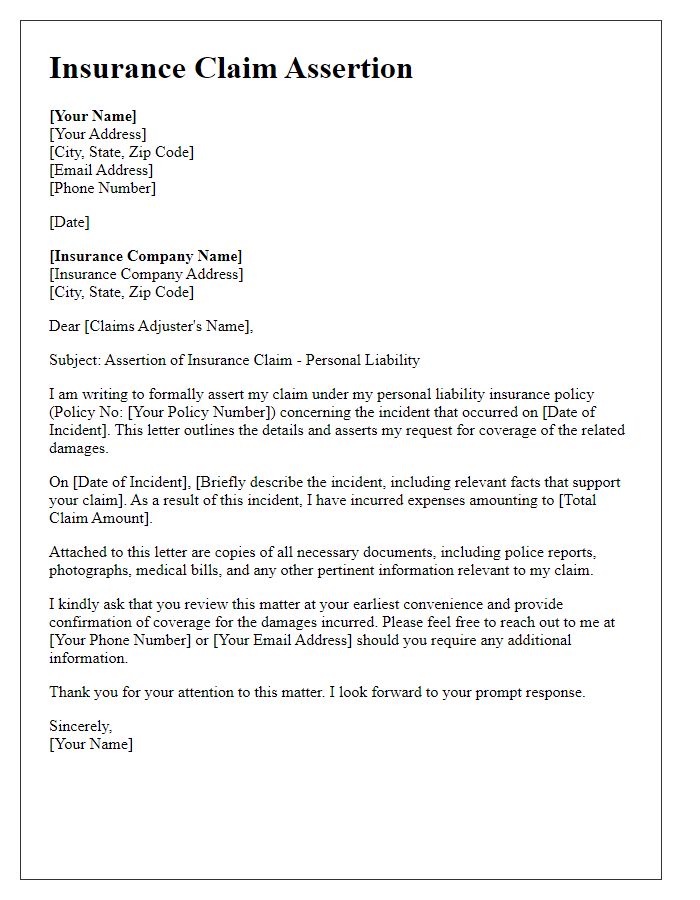

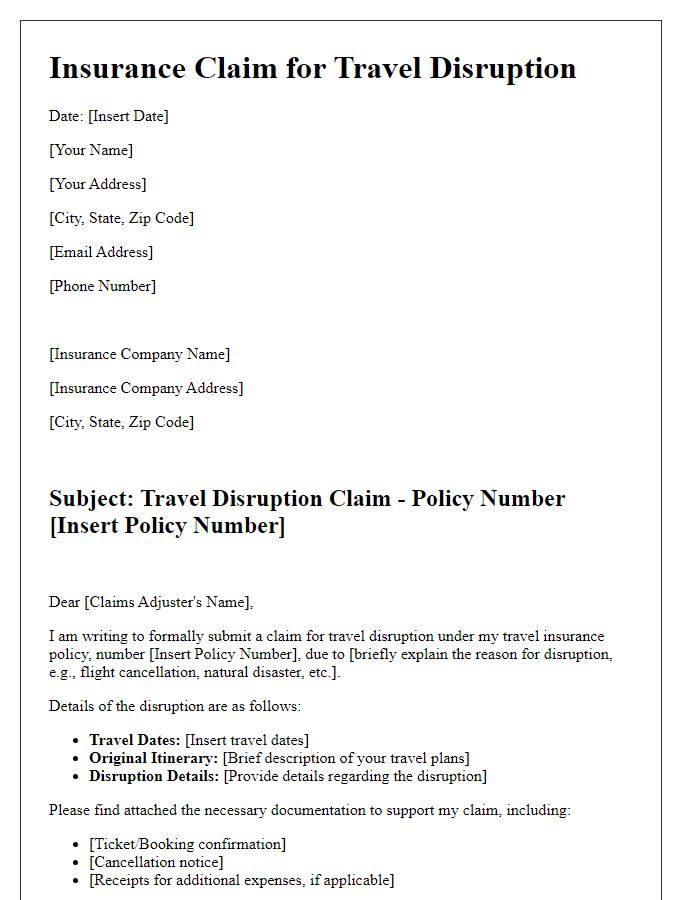

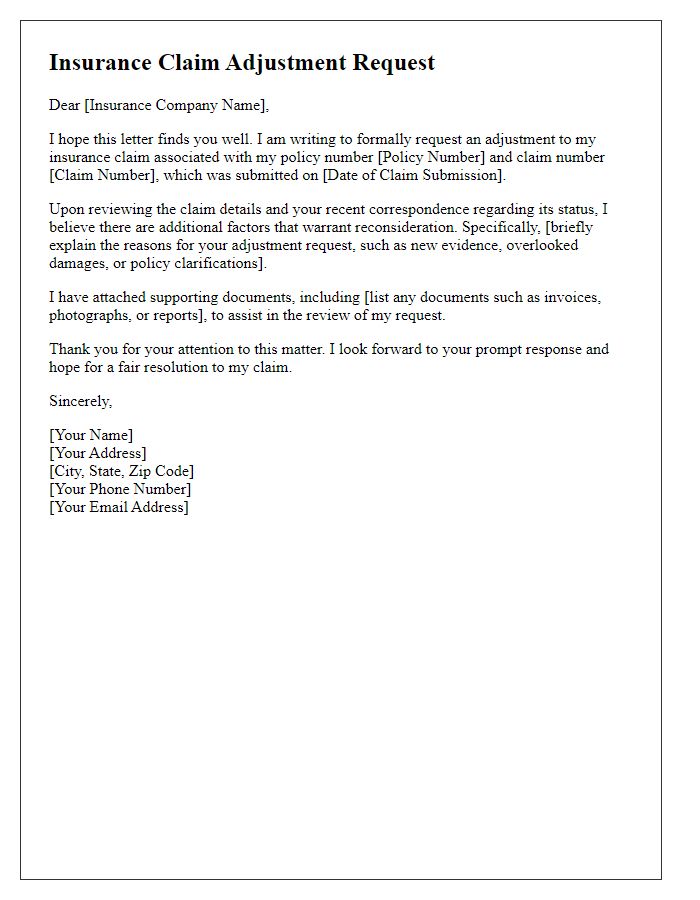

Are you navigating the often complex world of insurance claims? Writing a clear and effective claim notice is crucial to ensure you communicate your needs effectively and expediently. With the right letter template, you can articulate your situation while enhancing your chances of a favorable outcome. Join us as we explore the essential elements of an insurance claim notice and provide you with a comprehensive template to make the process smoother!

