When embarking on an acquisition, conducting thorough due diligence is crucial to ensure a sound investment. This detailed examination helps uncover potential risks and opportunities, allowing you to make informed decisions. A well-structured letter template can streamline this process, guiding you through essential inquiries and facilitating clear communication. Dive into the specifics of creating a robust due diligence letter template to enhance your acquisition strategy!

Company Overview

The company overview provides a comprehensive summary of Acme Corporation (established in 2005) headquartered in Austin, Texas, employing over 1,200 staff. With reported annual revenues exceeding $150 million in 2022, Acme specializes in innovative software solutions tailored for the healthcare sector, focusing on patient management systems and data analytics. Its flagship product, HealthSync, serves over 300 hospitals across the United States, enhancing operational efficiency and patient care. The organization has secured numerous patents (12 active patents as of 2023) for its cutting-edge algorithms, positioning it as a leader in healthcare technology. Acme's strategic partnerships with key industry players, including MedTech Innovations and CareLink, further bolster its market presence and technological capabilities. The company's commitment to research and development is evident through a dedicated budget allocation of 15% of annual revenue, aiming to introduce next-generation solutions by 2024.

Financial Performance

Financial performance analysis in acquisition due diligence involves examining the target company's revenue streams, profit margins, and historical financial statements over the past three to five years. Key financial metrics, such as EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) margins typically ranging from 10% to 30% for target industries, and net income growth rates averaging 5% to 15% annually, are analyzed. Analysts assess cash flow statements to understand operational efficiency, identifying any cash flow anomalies that could indicate potential risks. Balance sheet evaluation focuses on assets, liabilities, and equity ratios, ensuring compliance with financial covenants and assessing liquidity ratios like the current ratio, usually benchmarked above 1.5 for healthy companies. Through this comprehensive examination, potential acquirers can gauge the financial sustainability and pitfalls of integration within the larger corporate structure.

Legal Compliance

During acquisition due diligence, legal compliance involves a thorough examination of all legal documents, contracts, regulations, and compliance policies associated with the target company. Key documents, such as corporate bylaws, regulatory filings with agencies like the Securities and Exchange Commission (SEC), and compliance certificates are evaluated for adherence to federal and state laws. Jurisdictions involved may include local statutes in Delaware, where many corporations are formed, and international laws if the target operates globally. Investigating existing litigation history, intellectual property rights, and employee contracts assists in identifying potential legal liabilities. Furthermore, assessing compliance with industry-specific regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) for healthcare entities, is critical in determining financial and reputational risk. Each aspect aids in ensuring that the acquisition aligns with legal standards and safeguards against future litigation.

Intellectual Property

Acquisition due diligence on intellectual property (IP) plays a crucial role in assessing a target company's asset value, particularly in sectors like technology and pharmaceuticals. Thorough examination of patents, trademarks, and trade secrets allows for identification of potential risks and opportunities. For instance, reviewing patent filings (like those from the United States Patent and Trademark Office) can reveal the breadth and remaining lifecycle of critical patents. Understanding trademark registrations, especially in jurisdictions such as the European Union Intellectual Property Office, provides insights into brand strength and market presence. Additionally, evaluating licensing agreements, which may include royalties from notable agreements, can demonstrate revenue streams and contractual obligations tied to proprietary technologies or processes. Effective due diligence facilitates strategic decision-making regarding alignment with the acquiring company's goals and potential integration challenges, thereby maximizing the long-term value of the acquisition.

Organizational Structure

An effective organizational structure defines the hierarchy, roles, and responsibilities within a company, influencing decision-making and operational efficiency. In a merger or acquisition context, assessing the target company's organizational structure (such as executive leadership, departmental divisions, and reporting lines) reveals insights into its culture, governance, and workflow processes. The management team's experience, linked to their previous accomplishments, significantly impacts integration strategies. An analysis of the workforce, encompassing skills, experience, and retention rates in specific sectors, can highlight potential synergies or challenges post-acquisition. Furthermore, understanding geographical distribution (for example, multiple office locations across North America and Europe) provides clarity on resource allocation and potential redundancies, shaping strategic alignment and future growth trajectory.

