Are you a nonprofit organization navigating the complex world of legal compliance? Understanding the ins and outs of regulations is crucial for maintaining your organization's credibility and mission. In this article, we'll guide you through essential legal compliance strategies specifically tailored for nonprofits. Stick around to uncover practical tips that can help your organization stay on the right side of the law!

Organizational Structure

Nonprofit organizations, such as 501(c)(3) entities, require a clear organizational structure to ensure compliance with federal and state regulations. The governing board, comprised of individuals with diverse skills and backgrounds, plays a crucial role in oversight and decision-making processes. Each board member typically serves a term of three years, with a maximum of two consecutive terms, adhering to the guidelines established by the organization's bylaws. Additionally, the executive director, responsible for day-to-day operations, reports directly to the board, ensuring accountability and effective management. Committees, often formed for specific tasks like fundraising or finance, enable specialized focus and enhance operational efficiency. Proper documentation of meetings and decisions is essential for transparency and adherence to legal requirements, safeguarding the organization's tax-exempt status. Regular reviews of bylaws and organizational policies are necessary to remain compliant with evolving legal standards and best practices.

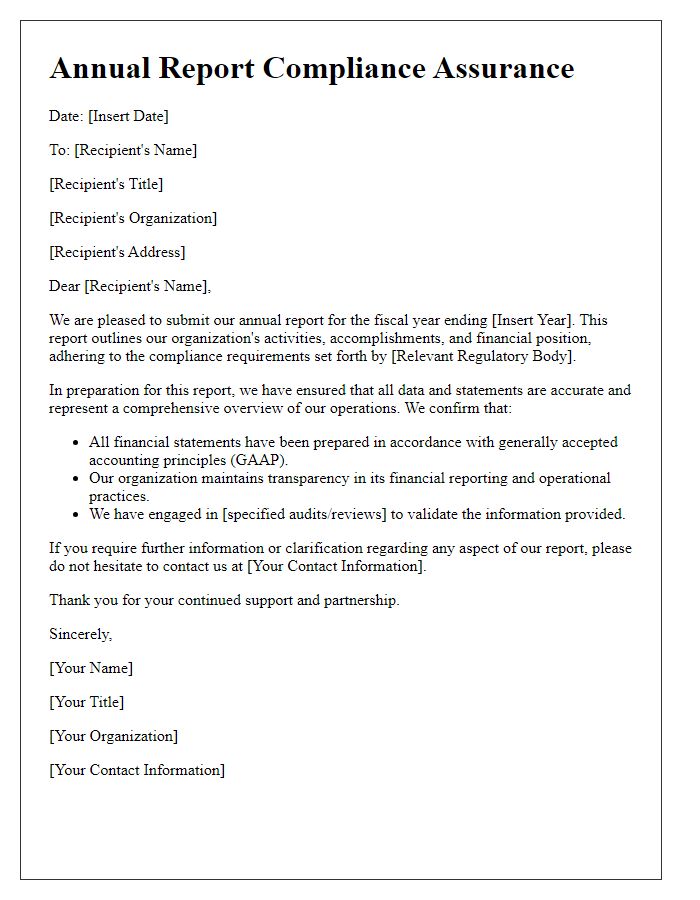

Regulatory Requirements

Nonprofit organizations must adhere to regulatory requirements to maintain their legal status and fund eligibility. Compliance with federal laws, such as the Internal Revenue Service (IRS) regulations, is critical for 501(c)(3) entities to ensure tax-exempt status. State regulations, often enforced by state charity officials, mandate registrations and periodic reporting. Additionally, adherence to the Sarbanes-Oxley Act (SOX) establishes standards for financial practices, aiming to prevent fraud and protect donors' interests. Regular audits by independent auditors enhance transparency and accountability, reinforcing public trust. Nonprofits are also subject to grant compliance requirements, which may include specific financial reporting and programmatic performance measures set by funding agencies. Understanding these legal frameworks helps ensure that organizations operate within the law, safeguarding their mission and community support.

