Are you feeling overwhelmed by the complexities of a securities fraud investigation? You're not aloneâmany individuals find themselves navigating this challenging landscape without the guidance they need. Understanding the intricacies of securities laws and the investigation process is crucial for protecting your interests. Join us as we delve deeper into the essentials of crafting a comprehensive letter template tailored for your securities fraud concerns, ensuring you're equipped with the knowledge to tackle any situation.

Opening statement and purpose.

Securities fraud investigations often begin with an opening statement outlining the intent and scope of the inquiry. These investigations target corporate actions that may involve misleading financial statements, insider trading activities, or deceptive practices that violate securities regulations. The primary purpose involves safeguarding investors' interests and maintaining market integrity. This process, often initiated by regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States, seeks to identify potential wrongdoing, assess the extent of fraudulent activities, and hold accountable those responsible, ensuring that justice is served and restoring trust in financial markets.

Detailed description of alleged misconduct.

In recent months, several high-profile incidents of securities fraud have come to light, revealing a troubling pattern of alleged misconduct within major corporations such as Enron and WorldCom. Investigative reports indicate systematic manipulation of financial statements, where companies misreported their earnings by as much as 20% above actual figures, misleading investors and inflating stock prices artificially. Whistleblowers have alleged that executives engaged in insider trading, selling shares based on non-public information regarding forthcoming earnings declines, resulting in substantial personal profits, estimated at millions of dollars. Regulatory bodies like the Securities and Exchange Commission (SEC) received numerous complaints, prompting investigations into suspicious trading volume spikes preceding major announcements. Key documents include falsified financial reports from fiscal years 2020-2022 and email exchanges among company executives planning to deceive shareholders. This misconduct not only jeopardizes market integrity but also threatens the financial security of countless investors, casting a shadow over the trust necessary for robust economic growth.

Request for documentation or evidence.

Securities fraud investigations require a comprehensive approach to gather pertinent evidence. Regulatory bodies like the U.S. Securities and Exchange Commission (SEC) often seek detailed documentation from companies under suspicion. Requested materials typically include financial statements, internal communications, and trading records related to specific stocks or securities. Dates of transactions and the identities of involved parties, including executives and brokers, are crucial. Additionally, evidence such as emails and reports that illustrate misleading claims, inflated earnings, or insider trading must be obtained. This documentation aids in establishing a timeline of events and may reveal patterns of deceitful behavior or compliance failures within the organization. Proper documentation facilitates thorough analysis and supports potential regulatory actions or legal proceedings in cases of fraudulent activities.

Contact information for further communication.

Securities fraud investigations often require meticulous attention to detail regarding contact information for effective communication. For further inquiries or clarification regarding ongoing investigations, it is crucial to maintain updated records. This includes direct phone numbers, email addresses, and physical addresses of key individuals involved, such as compliance officers, legal representatives, or specialized fraud investigators. This information aids in efficient coordination between regulatory bodies, law enforcement, and legal teams, ensuring timely responses and necessary documentation submissions. Keeping a centralized database accessible to all involved parties fosters transparency and expedites the investigation process.

Legal consequences and cooperation expectation.

Investigation of securities fraud can result in significant legal consequences, including lengthy prison sentences and hefty fines. Under the Securities Exchange Act of 1934, violations may lead to penalties reaching millions of dollars, depending on the severity of the fraud. Agencies such as the Securities and Exchange Commission (SEC) routinely conduct thorough investigations to hold perpetuators accountable. Cooperation during these investigations is crucial for any involved parties, as it can lead to reduced penalties or leniency in prosecution. Full disclosure of relevant documents, communications, and trading activities is often required, allowing regulators to piece together fraudulent schemes. Entities such as broker-dealers and investment advisors must remain vigilant and ready to provide the necessary information to facilitate a swift resolution.