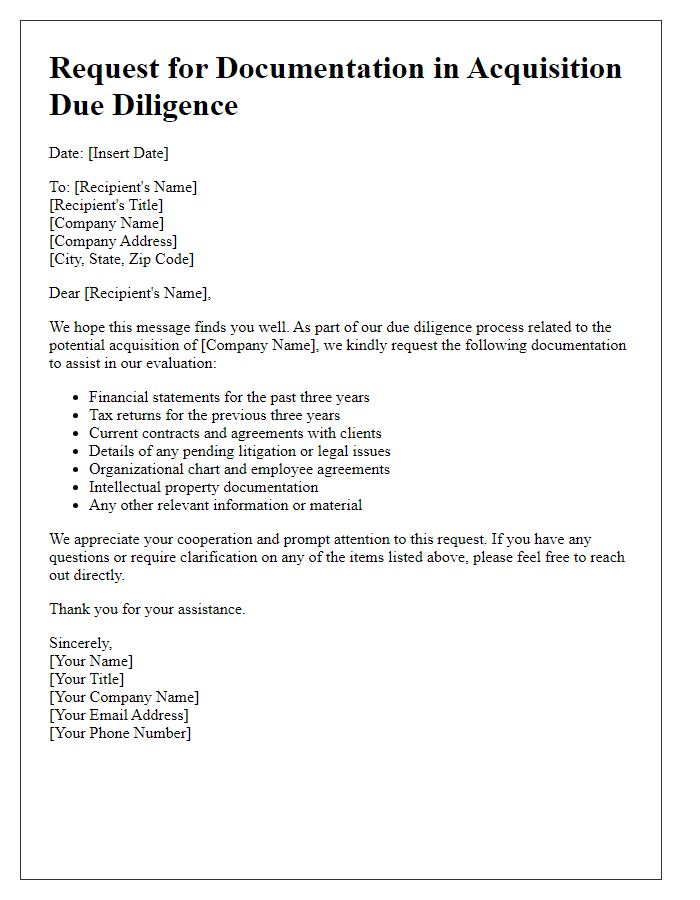

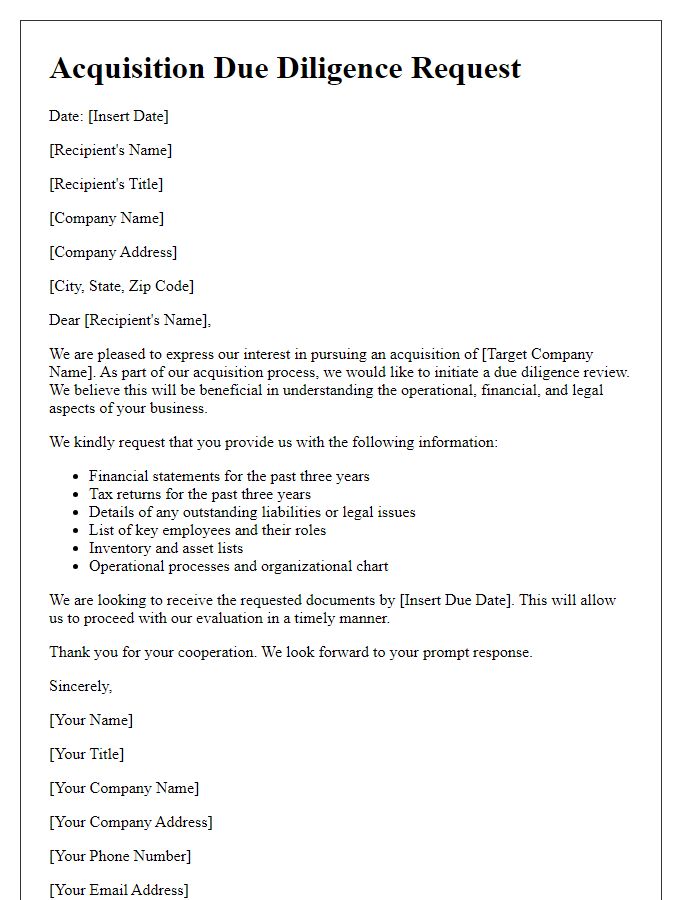

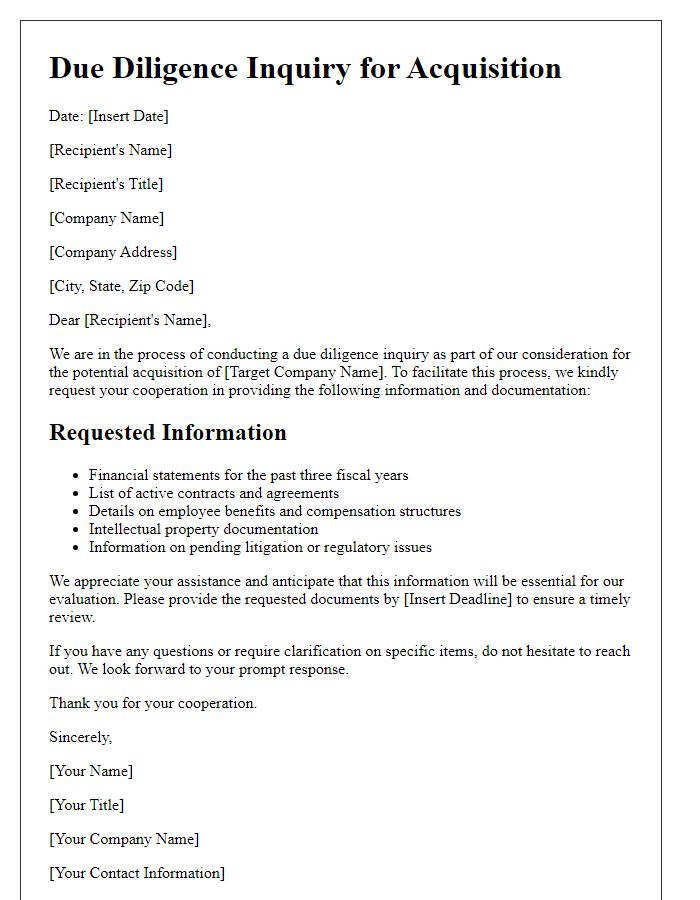

