situations, such as emergencies treated at local facilities, further complicate claim processing, as insurers often require retrospective reviews that can delay reimbursements.

Relevant Documentation and Evidence

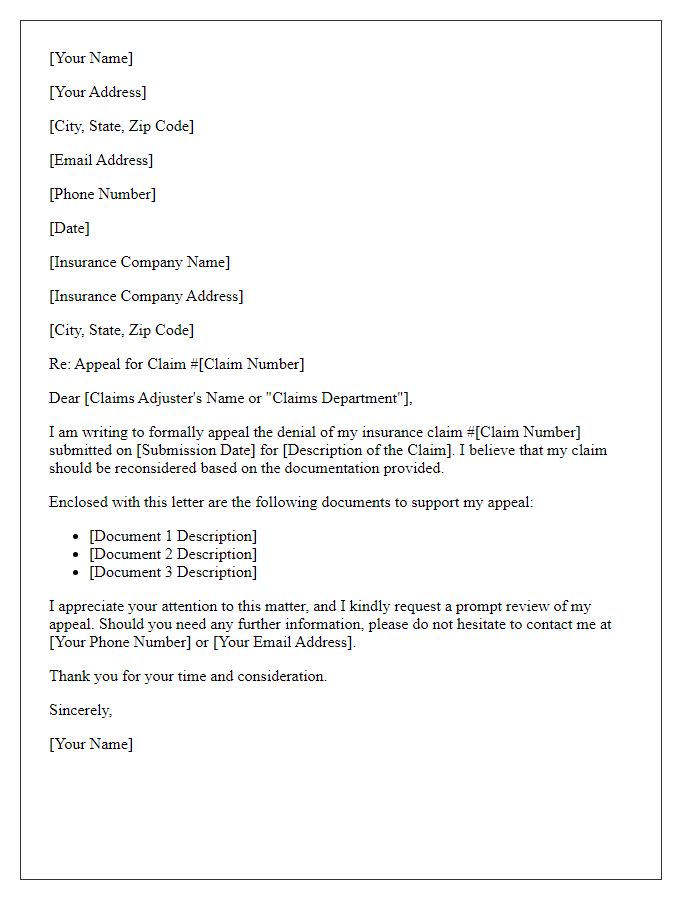

Resolving conflicts with health insurance providers often requires relevant documentation and evidence to support claims. Essential documents include policy agreements, which outline coverage details and benefits specific to individual circumstances. Claim forms play a crucial role in providing a structured format for submitting requests, while explanation of benefits (EOB) statements detail the insurer's payments and patient responsibilities for specific medical services. Supporting medical records, including detailed reports from healthcare professionals, can substantiate treatment necessity, while correspondence records, such as emails and letters, maintain a chronological timeline of communications. Additionally, billing statements from healthcare providers break down costs incurred during treatment, aiding in dispute resolution. Collectively, this documentation is vital for proper advocacy in navigating insurance conflicts, ensuring a fair assessment of claims based on factual evidence.

Specific Resolution Requested

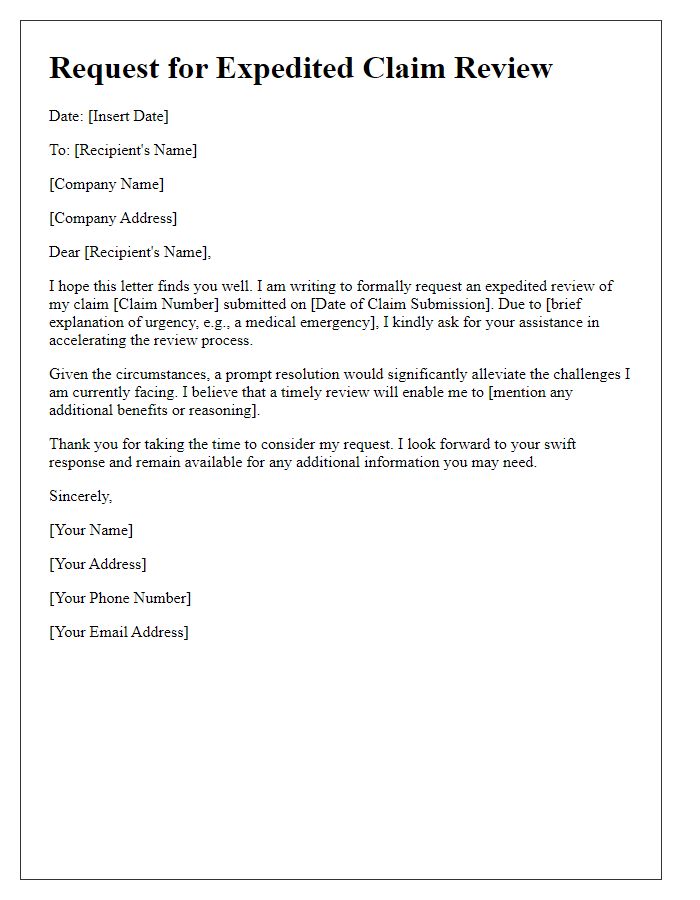

To effectively resolve conflicts with a health insurance provider, it is crucial to understand specific policy details, claim procedures, and regulatory guidelines. For instance, identifying the claim number associated with the dispute is essential for accurate reference. Understanding the specific benefits outlined in the policy can highlight discrepancies, particularly in coverage for treatments such as surgeries or medication. It is also important to know the timeline for claims processing, as delays can impact access to necessary healthcare services. Providing detailed documentation, such as medical records or invoices, can support your request for resolution. Contacting a representative from the health insurance provider's customer service can facilitate discussion and expedite the resolution process. Utilizing state insurance department resources may provide additional leverage or clarify your rights as a policyholder.

Contact Information and Availability

Contacting health insurance providers can often be a complex process requiring specific information and clear communication. Having relevant contact details, such as a dedicated customer service phone line (for example, 1-800-123-4567) and email address, is crucial for efficient resolution of issues. Ensuring availability during business hours (generally 9 AM to 5 PM, Monday to Friday in the United States) allows for prompt interaction. Referencing claim numbers (such as Claim #789456) and policy identification assists in faster identification of the case. Documenting dates of previous calls or correspondence can facilitate continuity of communication, making conflict resolution smoother.

Comments