Are you considering entering into an equity partnership but unsure of how to draft the terms? A well-crafted letter can set the tone for a successful collaboration and ensure both parties are on the same page. By clearly outlining expectations, responsibilities, and benefits, you can pave the way for a fruitful partnership. Let's dive into the essential elements of an equity partnership agreement to help you create a compelling template!

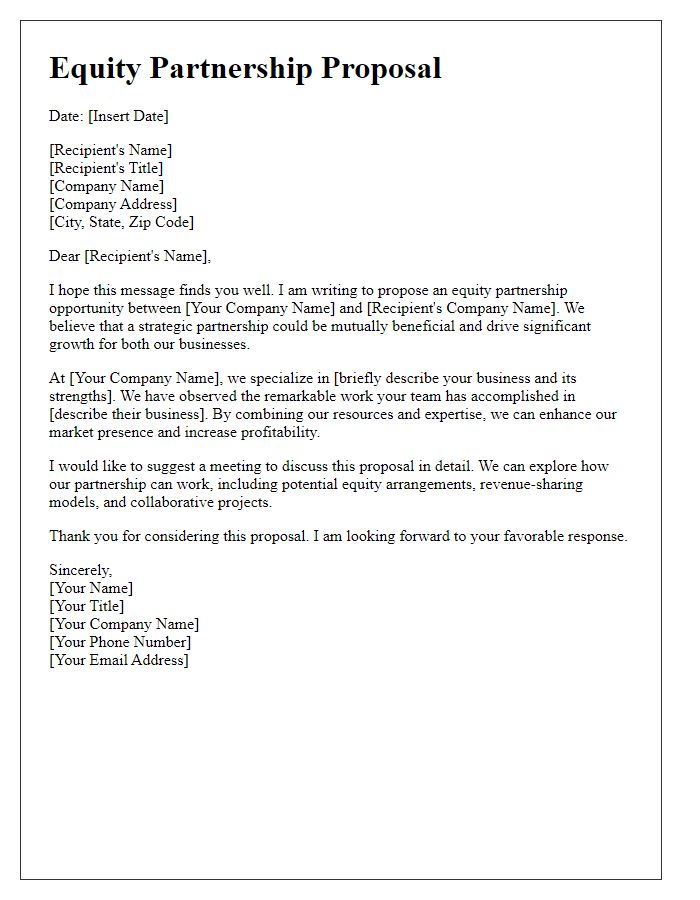

Partnership Objectives and Vision Alignment

Equity partnerships serve as pivotal collaborations, providing both parties with shared objectives aimed at fostering sustainable growth. Establishing clear partnership objectives ensures that both entities are aligned strategically toward common goals, such as increasing market share or enhancing product development. Developing a unified vision is crucial; it encompasses shared values and long-term aspirations, often reflecting in specific measurable outcomes, like achieving a 20% increase in revenue within two years. Furthermore, a mutual understanding of operational expectations and team responsibilities can enhance productivity, ensuring that partner organizations work cohesively. Regular evaluation of partnership effectiveness can facilitate course corrections and validate the alignment of vision, promoting resilience in the face of market changes or challenges.