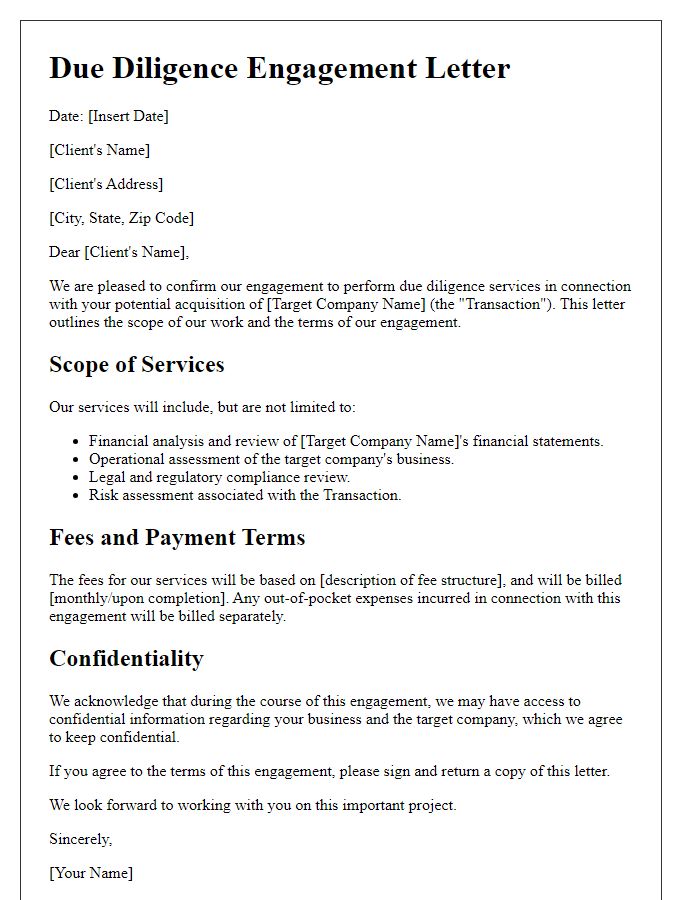

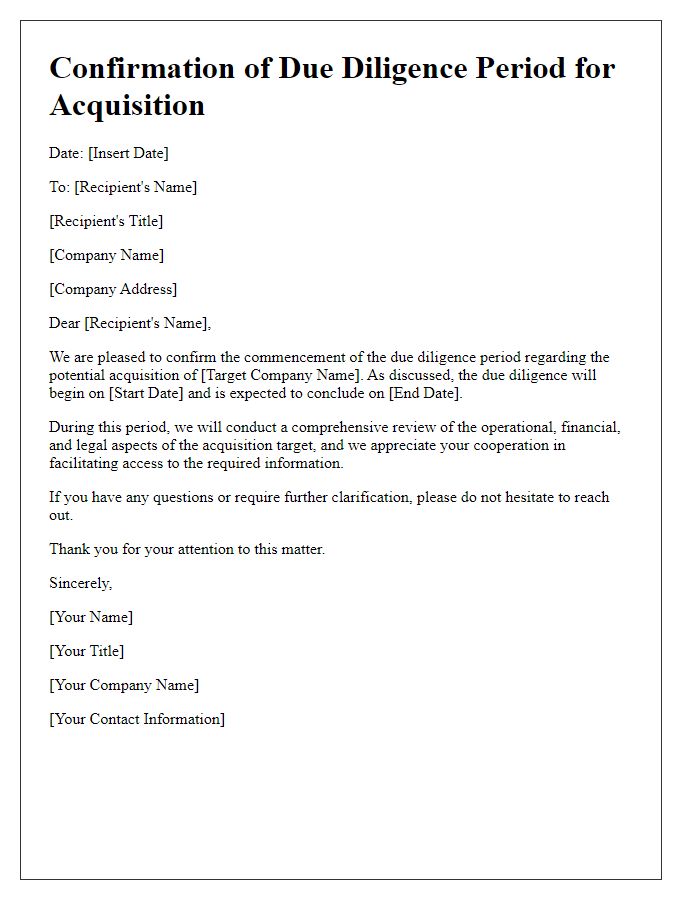

