Are you preparing for a legal compliance audit and feeling a bit overwhelmed? Rest assured, you're not alone in this journey. Understanding the requirements and best practices can make all the difference in ensuring a smooth audit process. Let's dive deeper into key strategies and insights that will help you navigate this essential task effectivelyâread on for more!

Purpose of the Audit

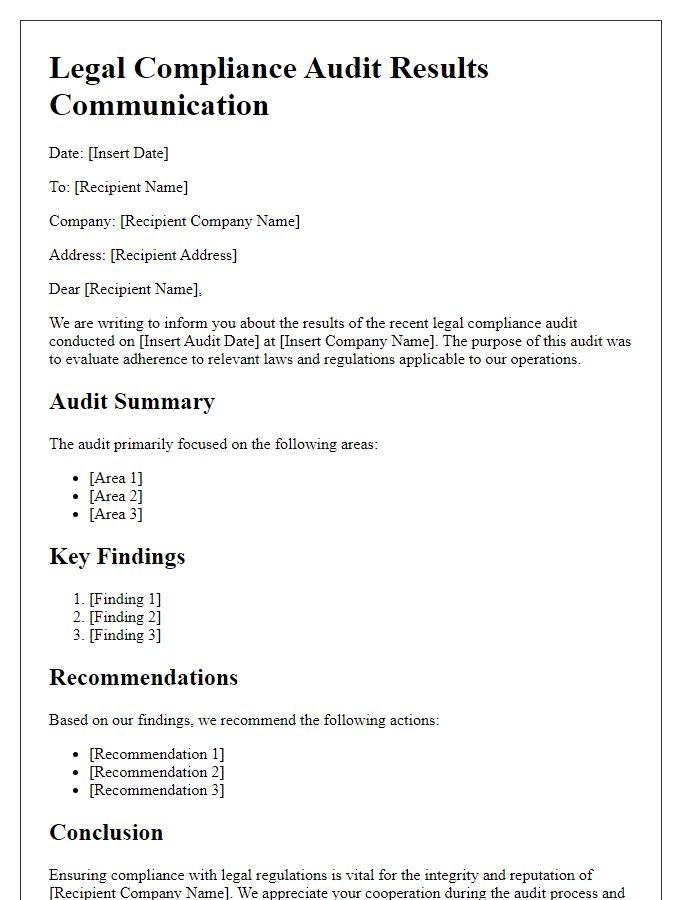

The purpose of a legal compliance audit is to assess adherence to applicable laws, regulations, and internal policies within an organization. This evaluation includes examining various areas such as employment law, environmental regulations, data protection laws, and industry-specific standards. Auditors will review documentation, conduct interviews, and analyze processes to ensure compliance with federal statutes, state laws, and local ordinances. Identifying areas of risk or non-compliance aims to mitigate potential legal liabilities, enhance operational efficiency, and promote ethical business practices. Ultimately, the audit helps ensure that the organization operates within legal frameworks while maintaining industry integrity.

