Are you exploring the world of equity compensation offers for your next career move? Understanding the intricacies of these financial incentives can be a game-changer in maximizing your overall compensation package. From stock options to restricted stock units, familiarizing yourself with the various types of equity can help you make informed decisions. Dive into our article to learn everything you need to know about crafting the perfect letter for your equity compensation offer!

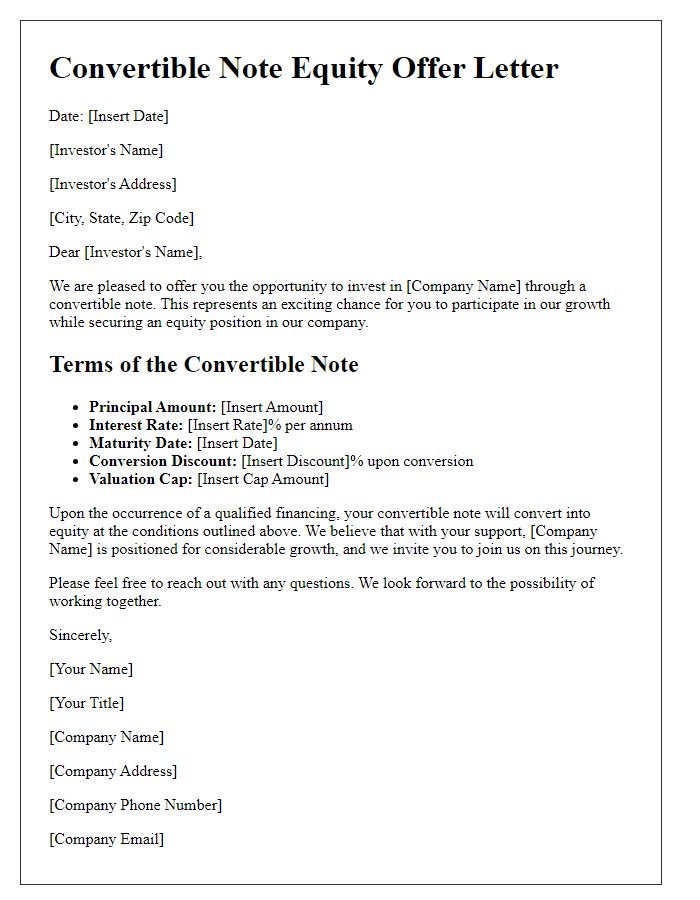

Introduction and Offer Summary

Equity compensation offers, which are increasingly common in technology companies, can significantly enhance employee motivation and align their interests with shareholder values. The offer typically includes stock options or restricted stock units (RSUs) that grant employees the right to purchase or receive shares at a predetermined price or after a vesting period. For example, a company may offer 1,000 RSUs with a four-year vesting schedule, incentivizing employees to stay and contribute to the company's long-term success. The details of the offer are often complemented by a summary of the company's current stock performance, projected growth, and the overall equity structure, providing clear context for the opportunity's potential value. Such compensation packages can foster a strong sense of ownership among employees, particularly in competitive markets like Silicon Valley, where innovation and talent retention are critical.

