Are you facing a financial liability dispute and unsure how to approach it? A well-structured letter can be your first step toward resolution, providing clarity and setting the stage for further negotiations. In this article, we'll guide you through crafting a compelling letter template that addresses your concerns effectively. Let's dive in and empower you with the tools to tackle this challenge head-on!

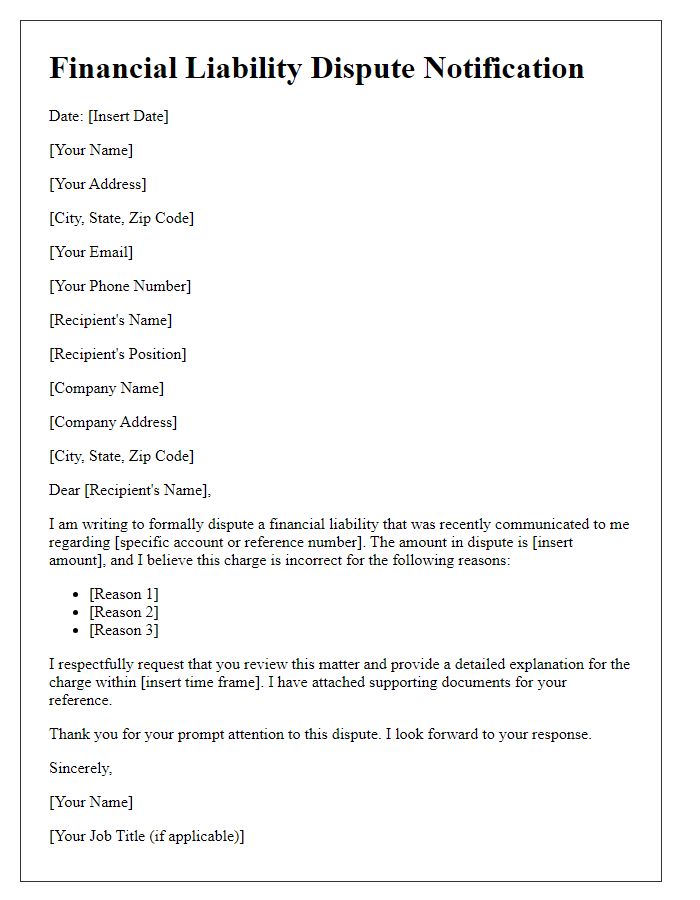

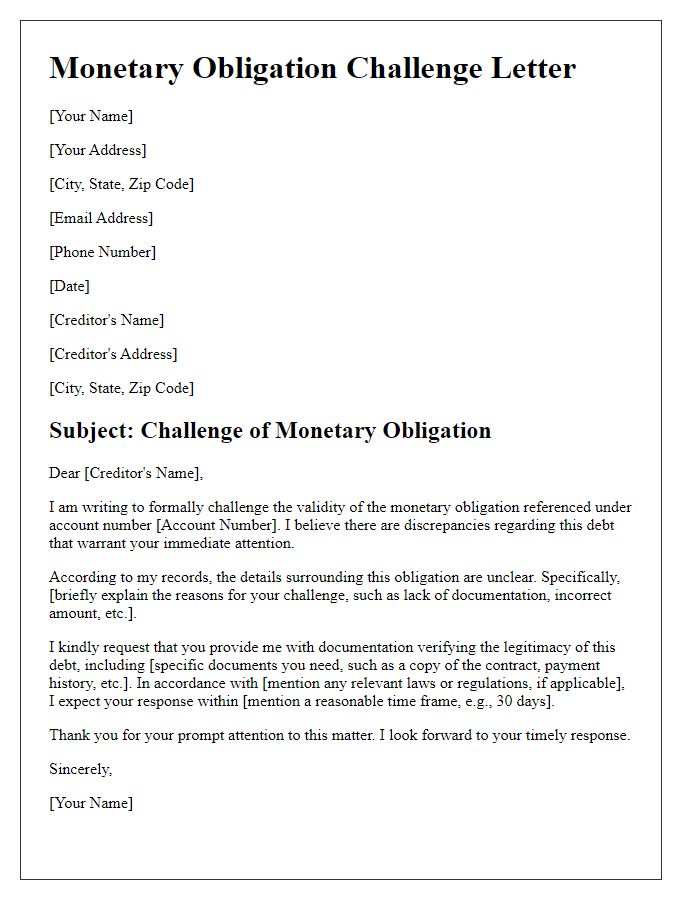

Accurate recipient and sender details

The financial liability dispute can arise from various circumstances, such as outstanding debts or service disagreements. Clear communication is essential to resolve these issues efficiently. Accurate details of the sender (individual or company) should include the full name, address, and contact information, ensuring their identity is unequivocally established. The recipient's information must be meticulously noted, reflecting correct full name, address, and any reference number or account details pertinent to the dispute. Specifying dates related to the financial obligation, including due dates and original loan or service date, is crucial for context. Any specific