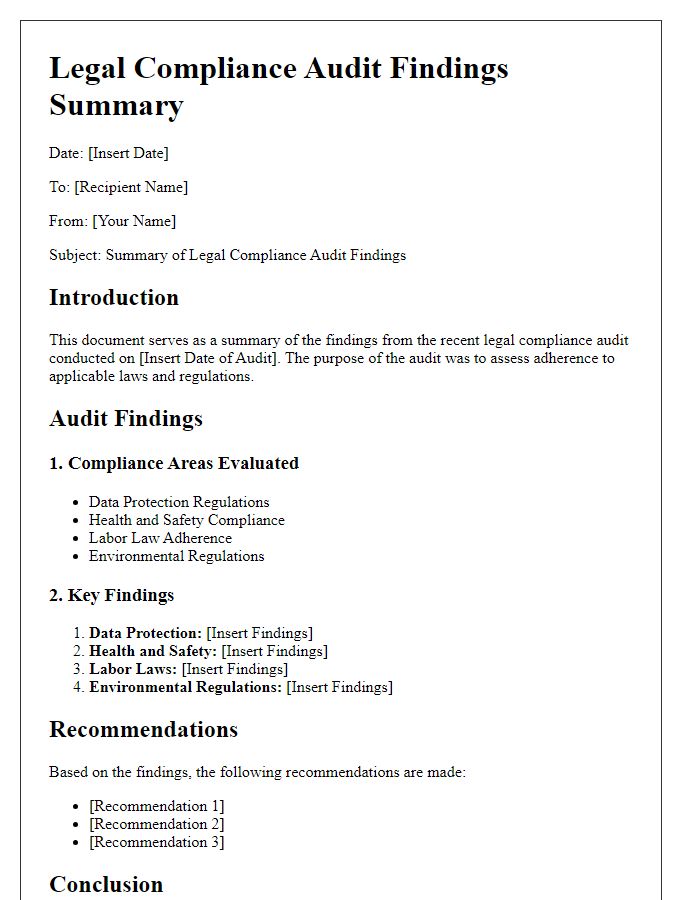

Scope of Compliance Areas

The scope of compliance areas in a legal compliance audit encompasses various regulatory frameworks and industry standards, which ensure adherence to laws and ethical guidelines. Key areas include data protection regulations such as the General Data Protection Regulation (GDPR) in the European Union, which mandates stringent measures for handling personal information. Financial compliance involves adherence to the Sarbanes-Oxley Act, ensuring accuracy in financial reporting and preventing fraudulent activities within publicly traded companies. Workplace safety regulations governed by the Occupational Safety and Health Administration (OSHA) in the United States require businesses to maintain safe working environments. Environmental compliance, regulated by the Environmental Protection Agency (EPA), enforces laws that aim to reduce pollution and promote sustainability. Additionally, adherence to employment laws, including the Fair Labor Standards Act (FLSA), ensures fair labor practices, including minimum wage and overtime pay. Each of these areas presents unique challenges and requires thorough evaluation to achieve comprehensive compliance across all operational facets of an organization.