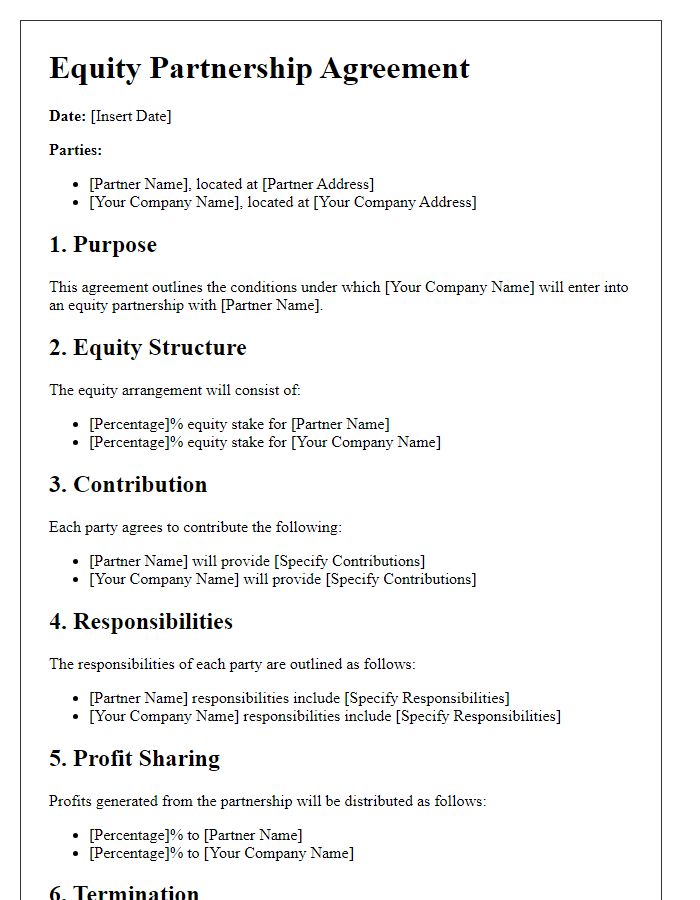

Equity Distribution and Vesting Schedule

Equity distribution within a partnership typically involves the division of ownership interests among partners based on their contributions and roles. The vesting schedule outlines the timeline over which partners earn their equity stake, often to encourage commitment and retention. For instance, a common structure might allocate 30% equity to a founding partner and 20% to each of two additional partners, with a four-year vesting schedule that includes a one-year cliff, meaning no equity is earned until the first anniversary of joining the partnership. At that point, 25% of the equity is vested, with the remaining equity vesting monthly over the next three years. This structure safeguards the investment of time and resources among all partners, ensuring that those who remain actively engaged contribute to the growth and success of the venture.

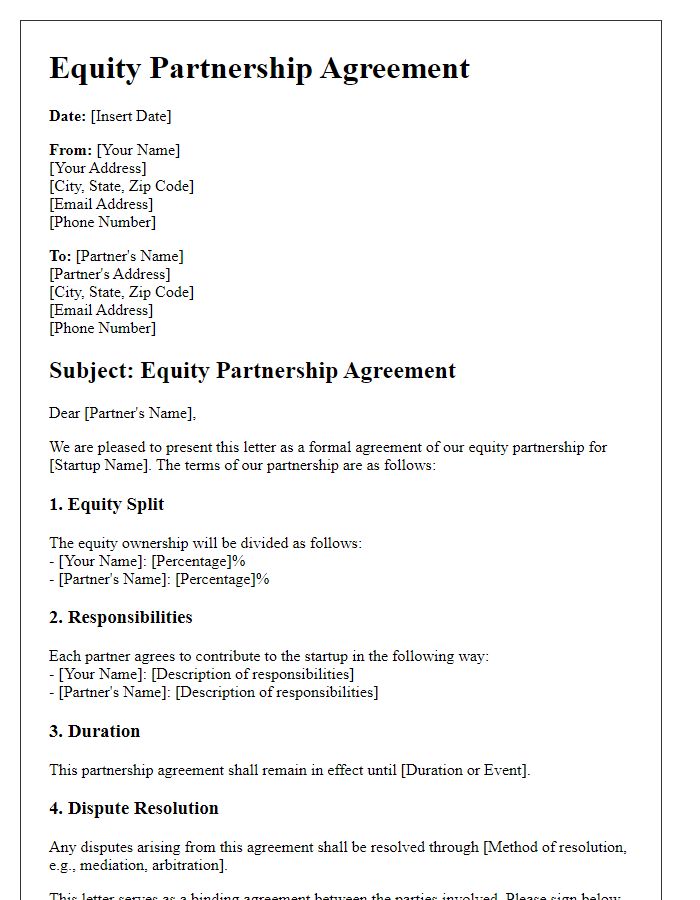

Roles, Responsibilities, and Decision-Making

Equity partnerships require a clear framework to outline roles, responsibilities, and decision-making processes. In an equity partnership, each partner typically contributes capital or resources in exchange for ownership stakes. For example, in a startup scenario, a co-founder may invest $100,000 in exchange for a 20% equity share. Responsibilities may include operational management, financial oversight, and strategic direction, where a technology partner oversees product development while a marketing partner handles brand promotion. Decision-making outlines how partners engage, often requiring unanimous consent for major financial decisions over a certain threshold, such as expenditures exceeding $50,000. Regular meetings, perhaps monthly, may facilitate communication and accountability, ensuring all partners are aligned with the partnership's goals, which in turn can foster a collaborative environment for long-term success.

Financial Contributions and Profit Sharing

Creating financial contributions and profit sharing agreements for an equity partnership involves detailing key elements. Each partner, such as Company A and Company B, needs to specify initial capital investments, future financial obligations, and the methods for calculating profit distribution. For instance, if Company A contributes $100,000 while Company B invests $150,000, the total capital may be proportioned 40% to Company A and 60% to Company B. Additionally, outlining conditions for profit-sharing percentages, perhaps 70% to Company B and 30% to Company A during the first five years, ensures clarity in financial results. Key terms regarding reinvestment strategies or withdrawal procedures should be prominently defined, ensuring both parties are equipped for transparent financial operations in the partnership.