amounts in dispute should be clearly outlined, enabling both parties to have an unequivocal understanding of the figures involved. Properly formatted records will facilitate smoother negotiations or potential legal proceedings.

Clear subject line

Financial Liability Dispute Notice: Urgent Resolution Required

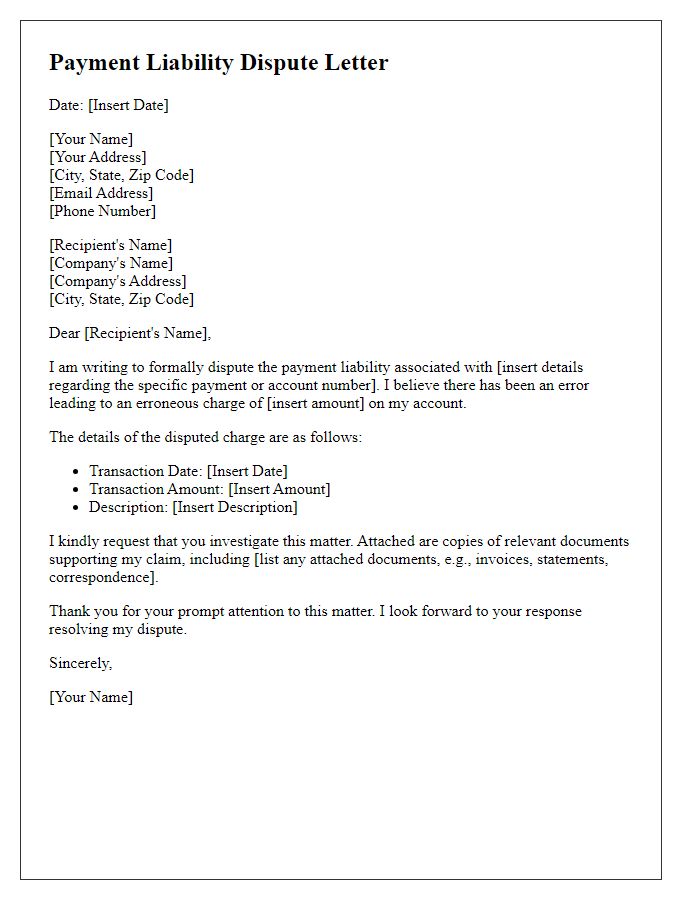

Detailed account information

A financial liability dispute notice serves as an official communication regarding discrepancies in account balances, including detailed account information such as transaction history, outstanding balances, and payment records. Specific details like account number (123456789), full name of the debtor (Jane Doe), and date of the last payment (March 15, 2023) are vital for clarifying the situation. Additionally, transactions, including a disputed charge from Company XYZ (Invoice #7890) dated January 10, 2023, must be documented to support the claim. This notice may reference relevant agreements, such as the original loan agreement from April 2021, outlining terms and conditions. It is essential to provide a clear deadline for response, often set at 30 days from receipt, to resolve the matter efficiently.

