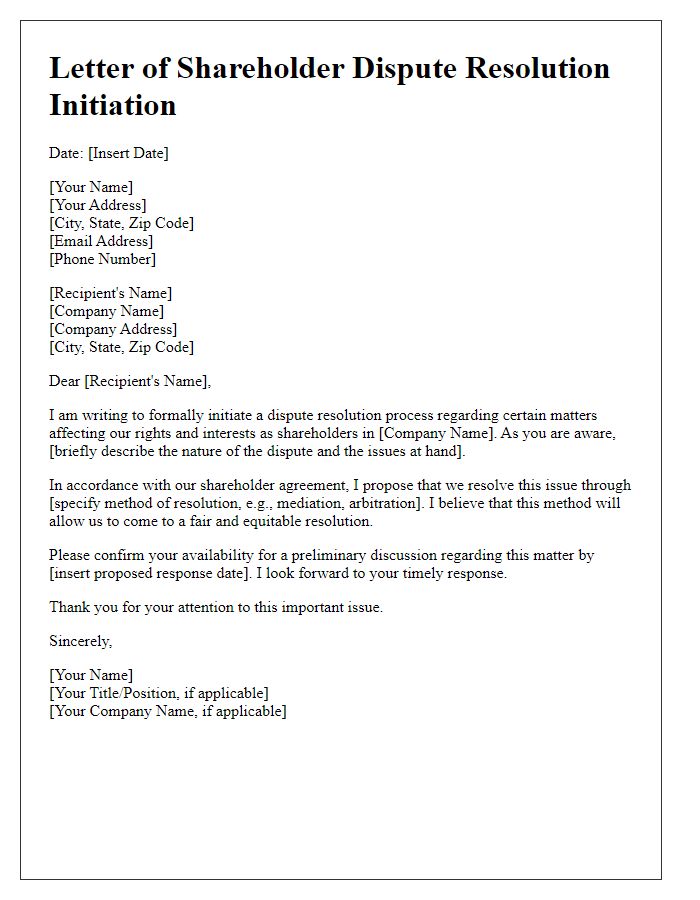

Navigating a shareholder dispute can be a complex and delicate matter, but effective communication is key to finding a resolution. In this article, we'll explore a structured letter template that can help address conflicts while maintaining professional relationships. By outlining the issues clearly and proposing potential solutions, you can foster an atmosphere of collaboration rather than contention. Join us as we delve into the essential elements of a shareholder dispute resolution letter and how it can pave the way for a successful outcome.

Clear identification of parties and roles

In a shareholder dispute resolution scenario, stakeholders including shareholders, board members, and legal advisors should be clearly identified to ensure proper representation and understanding of roles. Shareholders (individuals or entities owning shares in a company, such as John Smith with a 10% stake) must be duly recognized, alongside the board of directors (typically consisting of a chairperson and various members responsible for corporate governance, like Jane Doe as the chairperson). Legal advisors (attorneys specializing in corporate law, such as the firm Baker & McKenzie, known for its dispute resolution expertise) play a vital role in guiding the resolution process, ensuring compliance with relevant laws (like the Companies Act of 2006 in the UK), and facilitating negotiations. All parties must be documented with their respective roles and responsibilities to efficiently address the conflict and seek a collaborative resolution.

Specific description of the dispute and issues

A shareholder dispute can arise when there are conflicting interests among shareholders of a corporation, particularly regarding decision-making processes and financial distributions. For instance, the disagreement between shareholders regarding the allocation of dividends can lead to significant tensions. Shareholder A may advocate for immediate distribution of profits, citing the need for reinvestment in company infrastructure, while Shareholder B argues for retaining earnings to fund future growth projects identified in the strategic plan for 2024. Furthermore, issues such as a lack of transparency in financial reporting or differing interpretations of the company's bylaws can exacerbate the situation. Recent board decisions and actions, including a potential merger discussed during the last quarterly meeting in September 2023, have heightened disputes over strategic direction. The need for effective communication and resolution mechanisms, including mediation sessions scheduled for November 2023, is critical for restoring harmony and ensuring the long-term success of the corporation.

