Are you considering a business acquisition and unsure how to communicate the news effectively? Crafting the perfect acquisition notice can set the tone for a smooth transition and clear understanding among stakeholders. Whether you're addressing employees, clients, or partners, it's important to convey the message with clarity and professionalism. Curious about how to structure your letter and what key elements to include? Read on for our comprehensive guide!

Clear Subject Line

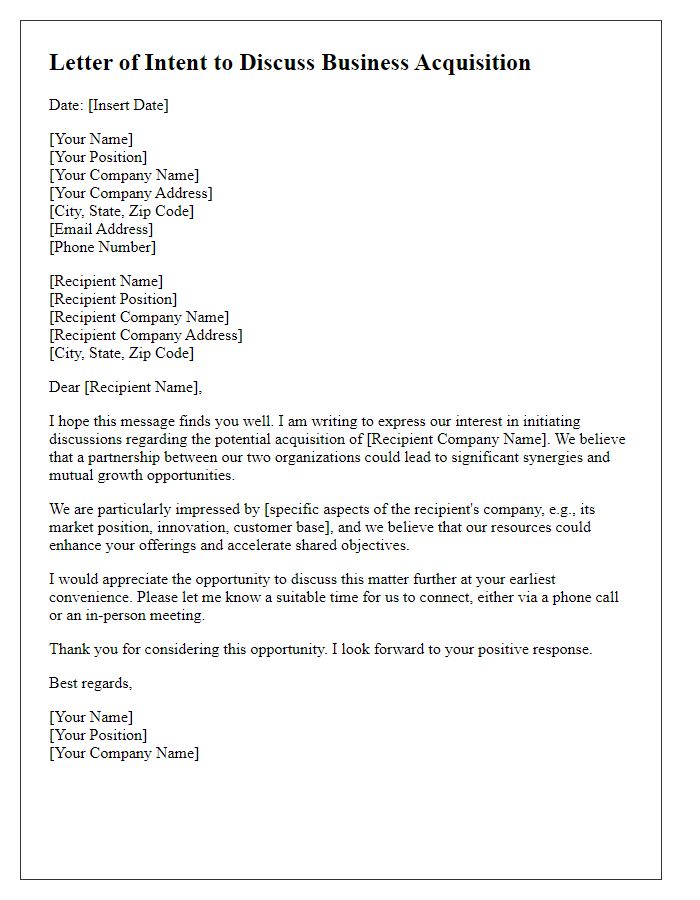

A business acquisition notice requires a clear and professional approach to ensure that stakeholders understand the key details of the transaction. The notice should include the name of the acquiring company, the name of the acquired company, acquisition date, and any potential impact on employees and operations. A straightforward subject line, such as "Notice of Business Acquisition: [Acquiring Company] Acquires [Acquired Company] on [Date]," is essential. This message serves to inform all relevant parties, including employees, clients, and stakeholders, about the changes and the anticipated benefits of the acquisition, ensuring transparency during the transition period.

Formal Salutation

A business acquisition notice serves as a formal communication regarding the transaction of one company purchasing another. This notification typically includes details such as the names of the acquiring and acquired companies, the date of the acquisition, and any pertinent information about future plans or changes. Formal salutation plays a crucial role in establishing a professional tone at the beginning of the notice. For instance, addressing executives or stakeholders with titles like "Dear Board Members" or "Dear [Acquiring Company's Name] Team" sets a respectful and serious context for the content that follows. Additionally, mentioning the names of specific individuals involved in the transaction, such as the CEOs or key decision-makers, can further personalize and strengthen the communication, fostering a sense of trust and accountability.

Introduction of Acquisition

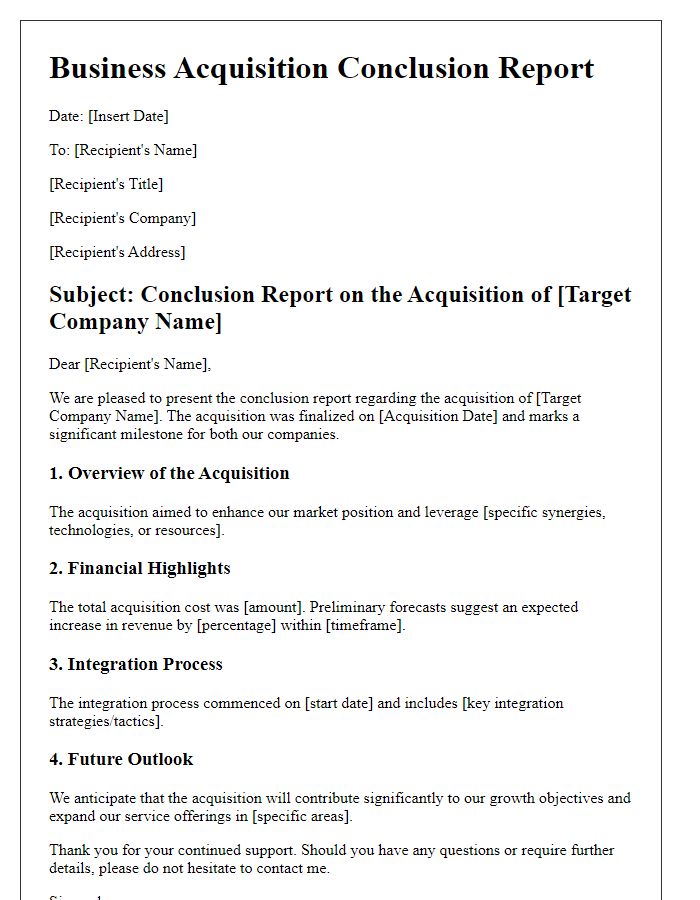

A recent acquisition announcement marked a significant milestone for Company A, a leading tech firm headquartered in Silicon Valley, which has finalized its purchase of Company B, a prominent player in cloud solutions based in Seattle. This strategic move, valued at $500 million, aims to enhance Company A's existing portfolio in artificial intelligence and broaden its market reach. Executives from both companies foresee the integration process will create innovative synergies, impacting over 1,000 employees. Stakeholders and clients can expect an official transition plan to be released by the end of the quarter, outlining key integration strategies and potential service enhancements that will arise from this union.

Impact and Benefits

The recent acquisition of XYZ Corporation by ABC Holdings, a leading investment firm based in New York, promises significant synergy and increased market share within the technology sector. This strategic move, valued at $500 million, aims to enhance product offerings while streamlining operations across both organizations. Employees from both entities will benefit from combined resources, promoting innovation and collaboration. Customers can expect improved service delivery through upgraded platforms and expanded support services. Additionally, shareholders might see a favorable impact on stock prices, driven by anticipated growth in revenue streams. Overall, this acquisition marks a pivotal moment in the landscape of the technology industry, paving the way for enhanced competitive advantage.

Contact Information for Queries

Acquiring a business involves meticulous planning and clear communication regarding future operations. For stakeholders requiring additional information, providing comprehensive contact details is vital. This should include essential data such as the acquisition date, relevant personnel's names (like Chief Executive Officer or Chief Financial Officer), and specific hours of availability for inquiries. Email addresses, phone numbers, and physical office locations (such as headquarters at 123 Business Ave, City, State, ZIP Code) must be readily accessible. Implementing a dedicated helpline or support email can streamline communication and ensure timely responses to queries about changes in management, operations, or other significant factors affecting stakeholders post-acquisition.

Comments