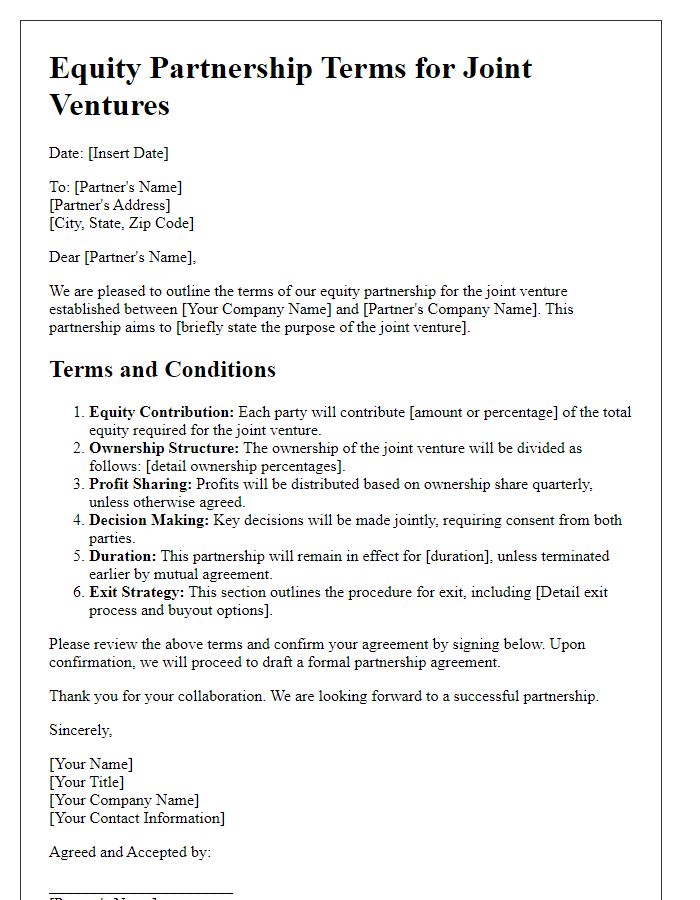

Exit Strategy and Dispute Resolution

An effective exit strategy in equity partnerships, particularly in a dynamic market landscape, is paramount for protecting stakeholders. Common mechanisms, such as buy-sell agreements, outline terms for a partner's exit, ensuring fair valuation--often involving independent appraisals--of the partner's equity share. Additionally, triggering events such as retirement, bankruptcy, or acquisition can dictate the exit process. Dispute resolution methods, including mediation and arbitration, provide structured approaches for addressing conflicts, thereby mitigating potential litigation costs. Locations like the American Arbitration Association (AAA) offer established frameworks to facilitate resolution. These strategies can safeguard against detrimental operational disruptions and maintain productive partnerships.