Reference to governing documents and agreements

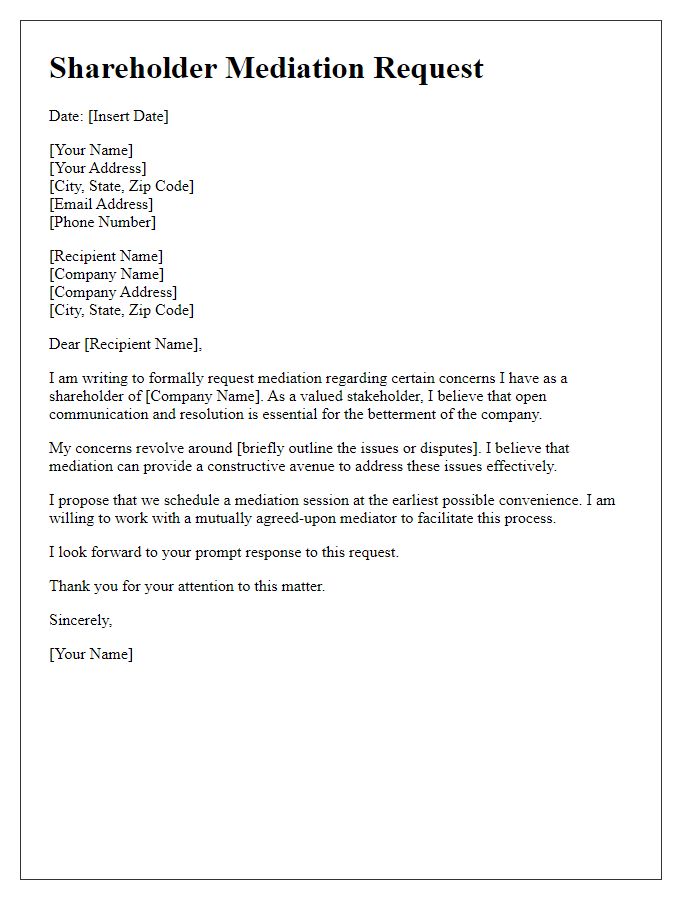

In the context of resolving shareholder disputes, reference to governing documents, such as corporate bylaws and shareholder agreements, plays a crucial role. These legal frameworks outline the rights, responsibilities, and procedures that shareholders must adhere to, establishing a foundation for conflict resolution. For instance, the corporate bylaws may detail the voting rights of shareholders, quorum requirements, and the process for electing board members, ensuring transparency and fairness. Shareholder agreements, on the other hand, often include clauses that address dispute resolution mechanisms, such as mediation or arbitration, which can mitigate the need for lengthy and costly litigation. Compliance with these governing documents is essential to maintain order and protect the interests of all parties involved in the dispute.

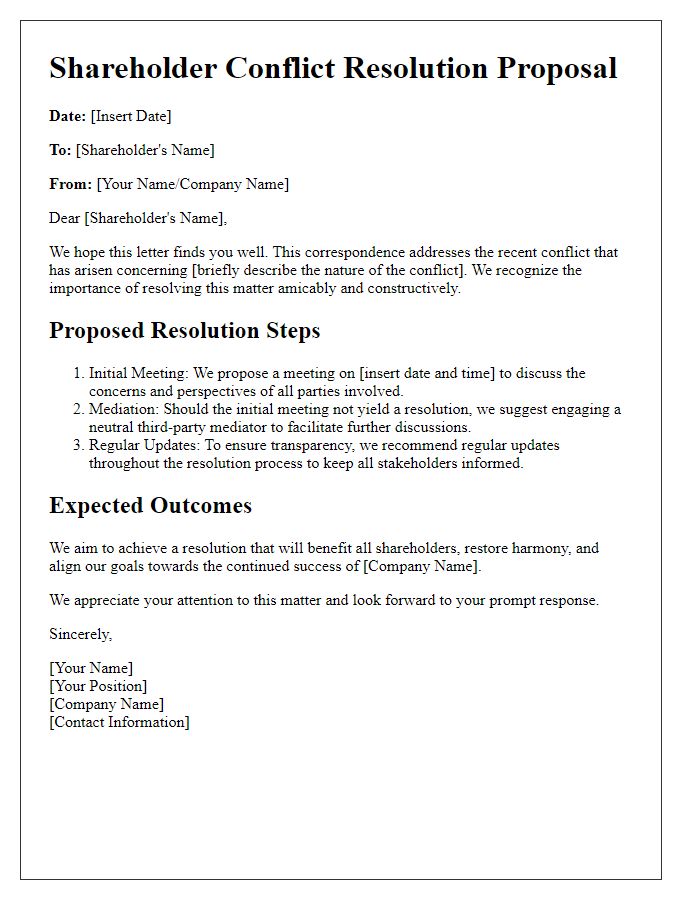

Proposed resolution steps and timeline

Shareholder disputes can create significant challenges for corporations and affect overall performance. Effective resolution steps are vital for maintaining harmony and protecting shareholder interests. Proposed resolution steps include initial mediation (commonly within 30 days), where a neutral third party facilitates discussions between disputing shareholders. Following mediation, if unresolved, arbitration may be initiated (often within 60 days), providing a structured environment for a binding decision. Shareholders should present their cases, supported by relevant documentation, to the arbitrator during this phase. In instances where arbitration fails, a court filing may occur (typically by 90 days) to seek judicial intervention or enforce the resolution. Implementation of agreed-upon solutions and follow-ups is crucial within a subsequent 30-day period to ensure compliance and prevent future conflicts.

Contact information for further communication

Disputes among shareholders can significantly impact the operational dynamics of a company, often necessitating structured resolution protocols. Clear communication channels are essential, ensuring that all parties remain informed throughout the resolution process. For further communication, provide comprehensive contact information including designated representatives' names, direct phone numbers, email addresses, and alternative methods such as online portals. Additionally, list specific office locations for any necessary in-person meetings, enhancing accessibility for all involved stakeholders. ucit prbNdhn (proper management) of these disputes can lead to more productive discussions, preventing further escalation and fostering a cooperative environment.

Comments