Are you feeling a bit overwhelmed by your tax liability? Many people find themselves grappling with complex tax regulations and unclear obligations, which can lead to significant stress. Understanding your tax responsibilities is crucial to avoid any surprises come tax season. If you're looking for clarity on this important topic, keep reading to explore how you can navigate your tax liabilities effectively!

Accurate Identification of Taxpayer Information

Accurate identification of taxpayer information is crucial for proper tax liability assessment. Taxpayer Identification Numbers (TIN), Social Security Numbers (SSN), and Employer Identification Numbers (EIN) serve as unique identifiers for individuals and businesses, ensuring correct record-keeping by the Internal Revenue Service (IRS) in the United States. Inaccurate information can lead to complications such as incorrect tax assessments, delays in refunds, or potential penalties. Documenting changes in taxpayer status, such as marital status adjustments or changes in business structure, should be reported promptly in accordance with IRS guidelines to maintain accurate records and avoid future tax liabilities.

Detailed Explanation of Tax Discrepancy

Tax discrepancies can arise from various sources, including errors in income reporting, deductions, or credits. Taxpayers may receive notices from the Internal Revenue Service (IRS) regarding discrepancies, especially if there are significant differences compared to reported information from employers or financial institutions. For instance, a mismatch in reported wages (such as a $10,000 difference in W-2 income from the employer versus what was reported on the tax return) can trigger IRS inquiries. Proper documentation, including pay stubs, bank statements, and previous tax returns, is crucial to clarify these discrepancies. Additionally, timely responses, typically within 30 days of notice receipt, are essential to avoid further penalties or interest accrual. Understanding the specific tax code sections that pertain to the disputed amounts can also aid taxpayers in forming a comprehensive defense against any claimed liabilities.

Reference to Relevant Tax Codes and Regulations

Tax liability clarification requires specific attention to relevant tax codes and regulations, such as the Internal Revenue Code (IRC) Section 61, which defines gross income, and Section 162, outlining ordinary and necessary business expenses. Taxpayers often refer to IRS Publication 17 for individual tax guidance and IRS Schedule C for self-employed income reporting. Each state has its own tax regulations; for instance, California's Revenue and Taxation Code SS17041 governs personal income tax obligations. Documentation and record-keeping are critical as the IRS mandates keeping tax records for at least three years, significantly impacting future audits or disputes. Understanding the implications of relevant tax codes ensures compliance and protects taxpayers from potential penalties or legal issues.

Clear Request for Specific Resolution or Clarification

Tax liability clarification involves understanding specific financial obligations related to income taxes. Individuals often seek clarity regarding calculations for annual earnings from various sources, including wages, investments, and freelance work. For example, a person receiving income from a side business may need detailed information regarding self-employment tax rates, currently set at 15.3% for net earnings up to $147,000 (as of 2023). Additionally, deductions related to mortgage interest payments, state taxes, and healthcare can significantly impact overall liability. Furthermore, understanding timelines for filing (April 15 for individual tax returns) can aid in avoiding penalties imposed by the Internal Revenue Service (IRS). Tax assistance programs available through community organizations can provide additional resources for individuals seeking to clarify their responsibilities accurately.

Inclusion of Supporting Documentation

In tax liability assessments, inclusion of supporting documentation plays a critical role in establishing the accuracy of reported income and expenses. Necessary documents, such as W-2 forms from employers, 1099 forms for freelance work, and receipts for deductible expenses, should be compiled meticulously. For instance, having bank statements from January to December for a specific tax year can provide a comprehensive view of income sources and expenditures. Additionally, organizing these documents according to categories like health expenses (which may include medical bills or insurance premiums), education costs, and home office deductions simplifies the review process. Accuracy and detail in documentation not only facilitate a clearer understanding of one's financial situation but also help avoid potential discrepancies that could lead to audits or penalties from the Internal Revenue Service (IRS).

