Are you ready to take the next step in securing your insurance? Submitting detailed policy information is crucial for ensuring that you receive the best coverage tailored to your needs. In this article, we'll guide you through the essential elements to include in your letter, making the process smooth and straightforward. So, grab a cup of coffee and join us as we dive deeper into how to create an effective submission letter!

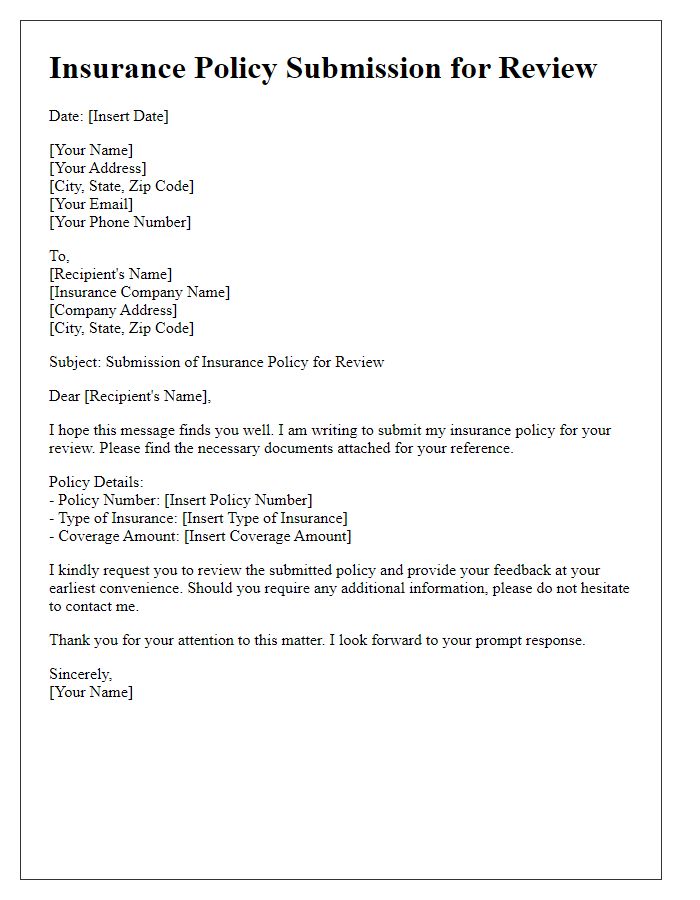

Policyholder Information

Insurance policyholder information includes names (first and last) and contact details (address, phone number, email) of the policyholder. The policy number serves as a unique identifier for the specific insurance plan, which may cover health, auto, or property. Coverage details outline what is included under the policy, including limits, deductibles, and exclusions. Premium amounts indicate the payment required for continued coverage, often assessed monthly or annually. Effective dates specify when the insurance coverage begins and when it expires, critical for ensuring protection during specific timeframes. Additionally, beneficiaries, who receive the benefits following a claim, should be clearly identified, along with their relationships to the policyholder.

