Are you feeling concerned about a breach of fiduciary duty? It's a serious issue that can impact trust and financial stability, and understanding how to address it is crucial. In this article, we'll walk you through a sample letter template that outlines your grievances clearly and effectively, ensuring your message is both professional and assertive. Let's dive in and explore how you can protect your rights and interestsâread on for the full details!

Introduction and identification of parties involved

In a breach of fiduciary duty case, the plaintiff may include an introduction identifying the key parties involved, such as the fiduciary (the individual or entity entrusted with the responsibility) and the beneficiary (the individual or entity owed the duty). The introduction may outline the relationship between these parties, which could be based on trust, such as between a trustee and beneficiaries in a trust, partners in a partnership, or corporate directors and shareholders in a corporation. This setup establishes the context for understanding the fiduciary duty, which is the legal obligation of the fiduciary to act in the best interest of the beneficiary. The introduction aims to clarify each party's role and the nature of their relationship, highlighting expectations of loyalty and care that the fiduciary is supposed to uphold.

Detailed description of fiduciary relationship

A fiduciary relationship exists when one party, the fiduciary, has a duty to act in the best interests of another party, known as the principal or beneficiary. This relationship often arises in situations such as between trustees and beneficiaries, attorneys and clients, or corporate officers and shareholders. For instance, in a trustee-beneficiary scenario, the trustee is entrusted with managing assets worth millions, ensuring the best return on investments while adhering to legal and ethical standards. The fiduciary must prioritize the beneficiary's interests, avoiding conflicts of interest or self-dealing. A breach of this duty may occur if the fiduciary misuses funds, neglects responsibilities, or fails to disclose pertinent information that affects the beneficiary's well-being, leading to potential financial damage or loss of trust. Such breaches can lead to legal action, claims for damages, and could ultimately result in the fiduciary facing significant penalties or loss of licensure.

