Are you aware of the latest changes in statutory compliance? Navigating the complex landscape of legal requirements can be daunting, and staying updated is crucial for your business's success. In this article, we'll break down essential statutory compliance updates you need to know, ensuring you're informed and prepared. So, grab a cup of coffee and join us as we delve deeper into what these changes mean for youâjust keep reading!

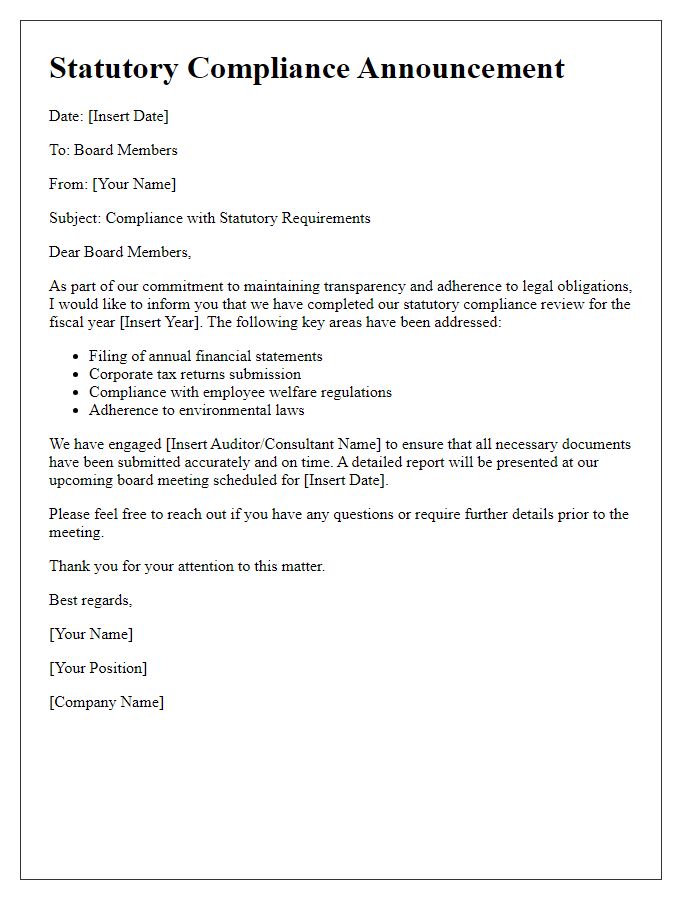

Recipient's details and accurate address

Statutory compliance alerts serve to inform businesses about legal obligations and regulations they must adhere to within their respective jurisdictions. For instance, companies based in New York City may need to stay updated on local labor laws, which can include wage requirements, workplace safety standards, and anti-discrimination policies. Organizations should ensure that recipient details, including full names and precise addresses, are accurate to avoid miscommunication. Incorrect information can lead to missed notifications regarding compliance deadlines imposed by regulatory bodies like the Occupational Safety and Health Administration (OSHA) or the Equal Employment Opportunity Commission (EEOC). Keeping this information updated is vital for maintaining legal standing and avoiding penalties.

Subject line emphasizing urgency and importance

Incorporating external audits into a company's compliance strategy is vital for ensuring adherence to regulations. Statutory compliance refers to the legal obligations that organizations must follow, such as labor laws, environmental regulations, and financial reporting standards, typically governed by national and local laws. Failure to comply can result in severe penalties, including fines and legal action. External audits, conducted by independent third-party professionals, provide an objective assessment of compliance and identify potential risks. An emphasis on timely audits, particularly before regulatory deadlines, can preemptively address compliance gaps and enhance the organization's reputation in the marketplace.

