Are you ready to take the plunge into your next adventure? Whether you're planning a dream vacation, gearing up for a new hobby, or treating yourself to that special something, securing a recreational loan can make all the difference. In this article, we'll explore the ins and outs of understanding your loan acceptance letter, so you know exactly what to expect. Join us as we dive deeper into this crucial step in your journey!

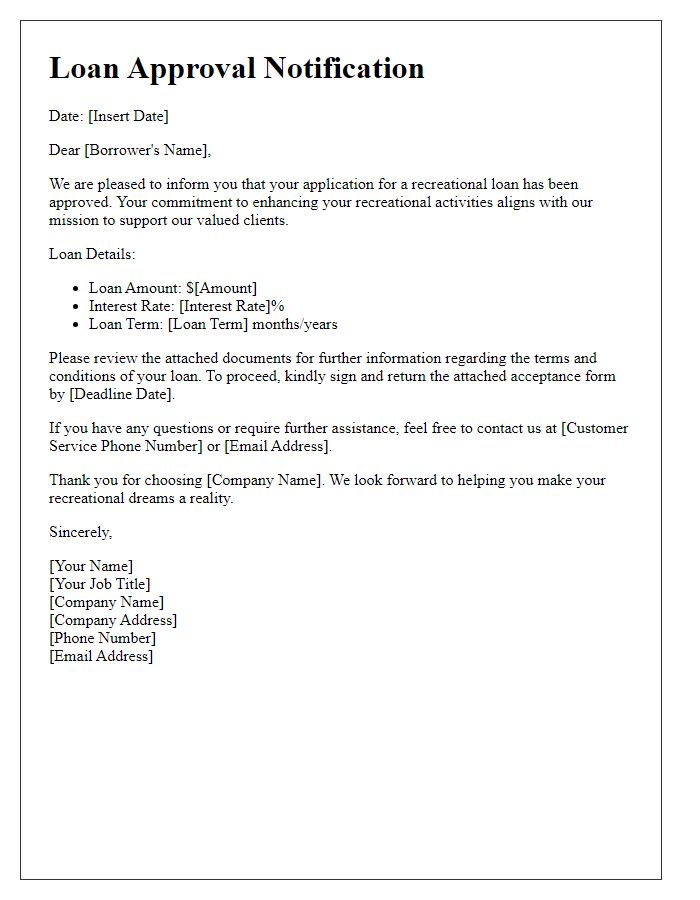

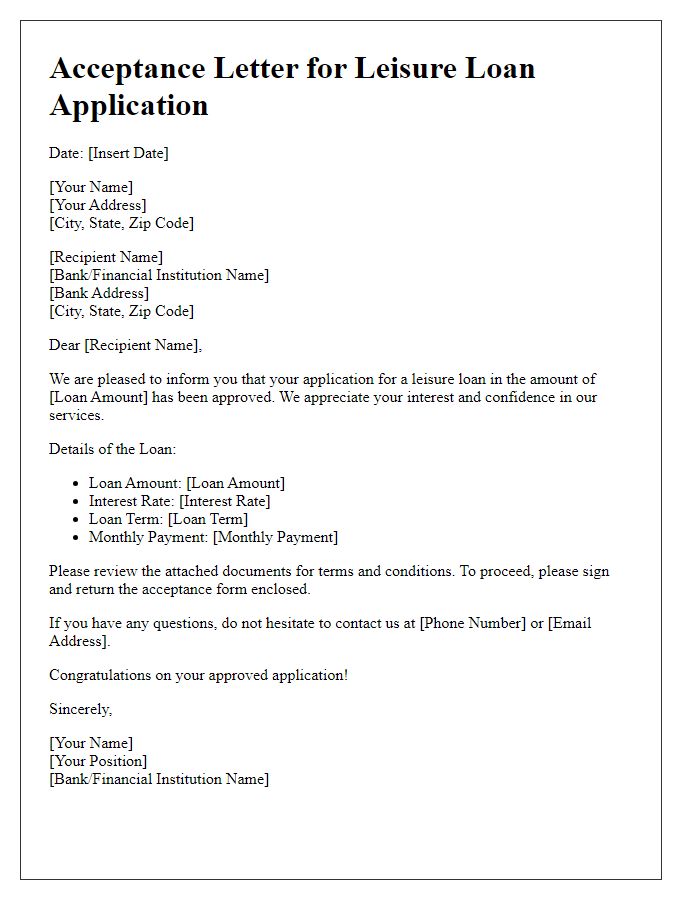

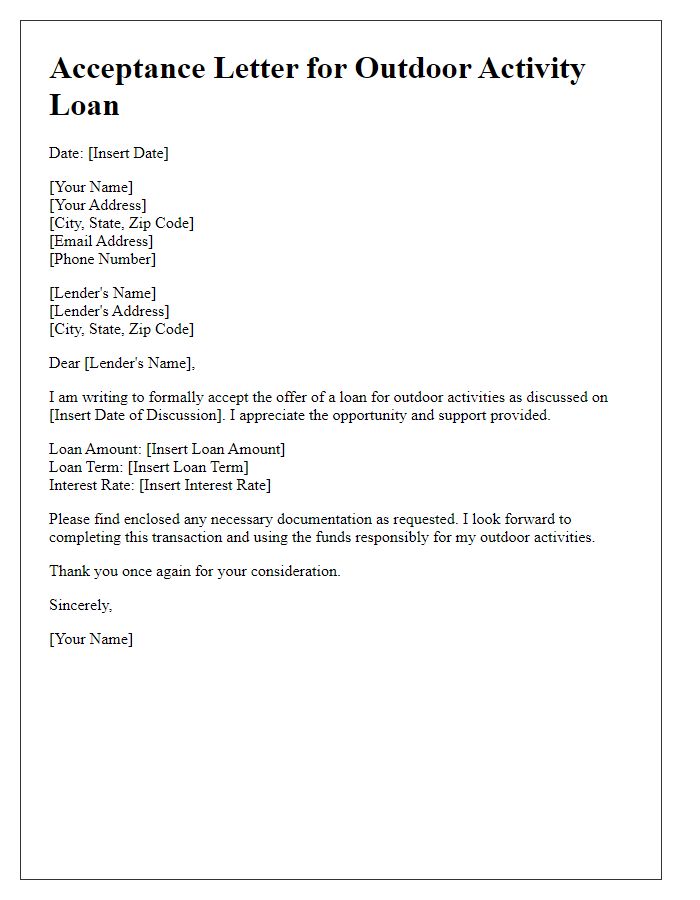

Borrower's Details and Loan Information

The recreational loan acceptance process typically involves assessing the borrower's financial situation and confirming details such as loan amount and terms. Borrowers often provide personal information including their full name, address, and contact information. Loan information includes the specific amount approved, interest rates, repayment terms, and duration. The loan may be intended for financing recreational activities or purchases such as a boat, RV, or vacation. Lenders meticulously review credit scores, income, and existing debts to ensure the borrower can manage the repayment effectively. Acceptance letters formalize the agreement, outlining the next steps for the borrower and the lender's obligations.

