Are you looking to implement a robust risk management framework within your organization? This article will guide you through the essential components and best practices to consider, ensuring that you effectively identify, assess, and mitigate potential risks. With a well-structured approach, your team can navigate uncertainties with confidence and safeguard your organization's assets. Dive into our comprehensive guide to learn how to create a tailored risk management framework that fits your needs!

Introduction of Risk Management Objectives

Risk management objectives provide a structured approach to identifying, assessing, and mitigating potential threats that could impact organizational goals. Effective risk management frameworks, such as ISO 31000, emphasize the importance of setting clear objectives, which not only enhance decision-making but also promote a culture of proactive risk awareness. Specific objectives may include maintaining compliance with regulatory standards, safeguarding assets valued over $1 million, protecting stakeholder interests during significant events (like mergers or natural disasters), and minimizing financial losses measured in percentage terms. Establishing these objectives enables organizations to align their risk management efforts with their strategic priorities, ensuring resilience and long-term sustainability in an increasingly complex business environment.

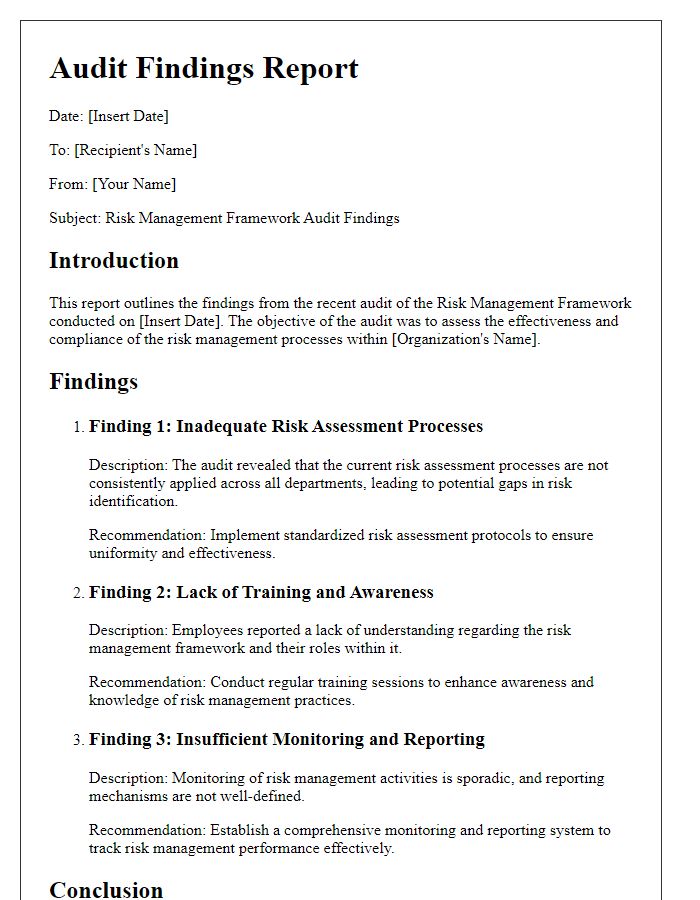

Outline of Risk Assessment Procedures

The risk assessment procedures encompass a systematic process designed to identify, evaluate, and prioritize risks that may impact an organization. This process begins with risk identification, focusing on potential threats such as financial instability, operational disruptions, and compliance failures. Utilizing methodologies like qualitative and quantitative analysis, each risk is then assessed based on its likelihood of occurrence and potential impact on business objectives, including metrics such as estimated financial loss or reputational damage. Following assessment, risks are categorized, and risk response strategies are developed, including mitigation measures, acceptance plans, or contingency actions. Regular monitoring and review cycles are established to ensure the effectiveness of risk management strategies, with continual updates to the risk register to reflect emerging threats or changes in the organizational landscape. Documentation occurs throughout, providing a comprehensive audit trail of decisions and actions taken in the risk management framework.

Description of Risk Mitigation Strategies

Effective risk mitigation strategies encompass various approaches to identify, assess, and reduce potential threats within an organization's operational framework. These strategies often involve risk avoidance, where activities are modified or omitted to eliminate specific risks, particularly in high-stakes environments such as healthcare or finance. Risk transfer is another crucial strategy, utilizing insurance policies to shift the financial burden of potential losses to third parties, which may safeguard assets worth millions. Implementing robust training programs enhances risk awareness among employees, ensuring compliance with industry regulations and minimizing human error incidents. Regular audits, often required in sectors like manufacturing or technology, help to detect vulnerabilities in processes or systems, leading to timely corrective actions. Furthermore, adopting advanced technologies, such as predictive analytics and artificial intelligence, allows organizations to monitor risk factors continuously, facilitating proactive rather than reactive management.