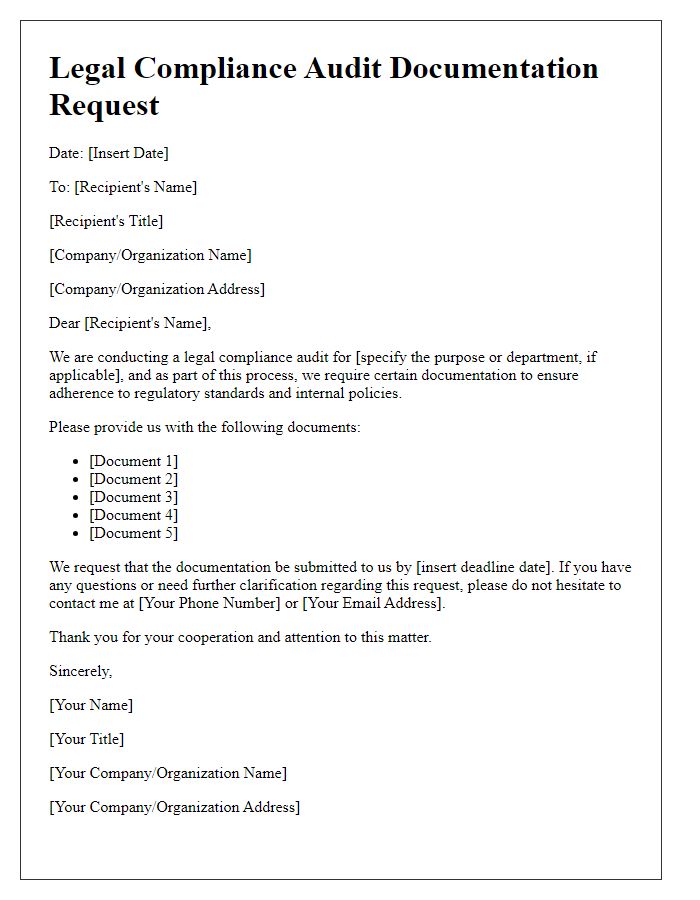

Documentation Required

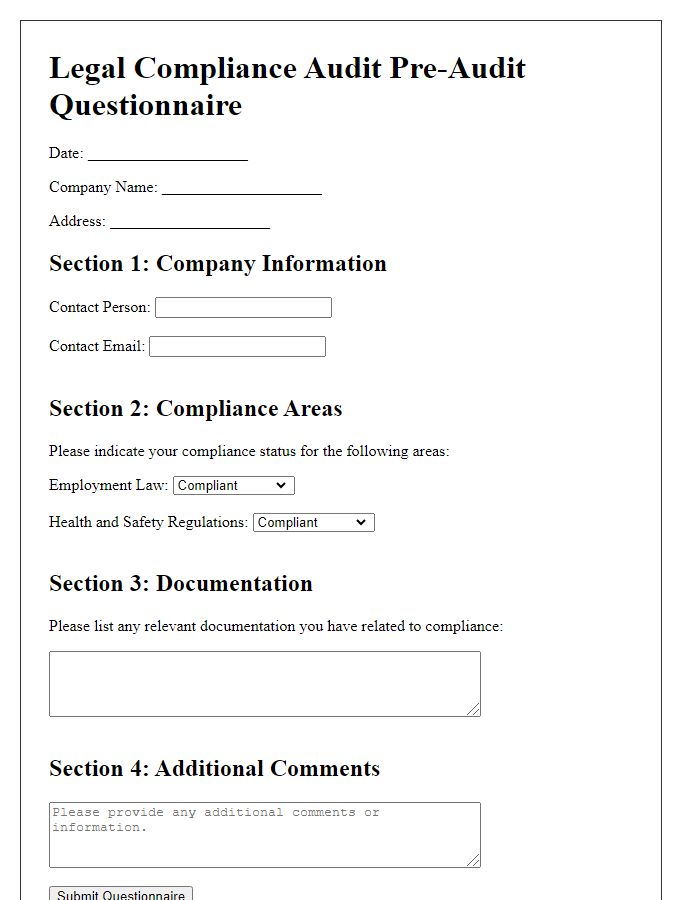

A legal compliance audit requires comprehensive documentation to ensure adherence to regulations and laws. Key documents include compliance policies and procedures manuals, detailing internal protocols for various laws such as the General Data Protection Regulation (GDPR) for data protection and the Occupational Safety and Health Administration (OSHA) standards for workplace safety. Additionally, evidence of employee training on compliance topics represents crucial documentation, encompassing attendance records, training materials, and certificates. Financial documents, including tax returns and accounting records, should reflect compliance with the Internal Revenue Service (IRS) standards. Lastly, incident reports or non-compliance reports from which corrective actions are derived illustrate organizational responsiveness to potential legal issues. This meticulously compiled documentation verifies alignment with applicable laws and regulations, ensuring a thorough evaluation of legal compliance.