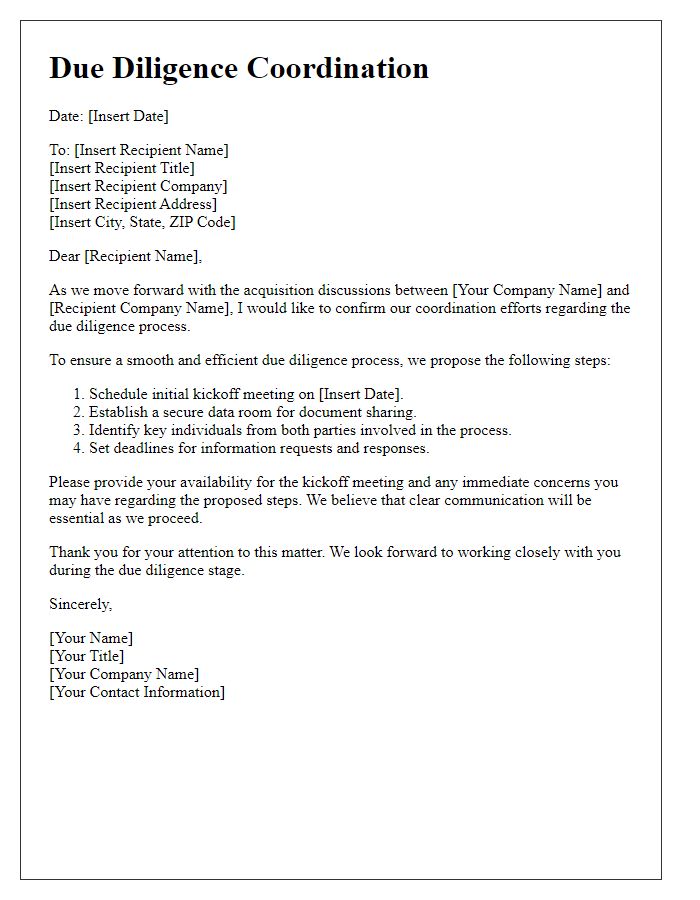

Letter Template For Acquisition Due Diligence Samples

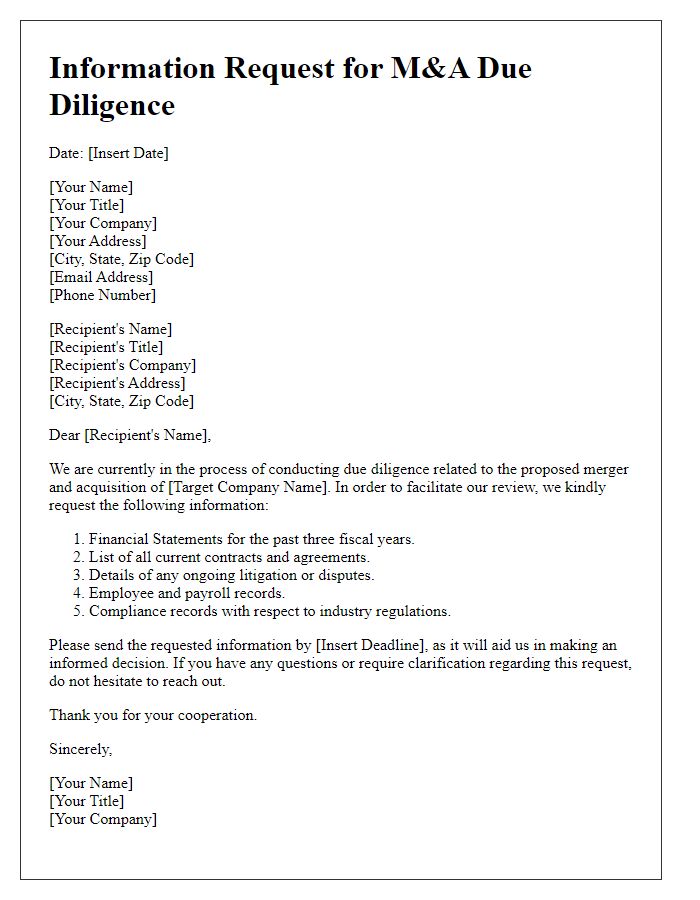