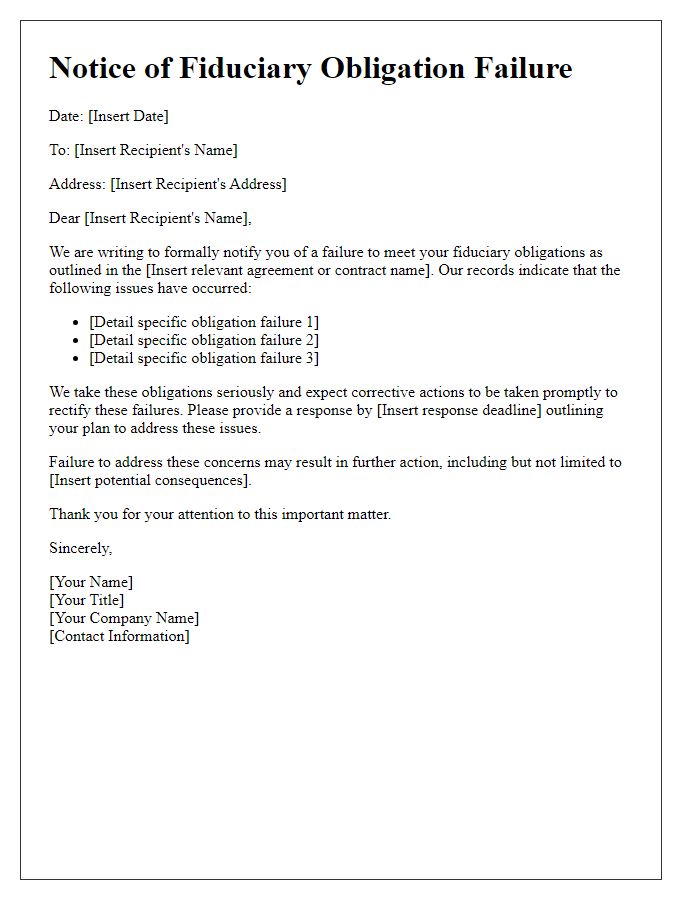

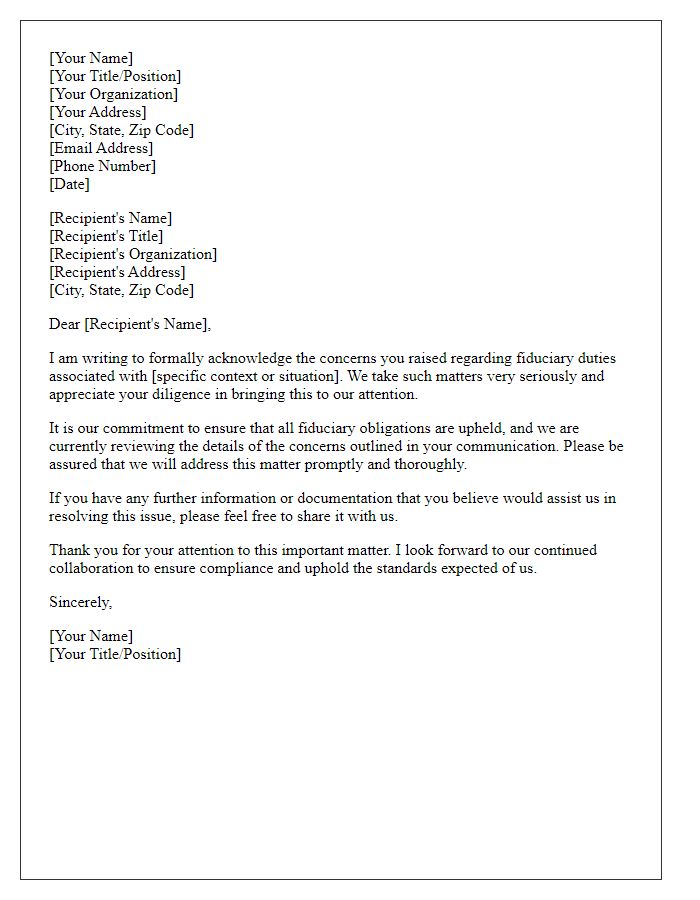

Specific breaches and evidence of duty violation

A breach of fiduciary duty occurs when a fiduciary fails to act in the best interest of another party, typically a client or beneficiary. Specific breaches may include mismanagement of funds, self-dealing, or failure to disclose relevant information. Evidence of such a violation can be found in financial records showing unauthorized transactions or meetings where conflicts of interest were not disclosed. Documentation like emails or agreements may indicate lack of transparency or failure to adhere to agreed-upon standards of conduct. A thorough examination of these materials can reveal whether a fiduciary acted with the necessary level of care and loyalty expected in their role.

