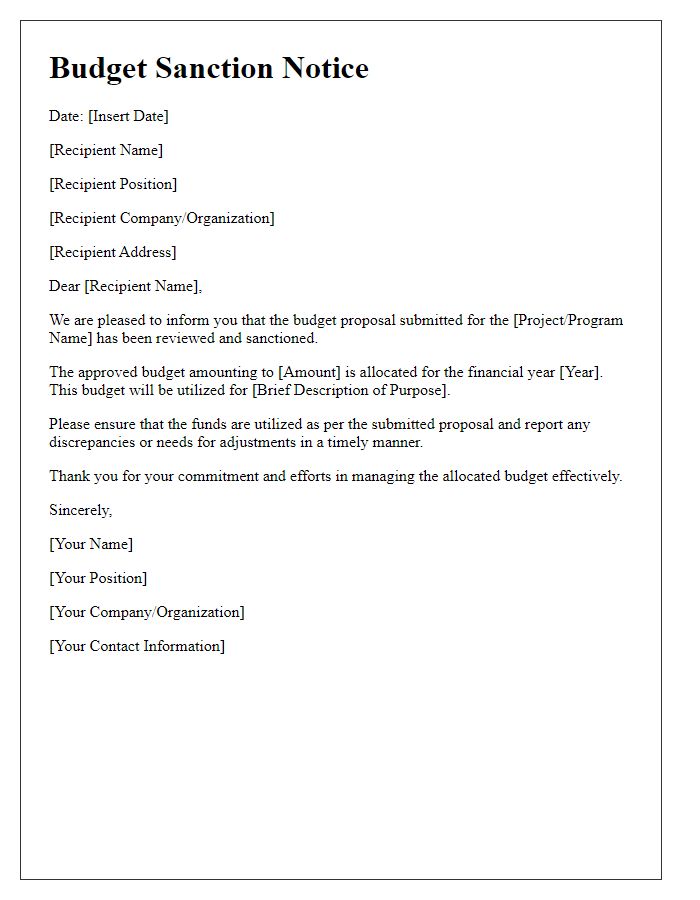

Are you ready to take your budgeting process to the next level? Crafting a budget approval notice can be both a vital and daunting task for any organization. In this article, we'll explore essential tips and a convenient letter template that ensures clear communication and streamlines the approval process. Dive in as we guide you through creating an effective budget approval notice that keeps everyone on the same page!

Clear Subject Line

Budget approval notifications are crucial for financial planning within organizations, such as corporations or non-profit entities. A well-defined subject line, for instance, "Approval Required: Fiscal Year 2024 Department Budget," ensures immediate recognition of the content. Detailed figures, such as a proposed budget of $500,000 for marketing initiatives or a $300,000 allocation for technology upgrades, clarify the financial implications. Mentioning specific departments, like Human Resources or Information Technology, adds context to the request. Including critical dates, such as a deadline for final approval by October 31, 2023, emphasizes urgency and accountability.

