Congratulations on becoming a new homeowner! This exciting journey can often be accompanied by a plethora of financial questions and challenges, especially when it comes to securing the right loan support. Whether you're navigating interest rates, understanding mortgage options, or seeking advice on budgeting, it's essential to have the right information at your fingertips. Join us as we explore the various types of loan support available for new homeowners and how to make the most of them!

Personalization and Recipient Information

New homeowners often seek loan support to assist with purchasing their first properties, navigating finances, and understanding mortgage options. Customized communication is essential for addressing individual circumstances, such as credit scores, income levels, and specific housing markets like those in Chicago, Illinois, or Austin, Texas. Key details include loan types available, interest rates (current average rates around 3.5% for fixed-rate mortgages), and down payment assistance programs, which can significantly reduce initial financial burdens. Financial advisors play a crucial role in providing personalized guidance tailored to different borrower profiles, ensuring that each new homeowner receives relevant information to make informed decisions during this crucial transition.

Clear Purpose Statement

New homeowner loans provide essential financial assistance to individuals and families embarking on their journey of homeownership, particularly in vibrant markets such as Los Angeles and Chicago. These loans typically aim to support first-time buyers in acquiring properties amidst rising housing costs, often exceeding $400,000 in these areas. Programs aimed at new homeowners often offer lower interest rates or down payment assistance, making homeownership more accessible. Local government initiatives and non-profit organizations may collaborate to provide educational resources about the home-buying process. Additionally, specialized loan products, such as FHA loans, cater specifically to lower-income buyers, ensuring that they can fulfill their dream of owning a home without overwhelming financial burdens.

Loan Details and Terms

New homeowners should be aware of crucial loan details and terms associated with their mortgage agreements, such as interest rates, which may range from 3% to 7% annually, depending on credit scores and market conditions. Loan amounts typically fluctuate, with averages between $200,000 and $500,000 for suburban properties in the United States. Repayment periods often extend from 15 to 30 years, influencing monthly payment amounts significantly. Additional costs include private mortgage insurance (PMI) requirements for loans with down payments below 20%. Homeowners should also consider prepayment penalties, which can incur fees if loans are paid off early, and understand the implications of adjustable-rate mortgages (ARMs), where interest rates can increase after a fixed period, impacting overall financial planning.

Contact Information for Assistance

New homeowners seeking loan support can contact local housing assistance programs for financial guidance. Agencies like the U.S. Department of Housing and Urban Development (HUD) offer resources in various cities, including New York City and Los Angeles. For example, the HUD website provides information on first-time homebuyer assistance programs, available grants, and low-interest loan options. Additionally, state-specific programs often exist to help with down payment assistance, particularly in states like California or Texas. Local credit unions, such as Navy Federal Credit Union, also frequently provide specialized loan programs tailored for new homeowners. Outreach to these organizations can facilitate informed decisions and enhance the home-buying experience.