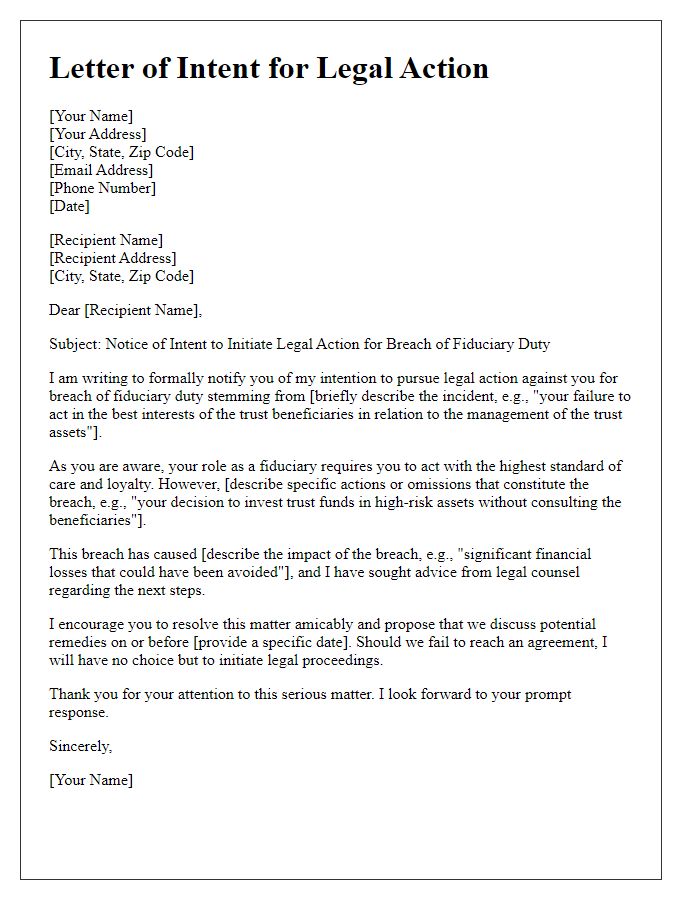

Legal implications and potential consequences

A breach of fiduciary duty occurs when a fiduciary (an individual or entity entrusted to act on behalf of another) fails to act in the best interests of the party to whom they owe the duty. This legal obligation is crucial in relationships such as those between trustees and beneficiaries, corporate officers and shareholders, or agents and principals. Violations can lead to significant legal implications including damages for financial losses, restitution of profits gained from the breach, and even punitive damages in cases of egregious conduct. Courts may impose injunctions to prevent further breaches and could require the fiduciary to surrender their position or account for mismanaged funds. The consequences can extend beyond financial penalties, potentially affecting the reputation and credibility of the fiduciary involved, and diminishing trust in related business or personal relationships. Note: Fiduciary duty principles are grounded in various legal frameworks, including the Common Law and statutory regulations, which vary by jurisdiction, impacting case outcomes.