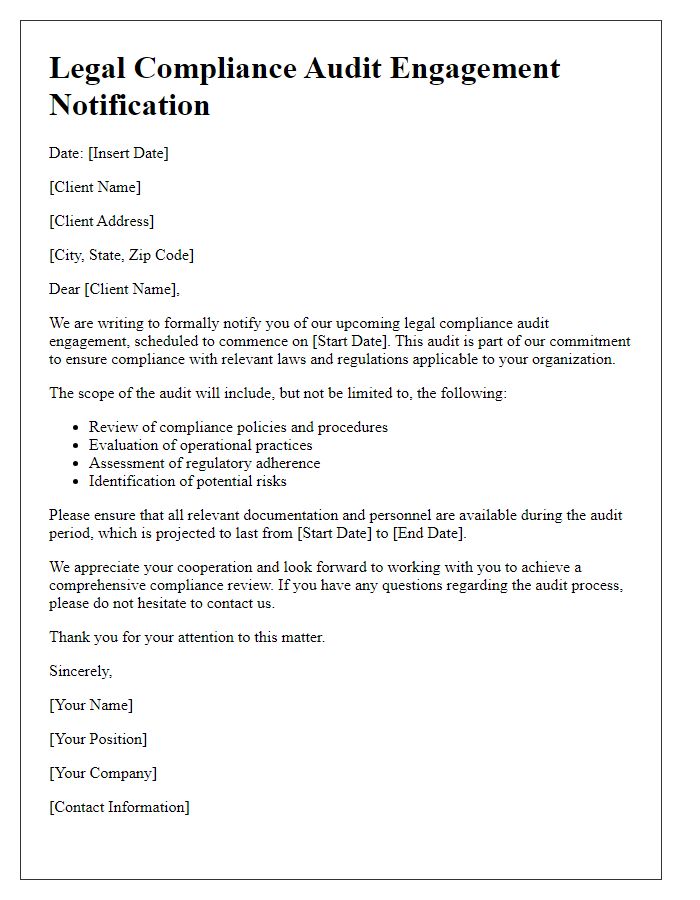

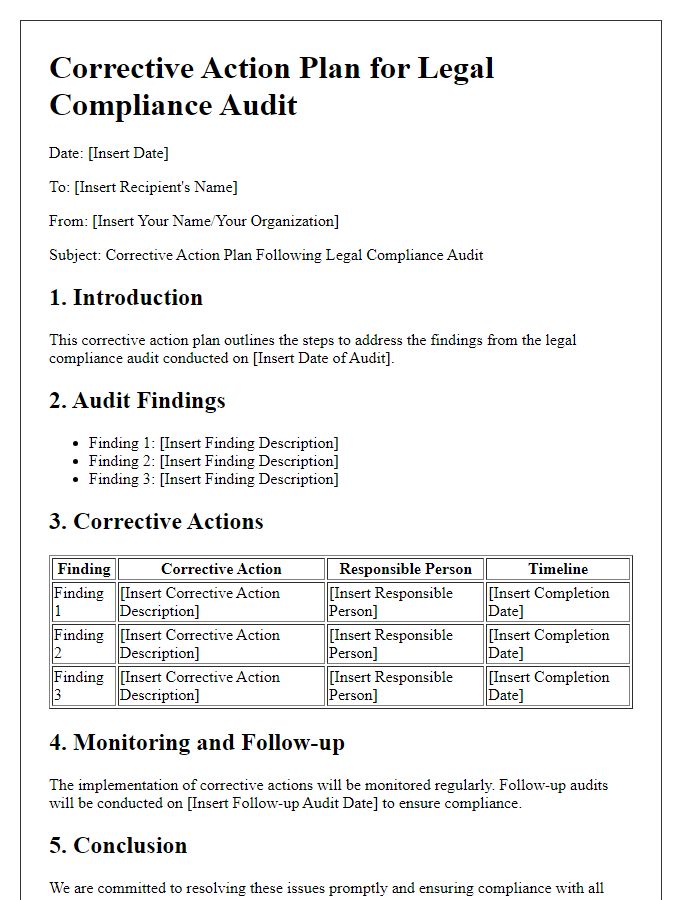

Timeline and Deadlines

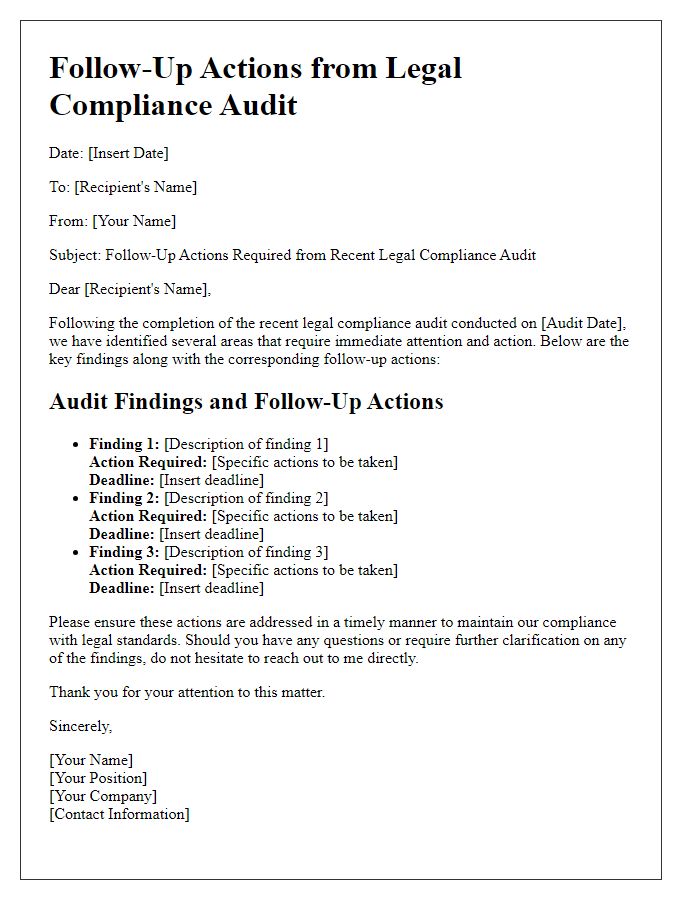

A legal compliance audit entails a thorough examination of an organization's adherence to laws, regulations, guidelines, and specifications relevant to its business. For effective planning, establishing a detailed timeline with specific deadlines is crucial. Key stages include the initial assessment phase, typically lasting two weeks, where the compliance team gathers all necessary documents and data (such as financial records and operational procedures). Following this, a two-week review period enables the team to analyze findings and identify gaps in compliance. The subsequent reporting phase, spanning one week, involves compiling the audit report detailing findings and recommendations. Implementing corrective actions should occur within four weeks post-reporting, ensuring that any compliance gaps are addressed