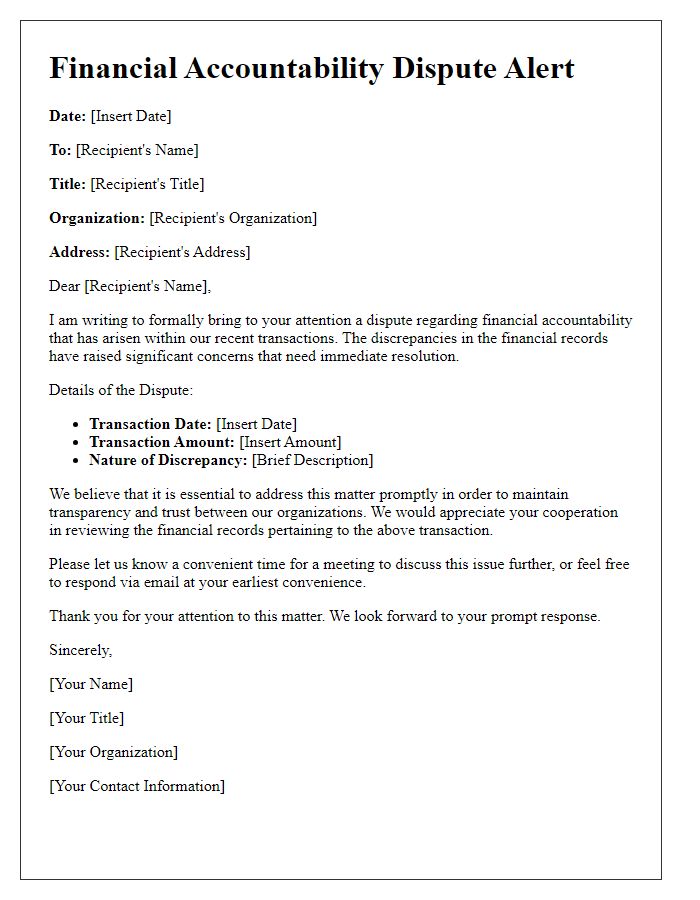

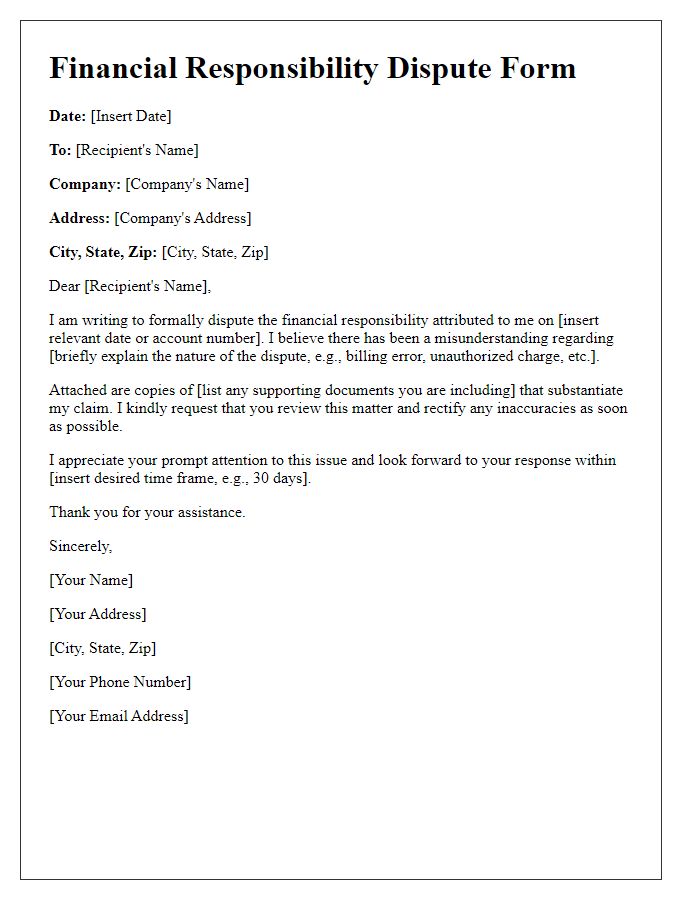

Explicit description of dispute

A financial liability dispute notice outlines the specific disagreements between parties regarding owed amounts, services rendered, or contractual obligations. In cases where an individual or company, such as ABC Corporation, claims a payment of $10,000 for consulting services provided from January to March 2023, the opposing party, XYZ Solutions, may dispute the legitimacy of these charges, alleging a breach of contract due to substandard service delivery. The notice should detail the timeline of events, including the initial agreement dated December 1, 2022, the terms of payment outlined therein, and any correspondence exchanged, such as emails and invoices that illustrate the disagreement. Additionally, reference to legal frameworks like the Uniform Commercial Code (UCC) could provide context for the parties' responsibilities. Parties must both compile all relevant documents, communications, and evidence, such as payment records or service documentation, to substantiate their claims and facilitate a possible resolution.

