Are you feeling a bit overwhelmed by the tax deduction verification process? You're not alone! Many individuals find navigating the nuances of tax deductions a bit confusing, but we're here to simplify it for you. In this article, we'll guide you through creating a clear and effective letter template to help you get the verifications you needâso keep reading to uncover all the essential tips!

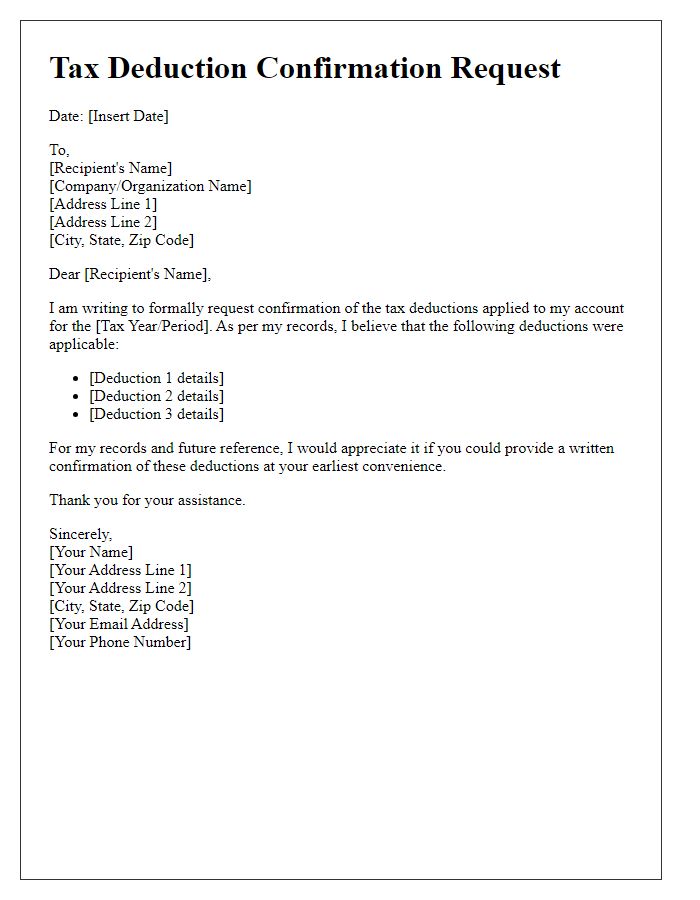

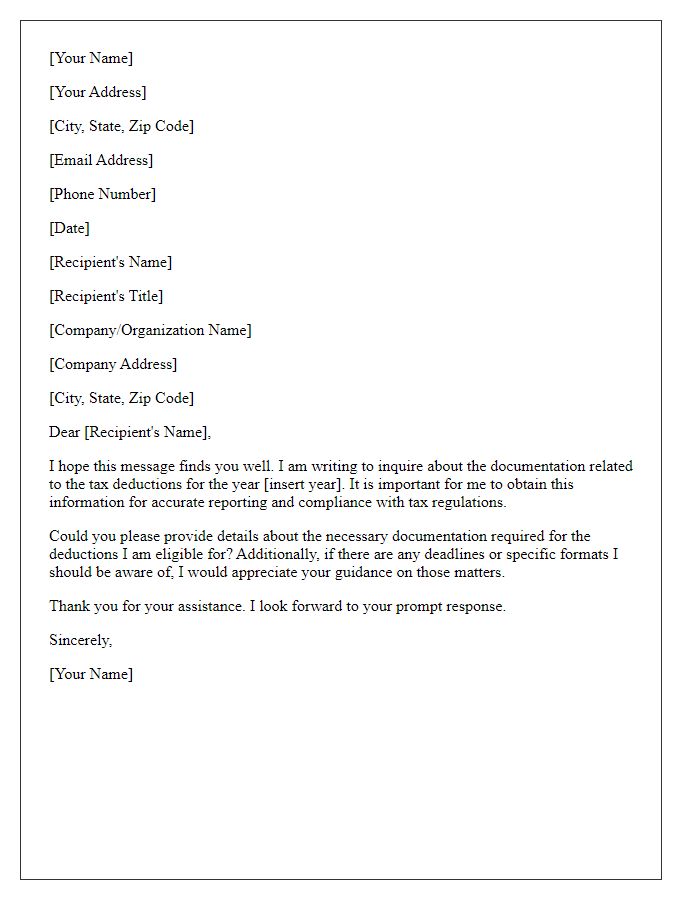

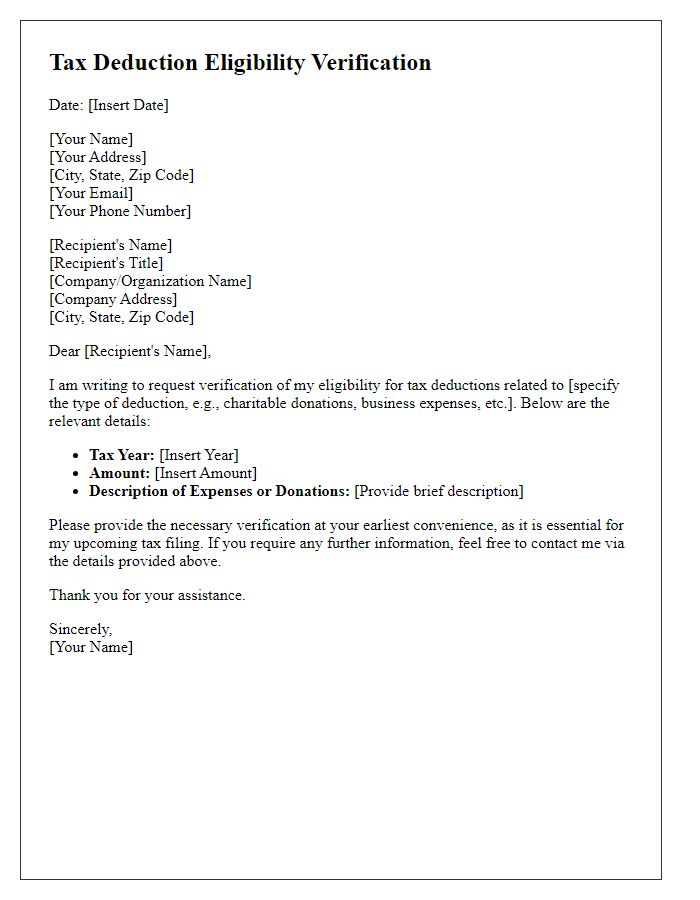

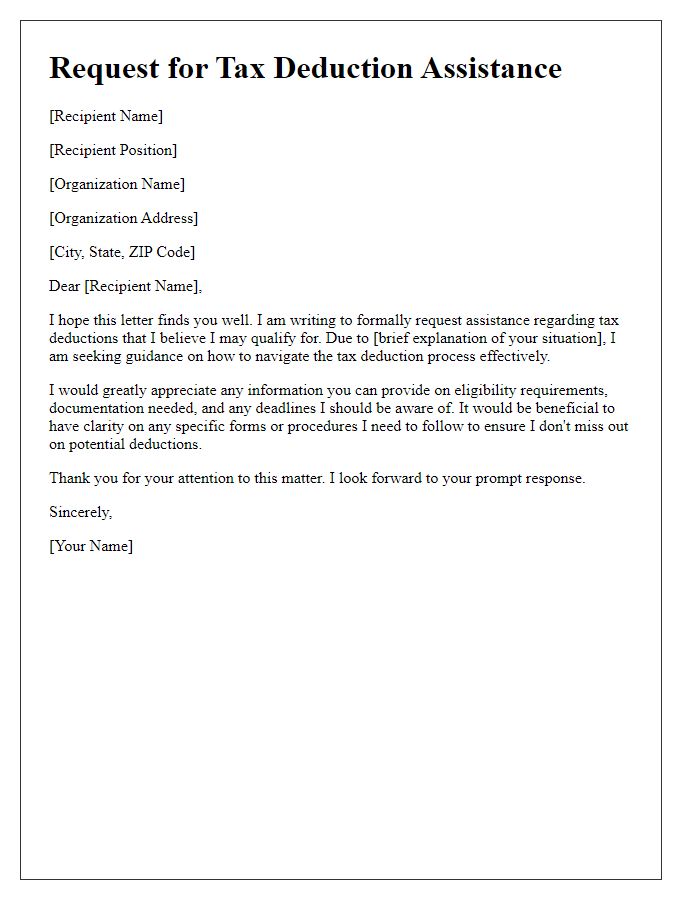

Sender's Information

Tax deduction verification involves scrutinizing financial documents as part of income tax filing. Essential entities