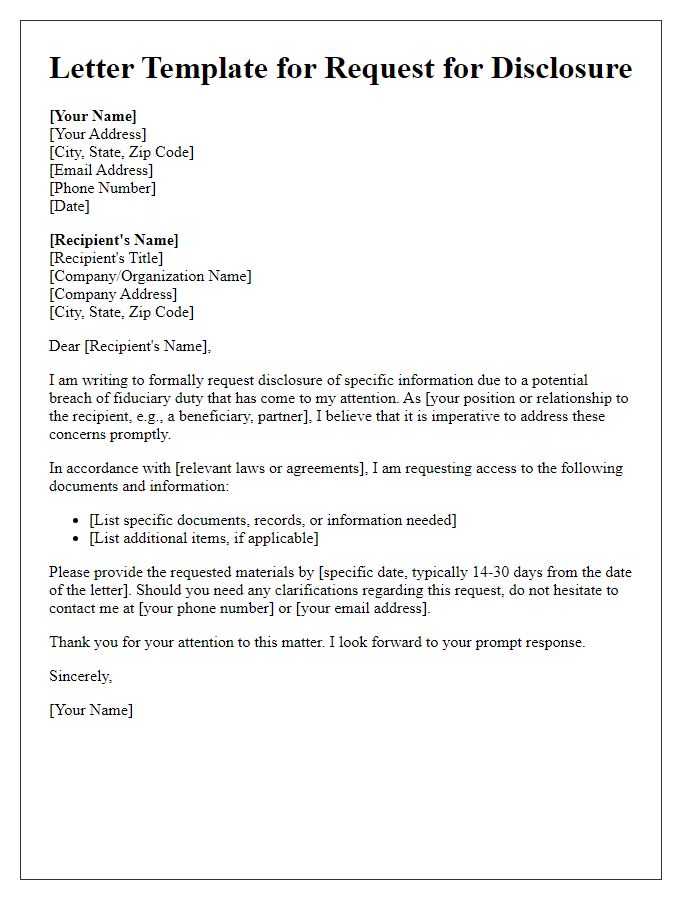

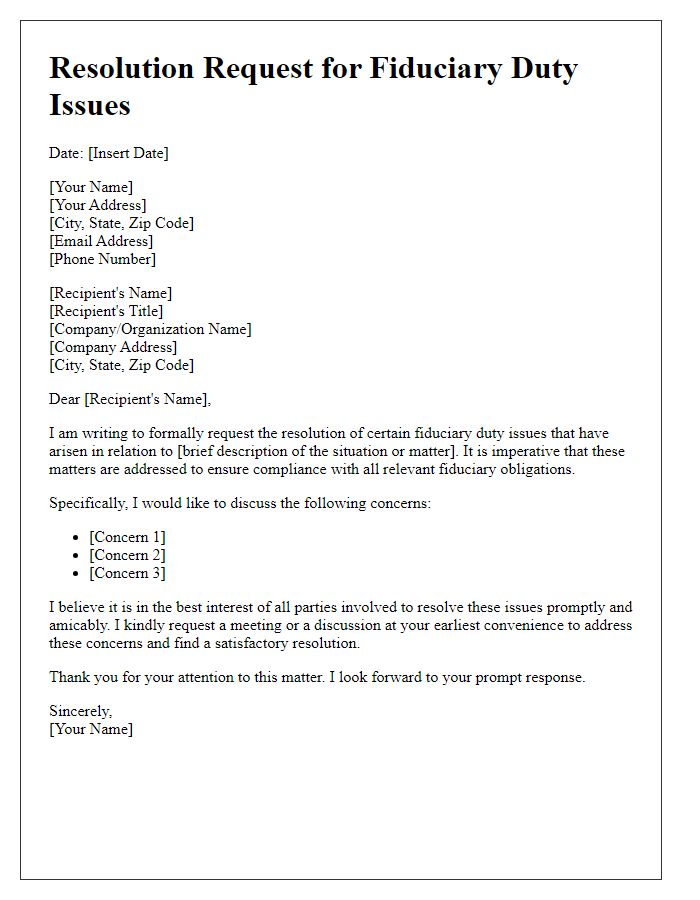

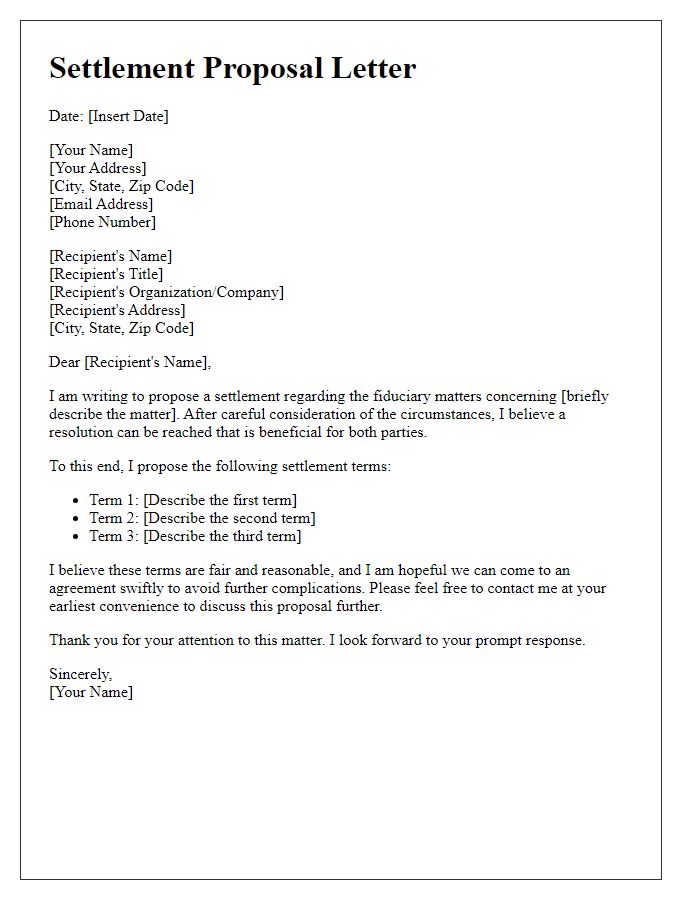

Proposed resolution or demand for corrective action

A breach of fiduciary duty occurs when an individual fails to act in the best interests of another party, often seen in relationships involving trust, such as between a trustee and beneficiary or corporate executives and shareholders. Instances of such breaches can take various forms, like misappropriation of funds or failure to disclose conflicts of interest, leading to potential legal and financial ramifications. A proposed resolution may involve demands for corrective actions, such as restitution of lost assets or appointment of an independent auditor to oversee fiduciary duties moving forward. These steps aim to restore trust and ensure that fiduciaries adhere to their obligations, protecting the interests of those they serve, especially in critical sectors like finance or non-profit organizations.

Comments