Policyholder Information

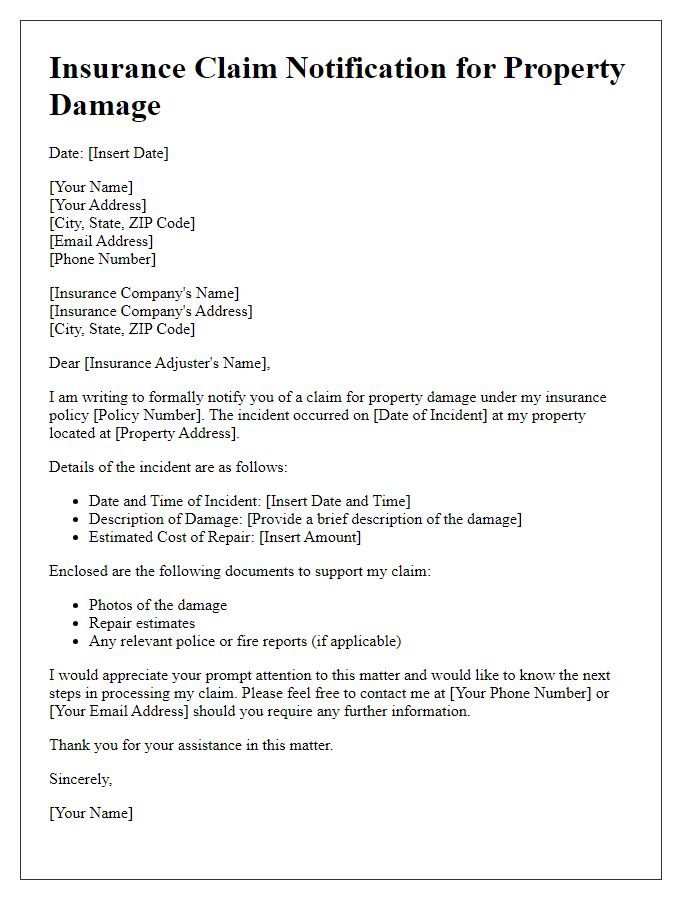

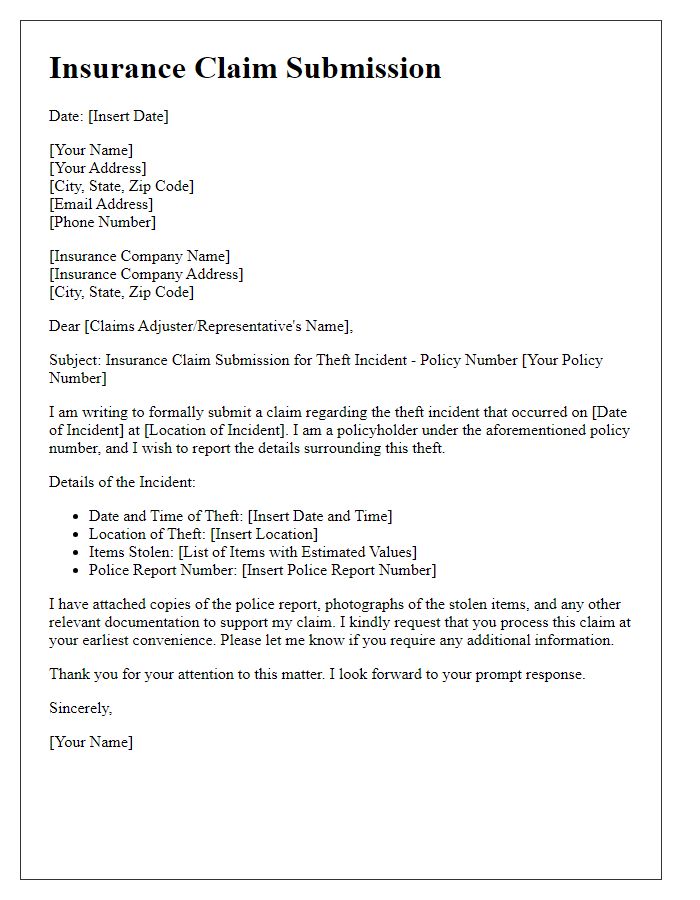

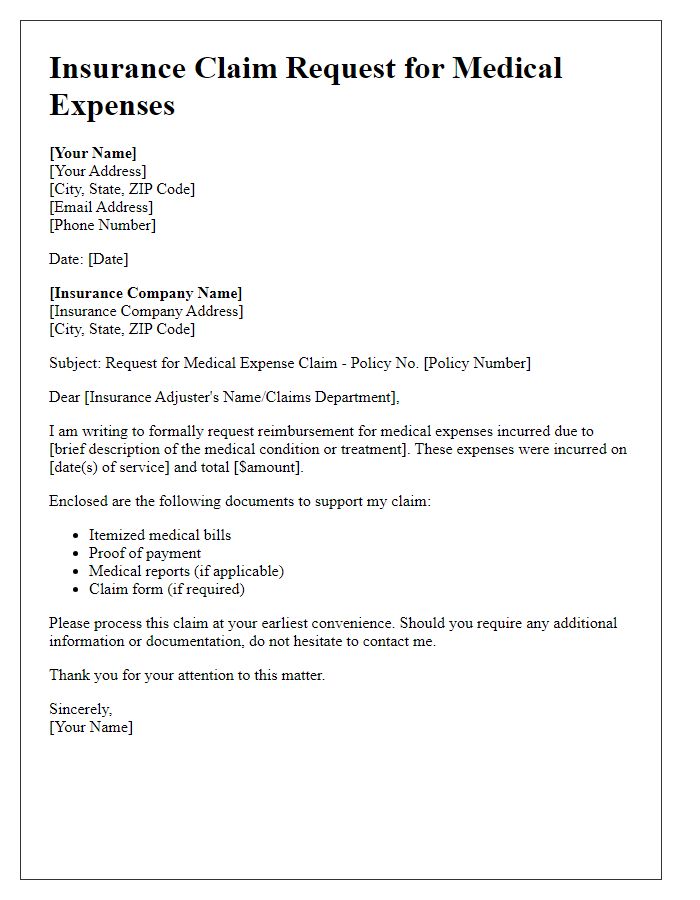

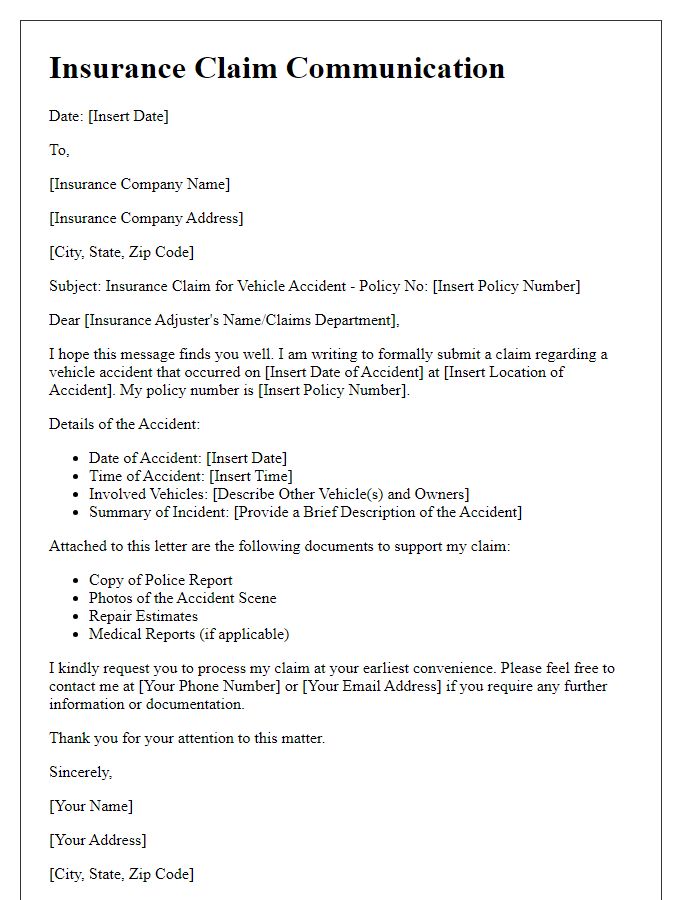

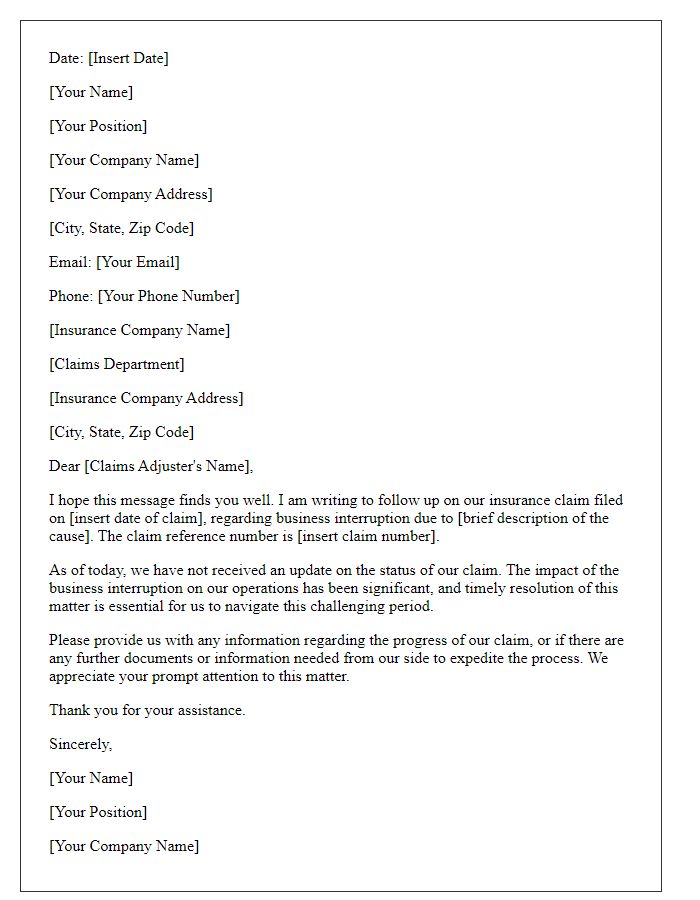

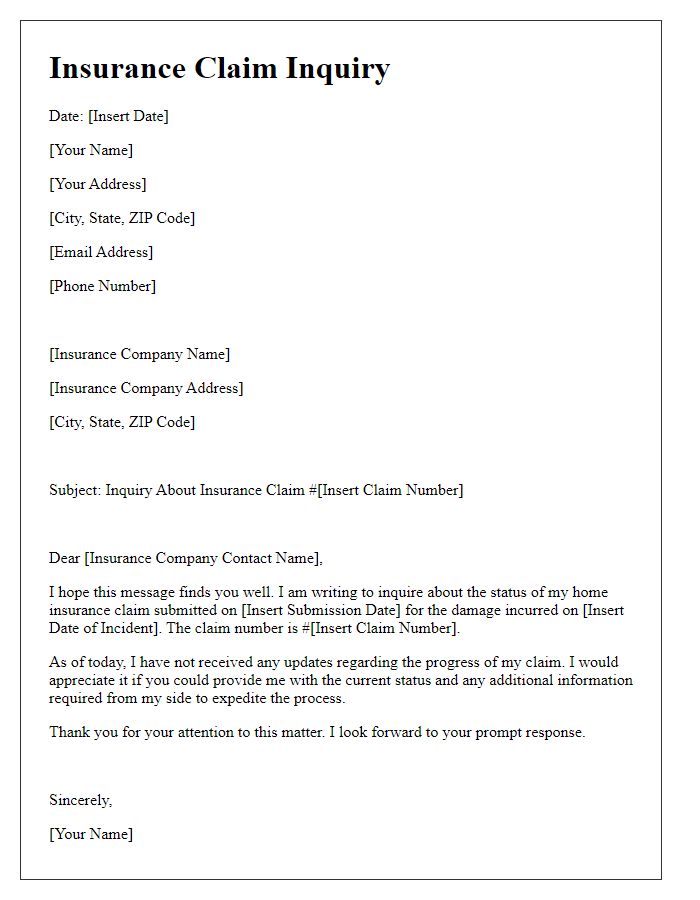

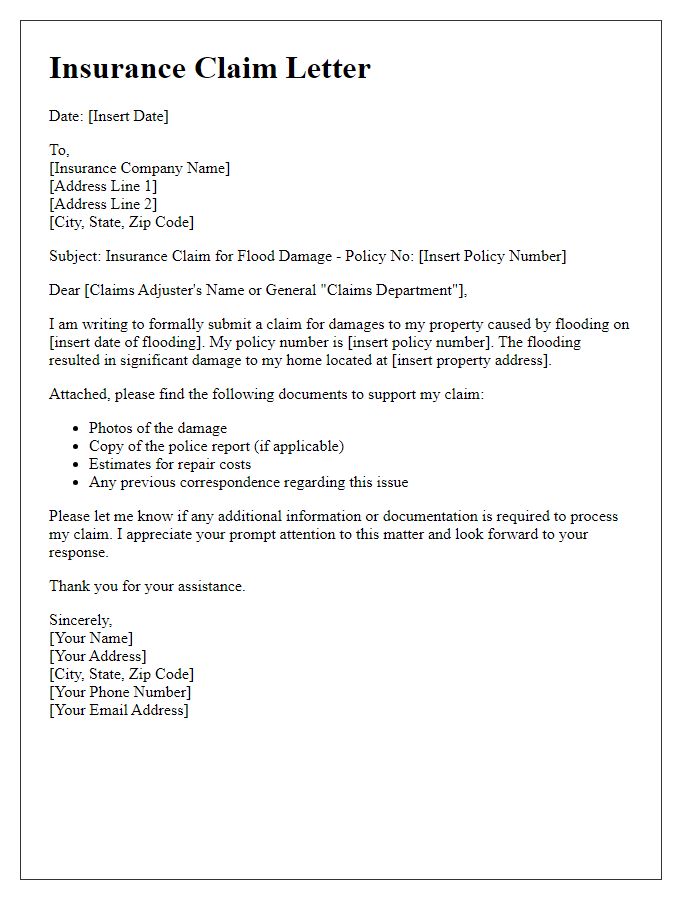

Policyholders of insurance contracts, typically identified by their unique policy number, often provide crucial details, including personal identification information and contact numbers, to facilitate smooth communication regarding claims. These individuals, who may reside in various regions (such as urban centers or rural areas), are responsible for reporting incidents leading to claims, like natural disasters (hurricanes, floods) or accidents. Accurate information, including dates of the events and any pertinent documentation (police reports, medical records), enhances the claims process, allowing insurance companies to evaluate damages and expedite reimbursement, ensuring policyholders receive necessary support during challenging times.

