When it comes to transfer pricing documentation, having a clear and organized approach is essential for businesses navigating the complexities of regulatory compliance. Whether you're a small startup or a multinational corporation, understanding the nuances of transfer pricing can save you from costly tax disputes and enhance your financial reporting. It's important to tailor your documentation to reflect the unique characteristics of your business and transactions. Ready to dive deeper into the essentials of transfer pricing documentation? Keep reading to uncover valuable insights!

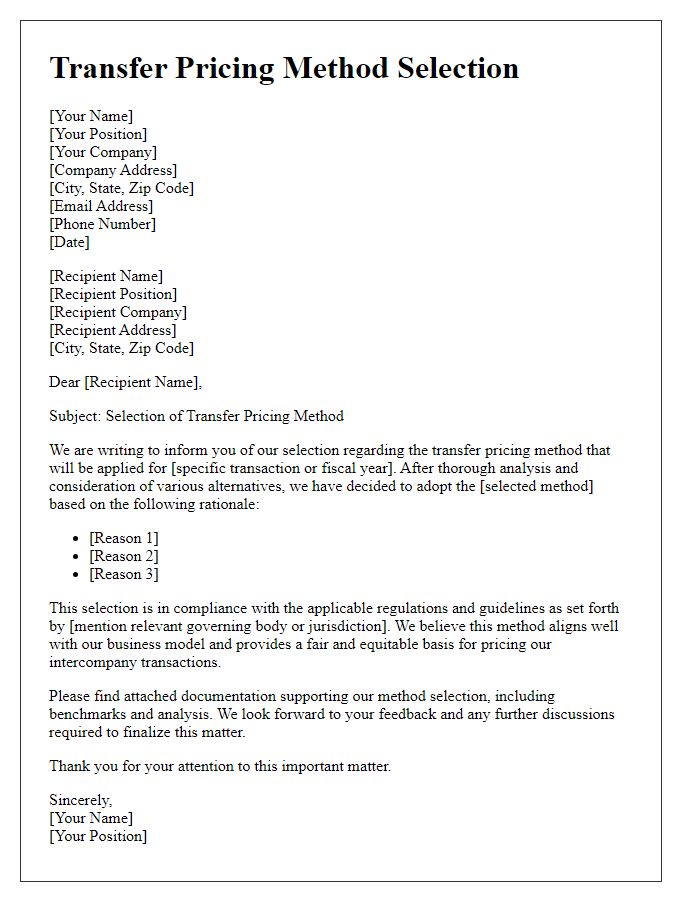

Subject Line Specificity

Transfer pricing documentation necessitates precision in subject line specificity to ensure compliance with regulations enforced by organizations such as the OECD (Organization for Economic Cooperation and Development). Accurate subject lines should reference the relevant fiscal year, such as "2023 Transfer Pricing Documentation Compliance" or specific test methodologies, like "Comparable Uncontrolled Price Method Analysis." Inclusion of the entities involved, such as "ABC Corporation to XYZ Subsidiary Transfer Pricing Assessment" enhances clarity. Specificity is crucial to streamline the review process during audits, like those conducted by the IRS (Internal Revenue Service) in the United States, minimizing risks associated with documentation inadequacies and ensuring alignment with local tax laws, such as the UK Transfer Pricing Regulations.

