Are you looking to ensure that your final wishes are honored and your loved ones are taken care of? Crafting a well-thought-out will and testament is essential for peace of mind and clarity for those you leave behind. In this article, we'll guide you through a simple yet effective letter template that will make the execution of your will straightforward and stress-free. So, if you're ready to take the next step in securing your legacy, keep reading to learn more!

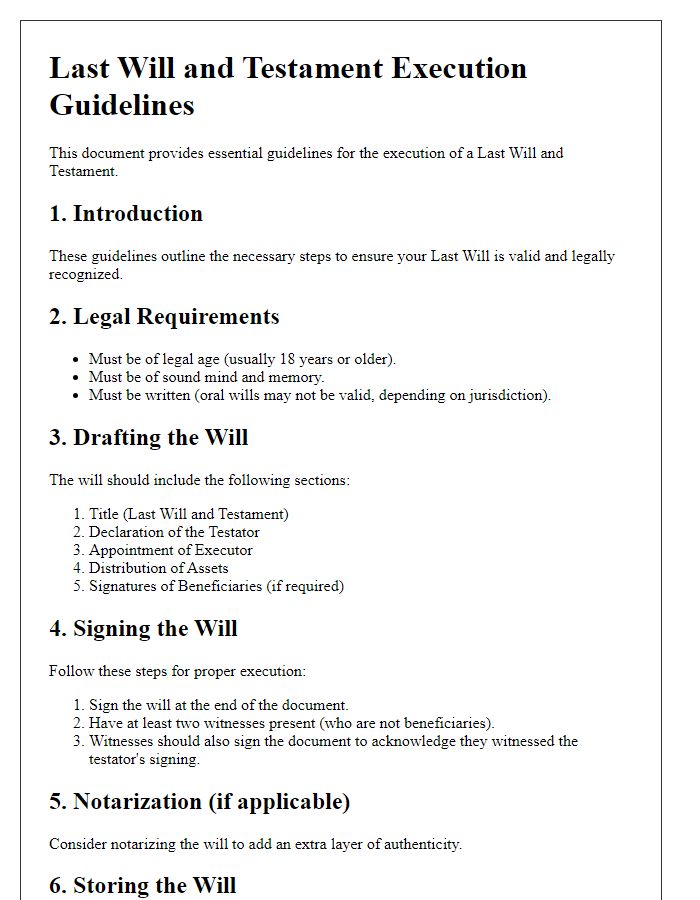

Executor's Authority and Responsibilities

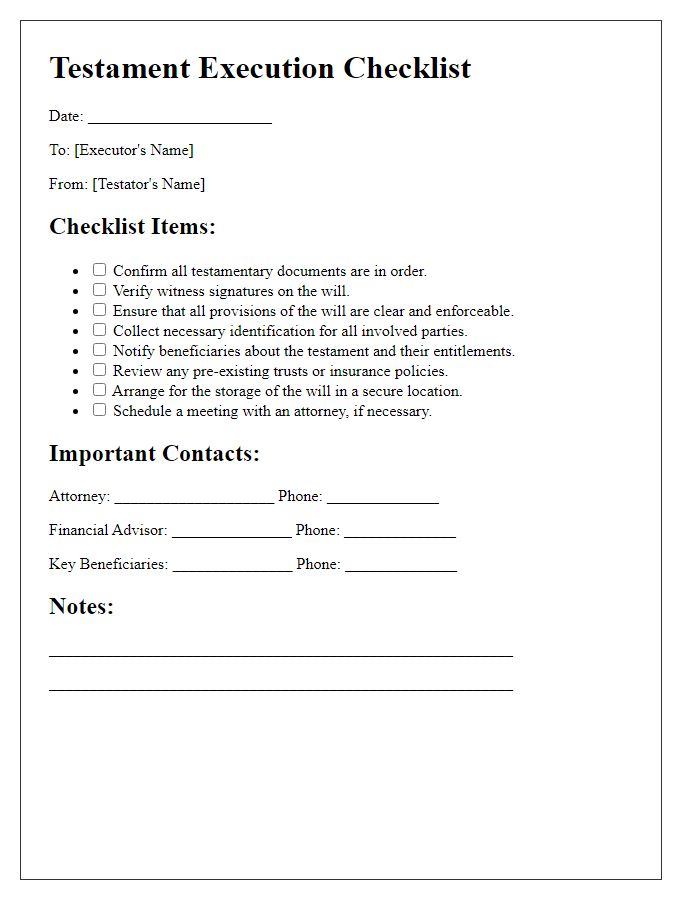

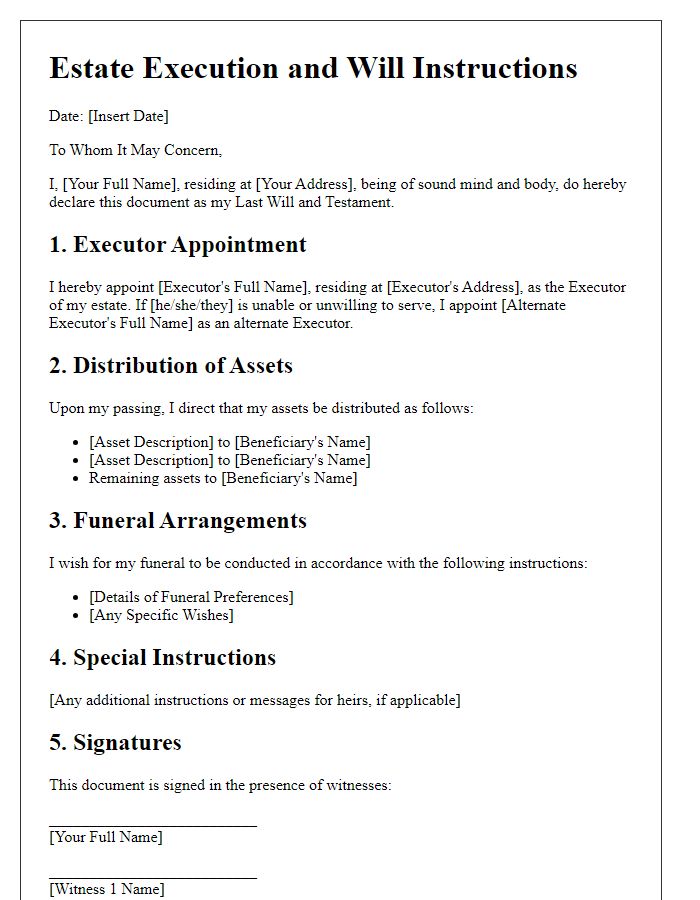

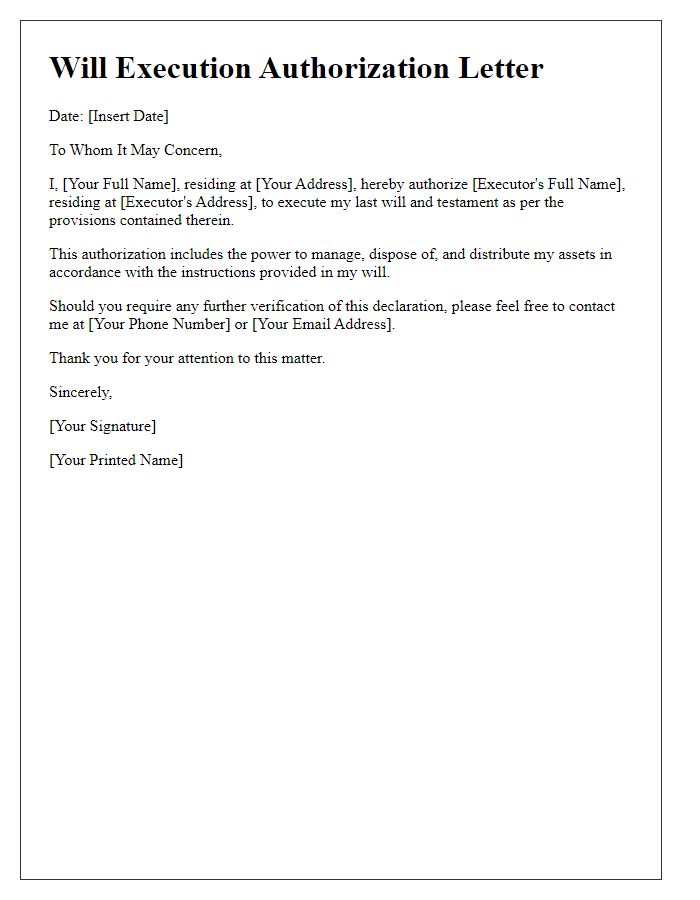

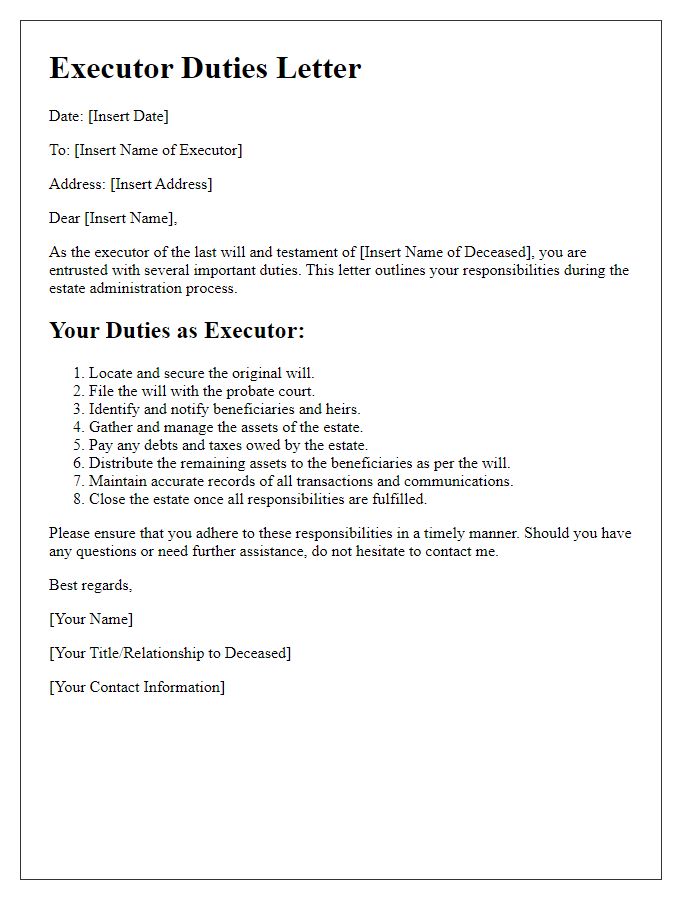

The executor's authority in the execution of a will entails managing the estate of the deceased individual, known as the testator, as dictated by the legal document. Key responsibilities include