Navigating cross-border tax issues can feel like deciphering a complex puzzle, but it doesn't have to be overwhelming. In this article, we'll break down the key considerations you need to keep in mind when dealing with international taxation. Whether you're a business owner venturing into foreign markets or an individual with overseas income, understanding the nuances of tax regulations is essential. So, let's dive in and unravel the intricacies of cross-border tax challenges togetherâread on to discover valuable insights!

Regulatory compliance

Cross-border tax issues encompass complex regulatory compliance challenges faced by multinational corporations operating in various jurisdictions. Tax regulations such as Transfer Pricing Rules (often applicable under OECD guidelines) require companies to set prices for transactions between subsidiaries in different countries properly. Non-compliance can result in substantial penalties, amounting to millions of dollars, and potential double taxation on revenue (where two different countries tax the same income). Regulatory bodies, such as the Internal Revenue Service (IRS) in the United States or the HM Revenue and Customs (HMRC) in the United Kingdom, often scrutinize these practices, demanding detailed documentation (including financial records and contracts) to ensure adherence to local tax laws. Understanding the specific regulations of each operating country (like VAT systems in European Union member states) is essential for minimizing tax liabilities and navigating audits safely.

Tax jurisdiction assessment

Navigating cross-border tax issues requires thorough evaluation of tax jurisdictions, especially in multinational operations. Understanding complex tax frameworks such as OECD guidelines governing Base Erosion and Profit Shifting (BEPS) is critical. Different countries, like the United States, France, and Japan, impose varied corporate tax rates ranging from 21% to 30%. Additionally, local tax regulations, compliance requirements, and treaties, like the Double Taxation Agreements (DTAs) between nations, significantly influence tax liabilities. Effective tax jurisdiction assessment can mitigate risks of double taxation and penalties through strategic planning. Professional guidance from tax advisors specializing in international taxation ensures compliance with evolving regulations while optimizing overall tax strategy.

Double taxation treaties

Double taxation treaties (DTTs) serve as international agreements between countries to prevent individuals and corporations from being taxed in both jurisdictions on the same income. These treaties are critical in cross-border tax issues, as they delineate which country has taxing rights over various forms of income, such as dividends, interest, and royalties. The implementation of DTTs can significantly reduce withholding tax rates (often from 30% to 5% or 15%) on income payments made between residents of different countries, fostering economic relations and encouraging foreign investments. For instance, the DTT between the United States and Germany enables eligible entities to benefit from reduced tax rates, ensuring compliance with the OECD guidelines while fostering transparency and cooperation. These treaties often include provisions for dispute resolution, which can mitigate risks related to double taxation and provide clarity for taxpayers in multinational operations.

Exchange rate considerations

Exchange rate fluctuations play a significant role in cross-border tax issues, affecting fiscal evaluations for multinational corporations and individuals. For instance, the varying exchange rates between the Euro (EUR) and the United States Dollar (USD) can impact the taxable income reported by companies operating within both the Eurozone and the United States. These differences often necessitate careful currency conversion methods, such as the spot rate or average rate for the reporting period, to ensure compliance with tax regulations set by authorities like the Internal Revenue Service (IRS) in the United States and the European Commission. Additionally, discrepancy in exchange rates at the time of transactions can result in capital gains or losses, influencing overall tax liability. Businesses must remain informed about the implications of exchange rate variations to strategically manage their cross-border financial reporting and tax obligations.

Documentation and record-keeping

Effective documentation and record-keeping are essential for managing cross-border tax issues, especially for multinational corporations operating in diverse jurisdictions such as the United States, Germany, and China. Proper records, including invoices, contracts, and payment receipts, should be maintained for at least seven years (as recommended by the IRS) to meet compliance requirements. Regulatory authorities like the OECD emphasize the importance of transfer pricing documentation to substantiate intercompany transactions. Furthermore, maintaining accurate financial records assists in navigating complex tax treaties and ensures adherence to local tax laws, minimizing the risk of audits and penalties. In a constantly evolving global tax landscape, having comprehensive documentation not only facilitates smoother audits but also aids in strategic planning for future tax obligations and liabilities.

