Are you preparing a compliance audit response and feeling a bit overwhelmed? Crafting the perfect letter can be the key to showcasing your commitment to regulations and standards. With the right template, you can address any findings effectively while demonstrating your willingness to improve and adapt. So, let's dive into some essential tips and examples that will help you navigate this process with confidenceâread on to learn more!

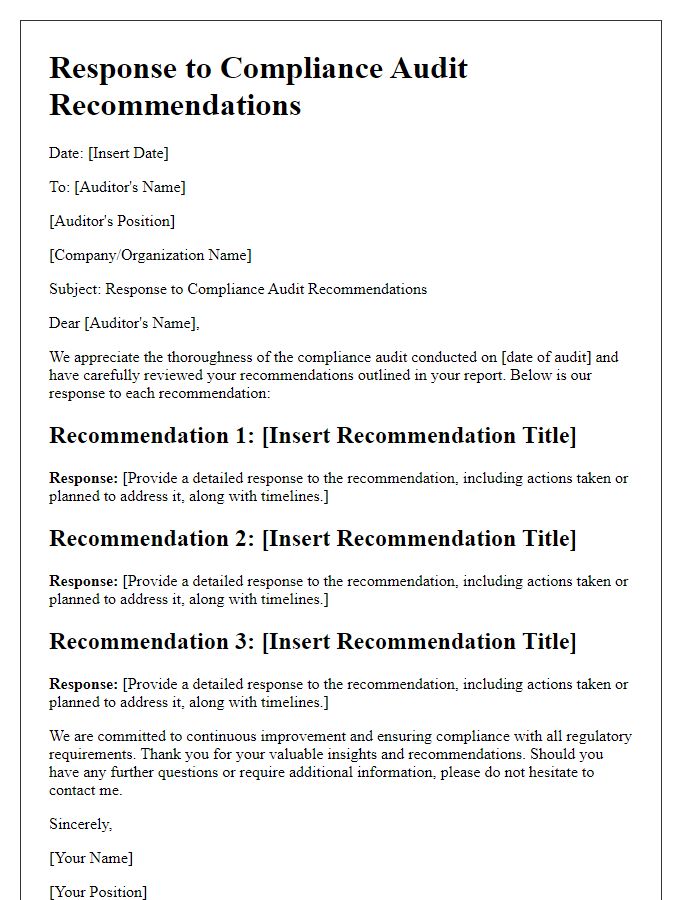

Tone and Formality

Compliance audits play a crucial role in organizations, ensuring adherence to regulations and standards. A formal response to audit findings emphasizes accountability. The tone remains professional, using precise language. Key components include acknowledgment of findings, detailed corrective actions with timelines, and designated responsibilities. Additionally, referencing specific regulations or standards, such as ISO 9001 or Sarbanes-Oxley, strengthens the response. Clear communication enhances transparency, crucial for maintaining stakeholder trust. Thorough documentation of processes is essential, highlighting commitment to continuous improvement within the organization. Overall, an effective compliance audit response reflects an organization's dedication to governance and operational excellence.

Specificity and Clarity

The compliance audit report highlighted several key areas requiring improvement within the organization's operational protocols. Documentation accuracy (ensuring records are precise and up-to-date) is essential for maintaining regulatory adherence to standards set by agencies like the ISO (International Organization for Standardization) and GDPR (General Data Protection Regulation). Training programs aimed at enhancing employee understanding of compliance regulations, particularly in sectors such as healthcare and finance, should be implemented. Furthermore, establishing a robust internal communication framework can promote transparency and accountability among staff, integrating technology solutions like secure intranet systems or cloud-based management tools to streamline information sharing and mitigate risks associated with non-compliance.

Supporting Documentation and Evidence

During a compliance audit, supporting documentation and evidence play a crucial role in verifying adherence to regulatory requirements and internal policies. Examples of such documentation include financial records, transaction logs, and compliance training certificates, all essential for demonstrating transparency and accountability. Additionally, electronic records like email correspondence related to compliance efforts and audit trails from software systems can provide critical insights into operational practices. Third-party assessments and internal review reports also serve as valuable evidence, illustrating the organization's commitment to maintaining standards and addressing previous audit findings. Collectively, this documentation illustrates an organization's proactive approach to compliance and risk management.