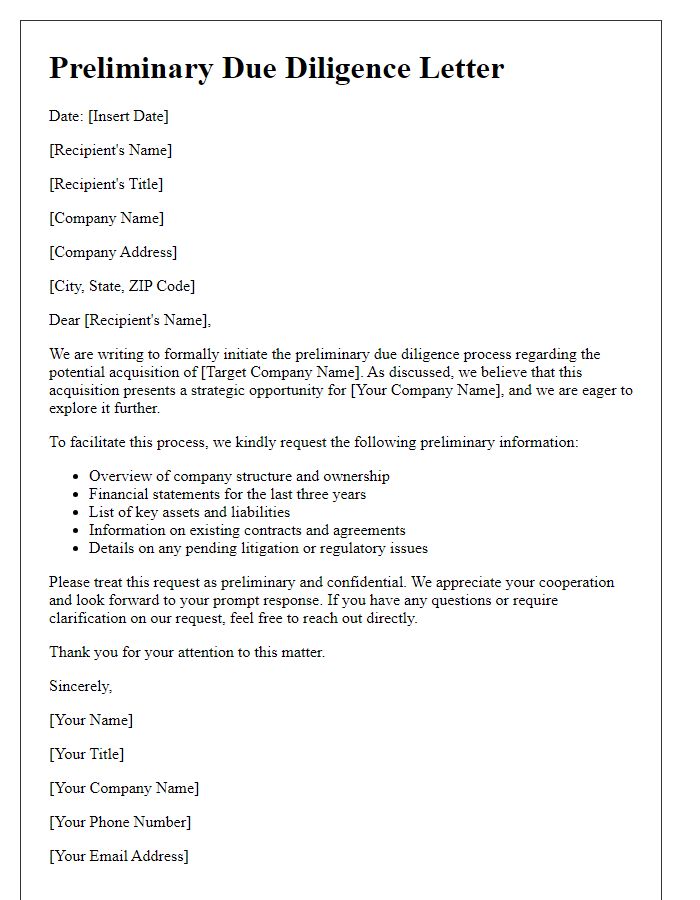

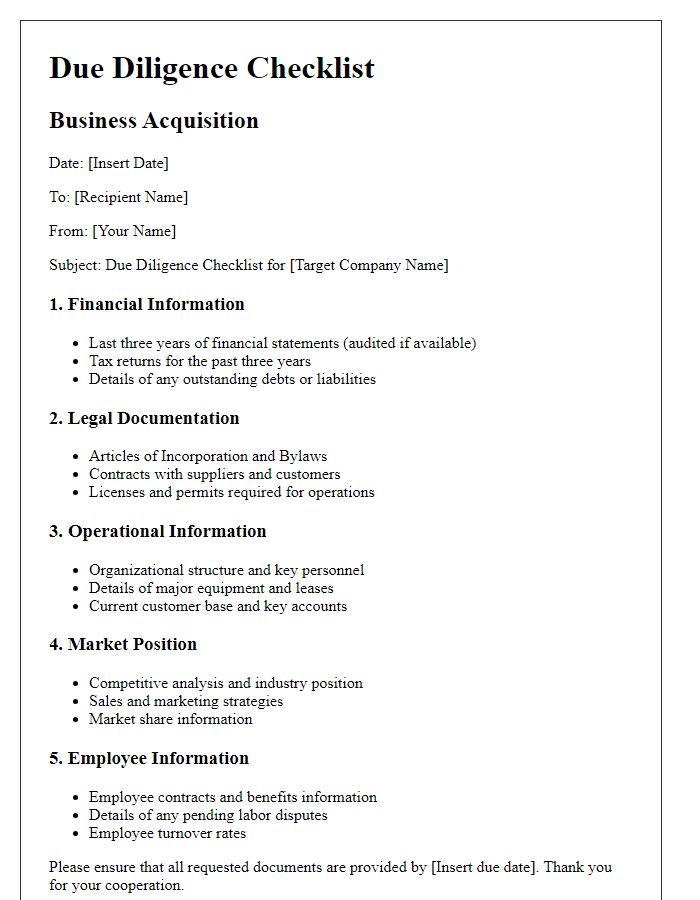