Roles and Responsibilities Assignment

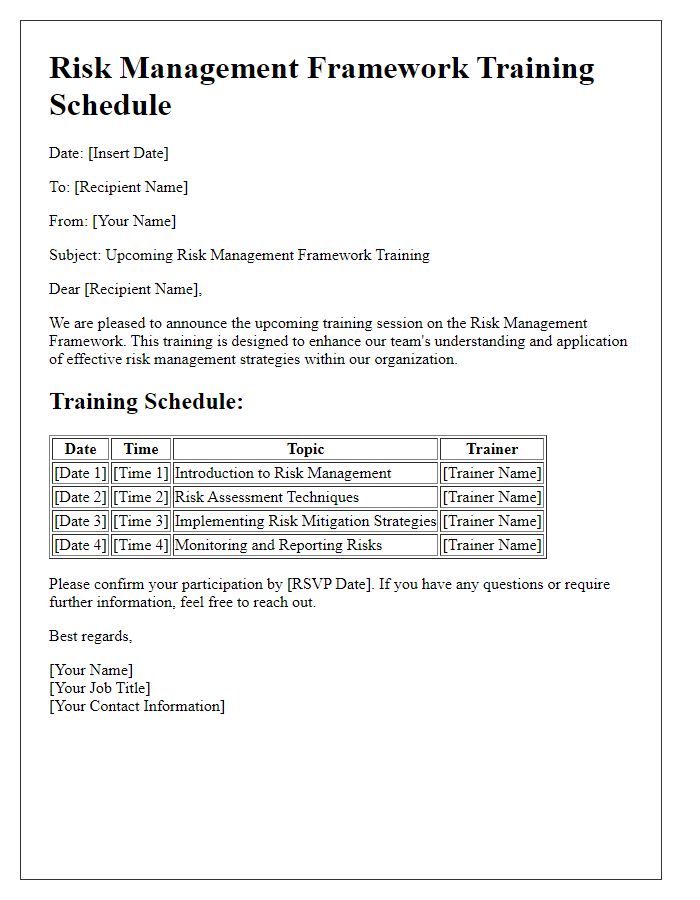

The Risk Management Framework (RMF) outlines the roles and responsibilities within organizations to effectively manage risks, enhance decision-making, and improve overall performance. Each team member, including risk managers, compliance officers, and department heads, plays a vital role in risk identification, assessment, and mitigation. Risk managers oversee the development and implementation of risk strategies, ensuring alignment with organizational objectives. Compliance officers monitor adherence to regulations, while department heads are responsible for integrating risk management practices into daily operations. Regular training sessions are essential for building awareness and competency across all levels of staff. Enhanced communication channels facilitate the reporting of potential risks, ensuring timely responses. All stakeholders must understand their specific responsibilities in creating a culture of risk awareness and accountability, essential for the organization's sustainability and success.

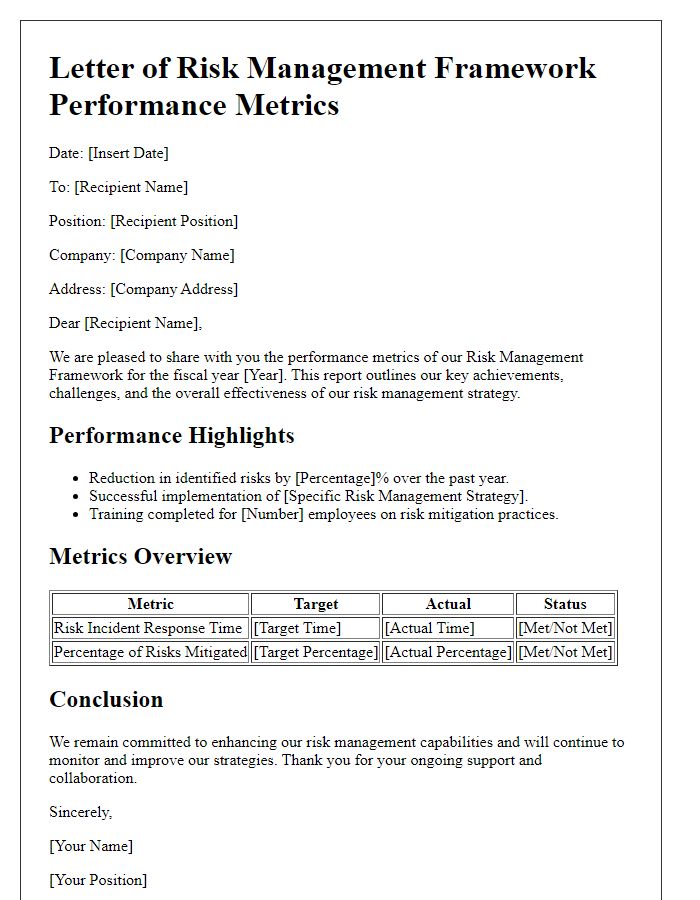

Monitoring and Reporting Framework

The Monitoring and Reporting Framework for risk management focuses on systematic tracking of potential risks within an organization, ensuring timely identification and mitigation. This framework includes the establishment of Key Risk Indicators (KRIs), which are metrics used to monitor the probability and impact of identified risks. Regular reporting intervals, such as quarterly reviews, facilitate assessments of risk exposure and management effectiveness. Stakeholders, including risk management officers and executive leadership teams, receive comprehensive reports detailing risk status, trends, and any necessary escalations. Tools like risk dashboards and heat maps visually represent risk levels, aiding in strategic decision-making. Furthermore, compliance with industry standards, such as ISO 31000 for risk management, reinforces the organization's commitment to transparent and accountable practices. The framework emphasizes communication channels for feedback and continuous improvement, ensuring that risk management is an evolving process aligned with organizational goals.

Comments