Are you looking to secure funding for your next big venture? Crafting a compelling letter for your equity investment proposal can make all the difference in attracting potential investors. It's essential to outline your vision clearly, demonstrate the potential for growth, and present a solid financial plan. Ready to learn more about how to write an impactful proposal? Keep reading!

Executive Summary

Equity investment proposals require a succinct executive summary to capture investor interest effectively. This summary outlines key financial projections (such as potential return on investment percentages), strategic objectives (like market penetration goals), and the business model description (operating revenue sources). Notable statistics, including estimated market size (often in the millions or billions of dollars), target demographics, and competitive landscape analysis, contribute vital context. Highlighting unique value propositions, such as patented technologies or exclusive partnerships, can differentiate the proposal. Additionally, mentioning milestones achieved (fundraising amounts or user acquisition figures) provides credibility and builds confidence for potential investors.

Market Analysis

The global market for renewable energy is projected to reach approximately $2.15 trillion by 2025, driven by increasing demand for sustainable solutions. Key regions include North America, Europe, and Asia-Pacific, with significant growth opportunities in countries like China and India due to government policies promoting clean energy initiatives. Notable events such as the Paris Agreement in 2015 emphasize international commitment to reducing carbon emissions, contributing to market expansion. Additionally, technological advancements in energy storage and solar panel efficiency are enhancing investment attractiveness. The competitive landscape features major players like Tesla, Siemens, and Vestas, indicating a robust ecosystem ripe for equity investments.

Business Model

The innovative business model of the company focuses on a subscription-based service that caters to eco-conscious consumers, providing a curated selection of sustainable products. Each month, subscribers receive a box containing five to seven items, including organic personal care products, biodegradable household cleaners, and zero-waste lifestyle accessories. The target demographic consists of millennials and Gen Z individuals aged 18 to 35, who are increasingly prioritizing sustainability in their purchasing decisions. By partnering with reputable brands committed to environmentally-friendly practices, the company ensures high-quality offerings while benefiting from an estimated market growth rate of 10% annually in the sustainable goods sector. Furthermore, the model incorporates a referral program to incentivize customer engagement, ultimately enhancing brand loyalty and driving revenue growth.

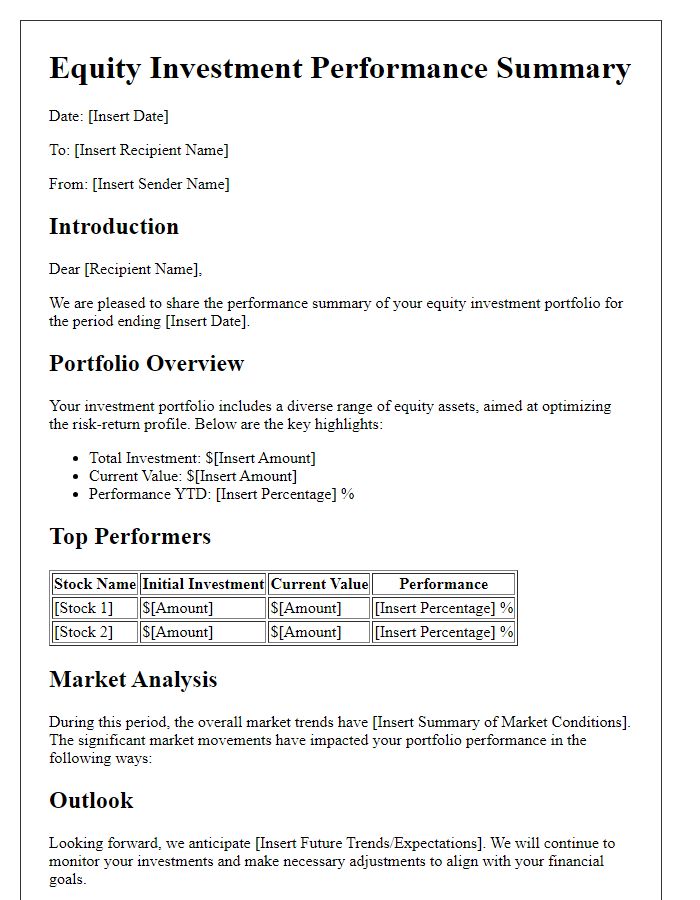

Financial Projections

Financial projections for equity investment submissions typically encompass projected revenues, expenses, and profit margins. For instance, a startup in the renewable energy sector may anticipate a revenue increase from $500,000 in Year 1 to $2 million by Year 3, supported by growth in solar installation contracts. Operational expenses might rise from $300,000 in the first year to $1 million by Year 3, reflecting expansion costs including employee hires and equipment purchases. Profit margins could improve from 40% to 50% as efficiency increases and brand recognition grows within the growing $1 trillion global renewable energy market. Accurate financial modeling and performance metrics are crucial for attracting potential investors. These projections should be underpinned by market analysis, addressing target demographics and competition in locations like California, where demand for sustainable energy solutions is surging.

Risk Assessment

Equity investment proposals require a thorough risk assessment to provide potential investors with insight into possible threats. Market volatility refers to unpredictable price movements affecting stocks in exchanges like the New York Stock Exchange (NYSE). Economic downturns, such as recessions, can severely impact consumer spending and business revenues. Regulatory changes, involving agencies like the Securities and Exchange Commission (SEC), can alter compliance costs for companies. Competitive risks emphasize the threat posed by emerging startups and established corporations within the same sector. Additionally, operational risks include issues within supply chains, labor disputes, or technology failures. Finally, reputational risks highlight the potential damage caused by negative publicity across social media platforms and news outlets. Each risk should be meticulously analyzed, presenting statistical data, historical examples, and mitigation strategies to reinforce the investment proposal's credibility.

Comments