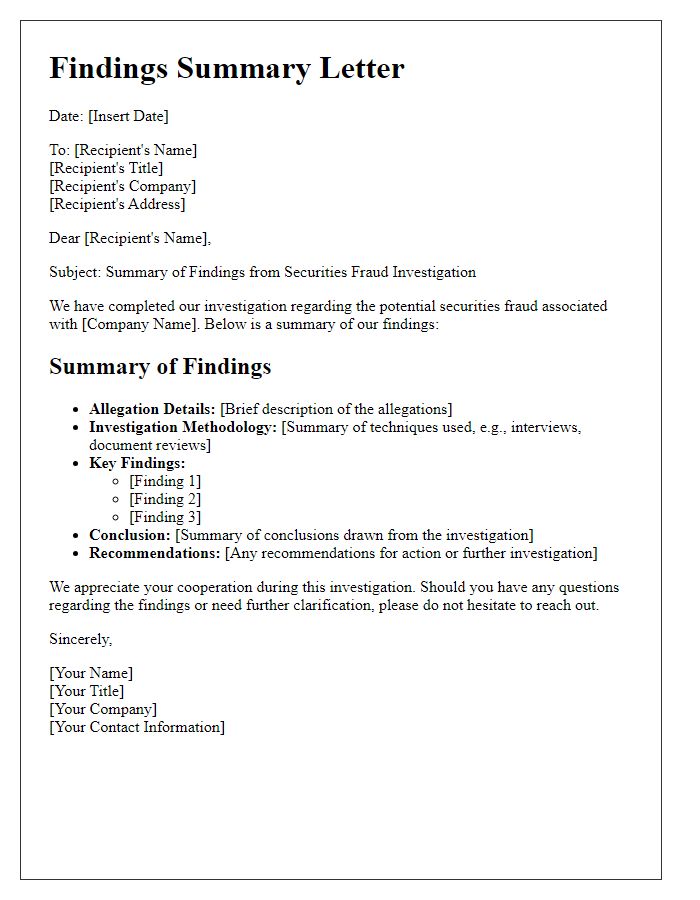

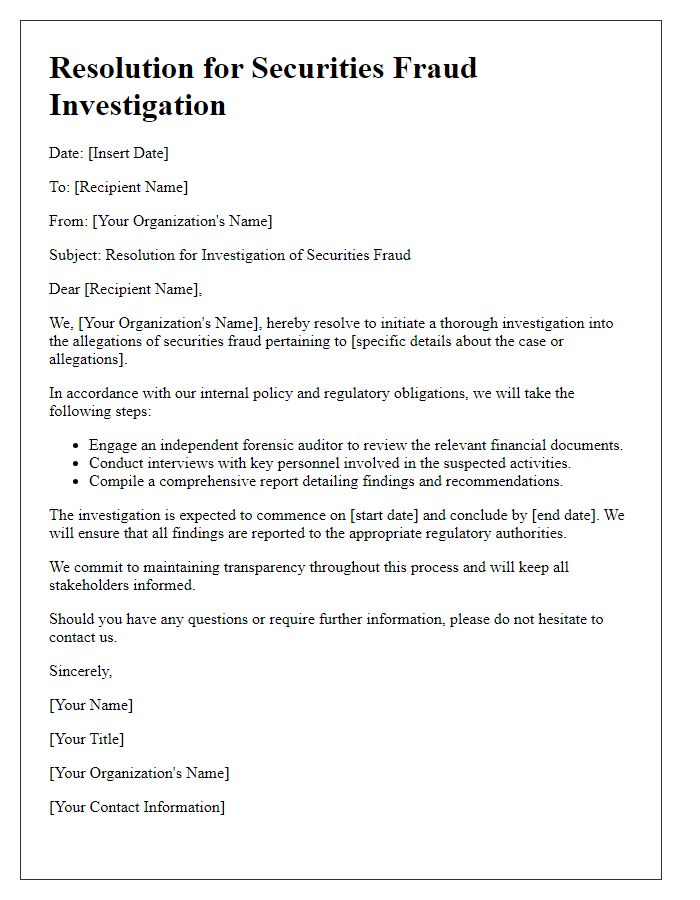

Letter Template For Securities Fraud Investigation Samples

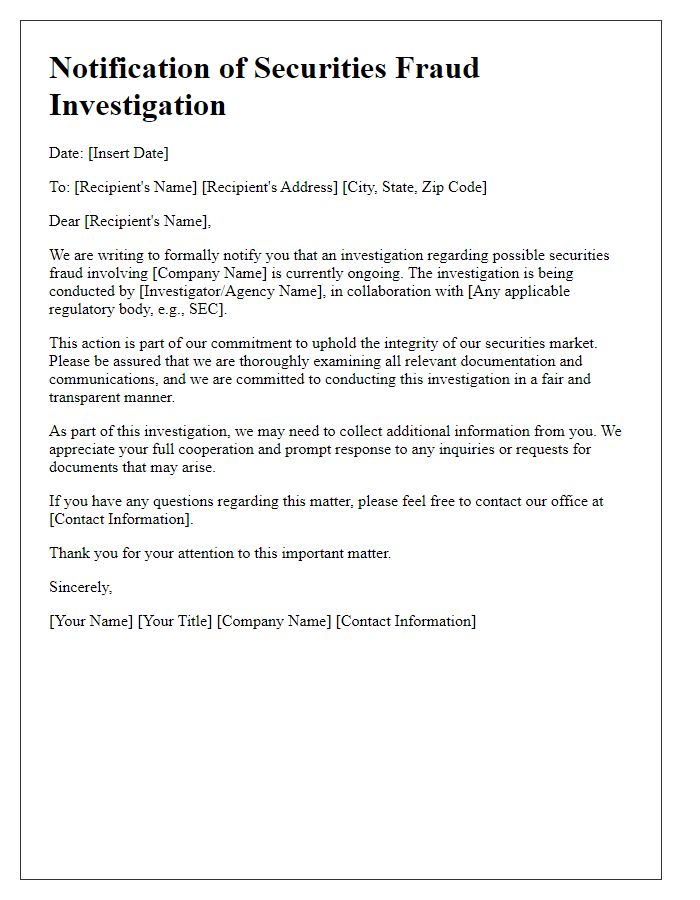