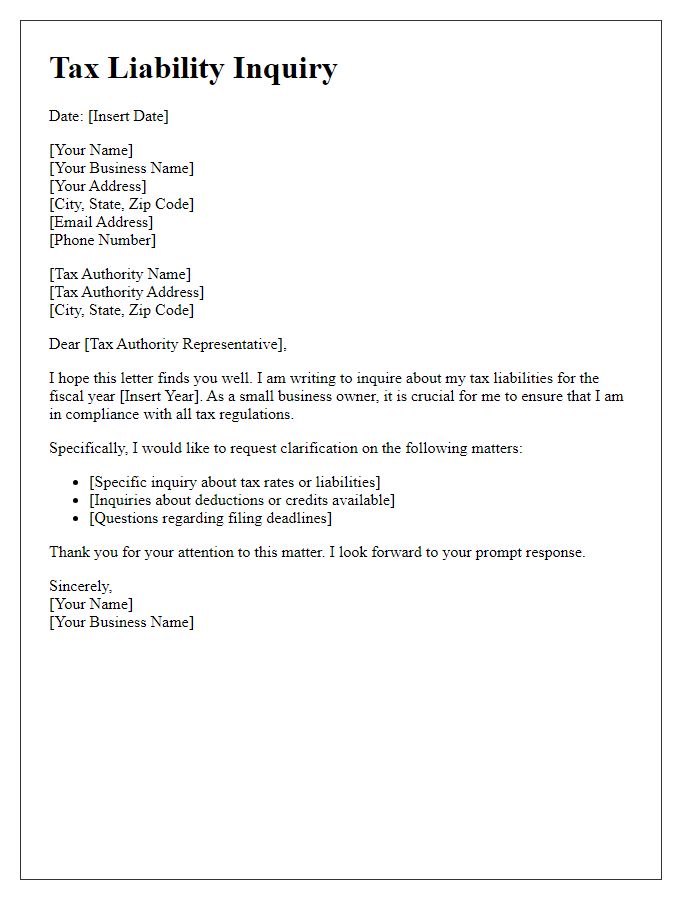

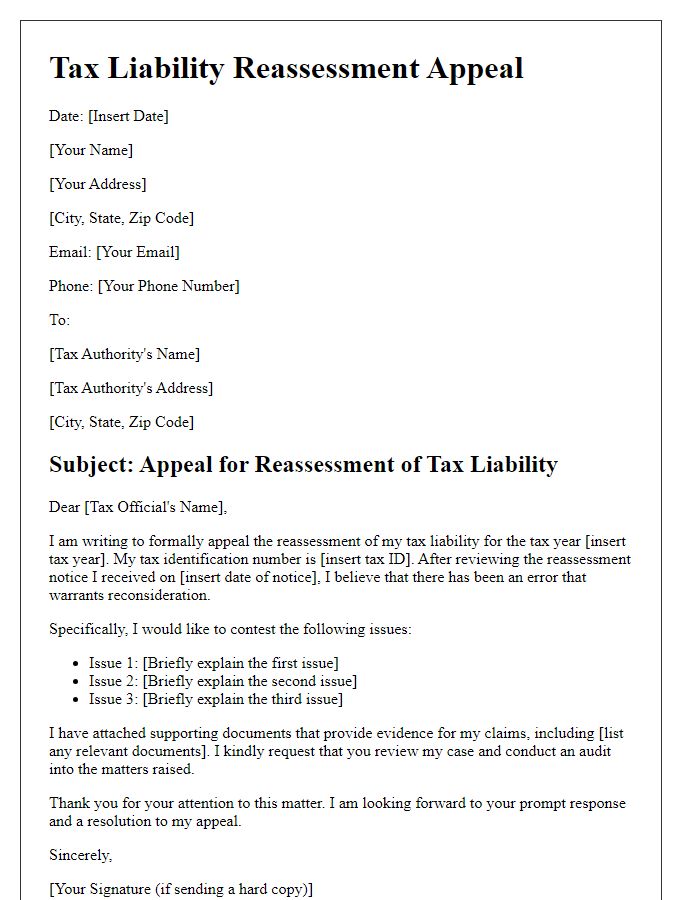

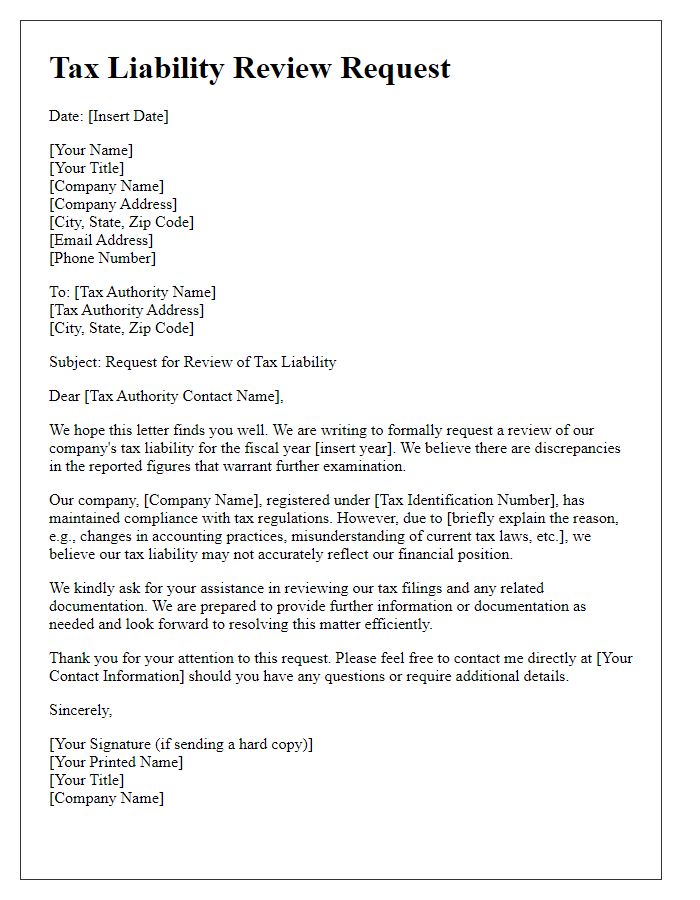

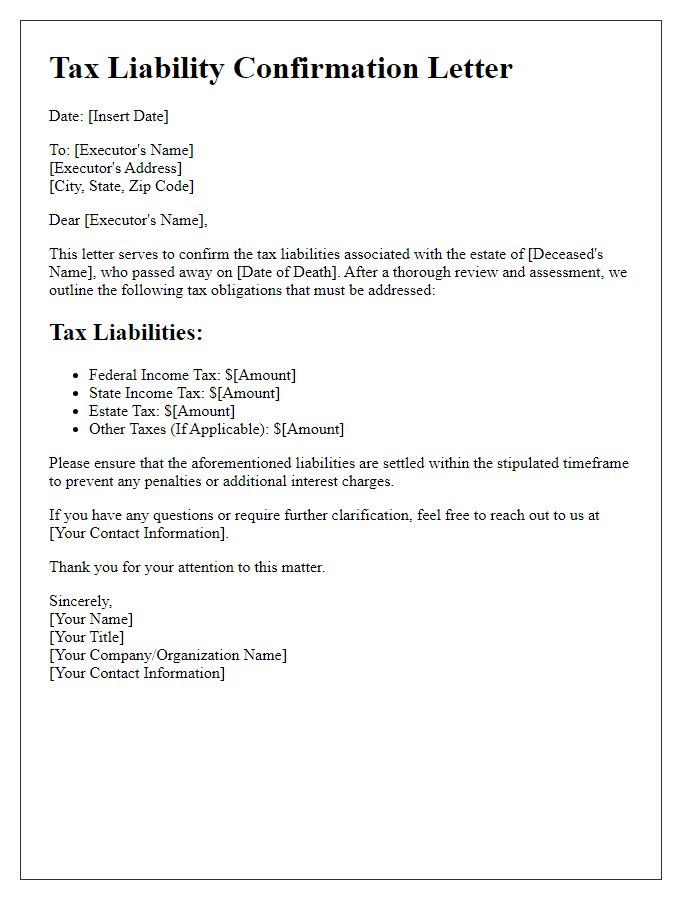