include the Internal Revenue Service (IRS), which governs tax regulations in the United States, and specific tax forms like IRS Form 1040. Deductible expenses, such as medical costs (often exceeding 7.5% of adjusted gross income) and mortgage interest payments (which can significantly reduce taxable income), should be accurately documented. Supporting documents, such as receipts, bank statements, and W-2 forms from employers, serve as critical evidence in proving eligibility for deductions. Timely submission of these documents by April 15 annually is crucial to avoid penalties and ensure compliance with tax laws.

Recipient's Information

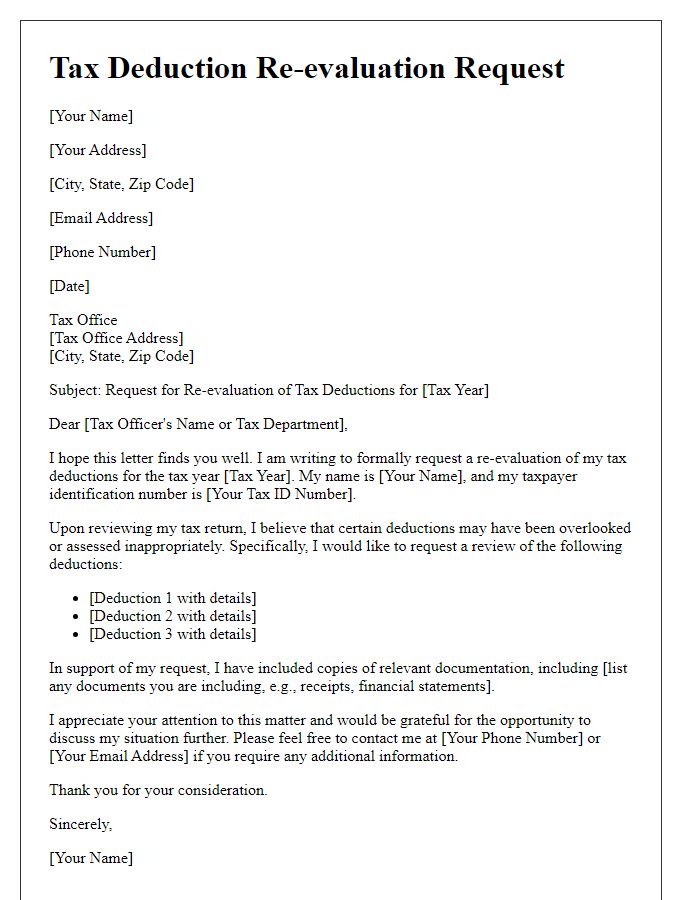

Tax deduction verification requires accurate documentation to ensure compliance with Internal Revenue Service (IRS) regulations. Essential details include the recipient's name (individual or entity), address (including city, state, and ZIP code), and taxpayer identification number (Social Security number for individuals or Employer Identification Number for businesses). Verification should specify the type of deduction claimed, such as charitable contributions, mortgage interest, or medical expenses, along with supporting documentation like receipt copies, bank statements, or Form 1098 for mortgage interest. This meticulous approach verifies eligibility and maximizes potential tax savings while minimizing audit risks.