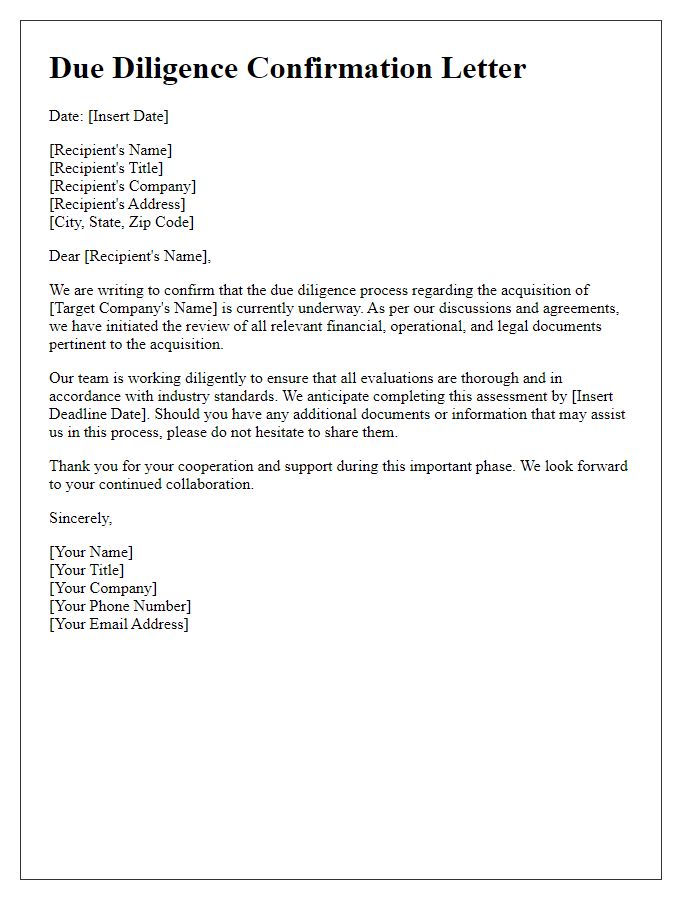

Letter template of Request for Documentation in Acquisition Due Diligence

Comments