Are you thinking about securing a small business loan to fuel your entrepreneurial dreams? Writing a compelling loan application letter is crucial in showcasing your business's potential and financial needs. In this article, we'll walk you through a straightforward template that can help you articulate your vision, outline your goals, and make a strong case for funding. Let's dive in and explore how you can craft an effective loan application that stands out from the crowd!

Business Information

Small businesses often seek financial assistance to fuel growth and development. When applying for a small business loan, it is essential to provide comprehensive business information. This includes the business name, such as "Green Leaf Gardening Services," established in 2019, located in Austin, Texas, a city known for its booming startup culture. The application should also detail the business structure, whether it's a sole proprietorship, LLC, or corporation. Furthermore, include the number of employees (e.g., 10 full-time staff), annual revenue figures (such as $250,000 in 2022), and industry type, like landscaping and gardening. Additionally, supplying a business plan that outlines objectives, target markets, and financial forecasts can provide lenders with necessary context for assessing loan viability and repayment capability.

Loan Amount and Purpose

Applying for a small business loan often involves detailing the requested loan amount and its intended purpose. A typical application may specify a loan amount, such as $50,000, aimed at expanding business operations. This amount could fund critical areas such as inventory purchase, marketing initiatives, and equipment upgrades in a specific industry, like retail or manufacturing. For instance, a small artisanal bakery might seek funding to acquire commercial ovens and expand its product line. Clear articulation of the loan purpose demonstrates a solid business plan and can enhance the lender's confidence in the potential for growth and repayment.

Financial Statements

A well-prepared financial statement is crucial for small business loan applications, showcasing the financial health of a business entity, such as a cafe or retail store. The income statement outlines revenues, expenses, and profit over a specific period, providing insights into profitability and operational efficiency. The balance sheet reflects assets, liabilities, and overall equity at a specific point in time, helping lenders assess the company's financial stability. Cash flow statements demonstrate the inflow and outflow of cash, indicating the business's ability to maintain liquidity and meet obligations. Details include percentages, monetary values, and comparison against industry standards, enhancing the lender's confidence in the business's financial integrity and future performance.

Repayment Plan

A well-structured repayment plan is crucial for securing a small business loan. This plan outlines how a business intends to repay the borrowed amount over a specified period. Key components include monthly payment amounts, interest rates, and loan duration. For instance, if a business borrows $50,000 with an interest rate of 5% for a term of five years, the monthly payment would be approximately $943.74. This breakdown provides transparency to lenders. Identifying revenue sources, such as projected monthly sales of $20,000, helps demonstrate the capacity to meet these obligations. Including a contingency plan, like securing additional income streams or a savings buffer, further reassures lenders about repayment reliability.

Owner's Background and Experience

Small business loan applications require an in-depth understanding of the owner's background and experience to assess suitability for financial assistance. The business owner, often with a significant history in entrepreneurship, may possess a degree in Business Administration from a reputable institution such as Harvard University or Stanford University, enhancing credibility. Previous experience might include operating a successful retail shop in downtown Chicago for over five years, where skills in inventory management and customer service were honed. The owner may also have completed specialized training in financial management, equipping them to effectively oversee budgeting and accounting processes. Participation in local business networks or mentorship programs, like SCORE, reflects a commitment to continual professional development. Demonstrated financial acumen and an understanding of market trends are vital aspects, showcasing the ability to adapt and thrive in competitive environments.

