Are you curious about how changes in loan interest rates can impact your financial future? Navigating the world of loans can be daunting, especially when it comes to understanding the nuances of interest rates. Whether you're looking to consolidate debt, buy a home, or refinance your existing loans, being informed is key to making empowered financial decisions. Join us as we delve deeper into this important topic and explore everything you need to know!

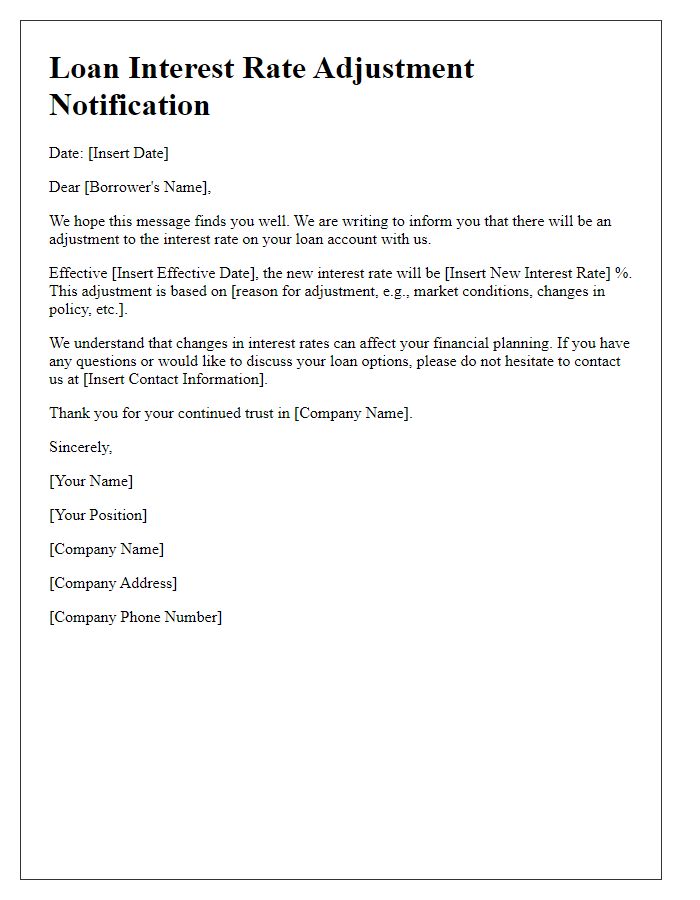

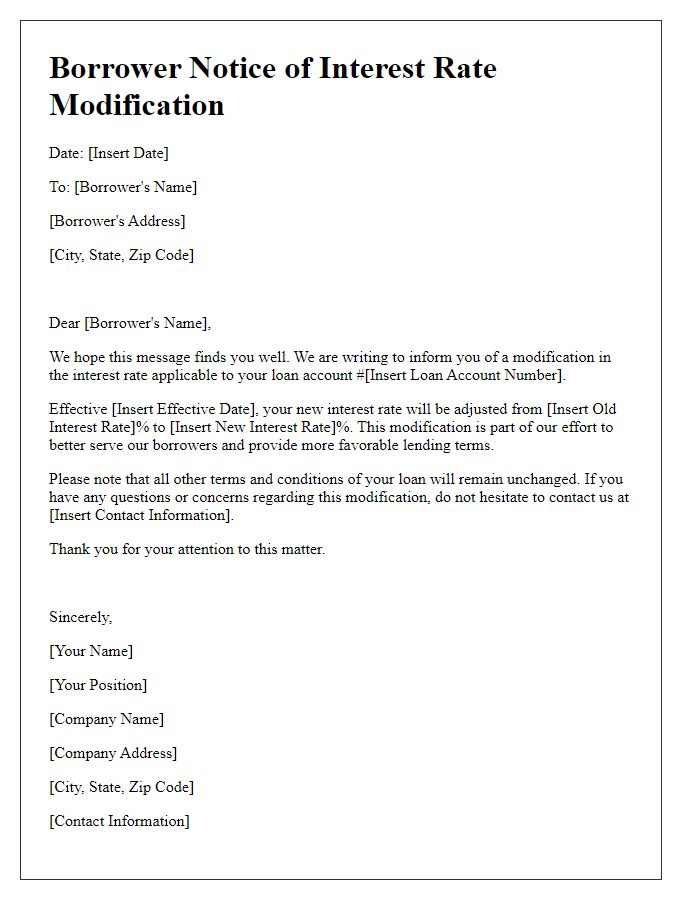

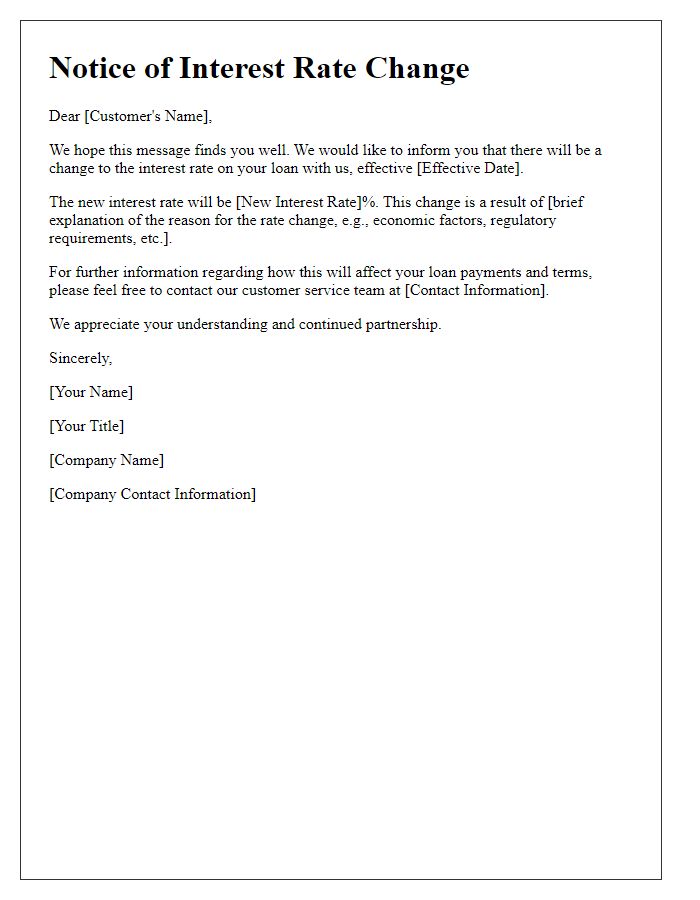

Loan account details

In finance, a loan interest rate change can significantly impact borrowers, such as those with adjustable-rate mortgages (ARMs) or personal loans. Effective interest rates can fluctuate based on economic indicators like the Federal Reserve's interest rate adjustments, which can occur several times a year. For example, a loan account with a principal amount of $250,000 may face changes in monthly payments depending on a new interest rate of 3% versus a previous rate of 2.5%. Borrowers in major cities, such as New York or San Francisco, often experience these fluctuations acutely due to regional economic conditions. Understanding loan terms, including amortization schedules and payment deadlines, is crucial for managing these changes effectively.

Current interest rate

The current interest rate for personal loans, such as those offered by major financial institutions like Chase Bank or Wells Fargo, stands at approximately 6.5% as of October 2023. This percentage applies to borrowers with a strong credit history, with potential rates varying from 4% to 12%, depending on individual credit scores and financial profiles. Changes in the Federal Reserve's monetary policy significantly impact these rates, which can fluctuate based on economic indicators like inflation rates and employment statistics. Additionally, the average loan term of 36 to 60 months determines the total interest paid over the life of the loan, influencing the overall cost for consumers.

New interest rate