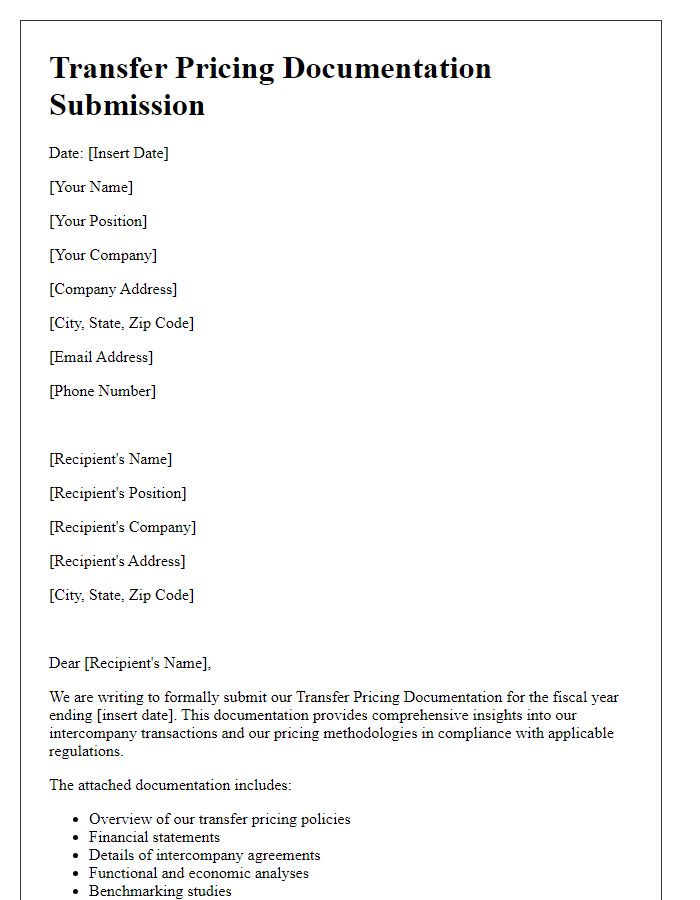

Comprehensive Scope and Purpose

Transfer pricing documentation serves a critical role in ensuring compliance with international tax regulations, particularly under OECD guidelines. This documentation outlines comprehensive methodologies for determining the arm's length price (ALP) of transactions between related entities within multinational enterprises. Such documentation must encompass detailed information about the organizational structure, financial statements, and the nature of intercompany transactions, which could involve goods, services, or financing arrangements. Properly prepared documentation, often covering target jurisdictions like the United States, Germany, or China, assists entities in justifying their transfer pricing practices during tax audits, mitigating risks of adjustment penalties that can range from 10% to 100% of the disputed amount. Moreover, ensuring that transfer pricing policies align with the business model and economic realities of each jurisdiction enhances the credibility of the documentation. Timely updates, reflecting changes in business operations or local regulations, are essential to maintaining effective compliance and negotiation positions with tax authorities worldwide.