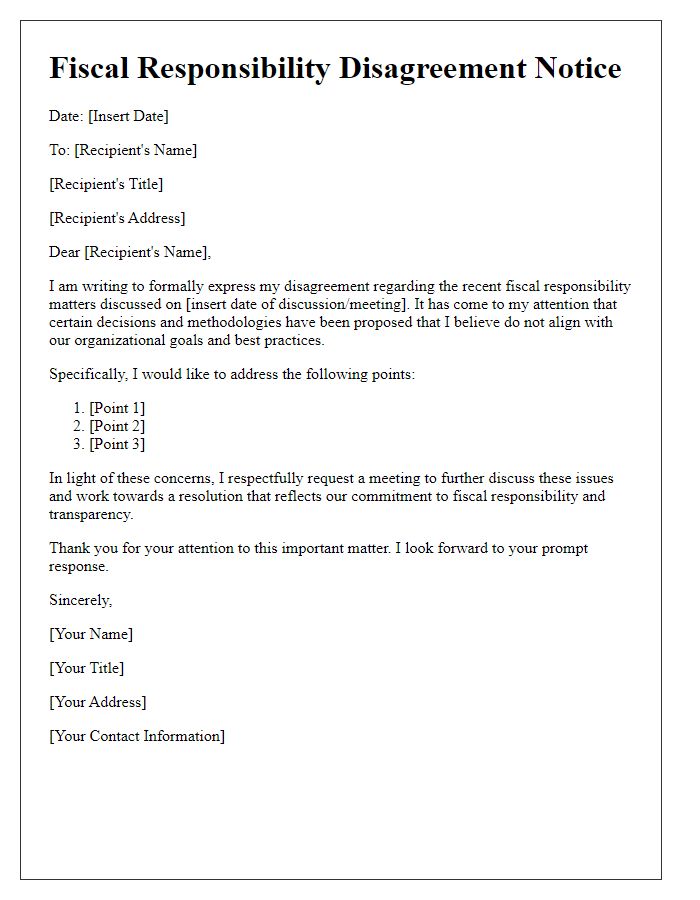

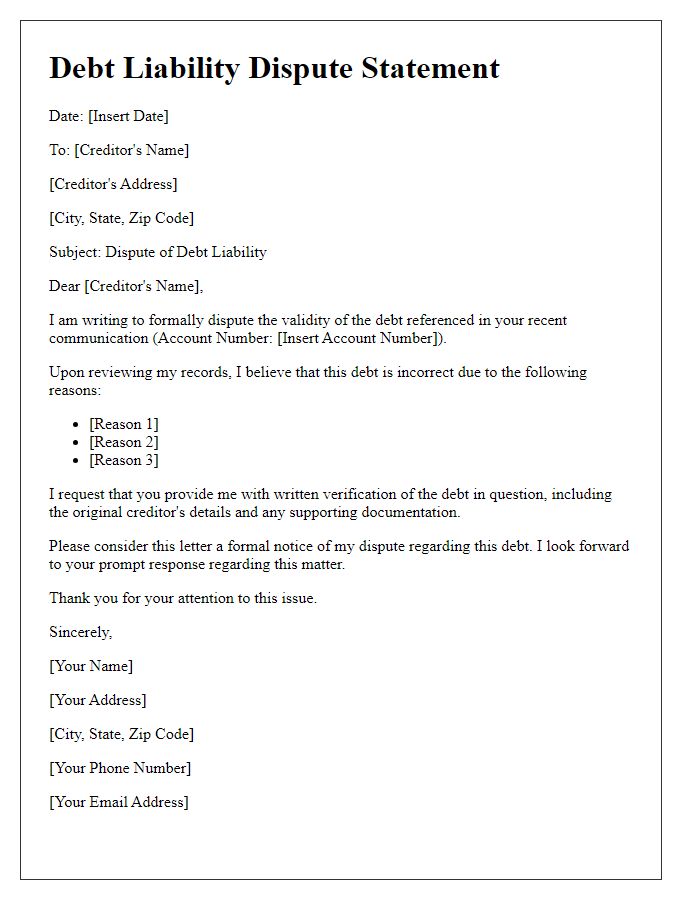

Request for resolution timeline

A financial liability dispute can arise from various contexts, such as loan agreements, credit card debts, or contractual obligations related to payments. Clear communication regarding the resolution of such disputes is vital. A request for a resolution timeline should include specific details about the dispute, including relevant dates, amounts involved, and parties accountable. Establishing a timeframe for resolution fosters transparency and accountability while encouraging prompt action. Including references to applicable laws or regulations, such as the Fair Debt Collection Practices Act (FDCPA) in the United States, can also strengthen the request for a structured timeline for addressing the financial liability concerns.

Comments