The recent adjustment in interest rates imposed by the Federal Reserve, which affected numerous financial institutions, now leads to a new interest rate of 4.75% for fixed-rate mortgages. This modification impacts borrowers nationwide, especially in popular housing markets such as Los Angeles and New York City, where mortgage rates are closely monitored. As of November 2023, this increase can result in heightened monthly payments for homeowners, significantly affecting housing affordability and overall economic conditions. Borrowers are encouraged to review their loan agreements and consider refinancing options in light of these changes.

Effective date of change

Effective July 1, 2023, the new loan interest rate of 5.25% will be implemented for all active mortgage accounts at ABC Bank, based in New York City. This adjustment follows recent changes in market conditions, including fluctuations in the Federal Reserve's federal funds rate, which influences lending rates nationwide. Borrowers will receive detailed statements reflecting this update by June 20, 2023, ensuring transparency about any adjustments to monthly payments or outstanding balances. Customers can consult with loan officers for personalized assessments or alternative financing options to mitigate the impact of this rate alteration on their financial plans.

Contact information for inquiries

Changes in loan interest rates can significantly impact borrowers' financial planning and budgeting. When lenders adjust their rates, specific notification methods (such as direct mail or email) typically inform customers effectively. For inquiries regarding loan interest rate changes, borrowers should contact the lender's customer service department, often accessible via a dedicated 1-800 phone number or online chat feature available on the official website. Additionally, email communication could be directed to a designated address for loan-related queries, ensuring swift responses from knowledgeable representatives. Understanding loan terms, including any new rates (e.g., fixed or variable) and effective dates, is crucial for making informed financial decisions.

Comments