Are you ready to take your organization's financial planning to the next level? Crafting a compelling annual budget proposal is essential for aligning your resources with your strategic goals. In this article, we'll explore the key elements to include in your letter and offer practical tips to make your proposal stand out. So grab a cup of coffee and let's dive into the essentials that will inspire your stakeholders to invest in your vision!

Clear objective statement

A clear objective statement for an annual budget proposal defines the primary goals and financial needs for the upcoming fiscal period. This statement articulates intentions to allocate resources efficiently and effectively, addressing critical areas such as operational costs, program enhancements, and strategic initiatives. For instance, the objective may focus on increasing funding for technology upgrades, which could aim to enhance productivity by 20% in departments like information technology and customer service. Additionally, it may highlight plans to provide training programs for employees, improving overall performance and job satisfaction within the organization. By clearly documenting these objectives, stakeholders can better understand the rationale behind the proposed budget and its alignment with the overall mission of the organization.

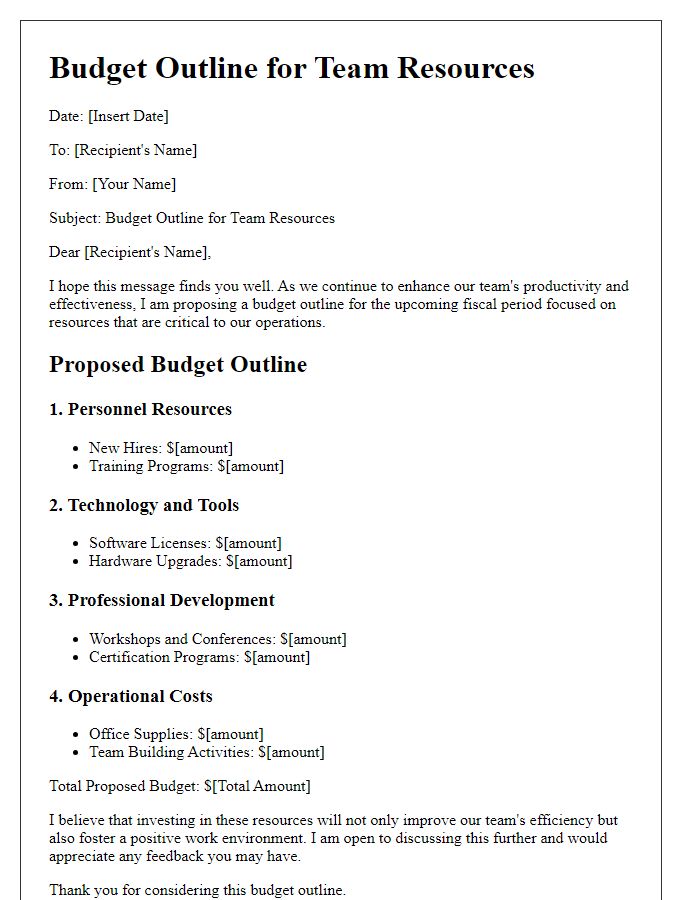

Detailed budget breakdown

The annual budget proposal outlines a comprehensive financial plan essential for organizational growth and sustainability. This budget consists of several key categories, including operational expenses, personnel costs, and project funding. Operational expenses may allocate approximately 30% to utilities and maintenance of facilities, such as office space located at 123 Business Avenue, along with 15% dedicated to technology upgrades, particularly software licenses and equipment for an estimated 50 employees. Personnel costs often represent the most substantial portion, generally around 50%, covering salaries and benefits for staff, which can include healthcare and retirement plans. Project funding frequently encompasses specific initiatives, with a proposed 5% earmarked for community outreach programs to enhance local engagement in the downtown district. A detailed breakdown ensures financial transparency while setting clear priorities for the upcoming fiscal year.

Justification for expenses

An annual budget proposal requires a clear justification for expenses to ensure alignment with organizational goals and efficient resource allocation. Detailing projected costs for operational necessities, such as salaries, office supplies, and technology upgrades, is crucial. For instance, salary increments may reflect market trends and employee performance reviews, while investments in technology (e.g., software licenses costing approximately $5,000) can enhance productivity. Additionally, training programs (averaging $2,000 per session) foster employee development and improve service quality. Justification must also consider unexpected expenses, like maintenance or unforeseen events, with a contingency allocation of about 10% of the total budget. Articulating these elements provides stakeholders with a transparent understanding of the proposed financial plan.

Alignment with organizational goals

The annual budget proposal plays a crucial role in aligning financial resources with the organizational goals of XYZ Corporation, a leader in sustainable product development. A detailed analysis reveals a projected increase of 15% in revenue for the upcoming fiscal year, driven by the launch of innovative eco-friendly products in Q2, a strategic shift aimed at reducing carbon footprints. Allocating funds towards research and development will empower teams to enhance product efficiency, aligning with our commitment to sustainability. Furthermore, investments in employee training programs are expected to boost team productivity by 20%, directly supporting our organizational objective of fostering a skilled workforce. Through a well-structured budget, the proposal aims to ensure that each dollar spent contributes to achieving the overarching mission of XYZ Corporation, ultimately driving growth while maintaining environmental responsibility.

Metrics for success evaluation

Creating a comprehensive annual budget proposal requires a clear framework for evaluating the success of allocated funds. Important metrics include return on investment (ROI), which quantifies financial gains relative to expenditures; key performance indicators (KPIs) specific to departments, such as sales growth percentages or customer satisfaction scores; and budget variance analysis, which compares actual spending to budgeted figures. Additionally, stakeholder engagement metrics, such as feedback surveys from internal teams in multinational corporations, can provide insights into employee satisfaction with resources. Timely financial reporting, occurring quarterly, enables ongoing tracking of financial health against projected goals, ensuring that necessary adjustments are made throughout the fiscal year. Ultimately, these metrics play a vital role in demonstrating accountability and transparency in financial management.

Comments