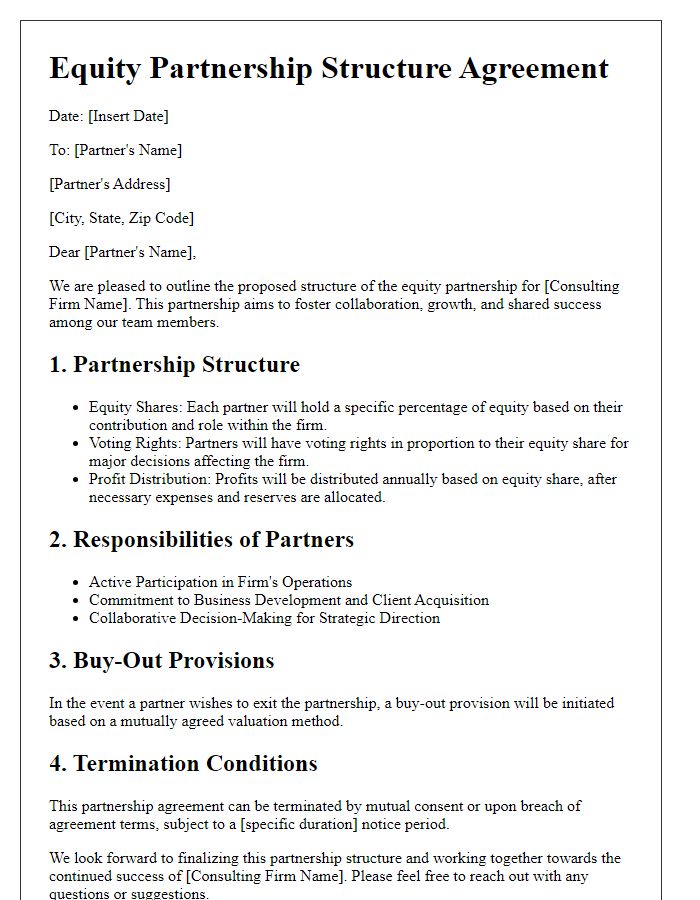

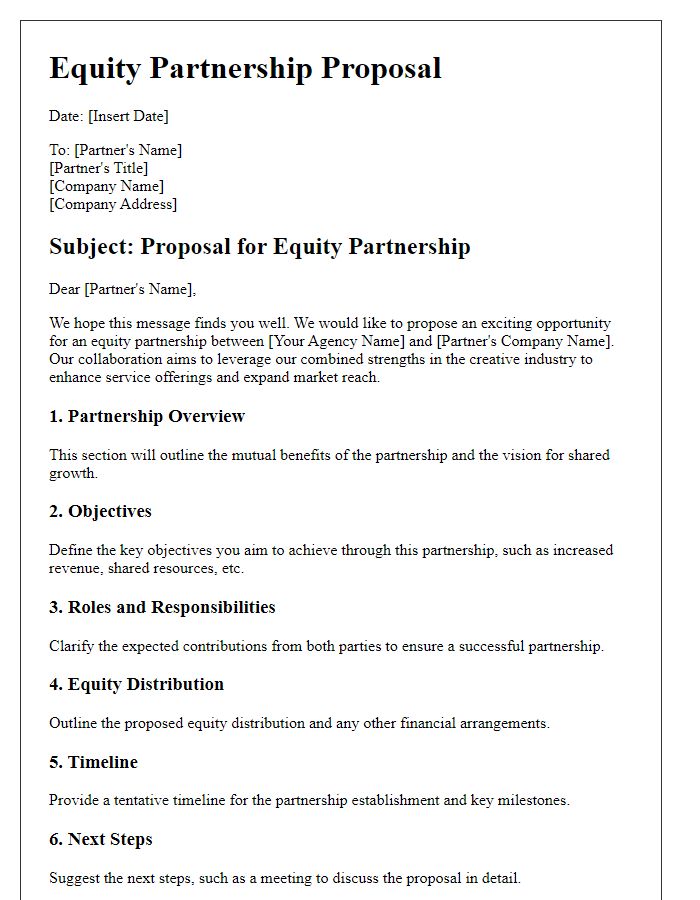

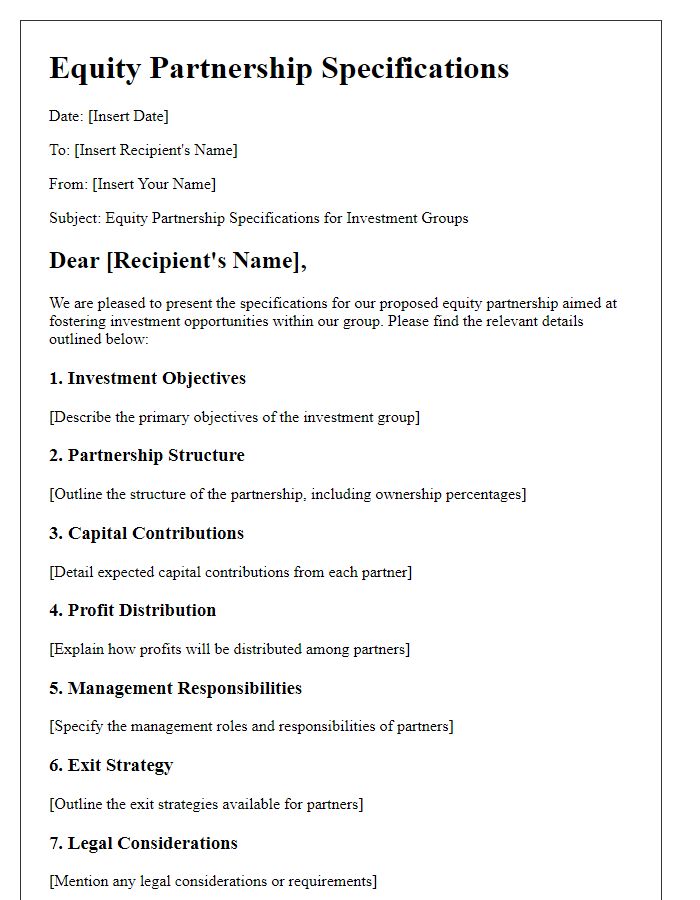

Letter Template For Equity Partnership Terms Samples

Letter template of equity partnership details for nonprofit organizations.

Letter template of equity partnership framework for real estate projects.

Letter template of equity partnership definition for franchise agreements.

Comments