Tax Exemption Status

Nonprofit organizations often seek tax exemption status under Internal Revenue Code Section 501(c)(3) to take advantage of benefits such as federal tax deductions for donors and state-level privileges. Achieving this status requires adherence to specific guidelines set by the Internal Revenue Service (IRS), including the submission of Form 1023, which details the organization's charitable purpose, governance, and financial data. Organizations must demonstrate their commitment to serving the public interest and refrain from political campaigning or private benefit to maintain compliance. Annual reporting through Form 990 is also mandatory to ensure transparency and accountability, allowing stakeholders to assess the nonprofit's financial health and operational effectiveness.

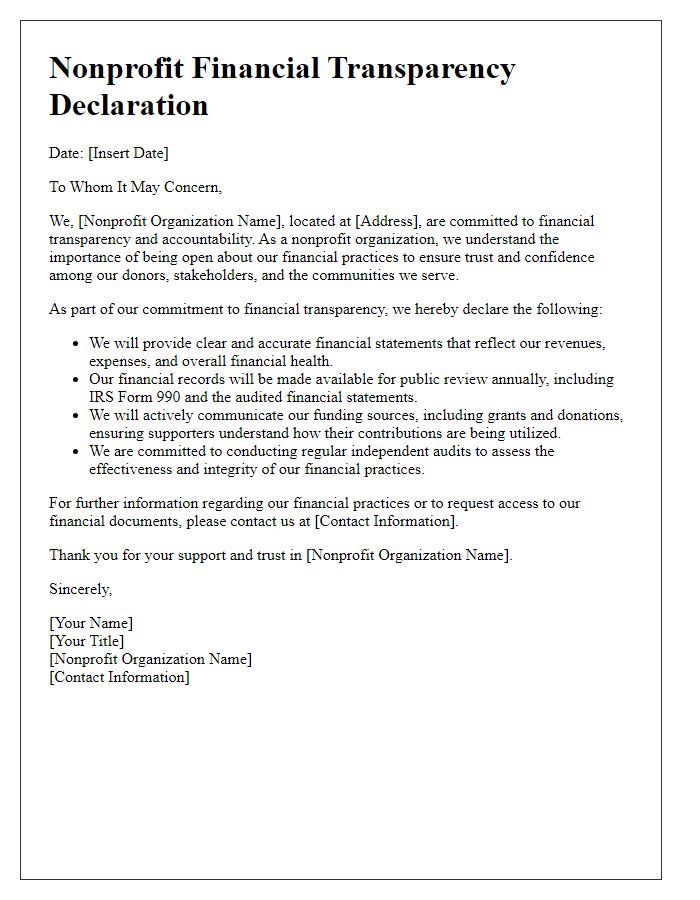

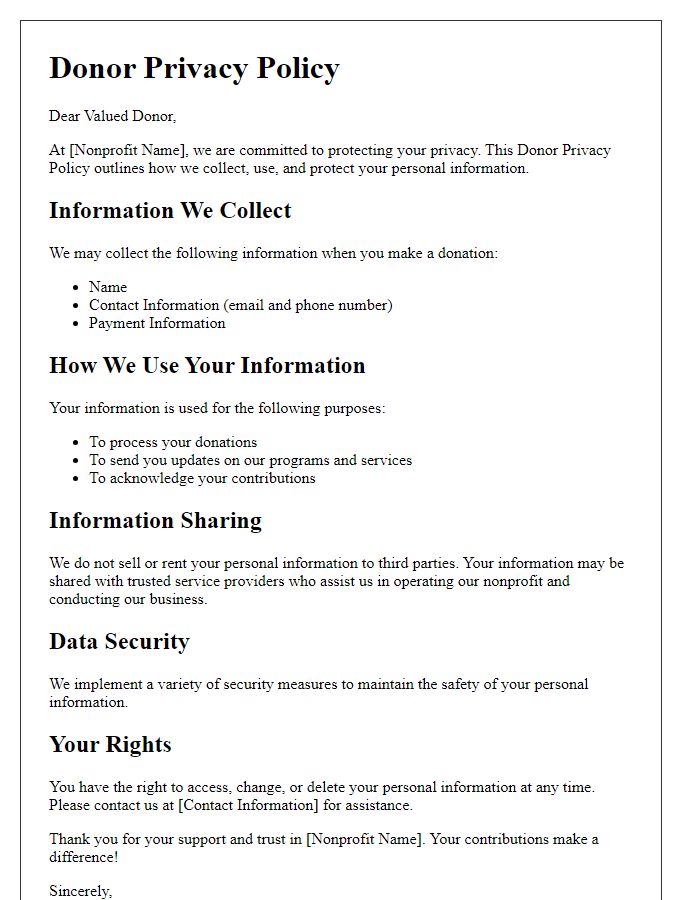

Financial Transparency

Financial transparency is crucial for nonprofit organizations, ensuring accountability to stakeholders and donors. Compliance with regulations set forth by the Internal Revenue Service (IRS) is essential, as it involves submitting Form 990 annually, which details revenue, expenses, and executive compensation. Nonprofits are encouraged to conduct independent audits, usually performed by certified public accountants (CPAs), providing an objective review of financial statements. Transparency about the allocation of funds is vital, with detailed reports highlighting specific programs, administrative costs, and fundraising expenses. Engaging with platforms like Guidestar or Charity Navigator can bolster public trust by providing accessible financial information and performance metrics to potential donors. Regular updates, such as quarterly financial reports published on the organization's website, promote ongoing communication with the community and enhance credibility.