Policy Number

The insurance claim process requires a detailed submission that includes the policy number, which is essential for identifying the insured party's coverage. In formal notice submissions, the policy number allows insurance companies, such as AllState or State Farm, to efficiently navigate through their databases, ensuring prompt processing of claims related to incidents like property damage or car accidents. Policy numbers typically contain a combination of alphanumeric characters, unique to each client, helping to prevent confusion among thousands of claims. Promptly including this key identifier enhances communication and expedites the overall claims handling process.

Incident Details

The incident details for the insurance claim encompass essential information regarding the event that has triggered the claim. On March 15, 2023, a severe hailstorm struck the city of Denver, Colorado, resulting in significant property damage. Hailstones measuring up to 2 inches in diameter battered rooftops, causing leaks and shingle displacement. The incident led to extensive damage to vehicles parked outside, particularly a 2021 Toyota Camry, which sustained dents and shattered windows. A subsequent assessment indicated an estimated repair cost of $5,000, necessitating immediate attention. This event, categorized as a natural disaster by the National Weather Service, exemplifies the impact of extreme weather events in urban areas. Documentation, including photographs and repair estimates, has been compiled to support the claim.

Itemized Claim List

The itemized claim list for the insurance claim process includes detailed information regarding the damaged property, such as electronics, appliances, or personal belongings. Each entry should contain a brief description of the item, such as "32-inch Samsung Smart TV," along with its purchase date, estimated value, and serial number for verification. The listing may also include supporting documents or photographs, which serve as evidence of ownership and condition prior to the incident. Specific monetary amounts correlating to each item aid in establishing the total claim value. Accurate itemization becomes crucial during the review process by the insurance adjuster, ensuring prompt and fair compensation for losses incurred.

Contact Information

When submitting an insurance claim notice, providing accurate contact information is essential. The information should include the claimant's full name, which ensures proper identification. An address (including street, city, state, and zip code) helps the insurance company facilitate correspondence and further processing of the claim. A valid phone number, preferably one that is frequently checked, allows for quick communication between the claimant and the insurance representative. Additionally, an email address is important for receiving digital notifications and updates regarding the claim status. Providing detailed and correct contact information streamlines the claims process, reducing delays and misunderstandings.

Comments