Are you ready to dive into the world of annual budget planning? This critical yet often overlooked process not only helps organizations allocate their resources effectively but also sets the stage for future growth and success. Whether you're a seasoned finance professional or new to the budgeting game, understanding the nuances of budget preparation can empower you and your team. Join us as we explore key strategies and insights that will make your annual budget planning process smoother and more impactful!

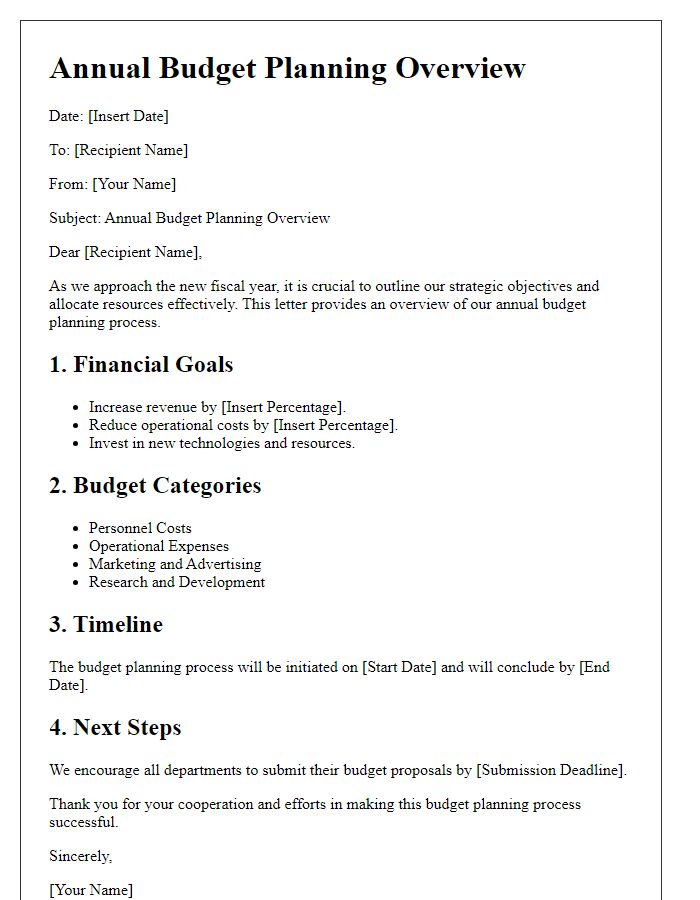

Date and recipient's information placement

The annual budget planning notification informs stakeholders about the financial allocations for the upcoming fiscal year. This document, typically dated at the start of the planning cycle, outlines strategic priorities, financial forecasts, and expected expenditures. It may include recipient information such as department names, roles, and responsibilities to ensure clarity and accountability. Distribution occurs through emails or official memos to facilitate structured dialogue and feedback during the budgeting process, fostering collaboration among finance teams and department heads.

Concise introduction with purpose statement

The annual budget planning notification outlines the strategic financial roadmap for the upcoming fiscal year, emphasizing key allocations and funding priorities. This proactive communication aims to ensure all departments align their objectives with the organization's financial goals, fostering transparency and collaboration. By providing clarity on budget timelines and expectations, stakeholders can effectively prepare for upcoming financial assessments and resource allocations.

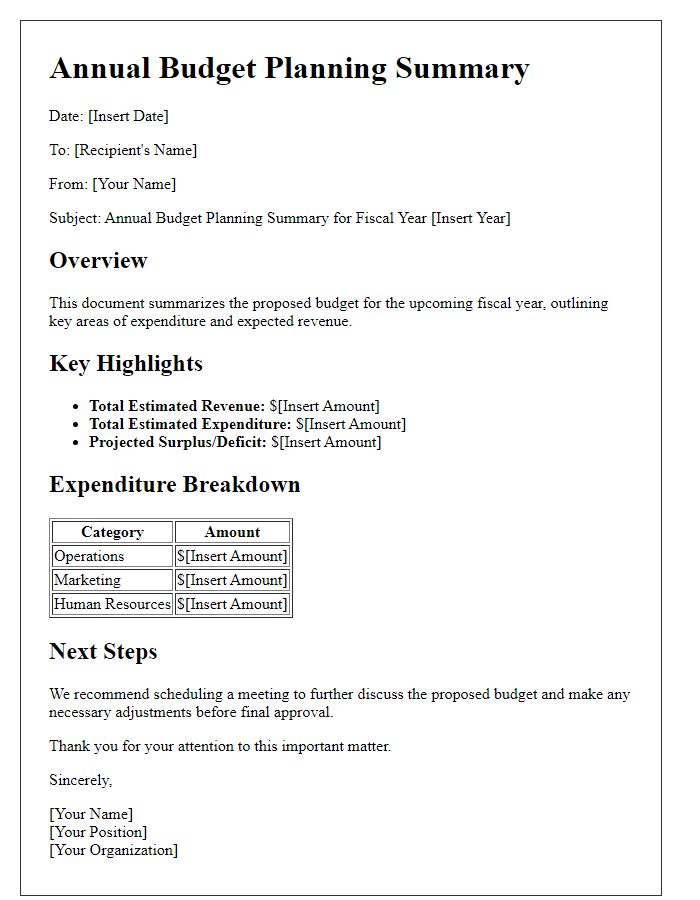

Summary of key budget highlights and changes

The annual budget proposal for the fiscal year includes several key highlights that underscore strategic fiscal responsibility and resource allocation priorities. Total projected revenues are estimated at $5 million, reflecting a 10% increase compared to last year. Major changes include an allocation of $1.5 million for infrastructure improvements, which encompasses road repairs and public facility upgrades in downtown Springfield (home to over 50,000 residents). Additionally, an increase in funding for educational programs by 15% is set to support local schools, impacting approximately 3,500 students. The healthcare sector will also receive expanded investments, targeting clinics serving underprivileged communities, estimated to affect 12,000 individuals. Finally, adjustments in departmental budgets aim to enhance efficiency, with specific reductions in administrative overhead by 5%, allowing for increased funds to directly support community services.