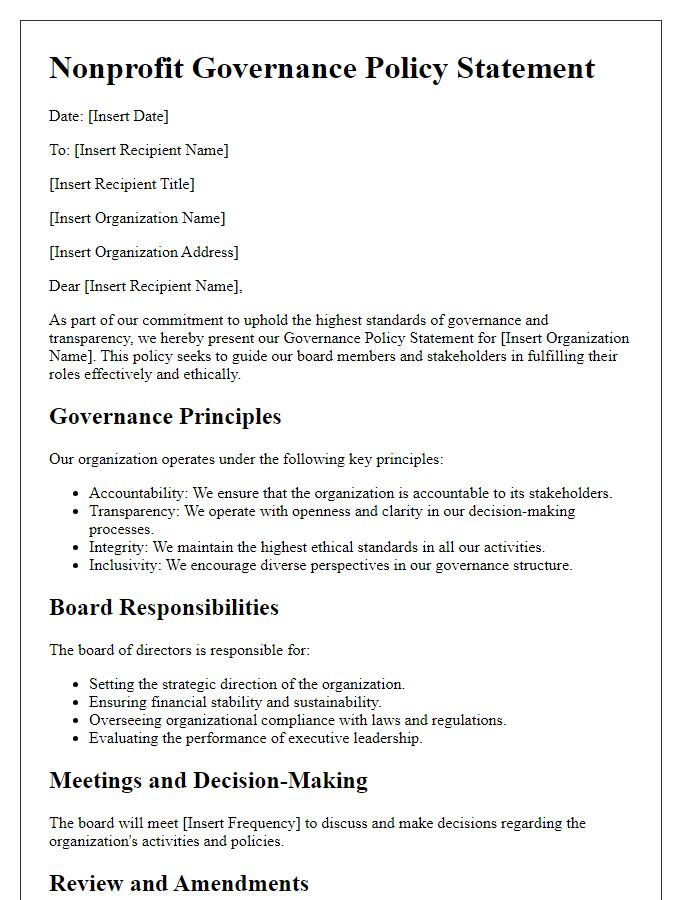

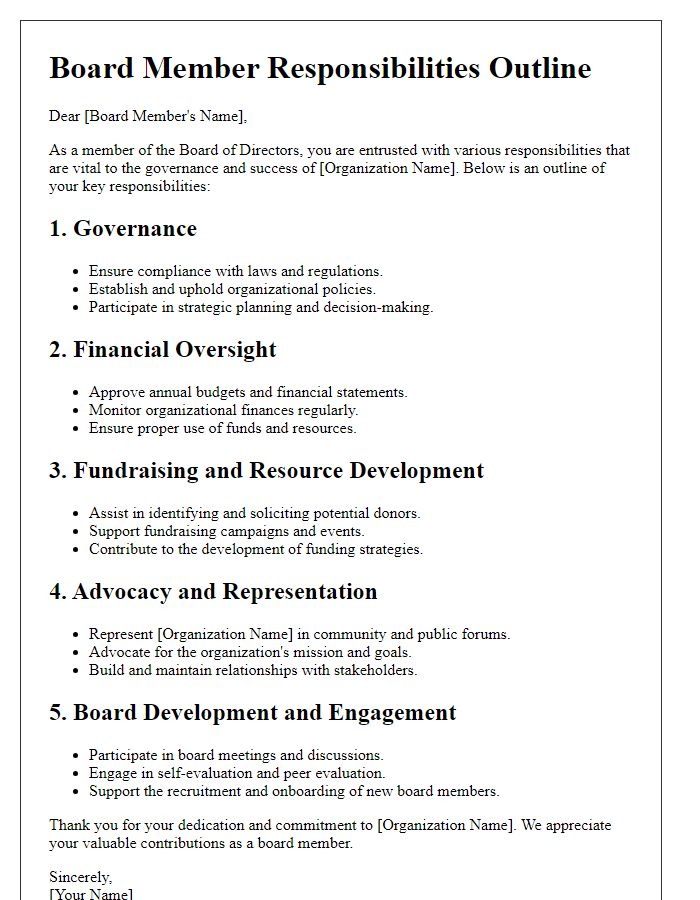

Board Governance

Nonprofit organizations require strict adherence to legal standards in board governance to maintain their tax-exempt status, typically under section 501(c)(3) of the Internal Revenue Code in the United States. Effective governance structures must include a defined board of directors, usually comprising a minimum of three individuals, who are not related to ensure objectivity and prevent conflicts of interest. These boards are responsible for overseeing the nonprofit's financial activities, compliance with state laws, such as filing annual reports with the Secretary of State, and