Purpose of the Letter

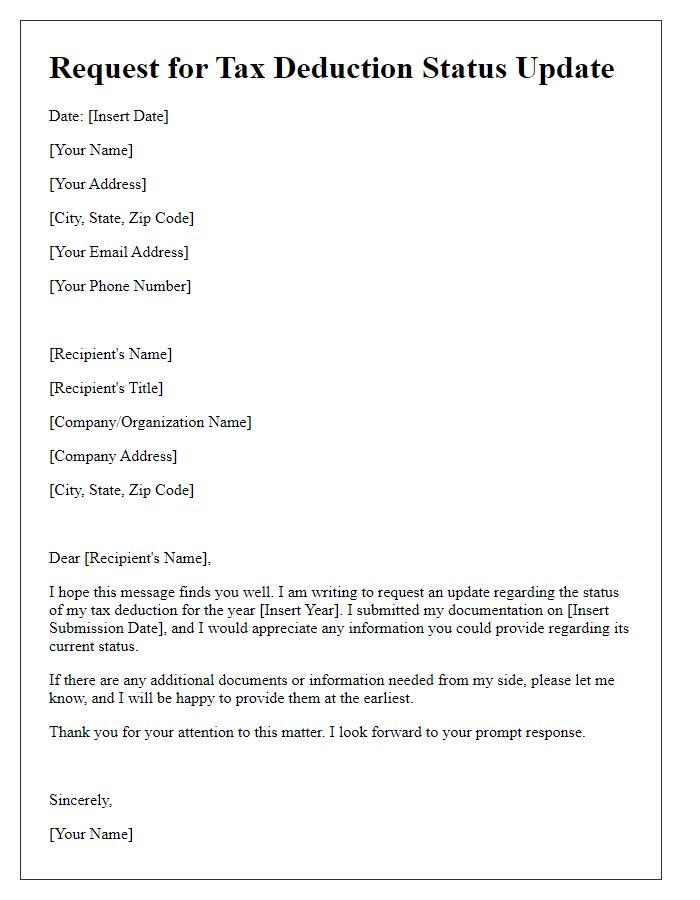

The purpose of the tax deduction verification letter involves formally confirming the eligibility and accuracy of specific deductions claimed on a tax return. This letter serves as documentation for tax authorities, ensuring transparency and compliance. Key details often include tax year, specific deductions, income sources, and documentation, such as W-2 forms or 1099 statements. This verification process is essential for taxpayers seeking to substantiate their claims, potentially involving court systems or audits if discrepancies are discovered. Timely submission of this documentation is critical to avoid penalties or interest on owed taxes.

Details of Tax Deduction

Tax deduction verification involves confirming eligibility for specific deductions available under tax laws. Examples include charitable contributions, home mortgage interest, or medical expenses. Accurate records, such as receipts and tax forms, are essential for substantiating claims. Tax deductions can significantly lower taxable income, affecting overall tax liability. Different countries have distinct regulations governing allowable deductions; for instance, in the United States, the Internal Revenue Service (IRS) sets guidelines for various tax deductions under the Internal Revenue Code. Deductions can vary in amount based on the taxpayer's filing status, income level, and the nature of the expense. Additional documentation may be required during audits or reviews to ensure compliance with tax regulations.

Signature and Contact Information

Tax deduction verification requires meticulous attention to documentation, ensuring compliance with Internal Revenue Service (IRS) regulations. Important elements include the taxpayer's full name for identification, social security number (SSN) to avoid duplication, and contact information such as phone number (usually a mobile number) or email address for follow-up inquiries. Additionally, capturing the signature of the taxpayer is crucial, validating the authenticity of the request and confirming agreement with the submitted information. Having accurate and thorough details on file facilitates a smooth verification process and expedites potential refunds, highlighting the significance of maintaining organized tax records throughout the fiscal year.

Comments