Letter Template For Tax Liability Clarification Samples

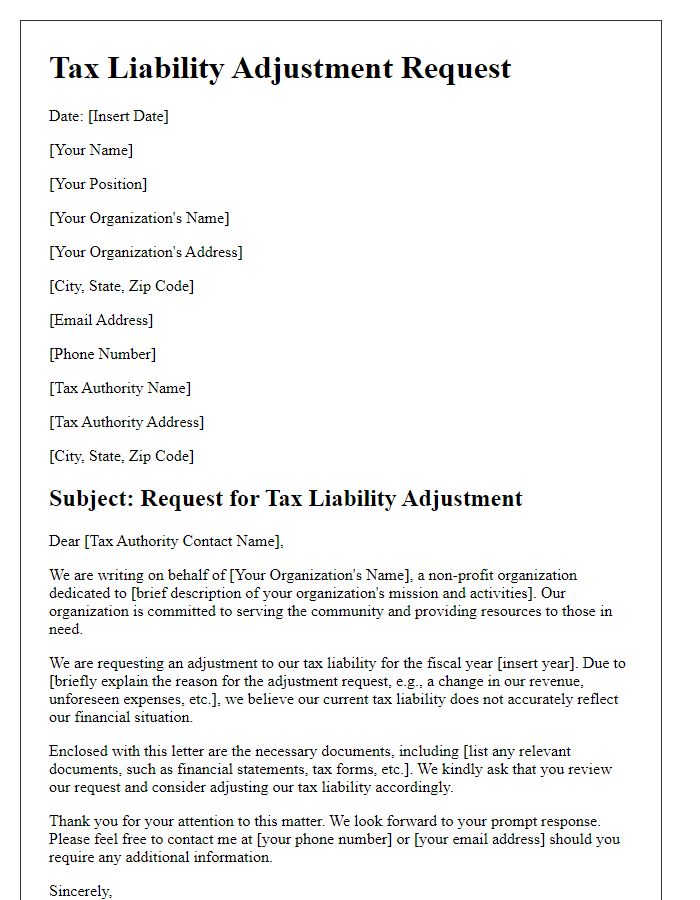

Letter template of tax liability adjustment request