promptly. Regular follow-ups, ideally scheduled quarterly, secure ongoing adherence to compliance requirements, underscoring the importance of maintaining legal standards.

Contact Information for Inquiry

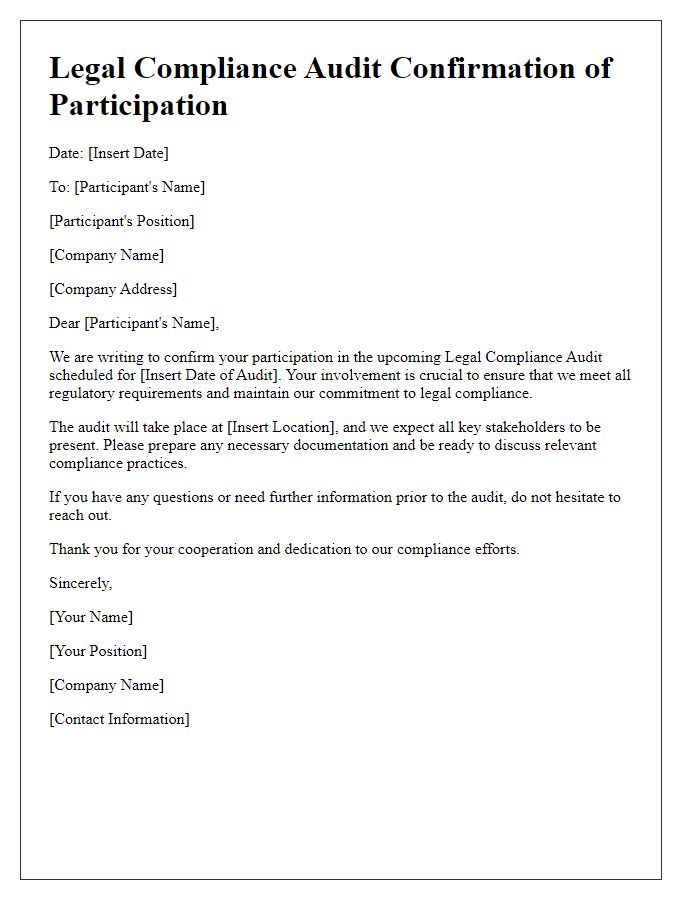

A legal compliance audit serves as a critical examination of an organization's adherence to mandated regulations and laws. Contact information, such as designated email addresses and phone numbers, becomes essential during this process to facilitate inquiries. This information typically includes the names of compliance officers or auditors assigned to the audit, as well as their positions within the organization, which may be a corporation or government agency. Accurate contact details ensure efficient communication and expedite the resolution of any compliance-related issues identified during the audit. Specific timeframes for response and preferred methods of contact may also be included to streamline the inquiry process.

Comments