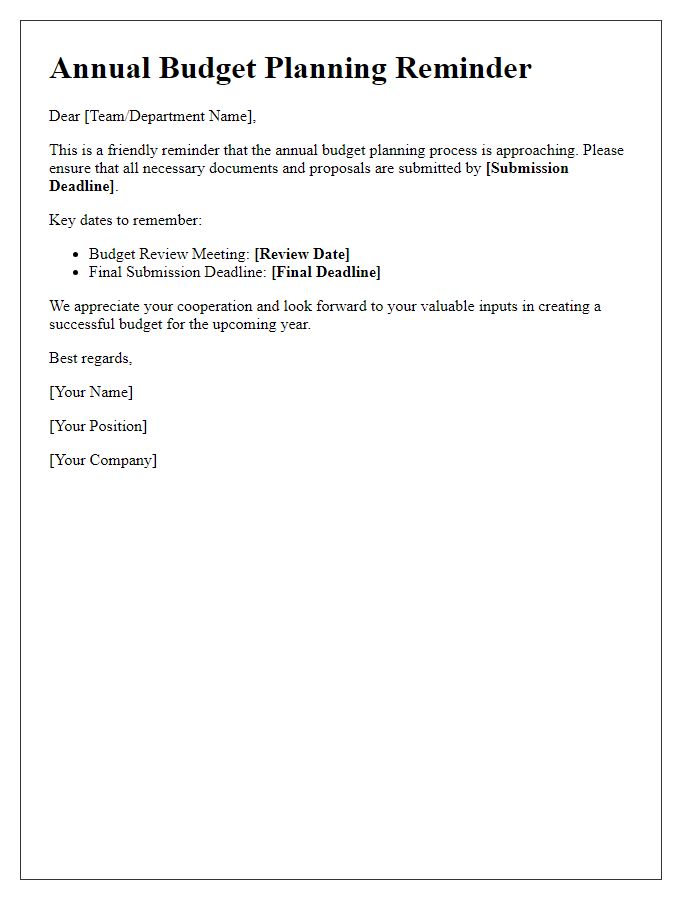

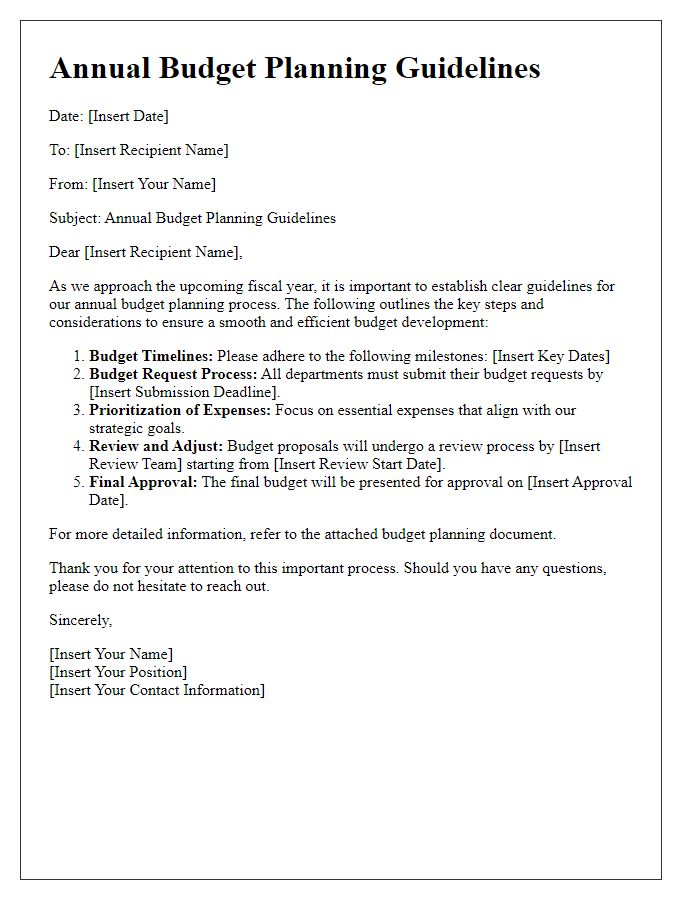

Clear guidelines and deadlines for feedback or action

Annual budget planning requires meticulous attention to detail and adherence to set deadlines. This year, all department heads must submit their budget proposals by October 15, 2023. Detailed guidelines encompass all expenditures, including operational costs, capital projects, and personnel expenses. Review sessions are scheduled for the week of October 23, allowing for constructive feedback. Final adjustments must incorporate suggestions from previous meetings. The completed budget will be presented to the Board of Directors on November 10. Timely submissions ensure alignment with organizational goals and sufficient time for revisions.

Contact information for further inquiries and support

The annual budget planning notification process is crucial for organizations to efficiently allocate resources. Contact information plays an essential role in facilitating smooth communication. Designated personnel, such as financial officers or budget coordinators located at the headquarters, typically handle inquiries. Their phone number might be (123) 456-7890, and email addresses generally follow the format name@organization.com. Additionally, support might be available through a dedicated helpline or chat service to assist with various budget-related questions or concerns. Prompt responses to inquiries ensure clarity in budget planning, critical for effective organizational operations.

Comments