adherence to bylaws. Regular meetings, ideally quarterly, should be documented in minutes, reflecting decisions made regarding strategic planning, fundraising, and financial management. Additionally, trainings on fiduciary duties are crucial for board members to understand their responsibilities concerning transparency and ethical conduct. Following these governance best practices not only boosts credibility but also enhances operational efficiency and community trust in the nonprofit sector.

Letter Template For Nonprofit Legal Compliance Samples

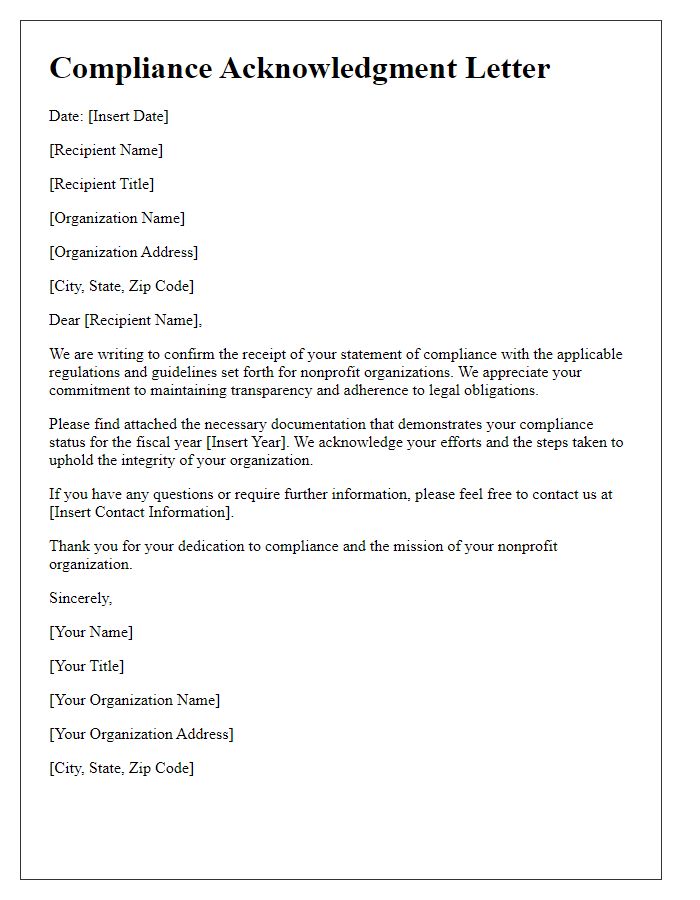

Letter template of compliance acknowledgment for nonprofit organizations

Comments