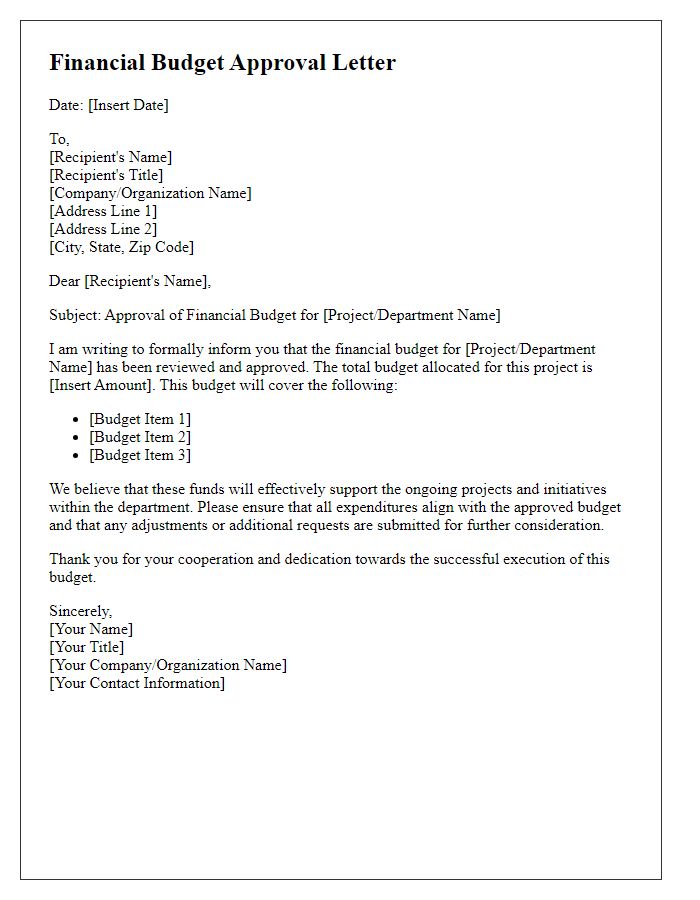

Concise Budget Summary

The concise budget summary outlines the projected financial plan for the upcoming fiscal year, detailing key allocations for departments such as Marketing, Operations, and Human Resources. A total budget of $3 million includes $1 million earmarked for new marketing initiatives aimed at increasing brand awareness and customer acquisition. Operations will receive $1.5 million to enhance production efficiency and modernize equipment, while $500,000 supports employee training programs in line with company goals. The summary highlights financial objectives, anticipated revenue growth of 10%, and a commitment to cost-effective strategies ensuring fiscal responsibility and sustainability. All proposed allocations align with organizational priorities, aiming to achieve strategic growth in a competitive market.

Justification of Expenses

The budget approval notice outlines the essential financial allocations required for ongoing projects within the organization. Key expenses include office supplies (estimated at $5,000 to maintain daily operations), software subscriptions (around $3,000 to ensure access to critical tools), and employee training programs (proposed budget of $10,000 aimed at enhancing staff skills). Each allocation directly supports our strategic goals for productivity and efficiency. Additionally, travel costs for upcoming conferences (projected at $7,000) will facilitate networking opportunities and professional development. Comprehensive justification for each expense emphasizes alignment with organizational objectives and commitment to responsible financial management.

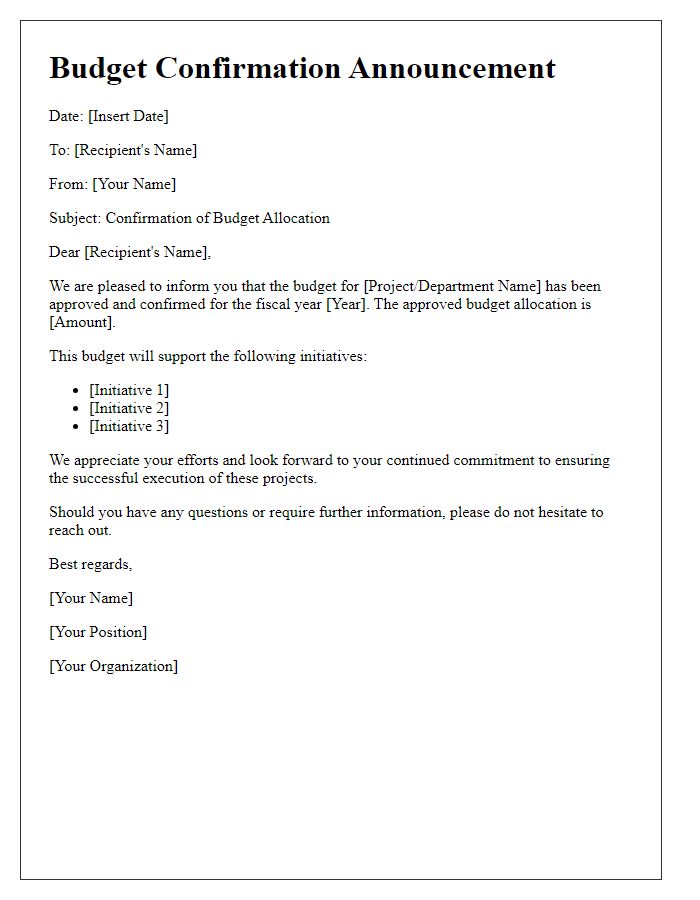

Impact and Benefits

Budget approval for the new marketing campaign at Tech Innovations Inc., estimated at $500,000, is anticipated to significantly enhance brand visibility. This campaign aims to reach over 1 million potential customers through digital advertising and influencer partnerships. The expected increase in website traffic by at least 30% can drive higher sales conversion rates, projected to boost revenue by approximately 15% in the upcoming quarter. Additionally, the campaign's strategic implementation will utilize customer engagement metrics from social media platforms such as Instagram and Facebook, ensuring an efficient allocation of resources and optimization of marketing strategies. Improved brand recognition can lead to lasting customer loyalty and a stronger competitive position in the technology sector.

Approval and Next Steps

The budget approval notice outlines the sanctioned financial plan for the upcoming fiscal year, detailing allocations for various departments such as marketing, research, and development. The approved budget, amounting to $500,000, has undergone scrutiny during the quarterly finance meeting held at the corporate headquarters in New York City on September 15, 2023. This actionable document highlights key areas of expenditure, emphasizing cost efficiency and strategic growth initiatives. Next steps involve disseminating this information across the organization, ensuring all departments adhere to the approved figures, and scheduling follow-up meetings by October 15, 2023, to assess progress and address any financial discrepancies.

Comments