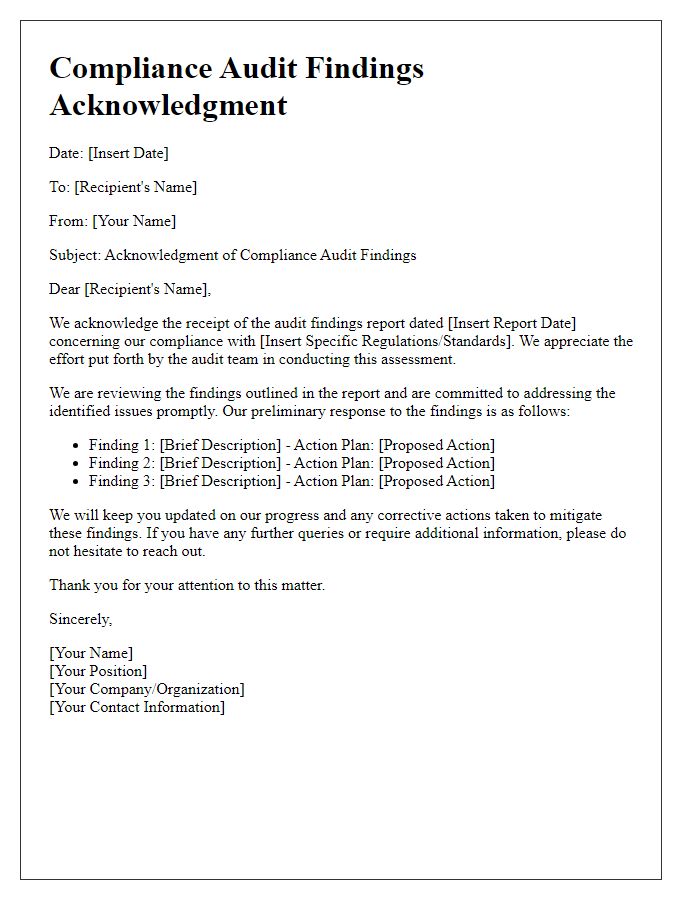

Acknowledgment and Responsibility

During a compliance audit, organizations must demonstrate acknowledgment of findings and responsibility for corrective actions. An auditor's report may highlight areas of non-compliance, including financial discrepancies (like unreported income), regulatory violations (such as failure to adhere to industry standards), and policy lapses (like insufficient training programs). Entities are required to draft a response outlining their recognition of the issues presented, ensuring their commitment to rectifying the identified deficiencies. Proper documentation, including timelines for corrective measures and designated personnel responsible for implementation, should accompany the response. This level of detail not only reflects accountability but also establishes a clear roadmap for compliance improvement to relevant stakeholders, such as regulatory bodies or internal governance committees.

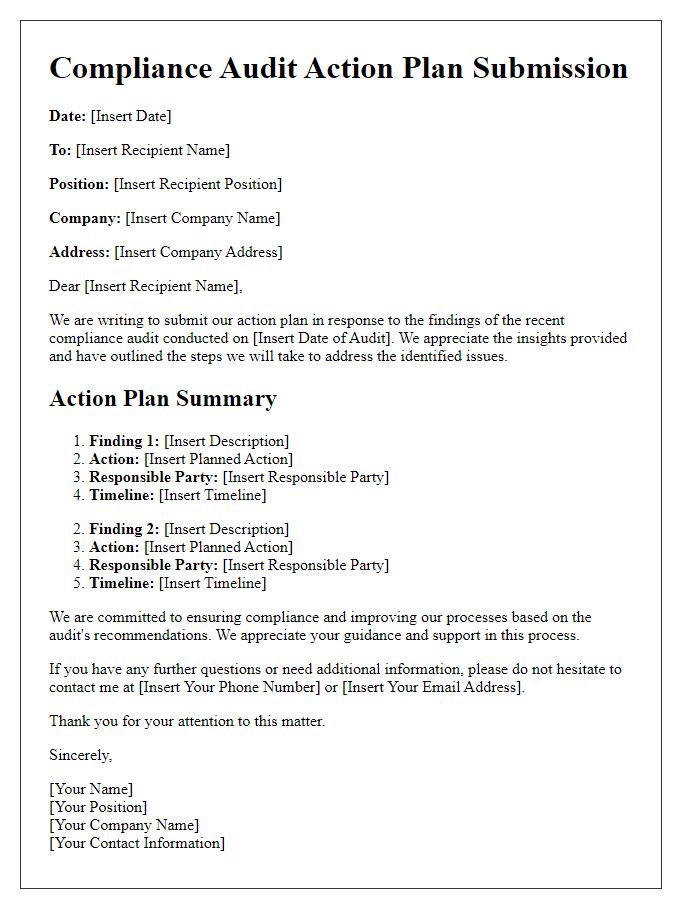

Action Plan and Timelines

An effective action plan for compliance audit response outlines necessary procedures and timelines to address identified deficiencies. The plan includes steps to rectify compliance issues such as updating internal policies, conducting staff training sessions, and implementing new reporting mechanisms. Specific milestones should be established, such as completing policy revisions by December 1, 2023, and conducting requisite training by January 15, 2024. Assigned responsibilities must be clear, assigning team members to oversee each phase of the plan, such as compliance officers or department heads. Regular progress reviews should be scheduled, with updates shared during bi-weekly meetings to ensure adherence to timelines. Additionally, documenting each step taken is essential for future audits and to demonstrate commitment to compliance standards.

Comments