Letter Template For Small Business Loan Application Samples

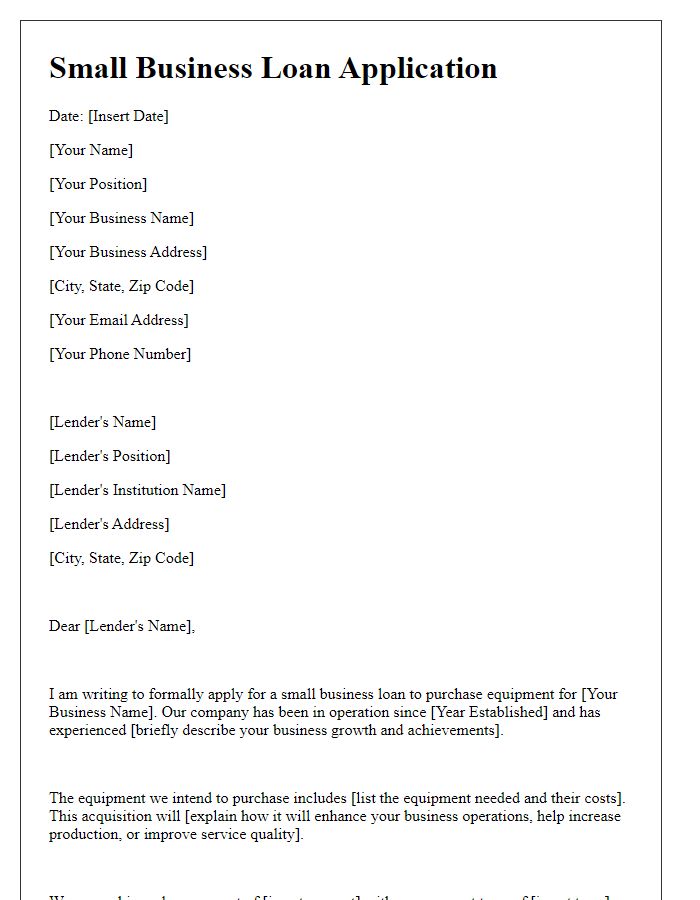

Letter template of small business loan application for equipment purchase

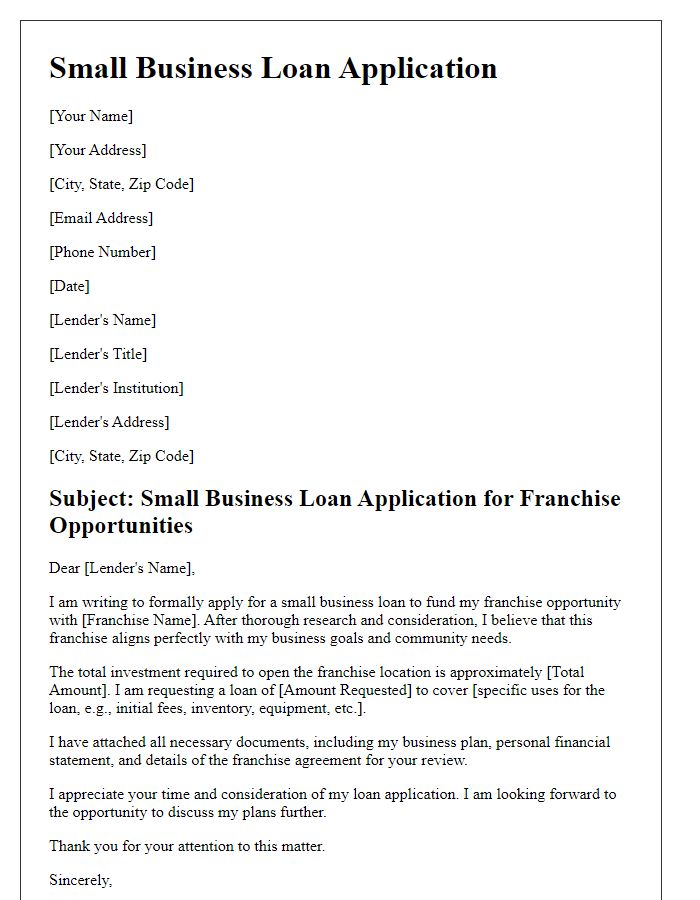

Letter template of small business loan application for franchise opportunities

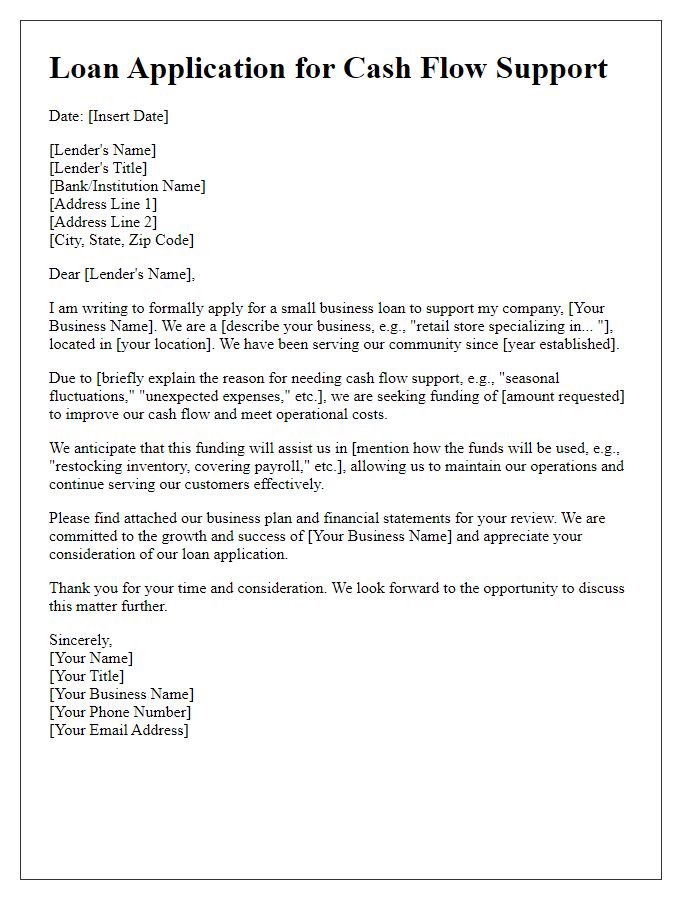

Letter template of small business loan application for cash flow support

Letter template of small business loan proposal for inventory acquisition

Comments