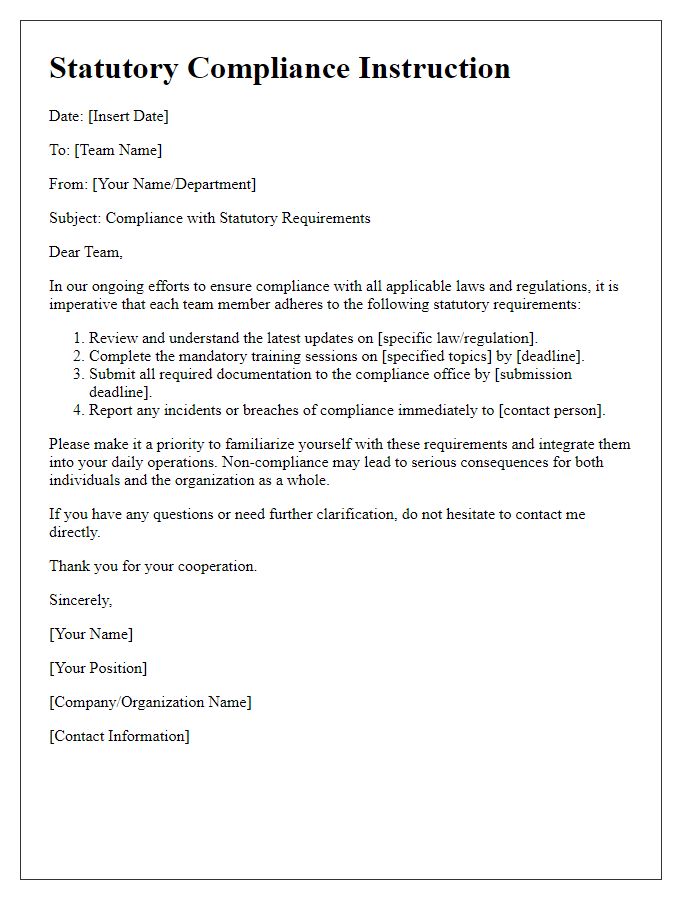

Clear identification of the statutory requirement

Statutory compliance requires adherence to legal obligations mandated by government regulations for specific industries. For example, the Occupational Safety and Health Administration (OSHA) in the United States outlines safety standards for workplaces to ensure employee protection. Compliance entails regular audits, documentation of safety protocols, and timely reporting of incidents, which must be aligned with specified deadlines, often quarterly or annually. Failure to meet these requirements can result in penalties, including fines that may reach thousands of dollars or even legal actions that affect corporate credibility. Regular training sessions for employees, meticulous record-keeping, and a dedicated compliance team can significantly enhance adherence to these statutory requirements.

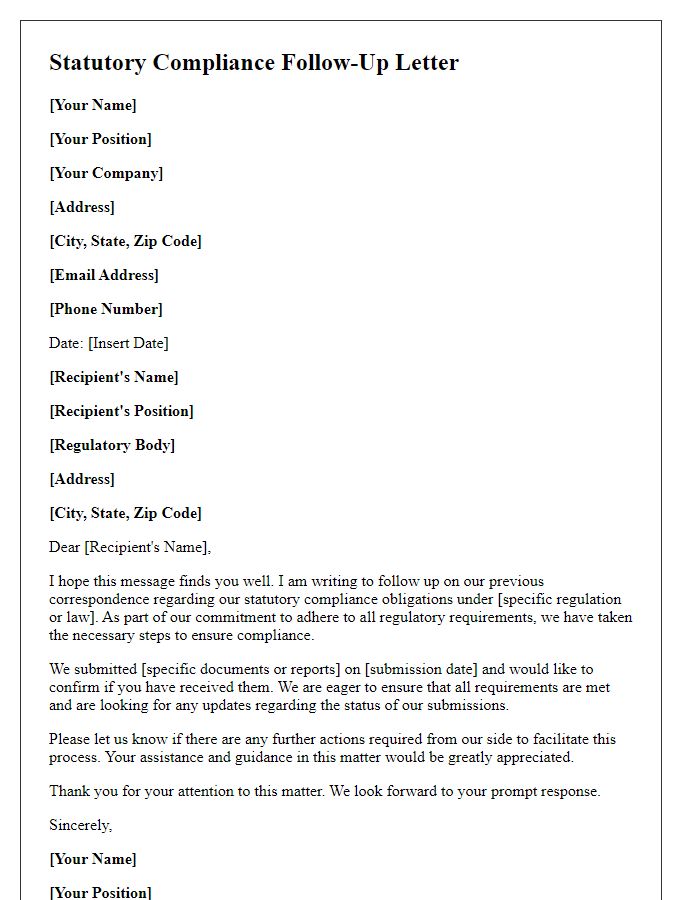

Deadline for compliance and potential consequences

Statutory compliance deadlines vary across industries and regulatory agencies, often leading to significant implications for non-compliance, such as fines, litigation, or operational disruptions. For instance, organizations must adhere to the updated OSHA regulations by December 31, 2023, to avoid potential penalties exceeding $100,000. The IRS requires businesses to submit annual tax filings by April 15, 2024, with late submissions incurring interest charges and additional fees. Failure to comply with data protection standards, such as GDPR, could result in severe fines amounting to 4% of annual turnover or EUR20 million, whichever is higher. Meeting these deadlines ensures adherence to local, state, and federal laws, safeguarding the company's reputation and operational integrity.

Contact information for queries and assistance

A statutory compliance alert serves as an essential notification to organizations regarding adherence to laws and regulations. Companies may encounter requirements mandated by government entities such as the Food and Drug Administration (FDA) or the Occupational Safety and Health Administration (OSHA). For assistance with compliance queries, designated contact points can include the compliance officer or the legal department. Their direct phone lines, such as (555) 123-4567, or email addresses, like compliance@company.com, serve as valuable resources. Addressing these inquiries promptly ensures that organizations remain updated on legal obligations and avoid potential penalties associated with non-compliance.

Comments