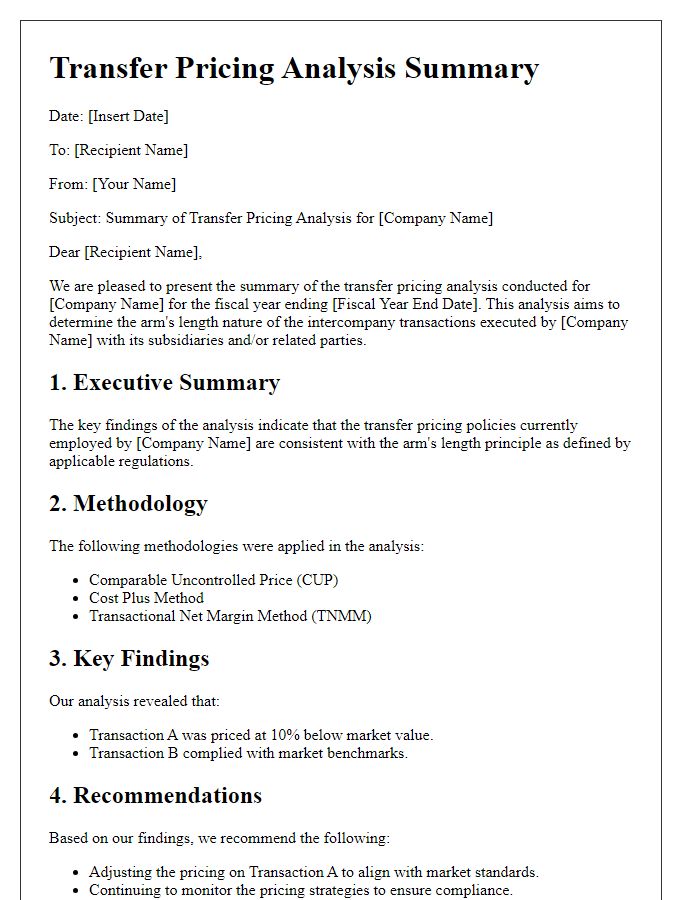

Detailed Transfer Pricing Methodologies

Transfer pricing documentation involves complex methodologies to determine the arm's length prices for transactions between affiliated entities across different jurisdictions. Common methods include Comparable Uncontrolled Price (CUP), which compares the price of a controlled transaction to an uncontrolled transaction; Cost-Plus method, where direct and indirect costs are calculated and a markup is added; and Transactional Net Margin Method, assessing profit margins of comparable entities. Additionally, the Profit Split method allocates combined profits among associated enterprises based on their respective contributions. These methodologies play a crucial role in compliance with regulations issued by organizations like the OECD, ensuring fair taxation in various countries. Detailed documentation supports these methodologies, encompassing financial statements, pricing policies, and market analysis, thereby aiding in audits and disputes over transfer pricing practices in global business operations.

Local and Global Compliance Standards

Transfer pricing documentation is vital for multinational enterprises engaged in cross-border transactions. Compliance with local standards, such as the OECD Transfer Pricing Guidelines, as well as global regulations, like the Base Erosion and Profit Shifting (BEPS) Action Plan, is essential to mitigate tax risks. Jurisdictions, including the United States and the European Union, impose specific documentation requirements, necessitating comprehensive records of intercompany transactions, financial statements, and pricing methods. Transfer pricing studies involve analyzing comparability factors such as functions performed, assets used, and risks assumed to determine arm's length pricing, ensuring adherence to regulations while justifying the pricing strategy employed. Timely upper economic analysis furthermore aids in aligning local policies with multinational audits, bolstering organizational transparency.

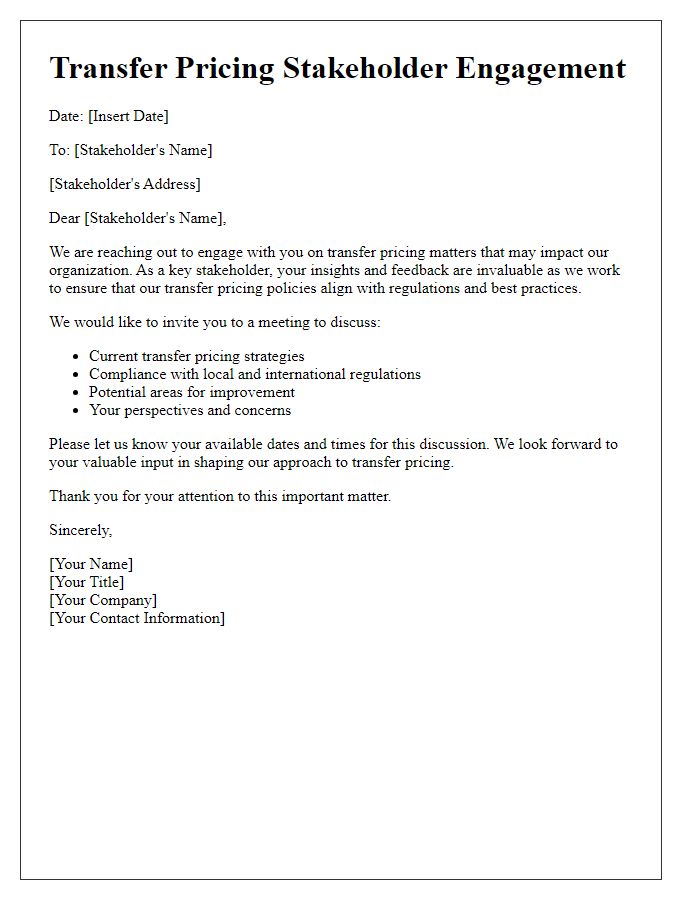

Contact Information for Queries and Follow-up

Transfer pricing documentation requires comprehensive details to ensure compliance with regulations. Contact information for queries and follow-up is essential for stakeholders such as tax authorities, financial analysts, or legal representatives. Include the name of the responsible individual, role or title (e.g., Transfer Pricing Manager), email address (e.g., manager@example.com), and a dedicated phone number (e.g., +1-234-567-8901). Document location details, including the city (e.g., New York) and country (e.g., USA), for geographical context. Establish a timeline for follow-up inquiries, usually within 10 business days, ensuring timely communication regarding transfer pricing policies and methodologies.

Comments