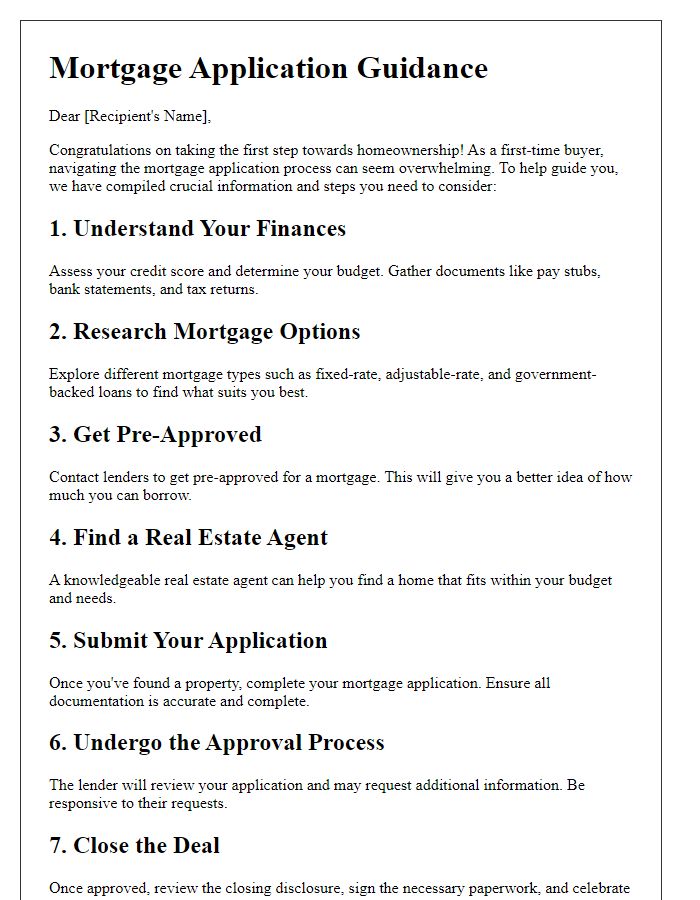

Call to Action and Next Steps

New homeowners often seek financial support to ease the transition into their first property. Various loan programs exist to assist with purchasing homes, such as FHA Loans (Federal Housing Administration Loans) specifically designed for low-to-moderate income buyers. The first step involves researching eligible loan types, including conventional loans and USDA loans for rural areas. Interested homeowners should gather necessary documents, such as income verification (pay stubs, tax returns) and credit reports, to streamline the application process. Additionally, connecting with local housing counselors through programs sanctioned by the Department of Housing and Urban Development (HUD) can provide valuable guidance tailored to specific circumstances. Exploring state-based assistance options can also uncover potential grants or subsidies available to first-time buyers. Empower your homeownership journey by taking actionable steps today.

Letter Template For New Homeowner Loan Support Samples

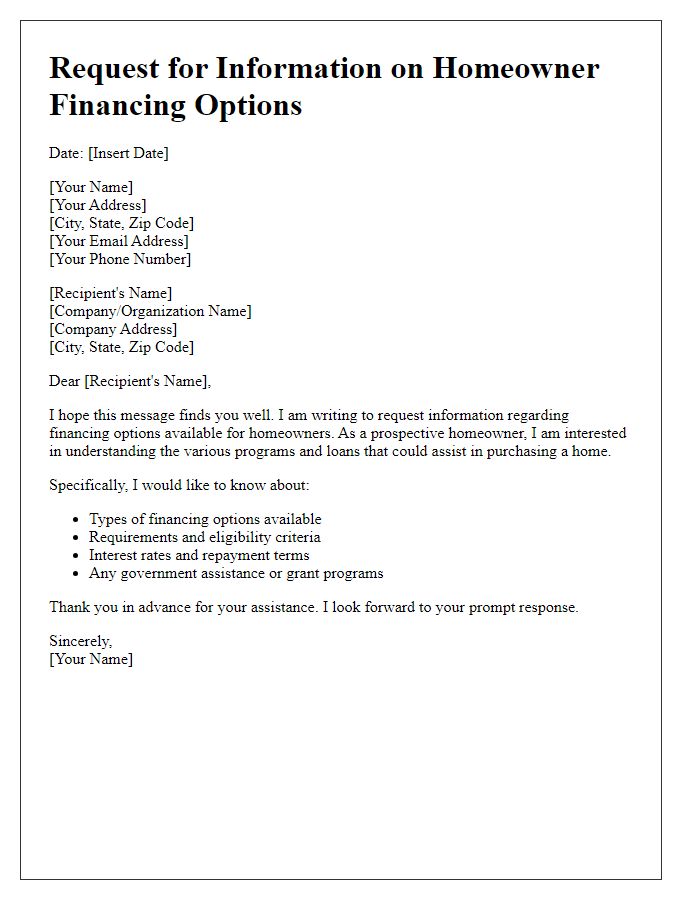

Letter template of information request regarding homeowner financing options

Comments