for non-profit organizations

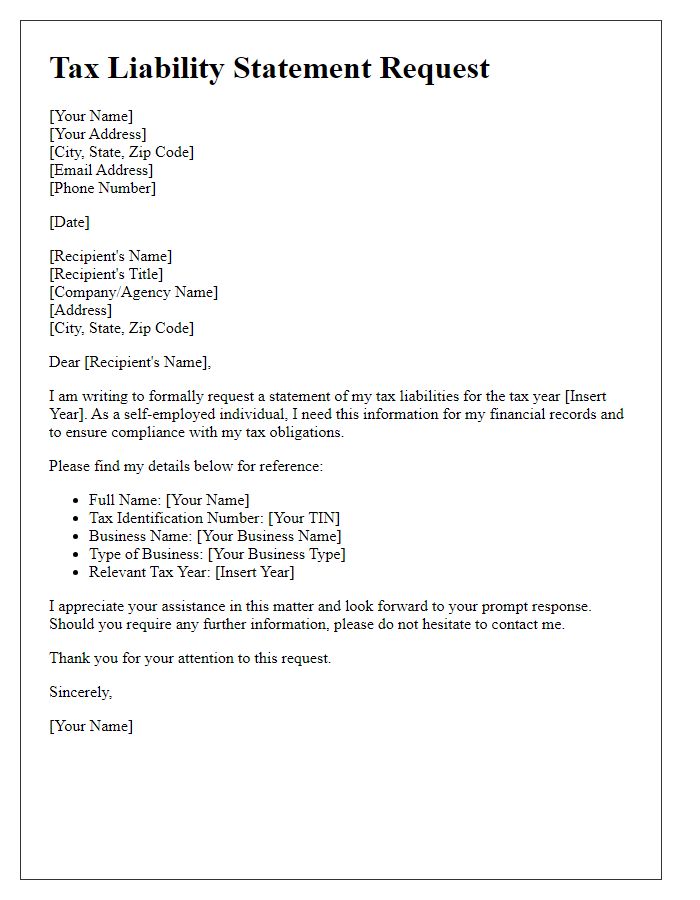

Letter template of tax liability statement request for self-employed individuals

Comments