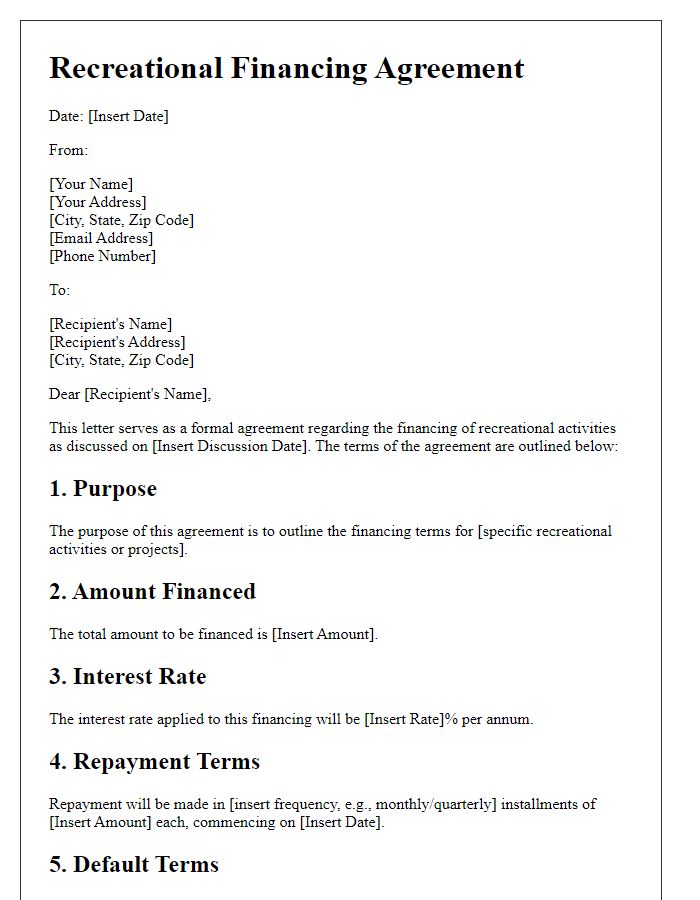

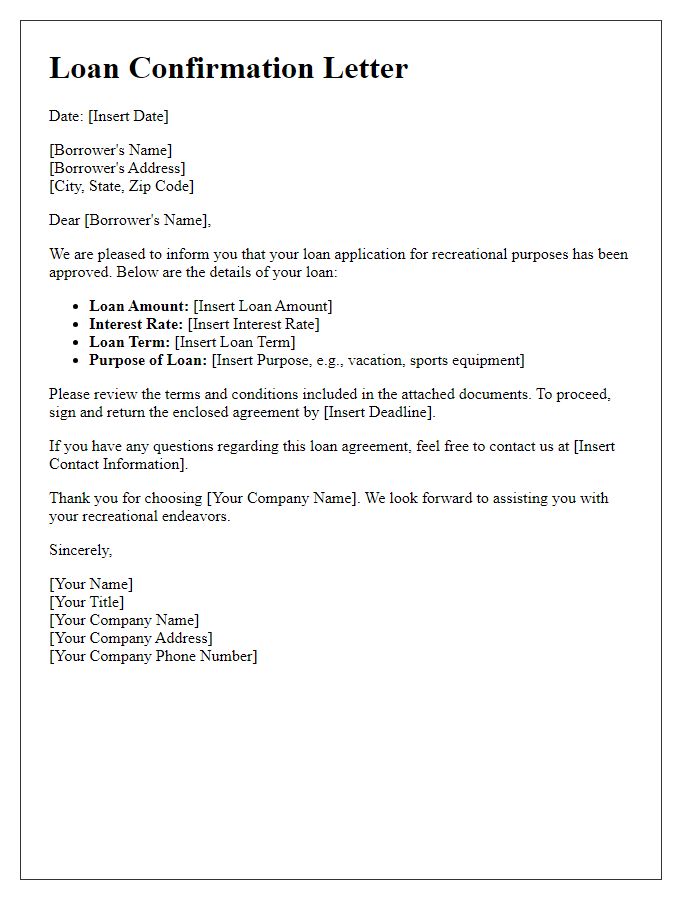

Loan Terms and Conditions

Recreational loans are typically associated with financing leisure activities or purchases, such as boats, RVs, or jet skis. These loans often have specific terms and conditions that borrowers must adhere to. The loan amount can range from $5,000 to $50,000, with interest rates average around 6% to 10% depending on credit scores and the lender. Repayment periods frequently span from three to seven years, allowing flexibility in monthly payments. Borrowers are usually required to provide proof of income and may need to submit a down payment ranging from 10% to 20% of the total purchase price. It's crucial to review loan documentation to understand any fees involved, like origination fees or prepayment penalties, which could impact overall loan costs. Defaulting on recreational loans may risk the repossession of the financed asset, so responsible budgeting and timely payments are essential for maintaining ownership and financial health.