collecting all assets such as real estate, bank accounts, and personal property, ensuring proper valuation for accurate distribution. The executor, appointed by the testator, must adhere to local probate laws, which can vary significantly among jurisdictions, such as California or New York. Duties also encompass settling any outstanding debts and taxes, filing necessary paperwork with probate courts, and communicating with beneficiaries regarding their entitlements outlined in the will. In cases of disputes or claims against the estate, the executor holds the responsibility of resolving these issues, often with the guidance of legal counsel, to uphold the testator's wishes while ensuring compliance with statutory requirements. Properly executing these duties not only facilitates a smooth transition of assets but also preserves the integrity of the testator's final directives.

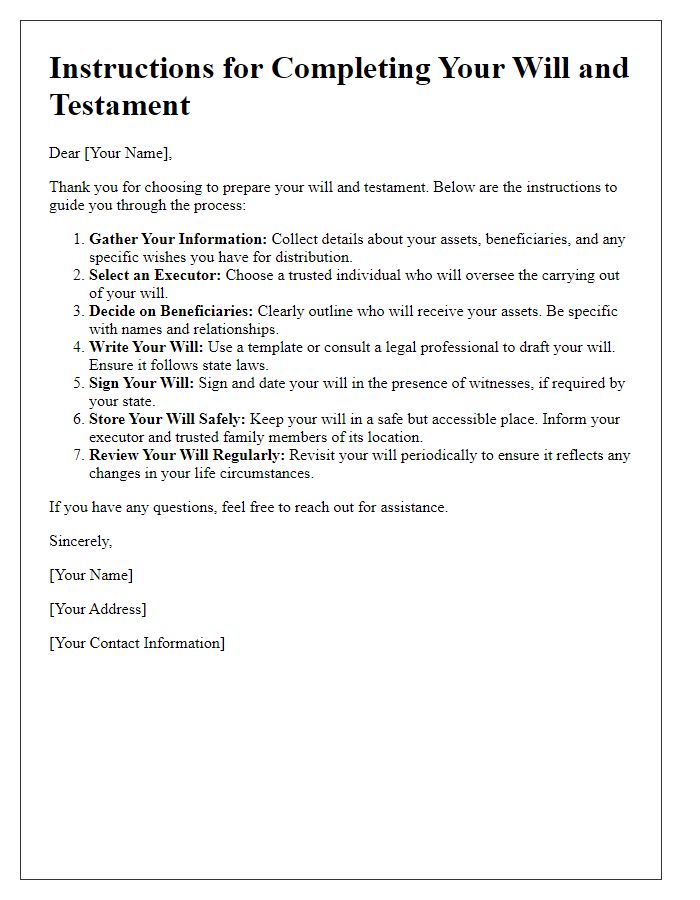

Identification of Beneficiaries

Identification of beneficiaries in a will and testament is a critical process ensuring the appropriate distribution of assets after an individual's passing. Key beneficiaries may include immediate family members such as spouses, children, or parents, often designated to inherit specific assets or percentages of the estate. Additionally, charitable organizations, friends, or distant relatives may also be named, thus broadening the scope of potential recipients. It is essential to provide full legal names, relationship to the deceased, and specific bequests for clarity. Understanding regulations, such as those in specific jurisdictions like California or New York, is crucial, as local laws can influence the distribution framework. Drafting clear and precise beneficiary designations prevents disputes and ensures a smoother execution of the decedent's wishes.