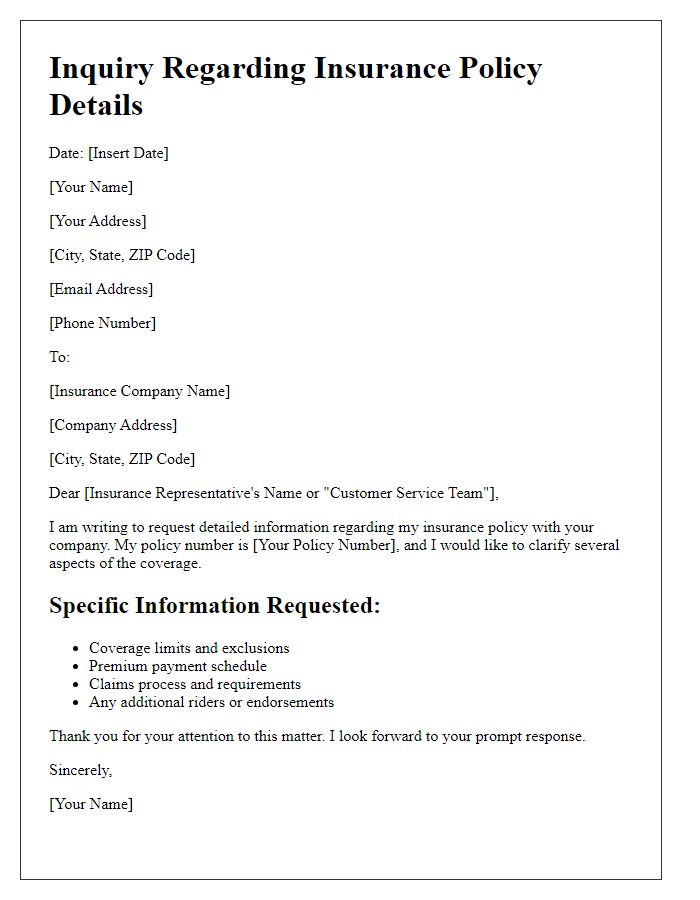

Policy Details and Coverage

Insurance policies provide crucial information regarding coverage, including details about premium amounts, deductibles, and specific risks covered. For example, a standard homeowners insurance policy can cover property damage up to $300,000, while liability coverage may extend to $100,000. Policies often specify additional coverages such as flood insurance, which may not be included in standard offerings. Additionally, each policy may have specific terms regarding exclusions, such as acts of nature or neglect, impacting the claims process. It's essential to review policy details thoroughly to understand the scope of coverage and avoid unexpected costs during claims.

Claim History and Previous Communications

Submitting detailed insurance policy information is crucial for processing claims effectively. Claim history, which includes previously submitted claims, settlement amounts, and dates, provides a comprehensive overview of the insured's prior incidents. Previous communications, such as emails, phone logs, or correspondence with insurance representatives, play a vital role in establishing context and continuity in understanding the claim process. This information is typically organized by date, outlining not just the claims but also responses from the insurance company, which can affect timelines and outcomes. Accurate presentation of this documentation ensures that all necessary details are considered, facilitating an efficient evaluation and resolution of the current claim.

Contact Information and Preferred Methods

Submitting comprehensive insurance policy information requires accurate contact details and preferred communication methods. Insurance policies (documents that outline coverage terms) often necessitate personal identification (name, address, phone number) for proper verification. Preferred methods (email, phone, postal service) ensure clarity in communication. For instance, using email (quick response time) facilitates faster exchanges of information, while phone calls can provide immediate clarification on any queries. Postal service (traditional method) might be used for sending original documents or legal notices. Including these specifics enhances the efficiency of the submission process and ensures all parties remain informed.

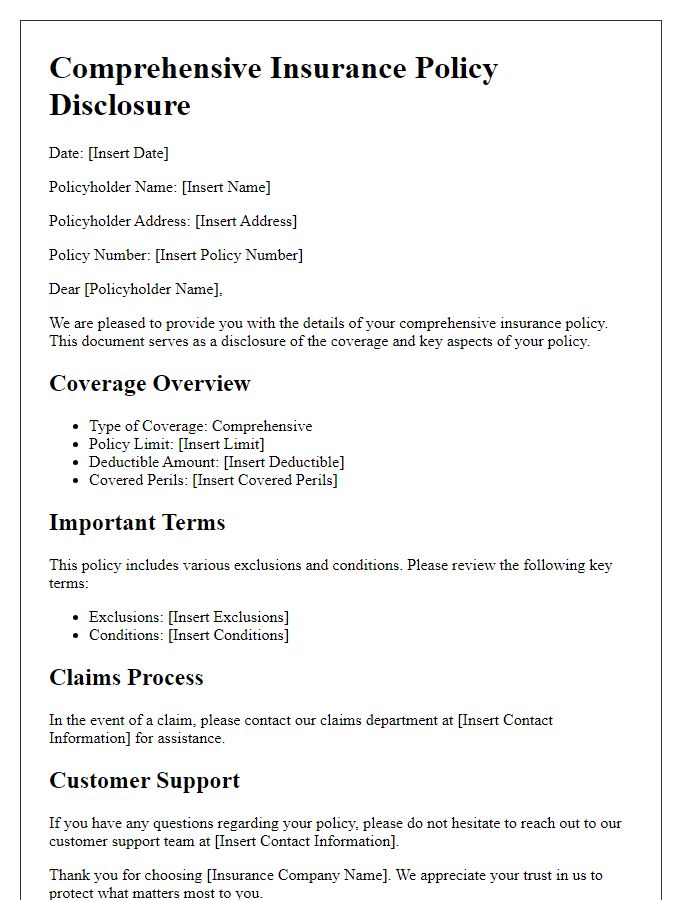

Attachments and Supporting Documents

Submitting detailed insurance policy information requires careful organization and clarity in presenting relevant attachments and supporting documents. Essential components include the insurance policy number, effective dates, coverage limits, and named insured individuals or entities. Important attachments often consist of the original policy document, endorsements, declarations page, and proof of premium payments. Additionally, supplemental documents such as claim history statements, risk assessment reports, and correspondence related to policy amendments may be included to provide comprehensive context. Properly labeling each document and maintaining a clear structure will facilitate the review process, ensuring all pertinent information is readily accessible for the insurance provider.

Comments