Letter Template For Cross-Border Tax Issues Samples

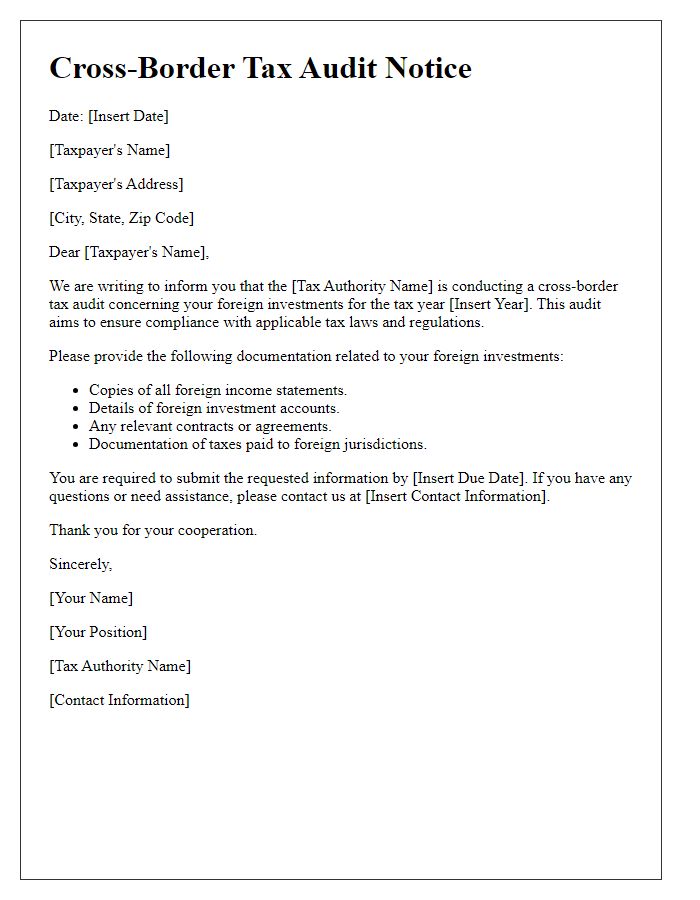

Letter template of cross-border tax audit notice for foreign investments

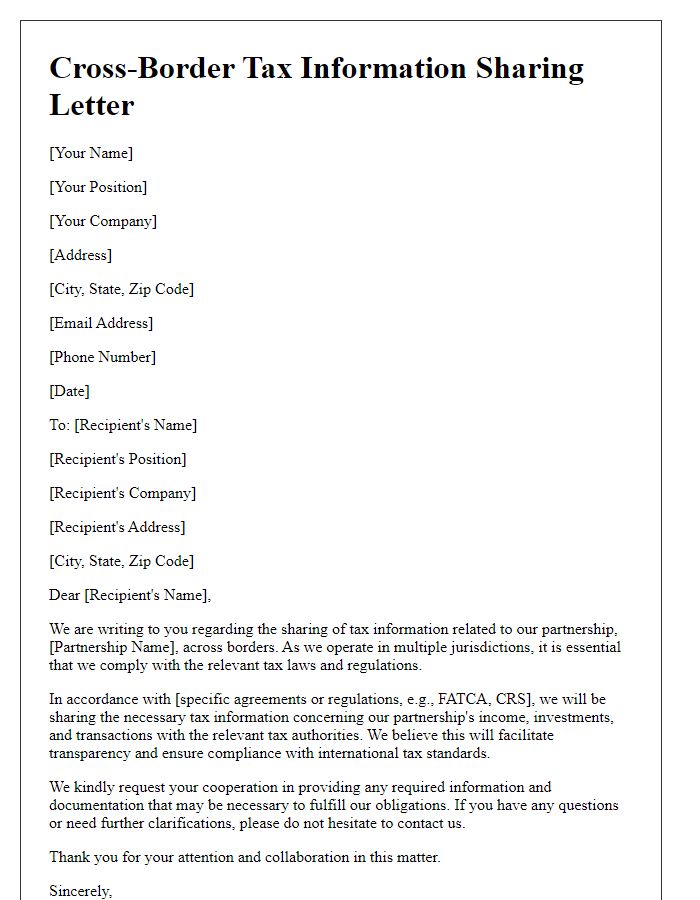

Letter template of cross-border tax information sharing for partnerships

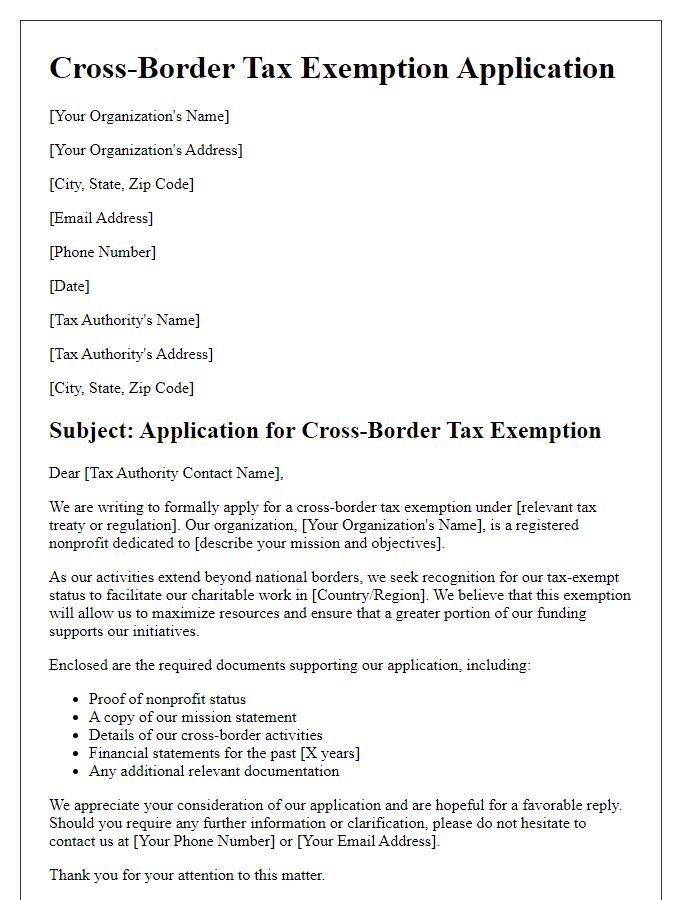

Letter template of cross-border tax exemption application for nonprofits

Letter template of cross-border tax treaty benefits request for residents

Comments