Distribution of Assets and Property

In a will and testament execution, the distribution of assets encompasses the allocation of various property types, ensuring that legal heirs receive their designated inheritances. Real estate, which may include family homes or vacation properties, needs to be specified with precise addresses and legal descriptions. Financial assets, such as bank accounts and investment portfolios, should list account numbers and financial institutions to avoid ambiguities. Personal property, including valuables like jewelry or art collections, requires detailed descriptions and, if applicable, appraised values for equitable division among beneficiaries. Any debts or obligations associated with the estate must be identified, ensuring that liabilities are settled prior to distribution, thus simplifying the transfer process for executors and heirs. Clear instructions assist in the efficient administration of the estate, ultimately respecting the deceased's wishes and minimizing conflicts among family members.

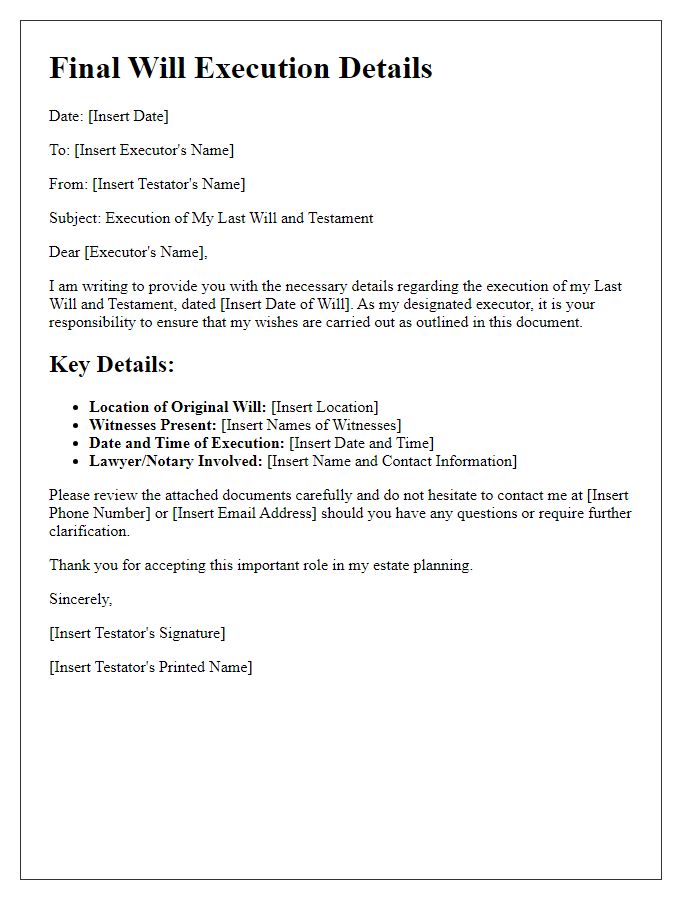

Funeral and Burial Instructions

Funeral and burial instructions hold significant importance in estate planning. A well-defined plan provides clarity to loved ones during a challenging time. Detailed instructions may include preferences for burial types, such as burial in a cemetery versus cremation, and specific locations, like a family plot in Greenleaf Cemetery in Springfield. Mentioning preferred funeral homes, such as Smith & Sons Funeral Services, ensures arrangements align with the individual's wishes. Furthermore, requests for religious services or memorial ceremonies at a chosen place of worship, like St. Mark's Church, can guide family decisions. Additionally, specifying involvement of particular clergy or friends can help create a fitting tribute. Articulating whether personal items, such as cherished photographs or a favorite book, should accompany the deceased can provide comfort. Clear documentation of these instructions can alleviate confusion and respect the deceased's last wishes.

Dispute Resolution and Legal Compliance

Disputes over wills can arise during the execution process, often leading to complex legal challenges in various jurisdictions. Ensuring clear communication among executors, beneficiaries, and legal advisors is essential to facilitate smooth execution. Implementing mediation techniques, such as involving neutral third-party mediators, can help resolve conflicts amicably. Familiarity with local probate laws, including deadlines, claim notifications, and distribution requirements, is crucial for compliance. Legal documentation must adhere to state-specific regulations, including witness signatures and notary verification, to ensure validity and avoid disputes. Additionally, understanding potential tax implications and debt settlement priorities can further simplify the estate administration process.

Comments