Letter template of notification regarding securities fraud investigation

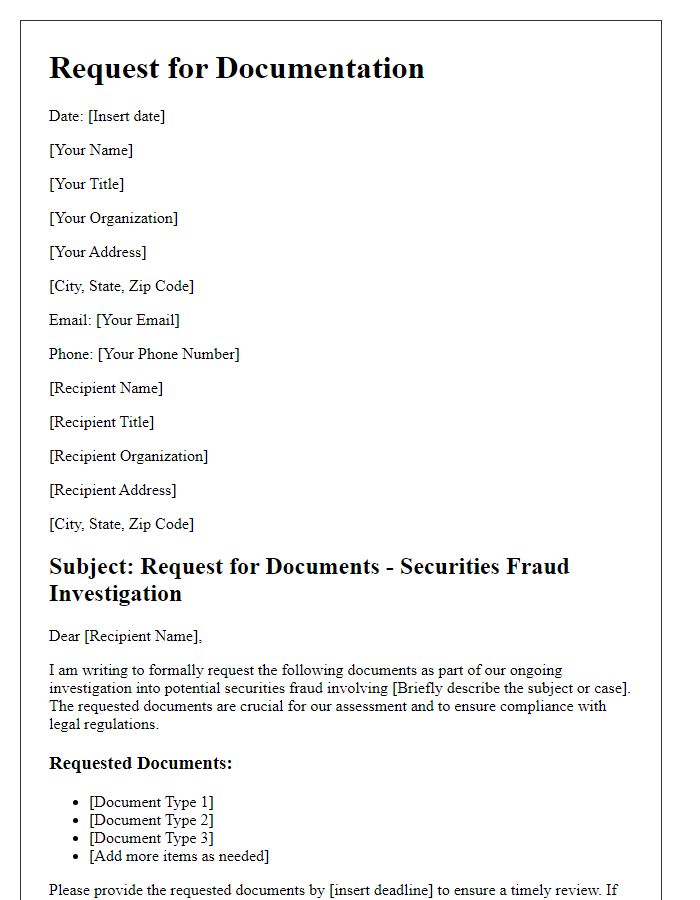

Letter template of request for documents in securities fraud investigation

Comments