Navigating the complexities of legal risk management can feel overwhelming, but it doesn't have to be! Developing a solid strategy not only protects your business but also empowers you to make informed decisions. In this article, we'll explore the key components of an effective legal risk management plan and how it can shield your organization from potential pitfalls. So, let's dive in and discover how to safeguard your interestsâread on!

Comprehensive Risk Assessment

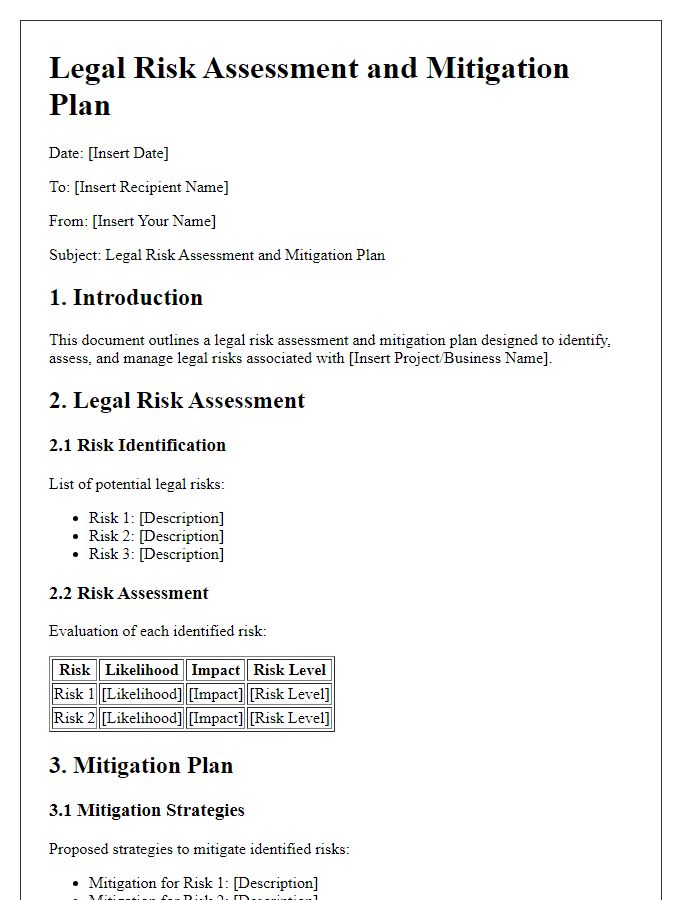

A comprehensive risk assessment in legal risk management strategy involves identifying, analyzing, and evaluating potential legal risks that may impact business operations, such as contract disputes, regulatory compliance issues, and litigation threats. This process typically includes evaluating internal policies and procedures, such as those outlined in the Sarbanes-Oxley Act (2002), assessing external factors like industry regulations enforced by bodies such as the Federal Trade Commission (FTC), and considering the implications of recent court cases. Effective risk management also incorporates detailed documentation of existing contracts, employee training programs on legal obligations, and the establishment of a risk response plan in line with corporate governance standards. Regular updates to the assessment, incorporating changes in laws or business activities, are essential for mitigating exposure to significant legal liabilities and ensuring the organization maintains compliance with laws applicable in jurisdictions where it operates.

Clear Communication Plan

A clear communication plan is essential for effective legal risk management in any organization. It outlines the processes and channels for disseminating important information related to legal risks and compliance issues. Key steps include identifying stakeholders, such as management teams, employees, and external legal counsel. Organizational policies should specify how legal updates, changes in regulations, or compliance requirements are communicated, typically through regular meetings or email newsletters. Training sessions play a critical role in educating employees about the legal implications of their roles. Moreover, incorporating feedback mechanisms, such as surveys, can enhance the understanding and effectiveness of communication strategies. Documented procedures should be easily accessible, enabling prompt communication in response to potential legal issues, thus minimizing risks and ensuring regulatory compliance.

Effective Compliance Monitoring

Effective compliance monitoring involves a systematic approach to ensure adherence to legal regulations and internal policies within organizations. Compliance officers must develop robust frameworks to assess risk levels and monitor activities regularly across multiple sectors, such as finance and healthcare. Tools such as automated compliance management software can analyze data in real-time, enhancing transparency and accountability. Regular audits, detailed reports, and employee training sessions are crucial for fostering a culture of compliance and mitigating risks associated with legal liabilities. High-profile compliance failures, exemplified by cases like Enron in the early 2000s, underscore the importance of proactive monitoring and the costs associated with negligence. Organizations must also stay updated on evolving laws, such as the General Data Protection Regulation (GDPR) in Europe, to ensure that their practices align with the latest legal standards.

Regular Legal Audits

Regular legal audits play a crucial role in legal risk management strategies for organizations, particularly in sectors such as finance, healthcare, and technology. Conducting these audits, typically every six months or annually, ensures compliance with evolving laws such as the General Data Protection Regulation (GDPR) and the Sarbanes-Oxley Act. Identifying gaps in legal compliance not only mitigates potential penalties but also safeguards the organization's reputation, especially in high-stakes environments like multinational operations or publicly traded companies. The auditing process involves evaluating client agreements, employment contracts, intellectual property rights, and regulatory compliance, ensuring all documents align with current legal standards. Engaging with specialized legal professionals or external auditors from leading law firms often enhances objectivity and thoroughness, providing an unbiased view of legal risks that may arise within the organization.

Crisis Response Protocol

A comprehensive Crisis Response Protocol outlines essential procedures for managing legal risks during emergencies or crises. This protocol typically includes key components such as an incident response team (IRT) consisting of legal experts, communication specialists, and crisis managers. The IRT must assess the nature of the crisis, determine legal implications, and develop a strategic communication plan to address stakeholders--employees, clients, regulatory authorities, and the public--effectively. Timely documentation, including incident reports and legal correspondence, is critical to minimize liabilities. Moreover, real-time monitoring of social media channels and news outlets (especially during high-profile incidents) will aid in understanding public sentiment and regulating narrative control. Regular training and simulations empower staff to act decisively during unforeseen events, adhering to established protocols. Ensuring compliance with relevant laws--such as data protection regulations (like GDPR) and industry standards--remains paramount throughout the crisis response process.

Letter Template For Legal Risk Management Strategy Samples

Letter template of comprehensive legal risk management strategy proposal

Comments