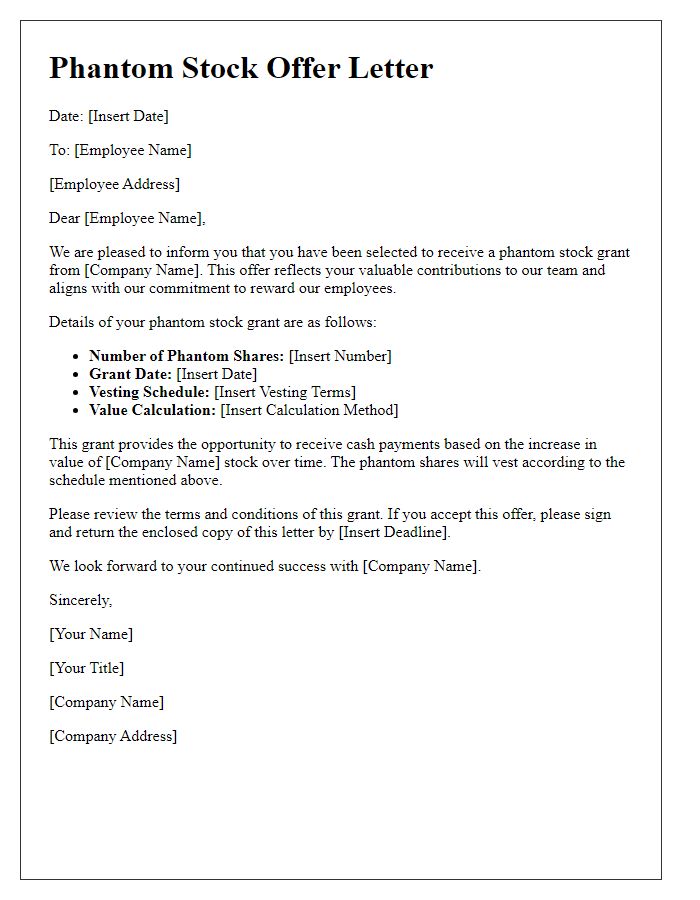

Equity Grant Details

An equity compensation offer provides employees with stock options or shares as part of their overall remuneration package. This type of arrangement aims to align employee goals with company performance. Equity grants typically include specific details such as the number of shares offered, the vesting schedule (the timeline over which employees earn their shares), and the strike price (the price at which employees can purchase shares). Companies often use this incentive to attract and retain talent, particularly in competitive industries like technology and finance. Understanding these components is crucial for employees to evaluate the potential financial benefits of their stock options effectively.

Vesting Schedule and Conditions

Equity compensation offers often include a vesting schedule, which outlines the timeline and conditions under which an employee can earn full ownership of their equity awards, typically in the form of stock options or restricted stock units (RSUs). The standard vesting schedule usually unfolds over a period of four years, divided into annual or monthly increments. For example, a common arrangement may involve a one-year cliff, where no equity is vested during the initial twelve months, followed by monthly vesting for the remainder of the period. Conditions tied to vesting may include continued employment with the company, the achievement of specific performance milestones, or meeting tenure requirements. Events such as mergers, acquisitions, or company IPOs (Initial Public Offerings) may also impact vesting terms, often accelerating the schedule to benefit employees.

Tax Implications and Compliance

Equity compensation, particularly in the form of stock options or restricted stock units (RSUs), carries significant tax implications that vary depending on individual circumstances. Employees receiving equity compensation in the United States, for example, may face ordinary income tax at the time of exercise or vesting, with capital gains tax applicable upon the sale of shares. In 2023, the federal income tax rate can range from 10% to 37%, depending on taxable income levels. Additionally, states such as California impose their own income tax rates, which can exceed 13%. Compliance with regulations set by the Internal Revenue Service (IRS), including timely reporting of income through required tax forms, is crucial to avoid penalties. Consulting with a tax professional is advised to navigate the complexities of equity compensation and ensure that employees understand their financial obligations and potential benefits, such as utilizing qualified plans or tax-deferred accounts.

Acceptance Procedures and Deadlines

Equity compensation offers, such as stock options or restricted stock units (RSUs), typically require candidates to understand acceptance procedures and deadlines. To formally accept an equity compensation offer, candidates must review the accompanying documentation, including grant agreements and vesting schedules, ensuring clarity on the terms, such as strike prices and expiration dates. The acceptance often necessitates signing and returning the agreements by a specified deadline, which could vary from a few days to several weeks after the offer date, emphasizing the importance of acting promptly to secure the offered equity benefits. Failure to complete these steps within the designated timeframe could result in forfeiting the opportunity, highlighting the critical nature of adhering to these procedures and deadlines.

Comments