Repayment Schedule and Interest Rate

Recreational loans can enable individuals to invest in leisure activities such as camping or boating. These loans typically feature repayment schedules ranging from 12 to 60 months, depending on the amount borrowed and borrower's financial profile. Interest rates on recreational loans may vary significantly, often ranging from 3% to 15%, influenced by factors like credit scores or lender policies. Understanding these financial terms is crucial for borrowers in places such as California or Texas, where recreational activities can have associated costs. Adhering to the repayment schedule can help maintain a healthy credit score and ensure the enjoyable recreational activity remains financially manageable.

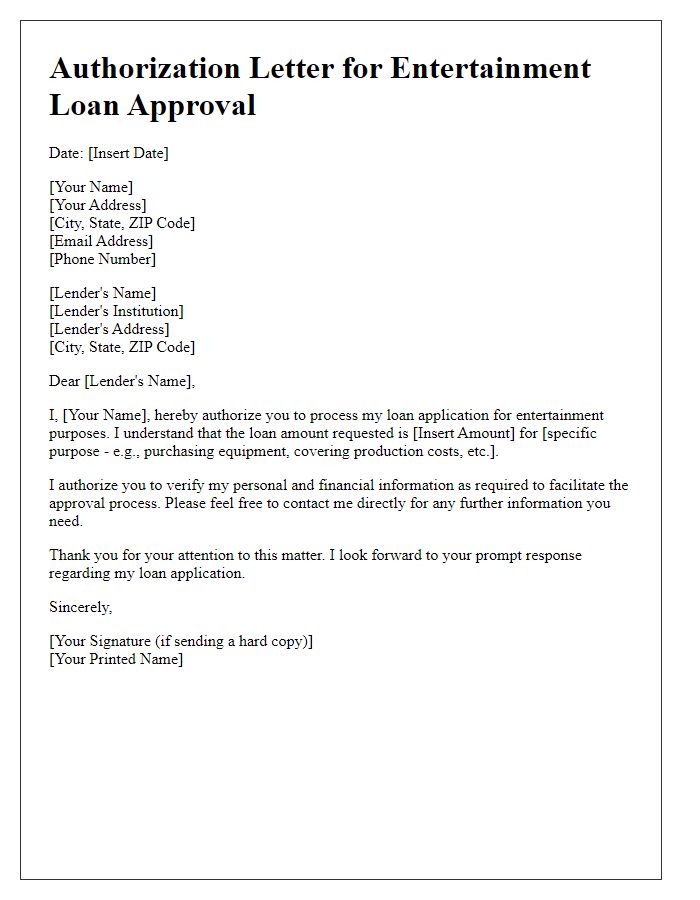

Necessary Documentation and Requirements

Recreational loan acceptance requires specific documentation and requirements to ensure a smooth approval process. Identifying personal information such as the applicant's Social Security Number (SSN) and proof of identity through a government-issued ID like a driver's license is essential. Financial documentation must include recent bank statements (usually from the last 30 days) and proof of income, such as pay stubs or tax returns from the previous year. Additionally, if the loan is for a specific recreational vehicle like an RV or a boat, details including the vehicle's make, model, year, and Vehicle Identification Number (VIN) are required. Lastly, a credit report will be evaluated to assess the applicant's creditworthiness; a minimum credit score of 650 is often necessary for approval. These comprehensive requirements help lenders assess the risk associated with the loan and ensure responsible borrowing.

Contact Information for Queries and Support

The acceptance of a recreational loan application signifies the agreement to support individuals in funding leisure activities, such as purchasing boats, RVs, or cabin retreats. This letter typically includes vital information about the loan amount, interest rates, and repayment terms. Contact details for queries encompass phone numbers, email addresses, or office locations, ensuring applicants can seek assistance or clarification. The presence of customer support representatives enhances the experience by providing guidance throughout the loan process and addressing concerns efficiently. Clear communication channels foster transparency and trust between the lender and the borrower, crucial for a successful financial partnership.

Comments